LayerEdge Token Analysis: Truth Behind the $EDGE Controversy

Uncover the facts about LayerEdge's token utility, economic model, and the recent $EDGE ticker controversy. Learn what the whitepaper reveals about this Bitcoin Layer 2 solution's tokenomics.

Crypto Rich

April 11, 2025

Table of Contents

What's Really Happening with LayerEdge's Token?

LayerEdge has positioned itself as a key player in Bitcoin's Layer 2 future, using advanced technology like zero-knowledge proofs and BitVM to improve Bitcoin's scalability. At the heart of this ecosystem is the LayerEdge token—a utility token designed to power transactions, reward network participants, and enable cross-chain operations.

Recently, controversy erupted when LayerEdge officially distanced itself from widely circulated "$EDGE" tokenomics information. This has left many in the crypto community confused about the token's actual details, timeline, and legitimacy.

This article digs into the official whitepaper to uncover what we actually know about the LayerEdge token, what remains uncertain, and what this means for potential users and investors.

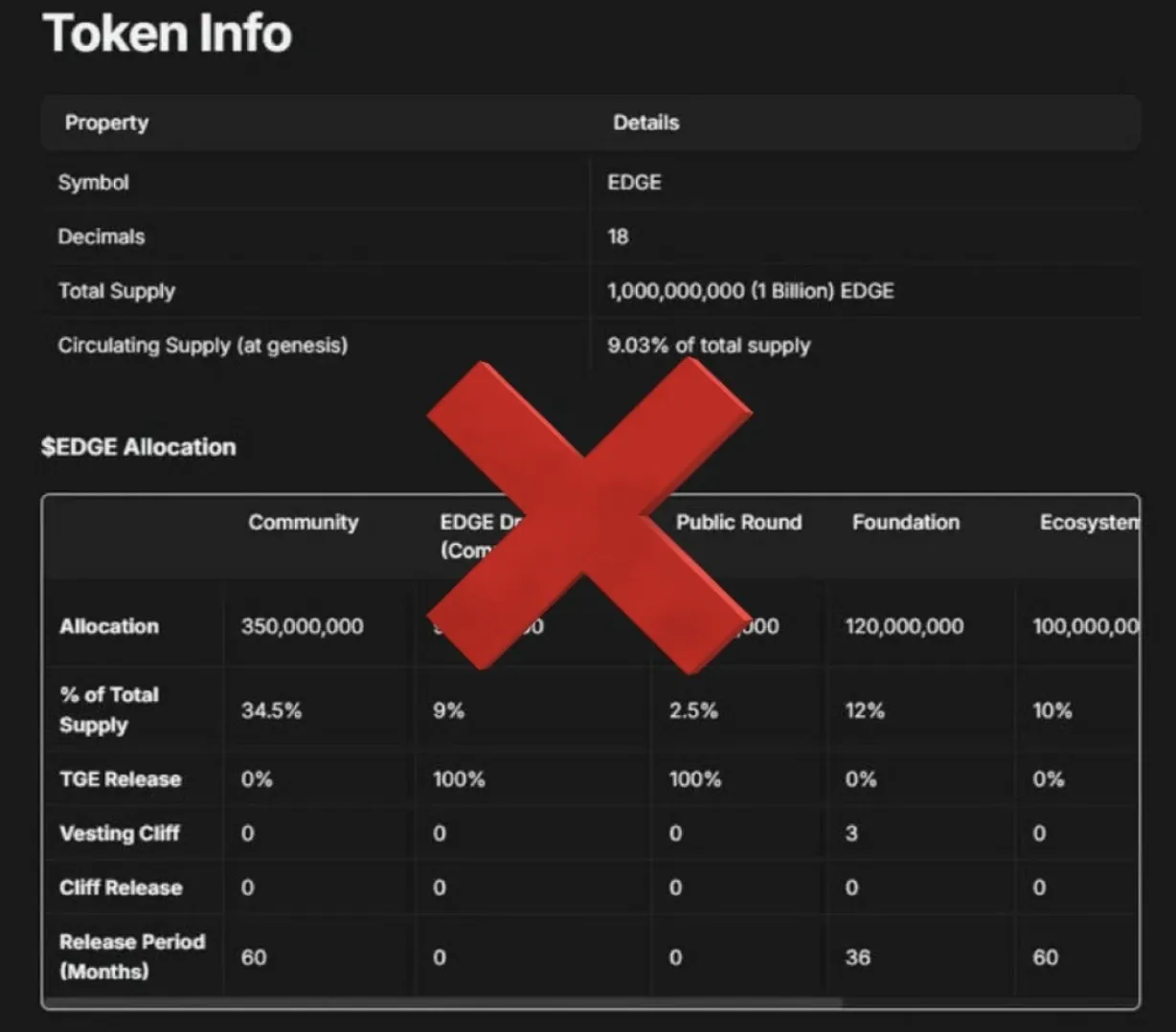

The $EDGE Token Controversy Explained

In recent weeks, unofficial tokenomics details for a supposed "$EDGE" token spread across crypto social media. These unverified figures claimed specific allocations that LayerEdge has since disavowed.

Instead of repeating these potentially misleading numbers, what's important to understand is that LayerEdge quickly denied any connection to this information. In recent posts on X (formerly Twitter), some users, including @mr_cbillionaire shared: "LayerEdge has disassociated itself from the trending EDGE Tokenomics, says data not from them". Additionally, a team member clarified: "The token is not affiliated with the LayerEdge Foundation... we may or may not use $EDGE as the final ticker."

Community reactions were mixed:

- Some users noted that a LayerEdge moderator had already identified the tokenomics as fake

- Others, including @TheDelta_Fam, said "LayerEdge pulling an Uno reverse card on their own tokenomics. Bold move, let's see if it pays off"

- @RoysharkCrypto voiced what many were thinking: "So who created that?"

The controversy has created uncertainty around LayerEdge's token, leaving many to wonder what information can be trusted.

What the Whitepaper Actually Says About LayerEdge's Token

While the ticker and specific distribution remain unclear, LayerEdge's official whitepaper provides solid information about the token's utility and economic model.

Token Utility

The whitepaper clearly outlines three core functions of the LayerEdge token:

- Payment for Fees: The token serves as the exclusive medium for paying transaction and verification fees within the ecosystem (Page 6)

- Node Incentivization: Light Nodes receive token rewards for verification tasks, encouraging decentralized participation (Page 4)

- Cross-Chain Operations: The token acts as a "universal gas token" for external protocols, with a portion of fees converted to ETH and BTC for native blockchain verifications (Page 8)

Economic Model and Formulas

The token's economic model is mathematically defined in the whitepaper:

Demand Dynamics (Page 6): The whitepaper explains that token demand increases in two ways: when more people use the network and when verification happens more frequently. Simply put, higher network usage means more demand for the token.

Node Reward Structure (Page 9): According to the whitepaper, node operators receive three types of rewards:

- Base rewards just for participating

- Client fees based on how much verification work they do

- Performance bonuses for catching fraudulent activities

Fee Distribution: On page 9 of the whitepaper, it shows the fees collected through the token are split into four categories:

- Funds for Ethereum transactions

- Funds for Bitcoin transactions

- Rewards for network participants

- Treasury funds for development and growth

Non-Governance Role

Importantly, the whitepaper explicitly states on page 9 that the LayerEdge token has no governance function. It exists purely for utility, focused on "facilitating sustainable economic stability without involvement in governance mechanisms."

What We Still Don't Know

Despite the whitepaper's details on token utility, several critical pieces of information remain missing:

Ticker Uncertainty

The whitepaper never specifies a ticker symbol, which aligns with LayerEdge's statement that "$EDGE" may not be the final choice. This leaves open the question of what the official ticker will be.

Missing Tokenomics Details

The whitepaper provides no information on:

- Total token supply

- Token allocation percentages

- Vesting schedules

- Initial circulating supply

These gaps suggest that either these aspects aren't finalized yet or LayerEdge is deliberately withholding this information until a later date.

Token Generation Event Timeline

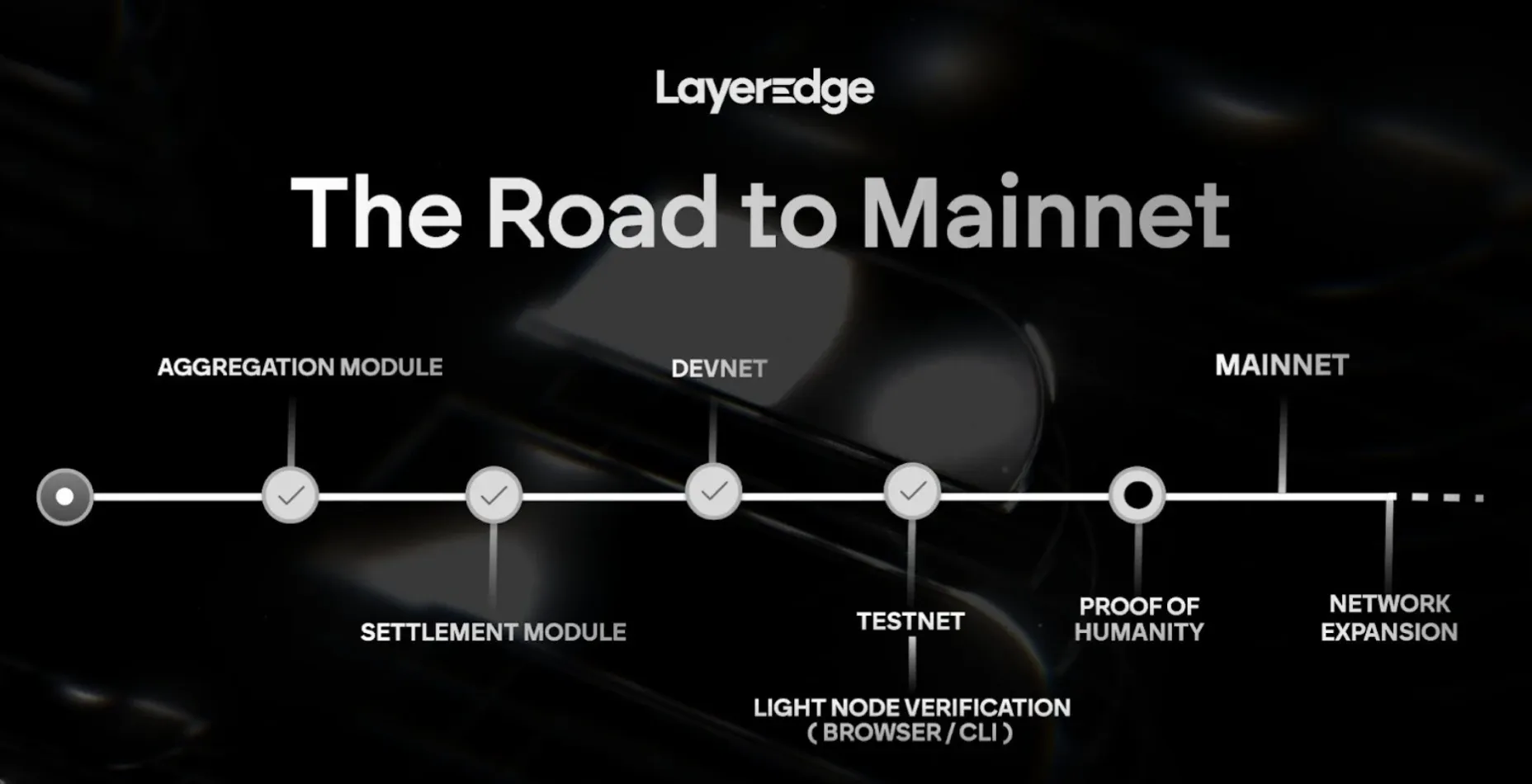

No official token generation event (TGE) date appears in the whitepaper or official communications. Community speculation has suggested Q2 2025 (April-May), which aligns with the recent conclusion of the testnet on March 22, 2025. Now that we're in April 2025, the community is watching closely for announcements, but this timeline remains unconfirmed by LayerEdge.

Implications for the LayerEdge Ecosystem

Testnet and Potential Airdrop

LayerEdge recently concluded Phase II of its incentivized testnet, which ended on March 22, 2025. Participants earn points for tasks such as running light nodes and submitting proofs.

As shown in LayerEdge's official roadmap above, the project has already completed several key milestones including the testnet phase. With the Proof of Humanity and Mainnet launches on the horizon, the token generation event likely aligns with these upcoming stages.

The whitepaper's node incentivization model suggests these points will likely convert to tokens at the TGE. However, without official confirmation from LayerEdge, any specific allocation percentages for airdrops remain unverified speculation.

Ecosystem Growth Potential

The token's utility design positions LayerEdge to drive adoption across multiple sectors:

- DeFi: Cross-chain verification capabilities

- AI/ML: Verifiable computation services

- IoT/DePIN: Sensor data validation

- Digital Identity: Secure verification processes

- Blockchain Gaming: Efficient transaction processing

The token's economic model supports these applications by making verification much more efficient. According to the whitepaper (Page 7), LayerEdge reduces verification complexity from linear to logarithmic. In simple terms, this means the system can handle many more transactions without slowing down, making it suitable for large-scale applications.

Risks and Opportunities

The $EDGE controversy creates both risks and opportunities for LayerEdge and the crypto community.

On the risk side, community confusion about what constitutes the legitimate token is an ongoing issue. This confusion could lead to potential phishing attempts, which is why LayerEdge has warned users with "Don't get phished" messages. The current lack of official tokenomics information also creates uncertainty for potential participants.

On the opportunity side, when LayerEdge releases clear token information, it will help clarify the project's direction. The technical design outlined in the whitepaper shows potential for LayerEdge to establish itself in the BTCFi sector once the token details are settled. Those who participated in the testnet may benefit if their participation points convert to tokens at launch.

Conclusion: Navigating the LayerEdge Token Landscape

LayerEdge has addressed the controversy by stating: "when we do launch, you'll hear it from us." The testnet's conclusion on March 22, 2025, provides a potential clue to the token timeline, with many anticipating an announcement soon in Q2 2025.

Despite the confusion surrounding the $EDGE ticker, the whitepaper reveals a thoughtfully designed token model with clear utility for fees, node rewards, and cross-chain operations. While key details like the ticker and supply remain unknown, if LayerEdge delivers on its technical promise, it could become a significant player in the BTCFi sector.

Visit LayerEdge's website and follow them on their social media channels, like X or Telegram, for official updates. The LayerEdge token story reminds us to prioritize official documentation over social media speculation when researching crypto projects.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens