Research

Ultimate PancakeSwap Tutorial: Doing Swaps, Staking CAKE and More

Master PancakeSwap in 2025: Step-by-step guide to token swaps, farming, staking, and multi-chain DeFi fun.

Crypto Rich

March 31, 2025

Looking to trade, earn, or play in DeFi? PancakeSwap offers token swaps, liquidity farming, staking, and lotteries on BNB Chain, Ethereum, and more. This guide breaks down its core features as of March 28, 2025, so you can start exploring in minutes and swap tokens or earn CAKE rewards right away!

What is PancakeSwap?

PancakeSwap is a multi chain DEX with an AMM model---no order books, just liquidity pools where users trade against pre-funded token pairs. Launched in 2020 on BNB Chain, it now spans multiple networks for more options and lower fees:

- BNB Chain

- Ethereum

- Arbitrum

- Polygon

- zkSync Era

- Linea

- Base

- Aptos

The platform stands out for its low fees, fast transactions, and wide selection of tokens. Each network offers different advantages: BNB Chain for affordability, Ethereum for token variety, and Arbitrum for speed.

Getting Started with PancakeSwap

Set Up Your Wallet

Before diving into PancakeSwap:

- Install MetaMask or Trust Wallet

- Add your network (e.g., for BNB Chain: Chain ID 56, RPC URL https://bsc-dataseed.binance.org/)

- Get native tokens for gas (BNB for BNB Chain, ETH for Ethereum)

- Load up tokens you want to trade or stake

Need BNB for gas? Buy it on Binance or another exchange and transfer to your wallet.

Connect to PancakeSwap

Ready to jump in? Here's how:

- Visit pancakeswap.finance

- Click "Connect Wallet" in the top right

- Select your wallet (MetaMask, Trust Wallet, etc.)

- Approve the connection

- Make sure you're on the right network!

Core Features of PancakeSwap

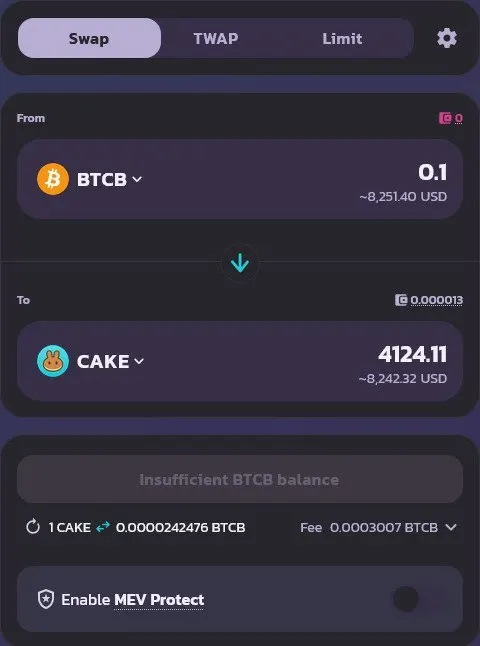

Swapping Tokens

Trade tokens in seconds:

- Go to "Trade" > "Swap"

- Pick your pair (e.g., swap 0.1 BNB for ~30 CAKE)

- Set slippage (0.5%-1% works for most trades)

- Click "Swap" and confirm in your wallet

Multi-chain tip: Each blockchain has its own token ecosystem - you will need to be on BNB Chain to trade BEP-20 tokens, ETH for ERC-20 tokens, etc. Choose your network based on the tokens you want to trade and consider gas fees (BNB Chain and Polygon generally have lower fees than Ethereum).

Advanced Trading Features

PancakeSwap also offers more sophisticated trading options:

- TWAP (Time-Weighted Average Price): Execute larger trades over time through the "Next Swap" feature. It splits big trades into smaller chunks based on time-weighted average pricing, reducing price impact and slippage---perfect for large trades or volatile markets. Example: Use TWAP when swapping 5,000 CAKE to minimize price impact.

- Limit Orders: Set the specific price at which you want to buy or sell. Your order only executes when the market hits your target price, giving you more control than standard swaps. Great for targeting entry or exit prices without constant monitoring. Example: Set a limit order to buy BNB at $400 if you believe the current price of ~$600 will drop.

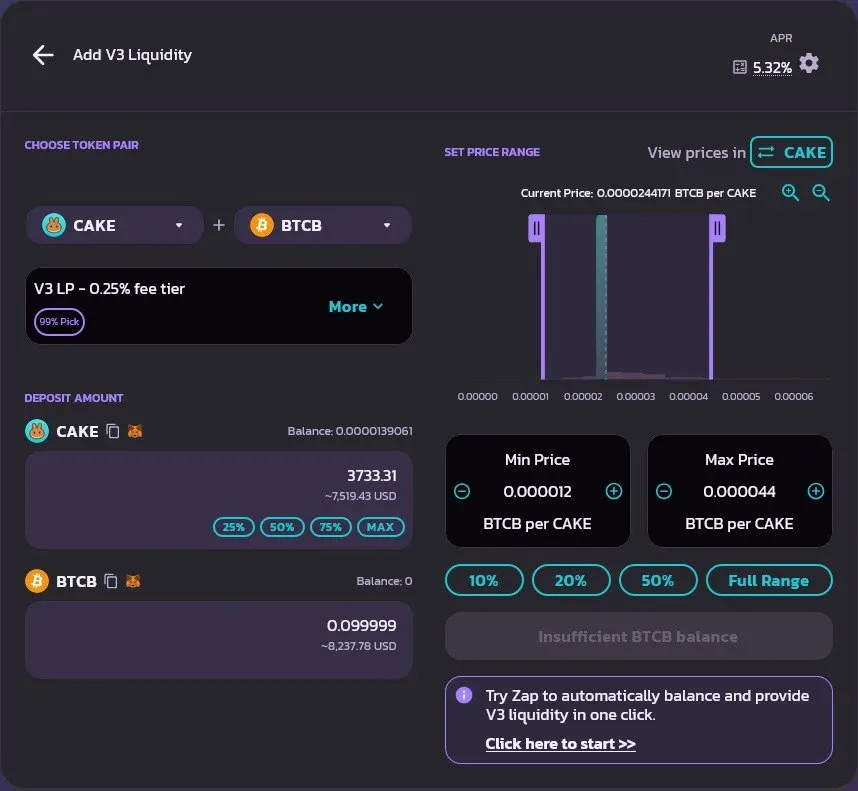

Farming with Liquidity Pools

Earn CAKE rewards plus trading fees while supporting trades:

- Go to "Earn" > "Farm/Liquidity"

- Select the pool you want to participate in

- Click "Add Liquidity"

- Enter amount

- Approve each token and click "Supply"

- Get LP tokens (V2) or NFT positions (V3) for your contribution

- Stake your LP tokens (V2) or NFT positions (V3) in Farms to start earning

Using Advanced Liquidity Features

Zap Function

PancakeSwap offers a handy "Zap" feature that lets you provide liquidity using just one token instead of two. When you select "Zap" when adding liquidity, the platform automatically splits your token, converts half to the paired token, and adds the liquidity pair for you---all in a single transaction. This saves you time and reduces gas fees when entering liquidity pools.

V2 vs V3 Liquidity Differences

PancakeSwap offers two liquidity versions with important differences:

- V2 Liquidity: Provides fungible LP tokens, uses fixed 0.25% fee, and spreads your liquidity across all price ranges

- V3 Liquidity: Creates NFT positions instead of LP tokens, lets you choose fee tiers (0.01%-1%), and concentrates your liquidity within specific price ranges for higher efficiency

Double rewards: You earn a share of trading fees from swaps in your liquidity pool PLUS additional CAKE rewards from farming!

Risk note: Price shifts might cause impermanent loss---potentially less value than simply holding your tokens. For V3 positions, your liquidity becomes inactive and stops earning if prices move outside your chosen range.

Earning with CAKE

PancakeSwap offers two main ways to earn with your CAKE tokens:

Comparing Farming vs Staking: While both earning methods involve your CAKE tokens, they differ in risk and rewards. Farming typically offers higher returns but carries impermanent loss risk from price changes. Staking provides more stable rewards with lower risk, making it better for beginners or those seeking predictable returns.

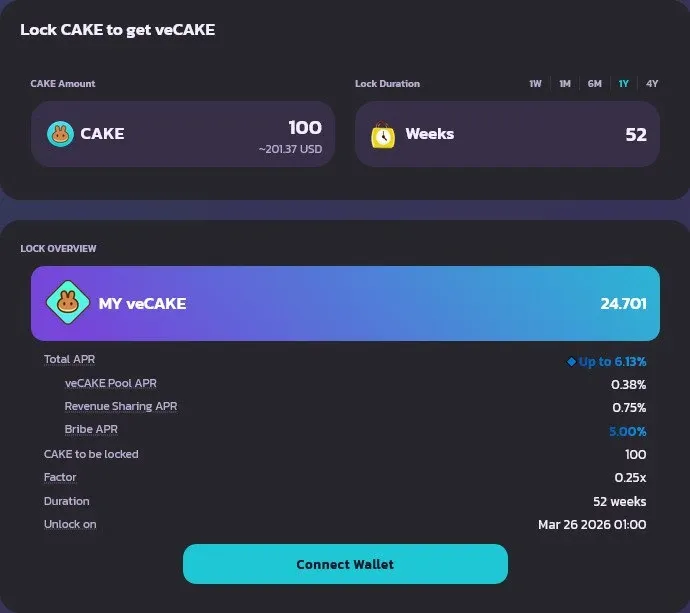

CAKE Staking

Lock your CAKE to earn more CAKE:

- Navigate to "Earn / Staking"

- Select "Stake CAKE"

- Choose how much CAKE to stake and your lock duration

- Longer lock periods provide higher APY

- Confirm and stake your CAKE

- Get veCAKE that can be used for governance voting, earning more CAKE from the reward pool, participating in IFO sales, and many other benefits

- Watch your rewards grow over time

Pro tip: Longer lock durations offer significantly higher yields but lock your CAKE---only choose this if you won't need those funds during the lock period!

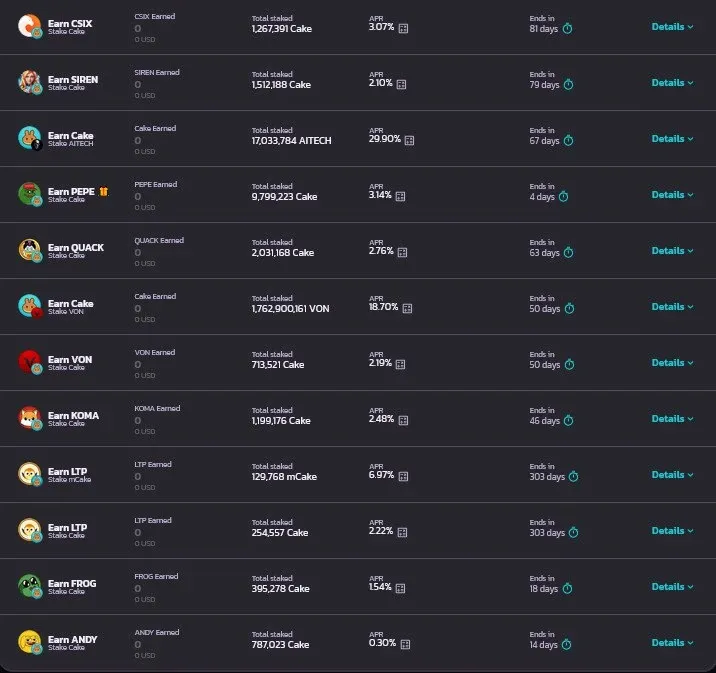

Syrup Pools

Stake CAKE to earn other tokens:

- Navigate to "Earn / Staking"

- Browse available Syrup pools

- Choose a pool for tokens you're interested in earning

- Enable the pool (one-time approval)

- Stake your desired amount of CAKE

- Harvest rewards manually, or auto-collect when unstaking your CAKE

Note: Most Syrup pools have limited durations, so check end dates before staking! Each pool offers tokens from established projects or new crypto ventures launching on PancakeSwap.

Lottery, Prediction, and More

Feeling lucky? Try these:

- Lottery: Risk $5 worth of CAKE tokens for a shot at thousands! Buy tickets, pick numbers (or get random ones), and wait for the draw. A draw occurs every 12 or 36 hours. The more numbers you match the bigger the prizes!

- Prediction: Bet with BNB on whether the BNB price will rise or fall in just 5 minutes. Get it right, win BNB!

- Initial Farm Offerings (IFOs): Stake veCAKE to buy new tokens before they hit exchanges

- Perpetuals Trading: Trade futures with leverage, get 5% fee discounts with CAKE

Stay Safe on PancakeSwap

Your security checklist:

- ✓ Verify the URL: pancakeswap.finance only (avoid scams!)

- ✓ Start small: Test new features with minimal funds

- ✓ Understand risks: Impermanent loss in farming, price volatility in staking

- ✓ Set reasonable slippage: Too high invites front-running

- ✓ Protect your keys: Never share your private keys or recovery phrase

- ✓ Disconnect when done: Don't leave your wallet connected

Conclusion

PancakeSwap blends swaps, farming, staking, and fun across multiple blockchain networks in one tasty DeFi package. Its user-friendly interface and expanding features make it perfect for beginners and DeFi veterans. With support for eight different blockchains, you can choose the network that best suits your needs—whether it's the affordability of BNB Chain, the variety of Ethereum, or the speed of Arbitrum.

Ready to jump in? Connect your wallet, swap your first tokens, and join the DeFi party!

To learn more and check out their other products, visit PancakeSwap and start exploring.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Latest News

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens