Top 7 On-Chain Analysis Tools You Should Know in 2025

On-chain analysis is key to understanding crypto trends. Explore the best tools for tracking whale activity, DeFi metrics, and blockchain insights in 2025.

Miracle Nwokwu

March 26, 2025

Table of Contents

The cryptocurrency market in 2025 is fast-moving, with blockchain innovation driving both growth and investment opportunities. For traders, investors, and analysts, understanding on-chain data is no longer optional—it's essential. Blockchain networks store massive amounts of transparent data, and on-chain analysis tools help transform this information into actionable insights. From tracking whale activity to monitoring DeFi trends, these tools offer powerful ways to stay ahead in an unpredictable market.

As institutional adoption grows and decentralized finance becomes mainstream, reliable analytics platforms have become a must. But with so many tools available, how do you choose the best one? This guide highlights seven of the most effective on-chain analysis platforms this year. Each has unique features and strengths to help you make more informed decisions, whether you're a seasoned trader or just starting your crypto journey.

Why On-Chain Analysis Is Essential in 2025

The transparency of blockchains sets them apart from traditional financial markets. Every transaction, wallet balance, and contract interaction is publicly available. On-chain analysis tools take this raw data and convert it into digestible metrics like transaction volume, active addresses, or liquidity movement, eliminating the need to manually sift through block explorers.

This level of insight is more critical than ever as the crypto market matures but retains its volatility. Bitcoin’s supply changes due to halvings, Ethereum’s staking mechanics, and DeFi’s rapid evolution all influence prices and trends. On-chain analytics can help detect patterns, monitor whale movements, and measure true adoption. Whether you’re evaluating a token’s potential or tracking smart money, these tools make it easier to spot opportunities and risks.

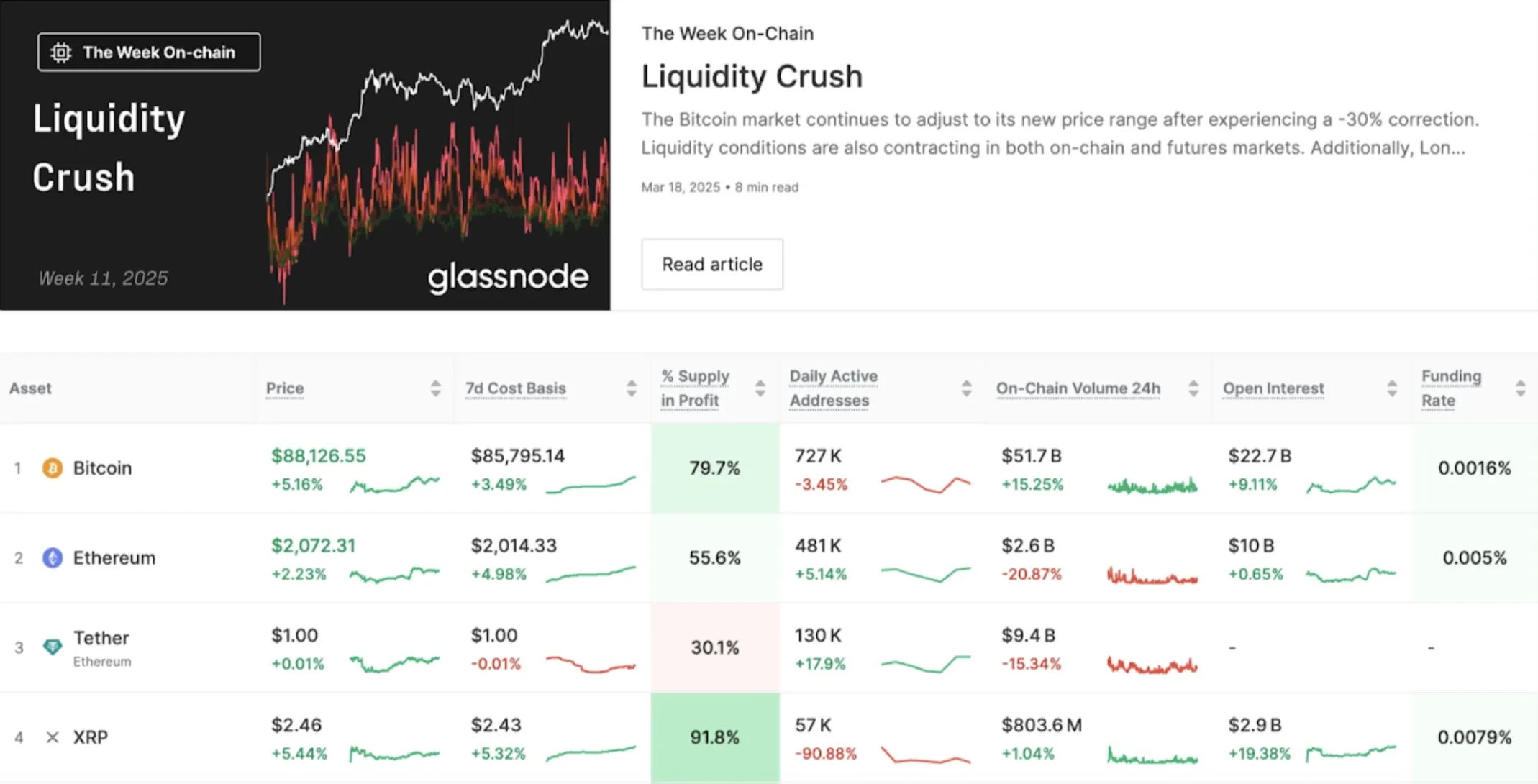

1. Glassnode: A Comprehensive Data Hub

Glassnode is a leading platform for detailed on-chain metrics. Designed for institutional investors and advanced traders, it offers insights across Bitcoin, Ethereum, and other cryptocurrencies. With over a decade of historical data, Glassnode provides tools to analyze market cycles, identify trends, and backtest strategies.

The platform's customizable dashboards give users access to complex metrics like the MVRV Z-Score or Net Unrealized Profit/Loss (NUPL), valuable signals for determining market sentiment and potential reversals. Its integration with TradingView also allows seamless technical analysis alongside on-chain data.

Key Features

- Over 10 years of historical blockchain data for in-depth analysis.

- Institutional-grade metrics covering supply dynamics, liquidity, etc.

- Decentralized network monitoring tailored for high-level investors.

- Seamless TradingView integration for charting and trading insights.

- Customizable dashboards for unique user needs.

Pro Tip: Start with Glassnode’s free tier for basic stats like wallet activity. For advanced analytics, consider the Studio plan ($49/month) to dive deeper.

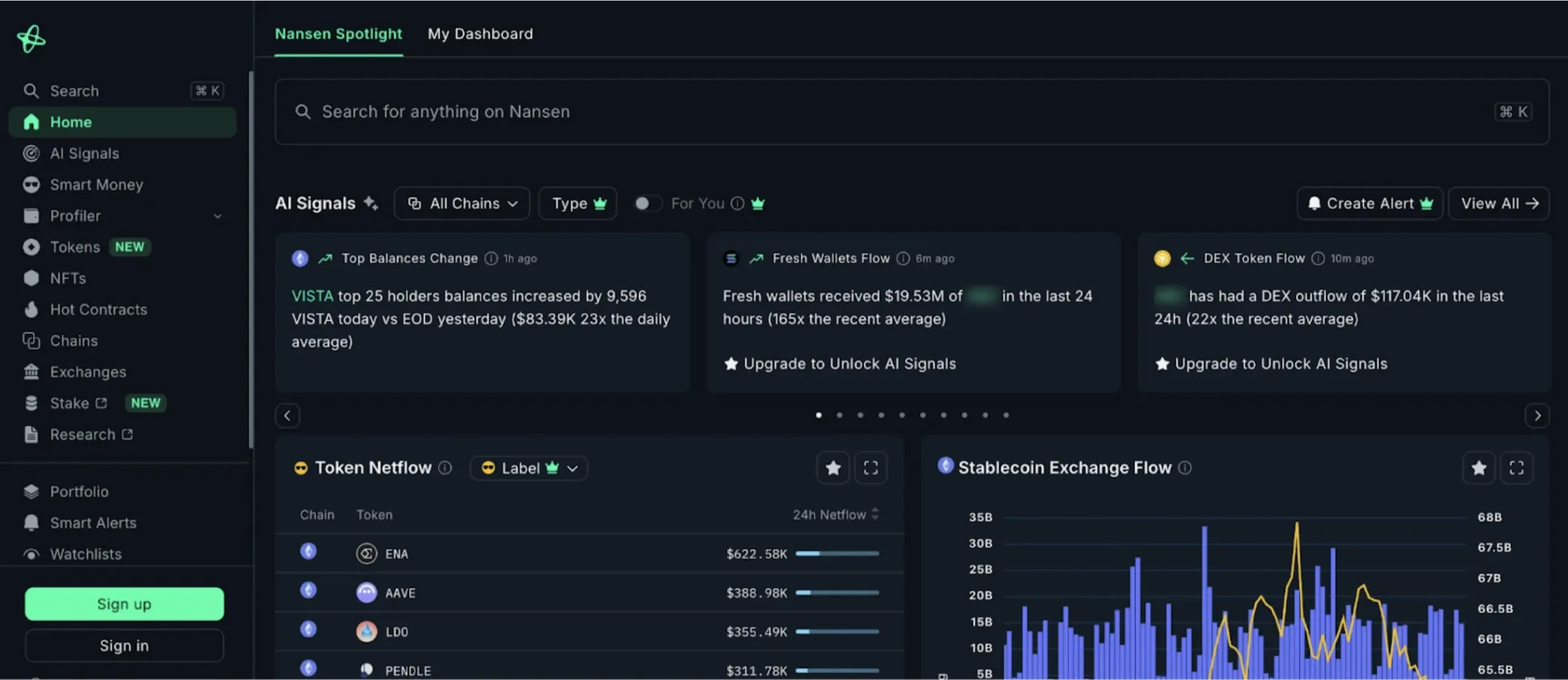

2. Nansen: Tracking Wallets and Smart Money

Nansen specializes in wallet tracking and identifying movements of significant players, often referred to as “smart money.” It labels wallet addresses and monitors their activity across multiple blockchains, providing real-time insights into trades, holdings, and patterns.

For example, if a major institutional wallet suddenly moves $10 million in ETH, Nansen can alert you before the market reacts. Its tools, like Token God Mode, summarize data in an easy-to-understand format, making it accessible for both new users and experts trying to avoid pump-and-dump schemes or find undervalued tokens.

Key Features

- Real-time tracking of wallet transactions to monitor whale movements.

- "Smart money" indicators to better predict market trends.

- NFT analytics to identify new collections and trading opportunities.

- Wallet labeling for clearer transaction context.

- Cross-chain support covering over 20 separate blockchains.

Pro Tip: Use the free Wallet Profiler to analyze any address. Upgrade to the Standard plan ($149/month) for real-time monitoring and alerts on market movements.

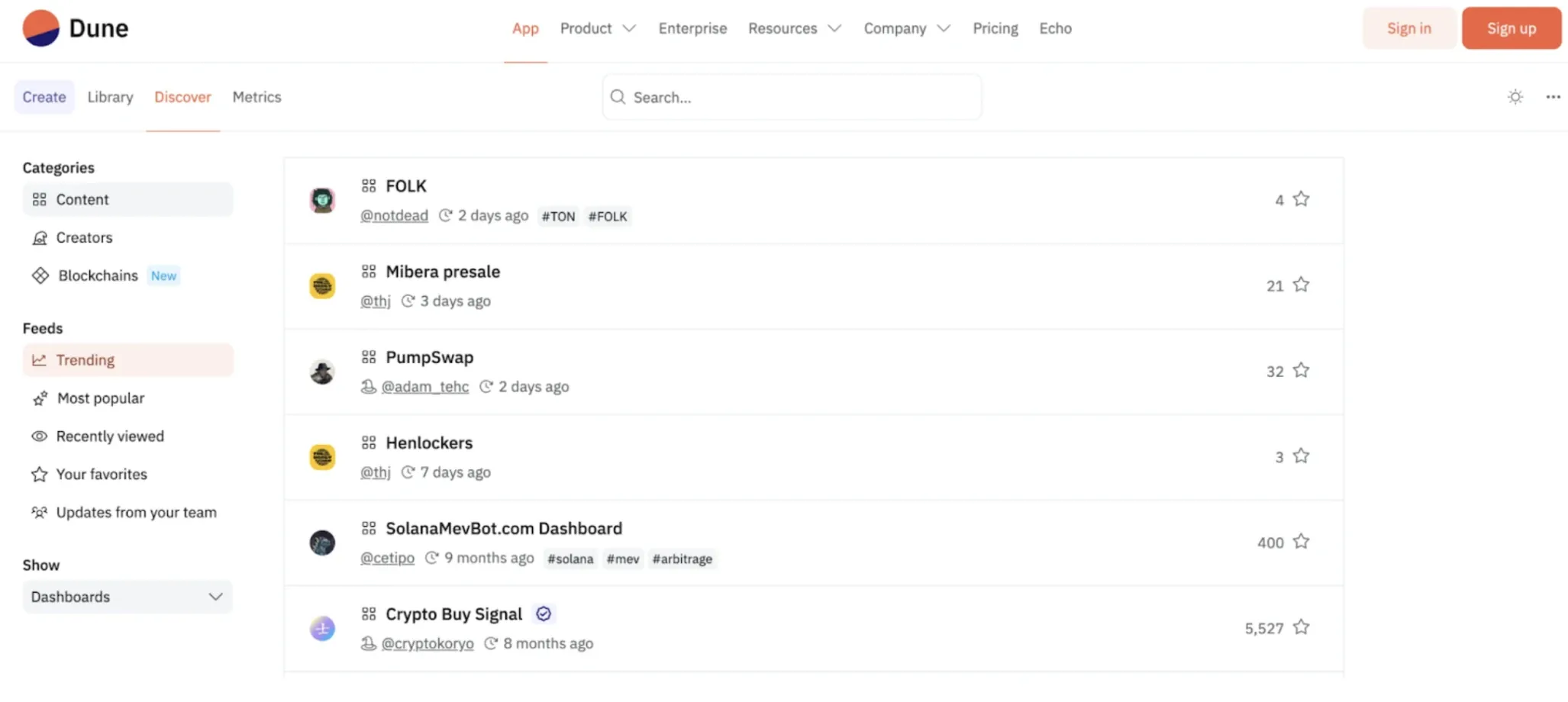

3. Dune Analytics: Build Custom Dashboards

Dune Analytics offers a unique experience by enabling users to query blockchain data directly. With support for networks like Ethereum, Polygon, and Solana, it’s a go-to for developers, analysts, and anyone comfortable with SQL.

You can create custom dashboards or use community-shared templates to track metrics like gas fees, NFT sales, or DeFi trade volume. While some technical knowledge is helpful, Dune's open design fosters creativity and collaboration, making it a favorite for creating tailored insights.

Key Features

- Fully customizable SQL-based data queries for in-depth analysis.

- Collaborative dashboards that users can share and update in real time.

- Advanced visualization tools for trends, heatmaps, and charts.

- Supports DeFi-focused metrics for Ethereum, Polygon, and others.

- Free to use with open access for creating personal dashboards.

Pro Tip: Check out public dashboards for free and start experimenting with simple queries. Advanced users can explore premium tiers for enhanced features.

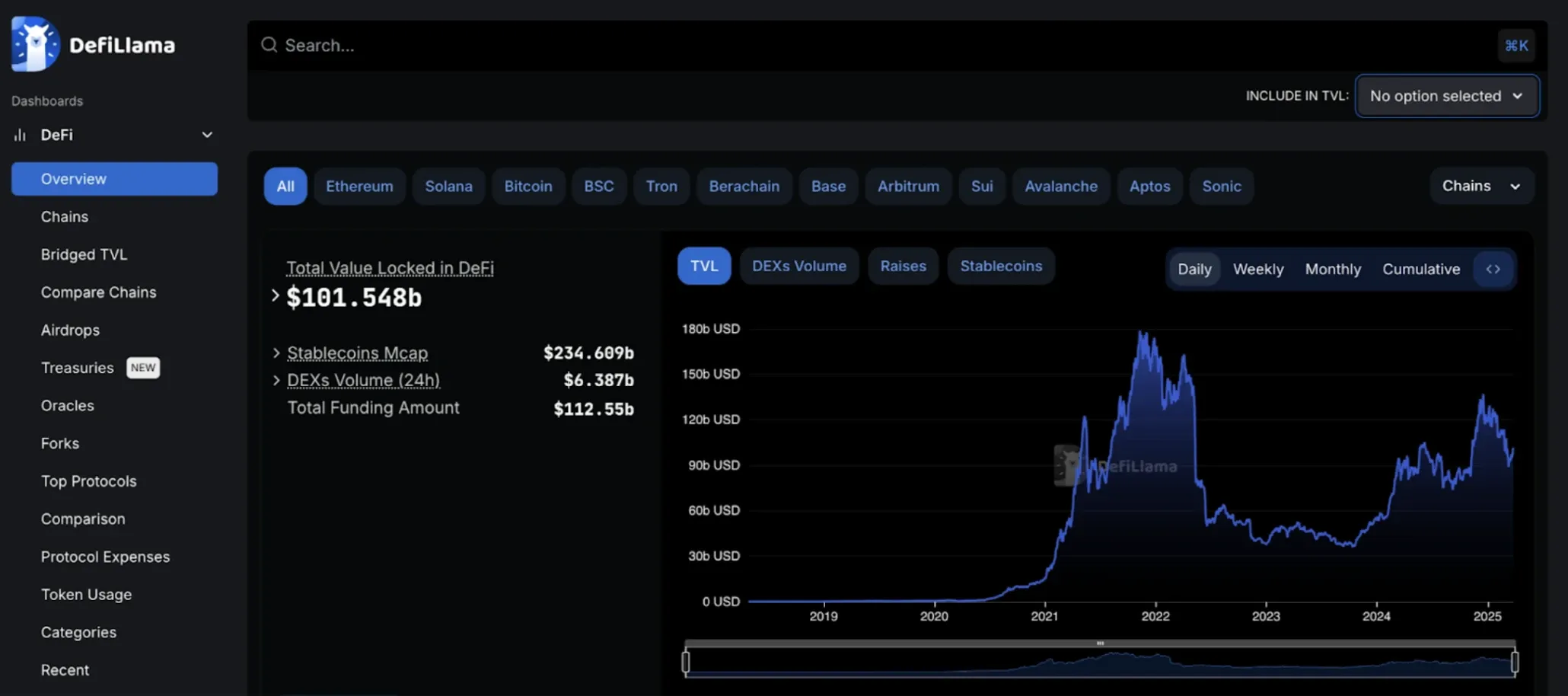

4. DefiLlama: Monitoring DeFi Metrics

DefiLlama has become a trusted resource for decentralized finance data. The platform tracks Total Value Locked (TVL) across hundreds of blockchains and protocols, providing an overview of liquidity trends in real-time.

Its interface is straightforward, offering insights into protocol performance, yields, and incentives without unnecessary features. This makes it perfect for identifying high-potential projects or flagging declines in liquidity that may indicate trouble.

Key Features

- Tracks TVL across 150+ blockchains and 1,500+ protocols.

- Open-source platform offering complete transparency.

- Specialized in DeFi protocol comparisons and market share analysis.

- Ideal for identifying high-liquidity farming and staking opportunities.

- User-friendly yet robust enough for institutional use.

Pro Tip: Watch daily TVL updates to spot growth trends. Rising TVL often signals growing confidence in a protocol. Check yield data for promising opportunities.

5. Santiment: Combining Data and Market Sentiment

Santiment blends on-chain metrics with social analysis. Its tools monitor blockchain data like transaction volume and wallet activity, alongside social chatter from platforms like Telegram and X.

Social trends often affect market behavior, with spikes in online mentions sometimes preceding price movements. Santiment’s historical database lets you see how sentiment aligns with price fluctuations, helping traders make data-informed decisions.

Key Features

- Tracks active addresses and transaction volumes with multiple metrics.

- Social sentiment analysis integrated with on-chain data.

- Offers predefined signals for up-to-date market trends.

- Useful for early identification of hype cycles and FOMO-driven trends.

- Sanbase platform for rich data visualization.

Pro Tip: The free tier gives access to social volume tracking. For deeper insights, upgrade to the Pro plan ($49/month), which includes whale transaction monitoring and advanced sentiment tools.

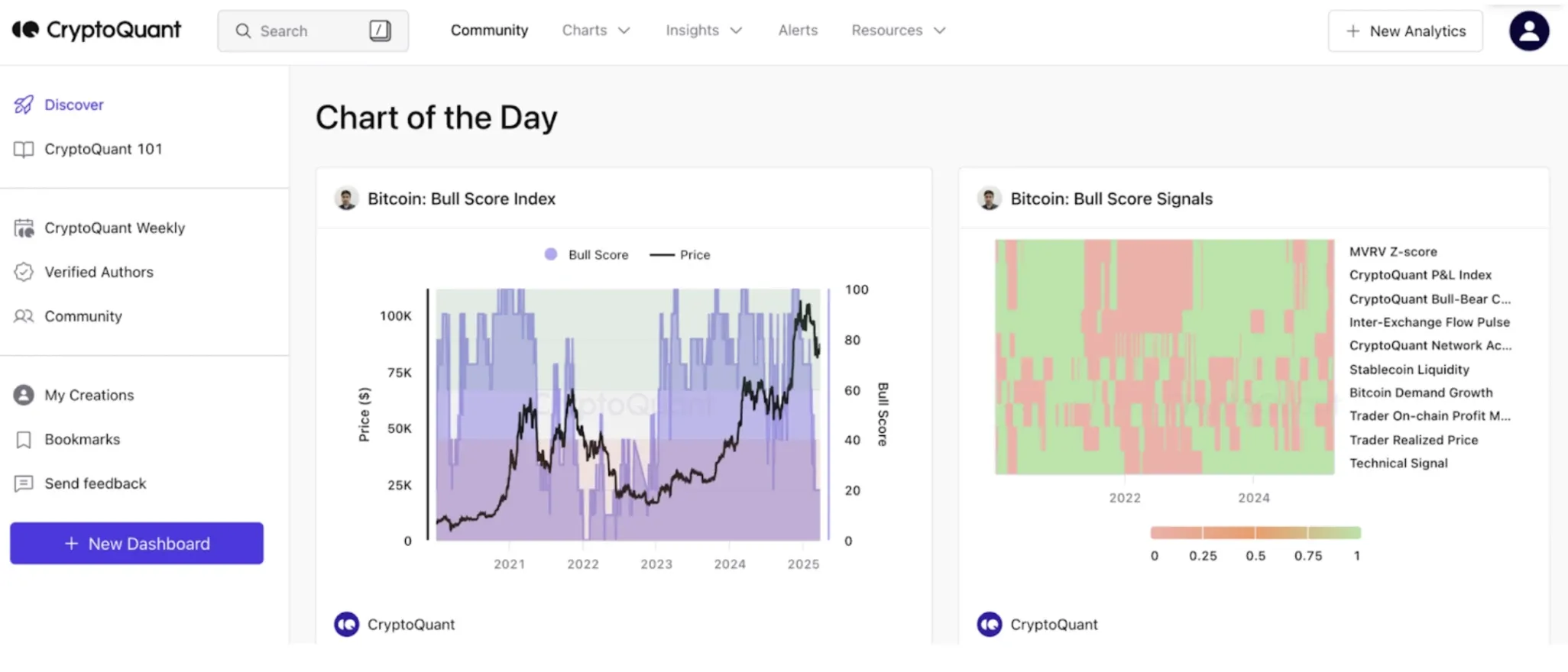

6. CryptoQuant: Real-Time Alerts for Traders

CryptoQuant caters to active traders by offering real-time data. Its appeal lies in features like exchange inflows, miner outflows, and reserve tracking, all of which can help predict short-term market shifts.

The platform also includes predictive indicators like the Exchange Whale Ratio, which highlights significant sell-offs by large wallets. With a focus on clarity, CryptoQuant makes it easy to interpret key metrics without overwhelming users.

Key Features

- Real-time exchange flow monitoring to anticipate market activity.

- Insights into miner behavior and on-chain supply shifts.

- Predictive metrics for Bitcoin, Ethereum, and other top coins.

- Sleek, user-friendly interface for traders of all experience levels.

- Integration with tools for alerts and automation.

Pro Tip: Use the free version to track basic exchange flows. For alerts on major market events, consider the Premium plan ($39/month).

7. Messari: In-Depth Research and Fundamentals

Messari is a go-to for long-term investors who prioritize fundamental analysis over day-to-day volatility. Known for its in-depth research reports, the platform also provides charts and metrics on market caps, protocol revenues, and adoption rates.

It’s ideal for comparing projects or evaluating Layer-1 ecosystems, with a balance of free and premium features. While it’s less useful for immediate trading signals, its focus on the bigger picture makes it a valuable resource.

Key Features

- Realized market cap metrics for deeper insights into asset valuation.

- Protocol analytics for long-term trend identification.

- Subscription options (Pro and Enterprise) for advanced features.

- Detailed asset profiles with actionable insights.

- Trusted resource for institutional investors and long-term strategies.

Pro Tip: Use Messari’s free screening tools to filter tokens by growth metrics. For detailed reports and analysis, upgrade to the Pro plan starting at $24.99/month.

Choosing the Right Tool

The right on-chain analysis tool depends on your goals:

- Active traders: CryptoQuant or Nansen

- Long-term investors: Glassnode or Messari

- DeFi enthusiasts: DefiLlama

- Custom analysts: Dune Analytics

- Sentiment-driven traders: Santiment

Most platforms offer free tiers, so it’s easy to try them before committing to a paid plan.

The Future of On-Chain Tools

As blockchain technology evolves, expect on-chain tools to incorporate AI for predictive modeling and expand coverage to new networks. Compliance-focused features will likely grow in demand as regulations tighten, making platforms like Glassnode even more valuable.

These tools will continue to be essential for navigating the crypto markets. Start with the free options, explore what works for you, and gradually upgrade as your strategy advances. With the right toolset, you’ll be better equipped to decode the blockchain’s data and make smarter cryptocurrency decisions.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Miracle Nwokwu

Miracle NwokwuMiracle holds undergraduate degrees in French and Marketing Analytics and has been researching cryptocurrency and blockchain technology since 2016. He specializes in technical analysis and on-chain analytics, and has taught formal technical analysis courses. His written work has been featured across multiple crypto publications including The Capital, CryptoTVPlus, and Bitville, in addition to BSCN.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens