What is Decentralized Finance (DeFi)? Full Guide

Discover how Decentralized Finance, or DeFi, evolved to become perhaps the most sophisticated ecosystem in crypto today. Where did it start and what does it look like now?

Crypto Rich

February 18, 2025

Table of Contents

The world of finance is experiencing a revolutionary transformation through decentralized finance, commonly known as DeFi. This groundbreaking technology is changing how people think about and use money, making financial services available to anyone with an internet connection. In this comprehensive guide, we'll explore how DeFi has evolved and where it's heading in the future.

Understanding DeFi's Origins

The story of DeFi begins with the creation of Bitcoin in 2009. While Bitcoin introduced the world to decentralized digital money, it was the launch of Ethereum that truly set the stage for DeFi. Ethereum's smart contract capability created new possibilities for financial services that could run without traditional banks or financial institutions.

A significant milestone in DeFi's history came in 2017 with the launch of MakerDAO. This platform introduced DAI, one of the first decentralized stablecoins. Unlike traditional cryptocurrencies, DAI maintained a steady value by being pegged to the US dollar, making it more practical for everyday financial transactions.

The Explosive Growth of DeFi

The numbers tell a compelling story about DeFi's growth. The Total Value Locked (TVL) in DeFi protocols shows a remarkable journey. From a modest $1 billion in early 2020, it skyrocketed to over $200 billion at its peak in 2021. Today, the TVL stands at $107 billion, demonstrating sustained interest and adoption despite market fluctuations.

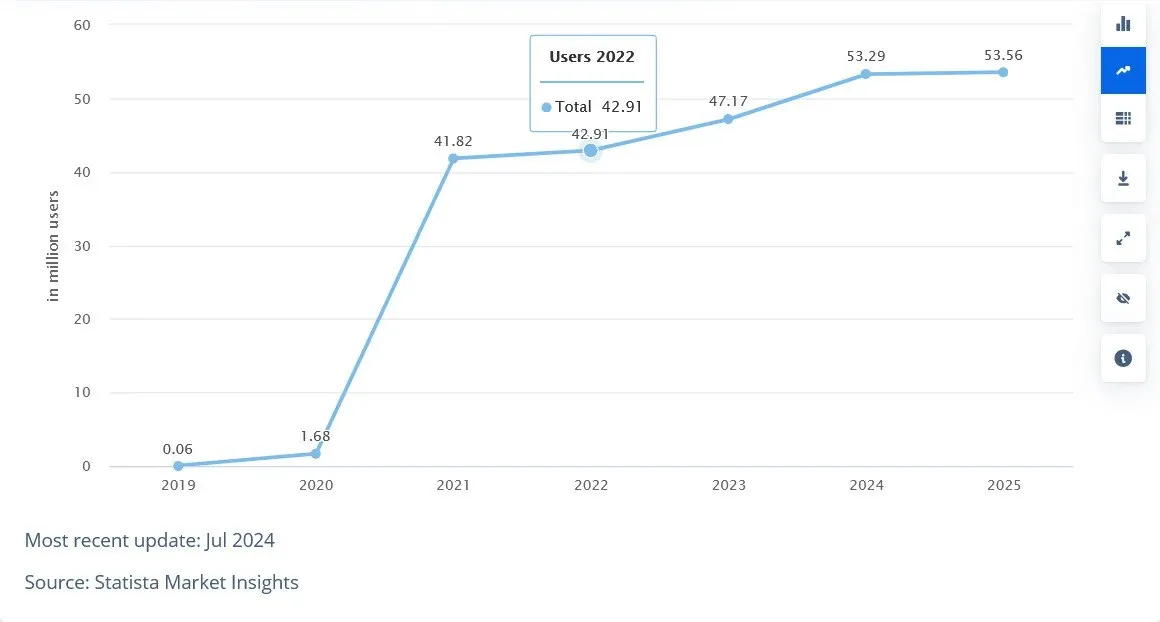

User adoption has seen equally impressive growth. The DeFi ecosystem now serves over 53.29 million users, up significantly from its peak of 41.82 million in 2021. This growth reflects increasing trust in decentralized systems and improved user accessibility.

The summer of 2020 marked a turning point with the introduction of Compound's COMP token, which sparked the yield farming phenomenon. This innovation allowed users to earn additional rewards for providing liquidity to the protocol. Shortly after, Uniswap emerged as a leading decentralized exchange, only to face competition from SushiSwap in what became known as the "vampire attack" - a strategic move where SushiSwap attracted Uniswap's users by offering better incentives.

Today's DeFi Landscape

Decentralized Exchanges and Liquidity Pools

Modern DeFi offers several core applications that have become fundamental to the ecosystem. Decentralized exchanges like Uniswap on Ethereum and PancakeSwap on BNB Smart Chain have revolutionized cryptocurrency trading. These platforms use automated market makers (AMMs) and liquidity pools instead of traditional order books, allowing users to trade directly from their wallets without intermediaries.

Decentralized Autonomous Organizations (DAOs) and Governance

One of DeFi's most revolutionary aspects is its approach to governance through DAOs (Decentralized Autonomous Organizations). Unlike traditional financial institutions where decisions are made by boards of directors and executives, DAOs enable direct community participation in decision-making processes.

In traditional finance, governance is typically hierarchical and closed. Shareholders might get voting rights, but day-to-day decisions are made by a small group of executives. In contrast, DAOs use smart contracts to enforce rules and governance decisions automatically. Token holders can propose changes, vote on protocol upgrades, and directly influence treasury management.

Take Uniswap's governance model, for example. UNI token holders can propose and vote on changes to the protocol, from fee structures to new features. This democratic approach ensures that users have a direct say in the platform's future. Similarly, Aave's governance allows token holders to vote on risk parameters, new markets, and protocol upgrades.

This shift to community governance has several key benefits:

- Transparency: All proposals and votes are recorded on the blockchain

- Inclusivity: Anyone can participate by holding governance tokens

- Alignment: Users who are most invested in the protocol's success make decisions

- Automation: Smart contracts automatically execute approved proposals

Lending and Yield Generation

Lending platforms such as Aave and Compound have created new opportunities for earning interest and accessing loans. Users can lend their crypto assets to earn interest rates that often exceed traditional banking rates. Borrowers can access these funds by providing cryptocurrency collateral, creating a seamless lending ecosystem.

Yield farming has evolved beyond simple liquidity provision. Users can now stack multiple yield-generating strategies to maximize their returns. This composability is unique to DeFi and allows for innovative financial products that wouldn't be possible in traditional finance.

The Future of DeFi

Scaling Solutions and Interoperability

As DeFi continues to grow, scaling solutions and high-performance networks have become crucial. Layer-2 networks like Arbitrum and Optimism are addressing Ethereum's scalability challenges by processing transactions more efficiently while maintaining security. These solutions are essential for handling increased user adoption and more complex applications.

Alongside Layer-2 solutions, several high-performance Layer-1 networks are gaining significant traction. Solana, known for its high throughput and low transaction costs, has become a major DeFi, and Memecoin hub. Avalanche's subnet architecture enables customizable blockchain networks with impressive speed. The Cosmos ecosystem, with its Inter-Blockchain Communication protocol (IBC), allows independent blockchains to communicate and transfer assets seamlessly.

Interoperability between these various networks has become a critical focus. Projects like Polkadot are building infrastructure to enable cross-chain communication, while bridge protocols facilitate asset transfers between different blockchains. This growing interconnectedness is creating a more unified DeFi ecosystem where users can easily move assets and interact with protocols across multiple networks, choosing the best platform for their specific needs.

Artificial Intelligence Integration

The integration of AI in DeFi is rapidly moving from theoretical possibilities to practical applications. Projects are already implementing machine learning and artificial intelligence to revolutionize various aspects of decentralized finance.

In lending protocols, platforms like Spectral are pioneering AI-driven credit scoring systems. By analyzing on-chain transaction history and wallet behavior, these systems create decentralized credit scores (MACRO scores) that help assess borrower reliability without traditional credit checks.

Trading and portfolio management have seen significant AI adoption. Numerai uses crowdsourced AI models to create sophisticated trading strategies, while dHEDGE employs machine learning to help users copy successful trading strategies. These platforms demonstrate how AI can democratize access to advanced trading techniques previously available only to institutional investors.

Security and fraud prevention have become primary use cases for AI in DeFi. Projects like Forta use machine learning algorithms to monitor blockchain transactions in real-time, detecting potential threats and unusual patterns that might indicate attacks or exploits. Their AI systems can identify suspicious activities like flash loan attacks or market manipulation attempts before they cause significant damage.

AI is also transforming user experience in DeFi:

- Natural Language Processing (NLP) powers chatbots that help users navigate complex DeFi protocols

- Predictive analytics help forecast market trends and gas fees

- Machine learning algorithms optimize yield farming strategies by automatically rebalancing portfolios

- AI-driven dashboards adapt to user behavior, showing relevant information based on individual trading patterns

Looking ahead, the combination of AI and DeFi could enable even more sophisticated applications:

- Dynamic risk management systems that adjust lending parameters in real-time based on market conditions

- Automated market makers (AMMs) that use AI to optimize liquidity provision and reduce slippage

- Personalized DeFi "robo-advisors" that create custom investment strategies based on user goals and risk tolerance

- Advanced anomaly detection systems that can predict and prevent potential smart contract vulnerabilities

Real-World Asset Integration

The future of DeFi extends beyond cryptocurrency. The tokenization of real-world assets is gaining momentum, with platforms working to bring traditional assets like real estate, art, and commodities onto the blockchain. This development could dramatically increase the liquidity of traditionally illiquid assets.

Liquidity Staking Tokens (LSTs) have emerged as a significant trend, particularly after Ethereum transitioned to Proof of Stake. Projects like Lido, Kelp, and Rocketpool, to name a few, are leading the way in making staking more accessible and liquid for users.

Challenges and Opportunities

While DeFi's future looks promising, several challenges need addressing:

Security remains a primary concern. The industry must continue developing better security protocols and audit processes to protect user funds. Smart contract vulnerabilities and hacks have led to significant losses in the past, emphasizing the need for robust security measures.

User experience requires significant improvement. Current DeFi interfaces can be intimidating for newcomers, and gas fees on some networks can be prohibitive. The industry is working on creating more user-friendly interfaces and reducing transaction costs through various scaling solutions.

Regional adoption varies significantly. Markets like India and North America show strong potential for growth, but regulatory clarity will play a crucial role in widespread adoption. Clear regulations could encourage institutional participation while protecting retail users.

Conclusion

The evolution of DeFi represents a fundamental shift in how we think about financial services. From its humble beginnings with Bitcoin to today's sophisticated lending, trading, and yield generation ecosystem, DeFi has proven its potential to democratize finance.

As we look to the future, integrating AI, improved scaling solutions, and tokenizing real-world assets suggest that DeFi's impact will continue to grow. While challenges remain, particularly in security and user experience, the industry's rapid innovation and problem-solving capability indicate a bright future.

Now is the time for those interested in participating in this financial revolution to learn more. Whether you're an investor, developer, or simply curious about the future of finance, DeFi offers opportunities for everyone to join in building a more inclusive and efficient financial system.

Stay informed, start small, and remember that this technology is still evolving. The future of finance is being written today, and DeFi is leading the way.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens