What is Hedera $HBAR and How Does it Work?

Discover Hedera HBAR: a carbon-negative, hashgraph-based ledger offering 10,000+ TPS, strong governance, and cutting-edge 2025 development

Crypto Rich

July 11, 2025

Table of Contents

What if blockchain could process Visa-level transactions sustainably without sacrificing security? Hedera is one of the most technically advanced distributed ledgers in crypto, yet many still overlook what makes it unique. Built on the Hashgraph consensus algorithm, Hedera delivers what traditional blockchains struggle with: scalable performance, energy efficiency, and enterprise-grade security.

Traditional blockchains create linear chains of blocks, but Hedera's Hashgraph protocol takes a different approach through a directed acyclic graph (DAG) structure. This fundamental difference enables exceptional throughput and near-instant finality while maintaining carbon-negative operations—each transaction consumes just 0.001 kWh, less than a Google search, and Hedera offsets more carbon than it emits.

The platform positions itself as the "trust layer of the digital economy," bridging enterprise applications with web3 solutions across finance, artificial intelligence, tokenization, and supply chain management. Fixed fees ranging from $0.0001 to $0.01 USD offer predictable costs that make Hedera viable for high-volume applications and micropayments.

Hedera's governance model sets it apart from other crypto projects. Rather than relying on anonymous validators or energy-intensive miners, the network operates under a council of leading global organizations, including Google, IBM, Boeing, Deutsche Telekom, and Standard Bank. This structure provides the regulatory compliance and stability that enterprises demand while maintaining the benefits of a distributed ledger.

History and Founding

Dr. Leemon Baird recognized fundamental problems with blockchain technology in 2015. Speed, fairness, and energy consumption all presented major limitations. His solution was the Hashgraph consensus algorithm, which he invented that same year.

Three years later, Baird partnered with Mance Harmon to co-found Hedera under Swirlds Labs, now known as the Hashgraph Company. Their vision centered on asynchronous Byzantine Fault Tolerance (aBFT) for fair, scalable consensus without energy waste.

The project raised $124 million through an initial coin offering in 2018 to fund the development of the HBAR token and network infrastructure. Hedera's mainnet launched in 2019 as a permissioned network before transitioning to public access in 2020. The team open-sourced the codebase during this transition.

A significant milestone came in 2021 with Ethereum Virtual Machine (EVM) integration, allowing developers to deploy Solidity smart contracts while benefiting from hashgraph's superior performance. The Hedera Council expanded significantly by 2023, each member contributing to network governance and operation.

In 2025, Hedera made a pivotal decision to contribute its codebase to the Linux Foundation's Project Hiero. This move established vendor-neutral governance and enhanced community-driven development, addressing long-standing concerns about centralization while preserving the platform's enterprise focus.

Technology: Hashgraph Consensus

Hedera's core innovation lies in its Hashgraph consensus mechanism, which takes a fundamentally different approach from traditional blockchain architecture. While blockchains create linear sequences of blocks, Hashgraph uses a directed acyclic graph where nodes communicate through "gossip about gossip" protocols.

Here's how it works: nodes share transaction information asynchronously, eliminating the need for leaders or miners. When a node creates a transaction, it immediately shares this data with other nodes, which then propagate the information throughout the network. Each node maintains a complete record of events and their relationships, creating mathematical proof of consensus without energy-intensive mining.

The virtual voting mechanism ensures fair transaction ordering. Traditional blockchains allow miners to manipulate transaction sequences for profit, but Hashgraph's consensus algorithm guarantees that all nodes process transactions in the same order. This prevents front-running and ensures mathematical fairness.

Performance Advantages Over Traditional Blockchains

Hedera's technical advantages become clear when comparing key performance metrics:

- Transaction speed: Processes over 10,000 TPS under optimal conditions compared to Ethereum's 15-30 TPS

- Finality time: Achieves 3-5 second finality versus minutes or hours for traditional blockchains

- Consensus model: Uses leaderless aBFT versus leader-dependent proof-of-work or proof-of-stake

- Energy efficiency: Carbon-negative operations versus high energy consumption of Bitcoin

- Fee structure: Predictable costs averaging $0.001 versus variable gas pricing that can spike unexpectedly

The platform's carbon-negative energy profile stands in sharp contrast to Bitcoin's high energy consumption and Ethereum's variable energy usage. University College London studies confirm this environmental advantage, with the network actually removing more carbon from the atmosphere than it produces.

Developer Integration and Compatibility

Hedera offers multiple development paths for different use cases. The platform's EVM compatibility allows developers to use existing Ethereum tools and deploy Solidity smart contracts without modification, benefiting from Hashgraph's superior performance characteristics including guaranteed finality and predictable fees.

For developers seeking alternatives to EVM, Hedera also provides native services through JSON APIs and SDKs that offer direct access to consensus, token, and file services. This flexibility enables both traditional smart contract development and native Hedera application building.

Recent platform upgrades in 2025 introduced advanced features that optimize efficiency for high-volume applications. These technical improvements specifically target IoT devices, AI agents, and other use cases that require frequent, low-cost transactions.

Governance and the Hedera Council

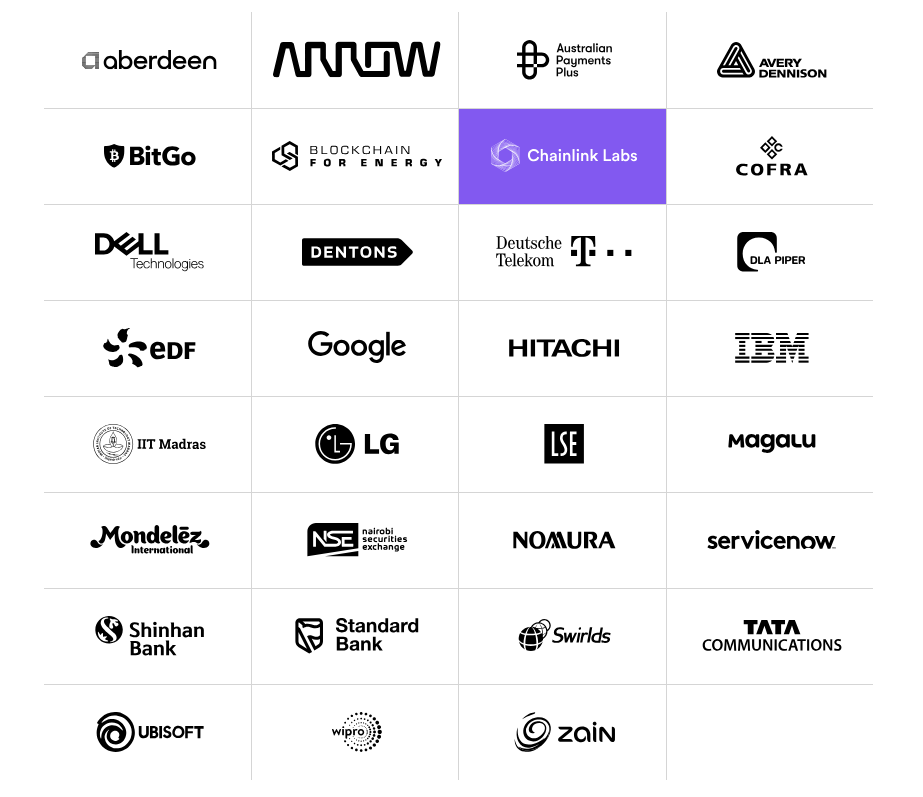

The Hedera Council represents one of the most sophisticated governance structures in distributed ledger technology. This body of up to 39 leading global organizations operates the network's consensus nodes and makes collective decisions about upgrades, fee structures, and technical standards.

Current council members span diverse industries and geographies, representing a balanced mix of sectors:

- Technology leaders: Google, IBM, Intel, and ServiceNow

- Financial institutions: Standard Bank, Nomura, Shinhan Bank, and Deutsche Telekom

- Enterprise solutions: Boeing, Dell Technologies, Arrow Electronics, and Hitachi

- Innovation partners: Ubisoft, Chainlink, abrdn, and DLA Piper

Each member holds equal voting rights regardless of their organization's size or influence. The council structure ensures enterprise-grade decision-making while maintaining decentralized control.

Members serve term-limited positions ranging from three to six years, with regular rotation ensuring diversity and preventing any single entity from gaining excessive influence over network operations.

This governance model addresses a critical challenge in distributed ledger technology: striking a balance between decentralization and regulatory compliance. Traditional permissionless networks struggle with regulatory uncertainty, while fully centralized systems lack the trust and transparency that distributed ledgers offer.

Community input is facilitated through Hedera Improvement Proposals (HIPs), which enable developers and users to propose network enhancements. The council evaluates these proposals based on their technical merit, ecosystem impact, and alignment with Hedera's long-term vision.

The 2025 open-sourcing of Hedera's codebase to the Linux Foundation's Project Hiero democratizes development while maintaining the council's governance role. This structure provides vendor-neutral oversight and enables broader community participation in technical development.

Recent council additions include organizations focused on artificial intelligence, tokenization, and sustainable finance. These new members reflect Hedera's evolution toward emerging use cases in high-growth sectors.

The HBAR Token

$HBAR is Hedera's native cryptocurrency, powering all network operations, including transaction fees, smart contract execution, file storage, and consensus services. The token's utility extends beyond simple payments to include staking for network security and governance participation.

Token Economics and Supply

Hedera's tokenomics feature a fixed supply of 50 billion HBAR tokens, with approximately 40% currently in circulation as of July 2025. This controlled release schedule prevents inflation while ensuring adequate liquidity for network operations and ecosystem development. The remaining 60% is held by the Hedera treasury for ecosystem grants, council operations, and strategic partnerships, with releases governed by the council's treasury management policies.

The token's utility model supports micropayments and API calls, making it ideal for IoT devices, AI agents, and other applications that require frequent, low-cost transactions. Fixed fees, ranging from $0.0001 to $0.01 USD, provide predictable costs that enterprises can budget for, unlike variable gas fee models that create uncertainty.

Market Performance and Staking

HBAR's current market performance shows strong momentum, with the token trading at approximately $0.16 USD and a market capitalization of $7.16 billion as of November 6, 2025. Trading activity has dropped recently, with a 24-hour volume of $237 million.

Staking yields currently range from 5-7% annual percentage yield through proxy staking mechanisms. This system allows HBAR holders to earn rewards by delegating their tokens to council nodes, contributing to network security while maintaining liquidity.

A notable development in early 2025 was the 1,200% increase in USDC minted on the Hedera network, significantly boosting liquidity and demonstrating growing institutional confidence in the platform's stability and performance capabilities.

Ecosystem and Use Cases

Hedera's ecosystem spans web3 applications and enterprise solutions, demonstrating the platform's versatility across different market segments. The total value locked (TVL) in DeFi has reached over $80 million as of November 2025, showing significant growth in DeFi adoption.

Decentralized Finance Applications

In decentralized finance, several key platforms have established a strong footing on Hedera:

- SaucerSwap: The primary decentralized exchange providing liquidity and trading services

- Bonzo Finance: Lending and borrowing platform with competitive rates

- HeliSwap: Token swapping service with minimal slippage

- Cross-border payments: Institutional partnerships enabling international transfers

These applications benefit from Hedera's fast finality and low fees, resulting in superior user experiences compared to traditional blockchain-based DeFi platforms. The predictable fee structure enables traders and institutions to calculate costs accurately, unlike variable gas pricing that can fluctuate unexpectedly.

Enterprise and Real-World Applications

Enterprise use cases showcase Hedera's practical value beyond the crypto ecosystem. Supply chain tracking through FreshSupply provides transparency and traceability for food products. Carbon credit trading via Dovu enables companies to offset emissions through verified blockchain transactions. Consumer payments through SKUx demonstrate retail applications with instant settlement.

The platform has gained significant traction in tokenized real-world assets (RWAs). Partnerships like abrdn and Archax enable tokenized real estate investments, opening traditional assets to blockchain-based trading and fractional ownership. This sector represents enormous growth potential as financial institutions explore digital asset management.

Artificial intelligence integration has emerged as a major growth driver in 2025, with the platform supporting AI agents that can interact with blockchain services autonomously. This positions Hedera at the intersection of two rapidly growing technology sectors. AI agents can execute smart contracts, manage digital payments, and coordinate complex transactions without human intervention.

Gaming applications include Ubisoft integrations and NFT platforms like MingoApps for ticketing and event management. These applications leverage Hedera's ability to handle high transaction volumes with consistent performance, crucial for gaming environments where users expect instant responses.

Developer Tools and Infrastructure

The platform provides comprehensive tools that simplify development for both web3 and enterprise applications. Hedera's SDK and API offerings reduce technical barriers while maintaining the platform's performance advantages. The Hedera Playground creates an interactive environment for testing and development, allowing new developers to experiment without complex setup requirements.

Recent Developments (2025)

Key Platform Launches and Partnerships

- Project Acacia: Ongoing collaboration with Australia's Reserve Bank focusing on wholesale tokenized assets and CBDCs.

- HashSphere: Private blockchain solution for regulated industries launched in Q3 2025.

- Linux Foundation integration: Hiero project graduated in August with over 800 contributors from 80+ organizations, 50+ adopters, and partnerships including OpenWallet Foundation and Hyperledger AnonCreds for vendor-neutral governance.

- NVIDIA partnership: Active development of Blackwell support enabling secure, verifiable AI computations.

- Chainlink integration: Deployment of CCIP, Data Feeds, and Proof-of-Reserve on mainnet for secure cross-chain DeFi and tokenized RWA applications.

- Bank of England and BIS collaboration: Participation in DLT Innovation Challenge exploring central bank money transactions on programmable ledgers.

Technical Improvements and AI Integration

Artificial intelligence advancements represent a major focus area for 2025. The Mavrik-1 engine for DeFi data analysis provides sophisticated analytics capabilities, while a four-layer AI stack supports agentic AI applications. These developments were showcased at WeAreDevs workshops, demonstrating practical integration between AI and blockchain technology.

The platform's hackathon program expanded significantly in 2025. Major events like the Africa Hackathon offered $1 million in prizes, while ETHGlobal Cannes provided substantial bounties for innovation. These initiatives have driven developer engagement and ecosystem growth, attracting talent from emerging markets and established tech hubs alike.

Mainnet updates introduced Jumbo and Zero-Cost Ethereum transactions, addressing scalability concerns and reducing barriers to adoption for enterprise clients. These improvements complement the platform's existing advantages in speed and cost predictability, making Hedera more attractive for high-volume applications.

Developer activity increased 176% in June 2025, indicating growing interest and adoption among technical communities. ISO 20022 compliance enhancements further strengthen the platform's position in traditional finance applications, particularly for cross-border payments and institutional settlements.

Challenges and Criticisms

Despite technological advantages, Hedera faces several challenges that impact perception and adoption in the broader cryptocurrency market.

Governance and Centralization Concerns

Critics argue that the council-based governance represents a more centralized approach compared to permissionless networks, potentially limiting the full benefits of decentralization. This perception fuels ongoing debates about the platform's true decentralized nature. However, Hedera's hybrid model represents a deliberate choice—prioritizing regulatory compliance and enterprise trust that anonymous node models cannot provide.

Market Position and Competition Challenges

Several factors continue to present obstacles for broader adoption:

- Web3 adoption gaps: Historical slower uptake in DeFi and NFT sectors compared to Ethereum and Solana

- Regulatory uncertainties: Delays in tokenization and CBDC timelines affecting growth projections

- Enterprise vs retail focus: Tension between institutional priorities and retail market engagement

- Scalability testing: Limited real-world stress testing at peak global transaction loads

The platform's response includes open-sourcing initiatives and Hedera Improvement Proposals (HIPs) that address governance concerns. The 2025 partnerships and hackathon programs specifically target broader developer engagement and ecosystem growth.

Future Outlook

Hedera's positioning for 2025-2026 growth centers on three key areas: artificial intelligence adoption, tokenized real-world assets, and institutional finance applications. Analysts project HBAR could reach $0.30-$1.00 with successful HashSphere deployment and AI integration milestones, though these predictions depend on broader market conditions and execution success.

Central bank digital currency expansion represents significant potential. WISeKey partnerships enable quantum-secure IoT applications, positioning Hedera for next-generation digital infrastructure. The platform's technical advantages can deliver substantial performance improvements over Ethereum in specific use cases, particularly those requiring high throughput and low latency.

Market volatility and increased competition remain primary risks. However, Hedera's enterprise partnerships and technical differentiation provide defensive advantages during market downturns and a strong positioning for recovery phases. The enterprise focus creates revenue streams that are less dependent on speculative trading, thereby mitigating these risks.

The convergence of AI and blockchain technologies creates new opportunities for Hedera's unique capabilities. As AI agents require blockchain services for payments, identity verification, and asset management, Hedera's performance characteristics become increasingly valuable for autonomous systems operating at scale.

Conclusion

Hedera's Hashgraph technology delivers on the blockchain's original promises through superior scalability, energy efficiency, and enterprise-grade security. The platform's 2025 advancements in AI integration, tokenization, and institutional partnerships demonstrate its evolution from a promising technology to a practical solution for real-world applications.

The combination of robust governance through the Hedera Council, technical innovation through Hashgraph consensus, and strategic partnerships across multiple sectors positions Hedera as a significant player in distributed ledger technology. While challenges around perception and adoption remain, the platform's technical advantages and enterprise focus provide sustainable competitive advantages.

As artificial intelligence and tokenized assets drive the next phase of blockchain adoption, Hedera's unique capabilities bridge traditional enterprise needs with emerging web3 applications. The platform's carbon-negative operations and regulatory compliance features align with growing institutional requirements for sustainable and compliant technology solutions.

HBAR's role as the native token powering this ecosystem provides investors with exposure to multiple growth trends, including AI, tokenization, and institutional blockchain adoption. The platform's technical capabilities and strategic positioning suggest significant long-term potential as these sectors continue expanding. If you want to find out more, you can visit Hedera at hedera.com or follow @hedera on X for the latest updates.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens