Binance Shows 'No Signs of Stress' Despite FUD

On-chain data from CryptoQuant shows Binance holds 659,000 BTC with just 0.6% reserve movement, countering FUD claims of exchange instability.

Crypto Rich

February 4, 2026

Table of Contents

On-chain data confirms Binance remains stable despite a wave of fear, uncertainty, and doubt sweeping social media in early February 2026. CryptoQuant analysis shows the exchange holds approximately 659,000 BTC with reserve movement at just 0.6%, a far cry from the distress signals seen before FTX's collapse. While critics draw parallels to 2022's darkest days, the numbers tell a different story.

The timing of this FUD coincides with Bitcoin's drop from $78,300 to $74,600 before rebounding. Some market participants were quick to blame Binance, but accusations of market manipulation and solvency issues appear to lack supporting evidence when measured against actual blockchain data.

What's Behind the Binance FUD?

Rumors have spread rapidly across X, with claims ranging from a supposed $1 billion Bitcoin dump to massive stablecoin outflows of $4.5 billion since January 8, 2026. Some posts warned of "FTX memories" and labeled the exchange as "collapsing." One particularly viral claim suggested 1.6 million ETH, representing 1.6% of total supply, left the platform in a single day.

Binance co-founder Changpeng "CZ" Zhao addressed these claims directly, calling them "imaginative FUD." He clarified that no $1 billion BTC sale occurred. Regarding questions about the Secure Asset Fund for Users (SAFU), CZ explained that the fund will purchase BTC gradually over 30 days. Binance has already deployed $201 million, acquiring 2,630 BTC over two days at prices between $74,000 and $76,000.

Notably, several X accounts amplifying the FUD appeared suspiciously similar, suggesting coordinated spreading rather than organic concern.

What Does On-Chain Data Actually Show?

CryptoQuant's analysis provides the clearest counterargument to the panic narrative. Their research post on X, titled "FUD vs Reality," presents several key metrics.

Binance's BTC reserves sit at around 659,000 BTC, virtually unchanged from 657,000 at the end of 2025. For context, following the FTX collapse, reserves dropped 12% as users fled to self-custody. Nothing remotely similar is happening here.

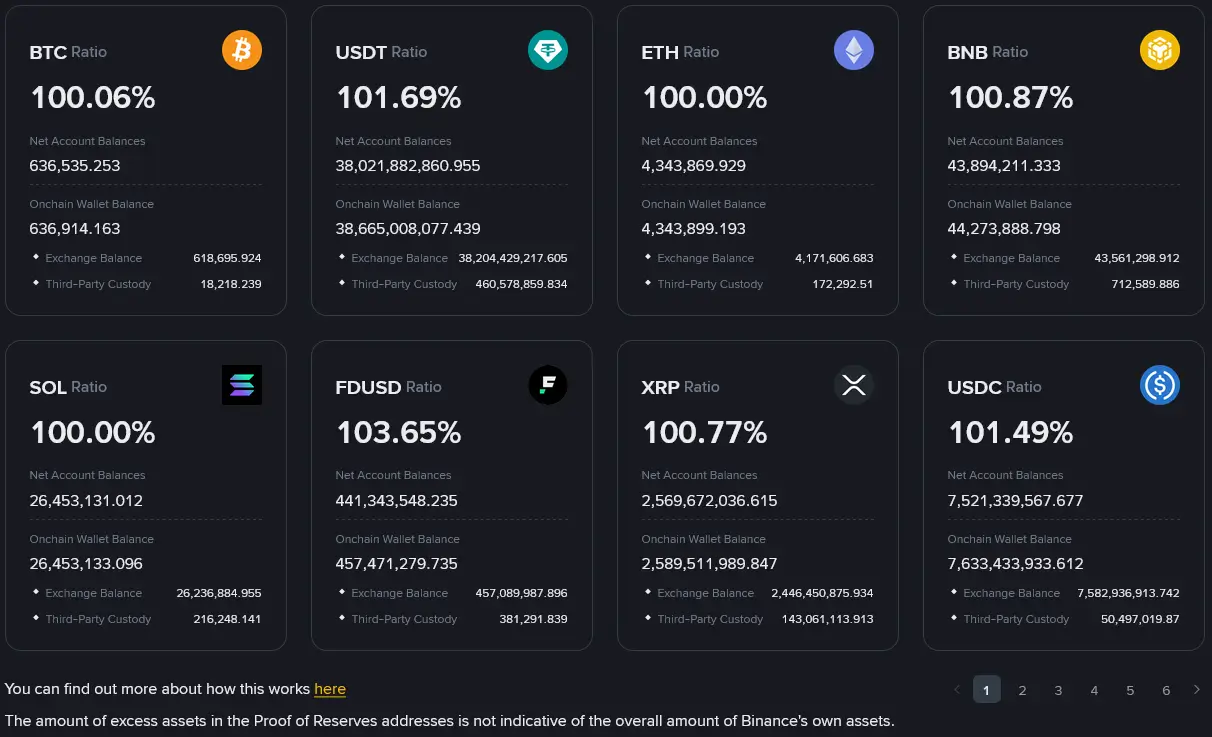

Netflows, which measure inflows minus outflows, remain routine. The 0.6% reserve movement indicates normal trading activity rather than a bank run scenario. Binance's January 2026 proof of reserves report shows 636,535 BTC in net balances, aligning with third-party audits.

CoinMarketCap's January 2026 exchange reserves ranking reinforces this picture. Binance topped the list with $155.6 billion in total reserves, more than the combined holdings of several competing platforms.

Analysts like Axel Bitblaze have compared current withdrawal velocity to historical crisis events including FTX and Celsius. The data shows no red flags.

What Does the Reserve Chart Reveal?

CryptoQuant's Bitcoin Exchange Reserve chart for Binance spanning March 2025 to February 2026 tells an interesting story. Reserves declined from approximately 668,000 BTC to around 615,000 BTC, a gradual 8% decrease over nearly a year.

This type of steady outflow is typically interpreted as bullish. Users withdrawing BTC to personal wallets for long-term holding reduces sell-side pressure on exchanges. Panic withdrawals look very different, with sharp, sudden drops rather than gradual declines.

The chart also shows an inverse correlation worth noting. As reserves decreased, Bitcoin's price showed resilience, ranging from $75,000 to $125,000 during the period. Decreasing reserves amid price stability suggests demand is outpacing available supply on the exchange.

Why Might This FUD Signal a Bottom?

Historical patterns offer some perspective. Santiment data indicates Bitcoin's rebound followed peak FUD levels, a pattern seen in previous market cycles. February has historically delivered an average 14.3% return for BTC, which could push prices toward $101,000 if the trend holds.

Beyond historical seasonality, broader market signals look constructive. ETF inflows continue, and gold accumulation trends suggest risk-on sentiment may be returning. SAFU's planned BTC purchases over the coming month could add additional buying pressure.

The coordinated amplification of this FUD, combined with strong on-chain fundamentals, has led some analysts to view the recent dip as a buying opportunity rather than a warning sign.

The Bottom Line

The data tells a calmer story. While social media amplifies fear with accusations of market manipulation and solvency concerns, blockchain metrics show business as usual at the world's largest crypto exchange. Stable reserves, normal netflows, and verified proof of reserves point to an exchange operating normally.

Whether sentiment shifts depends on what traders trust more: the posts or the proof.

Sources:

- CryptoQuant On-chain analytics platform providing Binance reserve data

- The Crypto Basic Coverage of analyst Axel Bitblaze's on-chain analysis showing 0.6% reserve movement and January 2026 proof of reserves data

- CoinDesk Reporting on CZ's response calling claims "imaginative FUD" and clarifying SAFU fund Bitcoin purchases

- Binance Proof of Reserves Official exchange page showing reserve ratios and net balances verified by third-party audits

- Incrypted Analysis citing CryptoQuant data showing Binance holds 659,000 BTC, virtually unchanged from end of 2025

- CoinMarketCap January 2026 exchange reserves ranking showing Binance leading with $155.6 billion in total holdings

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events

Buterin's 10,000 $ETH Selling Spree: Why Now?

February 24, 2026

February 24, 2026