CORE Ventures to Participate in ASX’ Second RWA NFT Mint

Core Ventures, supported by the CORE Foundation, has been confirmed as an investor into ASX’ next hotly-anticipated NFT drop.

Jon Wang

August 19, 2025

Via its official X/Twitter account, ASX has just now revealed that none other than Core Ventures will be participating in its next yield-bearing NFT mint, scheduled for August 21st.

According to its website, Core Ventures is a “Bitcoin-driven venture fund” supported by the Core Foundation. It invests in projects designed to further the utility and impact of BTC, and thereby align with the vision of the wider Core ecosystem.

Its decision to invest in ASX’ upcoming NFT mint is a testament to its confidence in the ASX project and mission, as well as ASX’ rising importance within the CORE ecosystem, having fully minted-out its first yield-bearing NFT collection back in June 2025.

“Our RWA NFTs were built to serve both institutional and retail investors alike… We are excited to announce that [Core Ventures] will be participating in our RWA NFT mint this week, bringing real estate yield and appreciation directly to their on-chain fund.”, reads ASX’ official announcement.

ASX’ announcement is brief and to the point. As a result, however, the ASX community of Lords is left guessing as to how much Core Ventures is committing to the mint. However, given the mint’s target raise of $50,000, we might guess at an investment between $5-20,000.

ASX’ Next RWA NFT Collection: The Details

ASX’ first yield-bearing NFT collection sold-out less than one hour into the mint’s public round, and excitement around this new mint on August 21st is therefore running high…

Details for ASX’ August 21st mint:

- RWA/Real Estate Investment: Franklin Jefferson Candlelight Apartments, Warrensburg, MO, United States.

- Total NFTs Available: 50,000

- Expected Yield: 8.5% APY

- Total Raise: $50,000

Aside from the mint price itself ($10 per NFT), all of the above figures reflect an increase from ASX’ first NFT collection, which raised $30,000 across 3,000 NFTs. This is, in turn, a reflection of the project’s growing traction, community, and notoriety within both the Core ecosystem, and the wider crypto landscape.

Additional Details

Aside from the above, there are a few other details we already know when it comes to the upcoming mint…

Firstly, Blockz has been confirmed as ASX’ official mint partner for the collection. Blockz is Core’s very first dedicated NFT marketplace and is a natural partner for the mint. At time of writing, Blockz’ official website still reads “coming soon” with the expectation now being that the platform will go live in ‘soft launch’ alongside ASX’ mint itself.

“We just can't wait for you to be our first”, reads a Blockz comment on one of ASX’ recent X/Twitter posts.

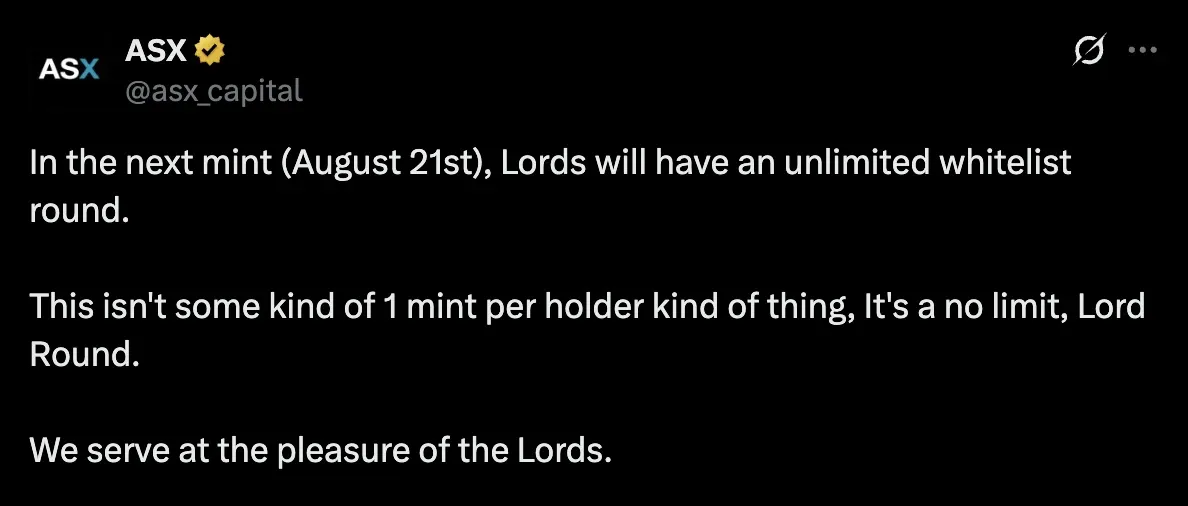

We also know that holders of NFTs from ASX’ first collection (for the Mountain View Apartment Complex in Arkansas, US) will be auto-whitelisted for the second collection. What’s more, these existing holders (‘Lords’ as they have come to be known) will have an “unlimited whitelist round”, with no cap on how many of these new NFTs they are able to mint. This decision from ASX’ founders demonstrated a loyalty to its community rarely exhibited in the cryptocurrency industry.

It may also make ASX’ next mint all the more competitive to access, bearing in mind that Core Ventures itself is likely to have committed to a not-insignificant portion of the collection.

Over and above this, we also know that the artwork for ASX’ NFTs has been designed by 9FStudioArt and, given the positive response to their aesthetic so far, is likely to continue to produce designs for future collections.

Final Thoughts

With just two days left until the mint itself, excitement is running high within ASX’ community and the broader Core ecosystem.

At a glance, it appears that ASX has done everything right when it comes to this upcoming collection…

After minting out its first collection, the project was quick to capitalize on momentum, announcing an even bigger, more exciting launch shortly thereafter. Its decision to effectively reward holders from its first collection is also laudable and is a community strategy that may serve the project well as it continues to build in 2025 and beyond.

While nothing is ever certain, ASX’ existing track record of selling out collections, combined with an investment commitment from Core Ventures, and a high degree of expected interest from the existing Lords community, this upcoming mint may well sell-out in rapid fashion.

Read Next...

Frequently Asked Questions

What is Core Ventures?

Core Ventures is an early-stage investment fund focused on the Bitcoin ecosystem. It invests in projects and startups that aim to enhance the utility of BTC itself and it is supported by the Core Foundation.

What Are NFTs?

NFTs, or non-fungible tokens, are unique digital certificates stored on blockchain networks that establish provable ownership and authenticity of digital assets like artwork, music, or collectibles, functioning essentially as tamper-proof digital deeds. While they don't grant copyright or prevent copying of the underlying digital content, they create verifiable scarcity and ownership records in the digital realm, similar to how a certificate of authenticity works for physical collectibles.

What is an ASX Lord?

An ASX Lord is anyone that holds one of ASX’ yield-bearing NFTs. ‘Lords’ is short for ‘Landlords’ - a name derived from the nature of ASX’ NFTs being backed by investment into premium real estate properties.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Jon Wang

Jon WangJon studied Philosophy at the University of Cambridge and has been researching cryptocurrency full-time since 2019. He started his career managing channels and creating content for Coin Bureau, before transitioning to investment research for venture capital funds, specializing in early-stage crypto investments. Jon has served on the committee for the Blockchain Society at the University of Cambridge and has studied nearly all areas of the blockchain industry, from early stage investments and altcoins, through to the macroeconomic factors influencing the sector.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events