What is Impermanent Loss in DeFi?

Learn what impermanent loss is, how it affects DeFi liquidity providers, and proven strategies to minimize losses while maximizing LP rewards.

Crypto Rich

January 16, 2021

Table of Contents

Last revision: September 17, 2025

Impermanent loss is the decrease in dollar value when you provide liquidity to an automated market maker (AMM) compared to simply holding those same tokens in your wallet. AMMs automatically rebalance your holdings as prices change, and this rebalancing process creates the loss.

Every liquidity provider faces this hidden cost. Understanding how it works gives you the tools to make smarter decisions about when and where to provide liquidity.

How Does Impermanent Loss Actually Work?

AMM protocols like Uniswap and PancakeSwap use mathematical formulas to maintain token ratios in liquidity pools. You deposit tokens, and the protocol automatically locks them in a 50/50 value split.

Here's where things get interesting. Market prices change constantly, so arbitrage traders step in to profit from price differences. They buy underpriced tokens from the pool and sell overpriced ones back to the market. This trading activity shifts the token ratio in your pool and creates impermanent loss.

Think of it this way: the AMM acts like an automatic trading bot that always sells your best-performing assets and buys more of your worst-performing ones. The system keeps your portfolio "balanced," but that balance comes at a cost.

The term "impermanent" is misleading. It suggests that the loss would reverse if prices return to their original levels, but crypto markets rarely move backward. Most of the time, what starts as "impermanent" becomes permanent when you withdraw your funds.

Why Do Token Prices Create Impermanent Loss?

The bigger the price difference between your two tokens, the bigger your loss. It's that simple.

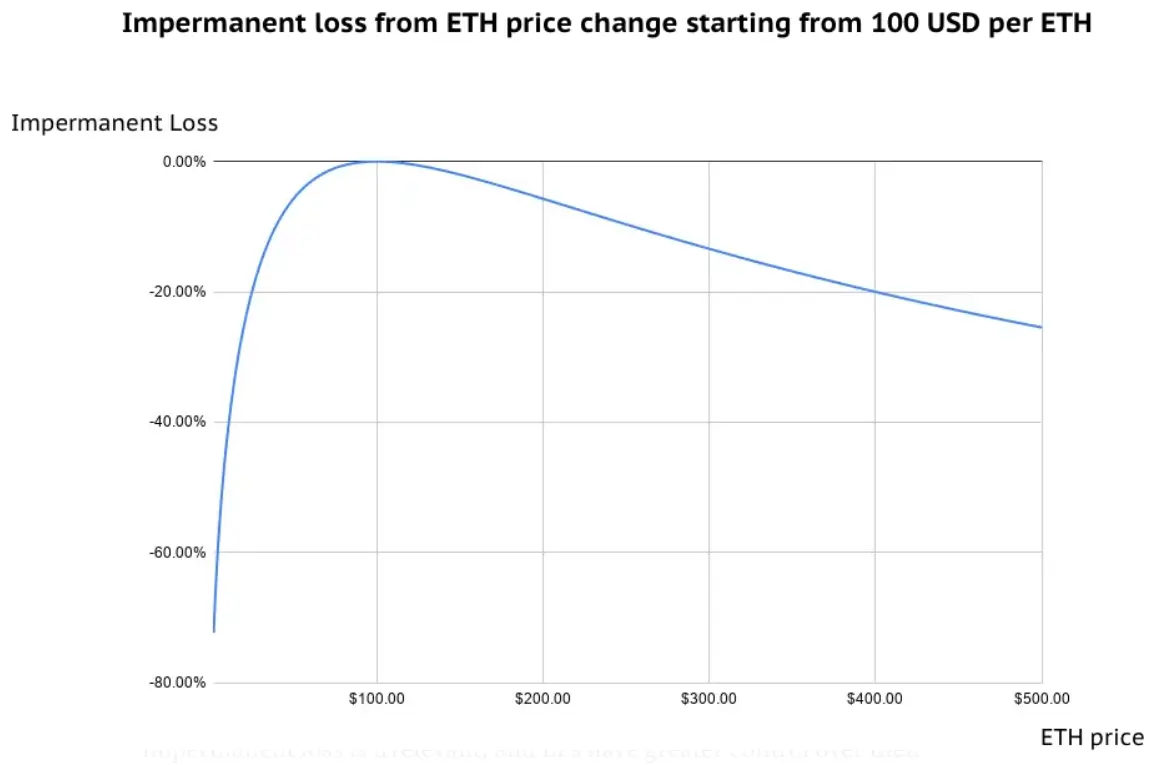

When one token in your pair significantly outperforms the other, the math gets ugly fast. Here's what different price movements cost you:

- 25% price change creates 0.6% impermanent loss.

- 50% price change creates 2.0% impermanent loss.

- 100% price change creates 5.7% impermanent loss.

- 300% price change creates 13.4% impermanent loss.

- 500% price change creates 25.5% impermanent loss.

Notice something important: it doesn't matter if prices go up or down. Any big movement between your paired tokens hurts your returns compared to just holding them separately.

Understanding the Rebalancing Mechanism

Here's the technical bit: AMMs use constant product formulas where token quantities multiply to create a fixed number. Picture it like a seesaw that must stay balanced.

If Token A doubles in price, the protocol automatically reduces your Token A holdings and gives you more Token B to keep things mathematically balanced. While this prevents the pool from running out of either token, you're the one paying for that stability.

What Strategies Minimize Impermanent Loss Risk?

Smart liquidity providers stick with tokens that move together. The closer your two tokens track each other's price movements, the less impermanent loss you'll face.

Stablecoin pairs make the most sense for conservative strategies. USDC/USDT pairs barely move against each other, keeping your losses under 0.1% most of the time. You won't get rich on fees, but you won't get crushed by price swings either.

Ethereum derivative pairs like ETH/stETH offer a middle ground. Since staked Ethereum typically tracks regular Ethereum pretty closely, you get decent fee potential without extreme impermanent loss risk.

Concentrated Liquidity Management

Uniswap V3 introduced a high-risk, high-reward approach called concentrated liquidity. Instead of spreading your tokens across all possible price ranges, you can focus on a narrow band where you think prices will stay.

The upside? You earn more fees when you're right. The downside? If prices move outside your chosen range, your impermanent loss can be brutal. Plus, you'll need to actively monitor and adjust your positions, which means more time and gas fees.

Active Position Monitoring

Nobody wants to babysit their liquidity positions 24/7. That's where automated tools come in handy.

Platforms like Arrakis and Gamma Strategies handle the heavy lifting for you. They automatically adjust your price ranges and collect your fees, though they'll take a cut for the service. You can also set stop-loss levels that pull you out of positions when losses hit predetermined limits.

When Does Providing Liquidity Make Financial Sense?

Here's the bottom line: you need to earn more from fees and rewards than you lose to impermanent loss. It's basic math, but the variables change constantly.

High-volume trading pairs often generate enough fees to offset modest price swings. Many protocols also throw token rewards on top, sometimes worth 20-100% annually. These incentives can make liquidity provision profitable even when impermanent loss stings.

The key is running the numbers. Add up your trading fees and token rewards, subtract impermanent loss and gas costs, then see if you're better off than just holding your tokens. If the answer is yes, you've got a winner.

Volume and Fee Analysis

Want to know if a pool makes sense? Look at the trading volume first.

Pairs moving more than $10 million daily usually generate enough fees to cover moderate impermanent loss over a week. Most Ethereum pools charge 0.3% per trade, while newer protocols experiment with dynamic fees that adjust based on how crazy the market gets.

How Do Modern Protocols Address Impermanent Loss?

The DeFi world knows impermanent loss is a problem, so teams are getting creative with solutions.

Curve Finance cracked the code for stable assets by using different mathematical curves designed specifically for tokens that should trade near each other. Instead of the standard AMM formula, Curve's algorithm assumes your tokens will stay close in value, which dramatically reduces impermanent loss.

Bancor took a different approach with built-in impermanent loss protection. Hold your position long enough, and they'll compensate you for losses. Sounds great in theory, but the protection comes with strings attached and doesn't always work as advertised.

SmarDex pushes the envelope further with Volatility Vaults, employing fictive reserves to dynamically tweak pricing and rebalance pools. This setup claims to slash impermanent loss in every scenario, sometimes flipping it into gains by capitalizing on volatility, but as an emerging protocol, it demands precise liquidity deposits to shine

Dynamic Fee Structures

Some newer AMMs try to balance the scales by charging higher fees during volatile periods. The logic makes sense: if impermanent loss risk increases, liquidity providers should earn more to compensate.

Uniswap V4 pushed this further with customizable fee structures and programmable hooks that let individual pools implement their own logic for different market scenarios. It's still early, but these innovations show promise for better risk-adjusted returns.

What Tools Help Track and Manage LP Positions?

Professional liquidity providers don't fly blind. They use analytics platforms to track performance across multiple positions and protocols.

Tools like Revert Finance and DefiLlama can show you real-time impermanent loss, fee earnings, and total returns for all your active positions. No more guessing whether your LP strategy is working.

For hands-off management, platforms like Arrakis and Gamma Strategies handle the technical stuff. They'll automatically adjust your ranges and harvest your fees, though they charge management fees for the service. Whether that's worth it depends on your position size and how much time you want to spend managing things yourself.

Portfolio Diversification Approaches

Don't put all your eggs in one basket. Smart liquidity providers spread their risk across multiple pools and protocols.

A balanced approach might include stable pairs for steady income and volatile pairs for higher potential returns. Size your positions based on how much impermanent loss you can stomach. Put more money in safer pools and smaller amounts in experimental or high-risk pairs.

Understanding Tax Implications of Impermanent Loss

Tax complications are one of the hidden costs that many liquidity providers don't consider until it's too late.

Taxable Events and Record Keeping

Here's where things get messy. Impermanent loss creates tax headaches, though the automatic rebalancing within AMM pools typically isn't considered a taxable event in most jurisdictions like the US.

The actual taxable events usually occur when you enter or exit liquidity pools, which can trigger capital gains or losses. Fee collection definitely counts as taxable income at regular rates, and those token rewards you're earning? Also taxable the moment you receive them, whether you sell or not. When you withdraw liquidity, any impermanent loss becomes "permanent" for tax purposes as realized gains or losses.

The bottom line: talk to a tax professional who understands DeFi before you provide serious liquidity. Keep detailed records of everything because crypto taxes are complicated enough without missing documentation, and tax treatment varies significantly by country.

Conclusion

Impermanent loss is the cost of doing business in DeFi liquidity provision. You can't eliminate it completely, but you can manage it intelligently.

The key is understanding the math, choosing your battles carefully, and keeping track of the total picture. Focus on correlated pairs for lower risk, or chase higher rewards with volatile pairs if you can handle the swings. Utilize the available tools to monitor your positions and automate tasks that make sense.

Most importantly, remember that impermanent loss is just one piece of the puzzle. When combined with trading fees, token rewards, and smart risk management, liquidity provision can still generate solid returns for informed participants who do their homework.

Sources:

- Hafner, M. & Dietl, H. (2024). "Impermanent Loss Conditions: An Analysis of Decentralized Exchange Platforms." arXiv preprint

- Labadie, M. (2022). "Impermanent loss and slippage in Automated Market Makers (AMMs) with constant-product formula." SSRN Electronic Journal

- Mohan, V. (2022). "Automated market makers and decentralized exchanges: a DeFi primer." Financial Innovation

- del Monte, I. & de Lucio, J. (2024). "Current Understanding of Impermanent Loss Risk in AMMs." ScienceDirect systematic review

- Saretto, A. (2023). "Decentralized finance proposed as alternative to traditional financial services." Federal Reserve Bank of Dallas Economic Letter

Read Next...

Frequently Asked Questions

What exactly causes impermanent loss in liquidity pools?

Impermanent loss occurs when AMM protocols automatically rebalance your token holdings as market prices change. The protocol sells appreciating tokens and buys depreciating ones to maintain mathematical ratios, reducing your overall position value compared to holding tokens separately.

Can impermanent loss be avoided completely?

mpermanent loss cannot be completely avoided in traditional AMM pools, but it can be minimized by choosing highly correlated asset pairs like stablecoins or ETH/stETH. Only perfectly correlated assets eliminate impermanent loss entirely.

Do trading fees and rewards compensate for impermanent loss?

Trading fees and token rewards often exceed impermanent loss in high-volume pools or during incentive programs. Calculate total returns, including all fees, rewards, and costs to determine if liquidity provision generates positive returns for your specific situation.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens