Hedera and the HBAR Token: Full Analysis & Review

Discover a full analysis and review of Hedera and its HBAR token. One of 2025’s hottest layer-1 blockchain ecosystems.

Crypto Rich

March 17, 2025

Table of Contents

What if a network could process 3 million transactions a day while using less energy than a light bulb? Hedera is doing it—redefining what's possible in the distributed ledger space. As enterprises increasingly demand scalable, secure, and sustainable blockchain solutions, Hedera has emerged as a standout platform built for real-world business applications.

This isn't your average cryptocurrency project—it's a third-generation distributed ledger blockchain designed from the ground up to overcome the limitations that have held back mainstream blockchain adoption.

Hedera's Technical Edge

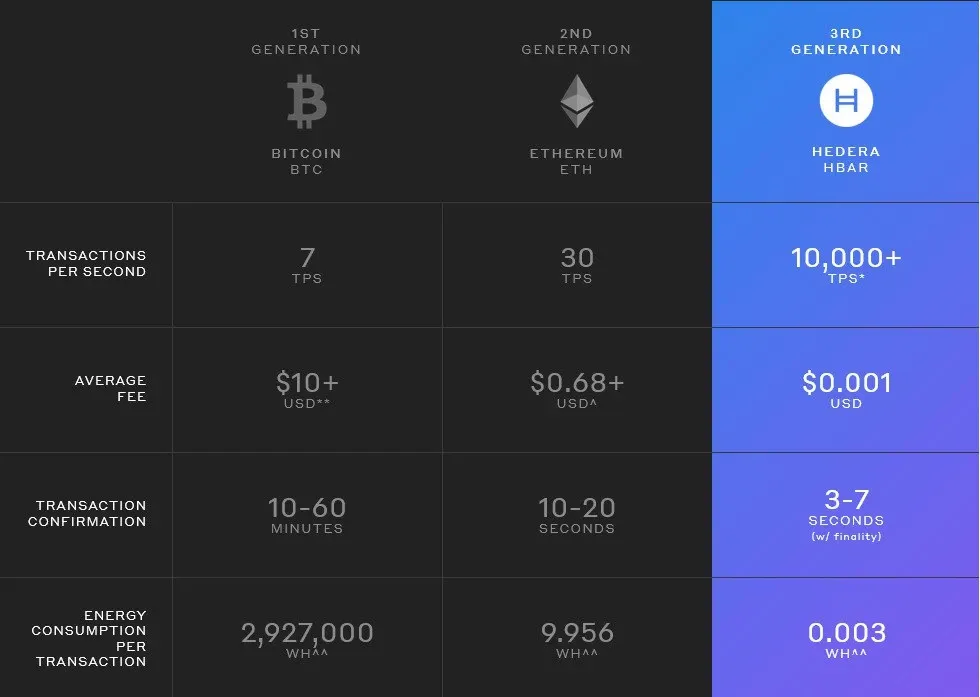

Hedera stands out in the crypto world with its hashgraph technology—a smarter, faster alternative to traditional layer one blockchains. Capable of handling 10,000 transactions per second, it leaves Bitcoin's 7 and Ethereum's 30 in the dust, all while keeping fees at a steady $0.0001. That efficiency makes it a natural fit for enterprise use.

Sustainability sets it apart too: Hedera runs carbon-negative, sidestepping the energy waste of older networks. While Bitcoin consumes a staggering 2,927,000 Wh per transaction and Ethereum uses 9,956 Wh, Hedera operates at just 0.003 Wh—a gap eco-firms can’t overlook.

The platform's latest update, mainnet 0.58 (launched Q1, 2025), brings significant business functionality. Long-term scheduled transactions allow companies to automate payments and contract executions years in advance—a game-changer for long-term business agreements and recurring operations. The improved Schedule Service System Contract enables developers to create more sophisticated time-based applications that were previously impossible on blockchain platforms. These aren't just technical upgrades—they're building blocks for practical business solutions that need reliable, predictable performance.

Powering Enterprises: Adoption and Partnerships

Hedera's approach to governance is refreshingly different. Its Governing Council brings together 30 global powerhouses (expandable to 39 seats), including Google, IBM, LG, Dell, and Deutsche Telekom—organizations that typically compete but collaborate here to steer the network's future. This structure provides something rare in crypto: institutional credibility with operational stability.

The network hit a milestone in March 2025 when Crypto.com and Binance implemented USDC stablecoin transfers on the Hedera Token Service (HTS). This integration means Hedera-based assets are now more accessible and liquid than ever before, creating new opportunities for businesses building on the platform.

Picture a supply chain where every product is tracked in real-time using Hedera's speed and reliability. That vision is becoming a reality through partnerships like the one with Taurus, which expands tokenization solutions across Europe, Asia, the Middle East, and Africa.

The financial world is taking notice too. HBAR ETF filings by Canary Capital, Valour, and Grayscale signal growing institutional interest in bringing Hedera to traditional investment portfolios. As of March 2025, these filings are still under SEC review, with some currently in a 21-day public comment period—a crucial regulatory step that could significantly expand Hedera's investor base if approved.

Inside the Network: Metrics and Mechanics

The HBAR Token: Fueling the Ecosystem

HBAR, Hedera's native cryptocurrency, serves two essential roles: paying for network services and securing the system through staking. When developers build on Hedera, they use HBAR to pay for token transfers, smart contract execution, and data logging—all at predictable, microscopically small fees that make even micropayments viable.

Token Allocation: Building for the Long Term

The 50 billion HBAR total supply has been thoughtfully distributed:

- 36.5% powers Ecosystem & Open Source Development—funding the applications and tools that make Hedera useful

- 25.4% went to Purchase Agreements with strategic partners and investors

- 16.2% supports Network Governance & Operations

- 14.1% remains as Unallocated Supply for future needs

- 7.7% covered Initial Development Costs & Licensing

This allocation strategy prioritizes building a sustainable ecosystem while maintaining resources for future growth.

Network Security and Staking Economics

As a proof-of-stake network, Hedera uses HBAR for consensus security. When tokens are staked to network nodes, they create a weighted influence on the transaction validation process. This weighted consensus model creates significant economic barriers against potential network attacks. To compromise the network, a malicious actor would need to acquire and stake more than one-third of the entire HBAR supply—a prohibitively expensive proposition designed to ensure network integrity.

The staking system also creates an economic incentive structure that benefits all participants. Transaction fee revenues are distributed between node operators and accounts staking to those nodes, aligning interests across the ecosystem while providing an earning mechanism for HBAR holders.

Network Metrics That Matter

Hedera's performance speaks for itself:

- Transactions finalize in just 2.90 seconds—compared to minutes on Bitcoin and 15+ seconds on Ethereum

- 7,836,554 active accounts are using the mainnet, outpacing rivals like XRP and Algorand in active users

- 42,219,399,509 HBAR are in circulation (out of 50 billion total).

The Road Ahead: Development and Vision

Hedera's development roadmap shows a clear path forward with features that matter for real-world applications.

Tech Deep Dive: What's Coming Soon

For those interested in the technical details, these initiatives are actively in development:

- HIP-991: Adding revenue-generating Topic IDs to the Hedera Consensus Service—enabling new business models for data-sharing applications and creating sustainable income streams for developers

- HIP-755: Enabling smart contracts to interact with scheduled transactions—a critical feature for automated finance applications like recurring payments and time-locked transactions

- HIP-756: Allowing smart contracts to designate treasury roles during token creation—simplifying token management for businesses

- Network Tooling: Enhancing consensus node operations for better resilience—ensuring enterprise-grade uptime and performance

On the horizon, planned developments include batch transactions (HIP-551) and improved metadata management for tokens (HIP-1028). For developers, a modularized local node testing environment is being prioritized to make building on Hedera faster and more accessible for builders using EVM (Ethereum Virtual Machine) smart contract coding.

Challenges to Address

Hedera's path to dominance isn't without hurdles. Its council, which has a maximum of 39 seats and currently consists of 30+ global enterprises like Google and IBM, ensures stability but sparks debate over concentrated power—some purists question its alignment with decentralization principles.

In the competitive landscape, Ripple's XRP excels in bank payments with 1,500 TPS, while Algorand's green technology (1,000+ TPS) courts enterprises—yet Hedera's 10,000 TPS maintains its technical edge. These competitors actively target the same enterprise market, creating a race to secure institutional adoption.

These challenges aren't roadblocks—they're stepping stones for a network that's playing the long game. Hedera's technical advantages and institutional backing position it well to address these issues as the ecosystem matures.

What's Next for Hedera?

Could Hedera become the backbone of enterprise blockchain adoption by 2026? The signs point toward increasing mainstream integration. As regulatory clarity improves and more businesses seek sustainable blockchain solutions, Hedera's combination of speed, stability, and environmental credentials makes it a compelling choice.

Watch for expanding use cases in supply chain, digital identity, and financial services—areas where Hedera's performance advantages translate directly into business value. The next chapter of this hashgraph revolution is just beginning to unfold…

Conclusion

Hedera stands at the intersection of enterprise needs and blockchain innovation, offering a combination of performance, sustainability, and institutional backing. Its technical advantages in transaction processing, cost structure, and environmental impact clearly differentiate it from legacy blockchain systems.

The platform's focus on practical business implementation, rather than speculative hype, positions it uniquely in the market. While challenges remain in balancing decentralization with enterprise requirements, Hedera's technological foundation and strategic partnerships provide a solid base for continued growth.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events