Vaneck Files for BNB ETF with the SEC

The filing follows VanEck’s earlier registration of the “VanEck BNB ETF” in Delaware on April 2nd and reflects its continued commitment to broadening access to digital assets through traditional financial channels.

Soumen Datta

May 5, 2025

Table of Contents

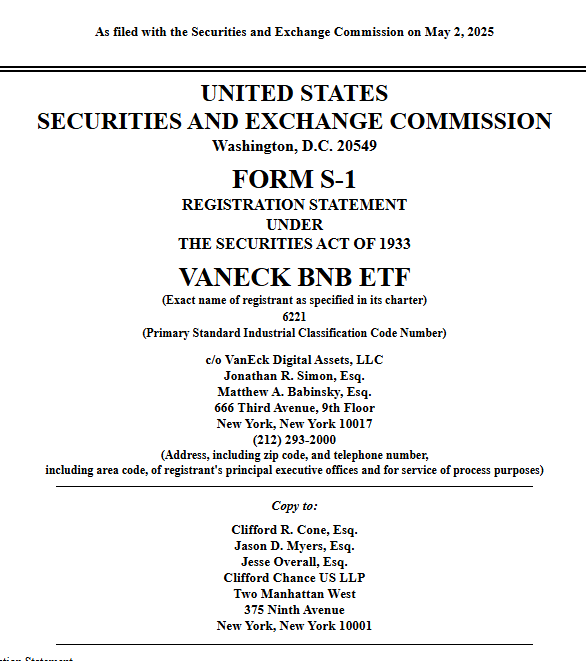

VanEck officially submitted its S-1 filing with the U.S. Securities and Exchange Commission (SEC) to launch a BNB exchange-traded fund (ETF). If approved, this fund would allow investors to gain exposure to Binance Coin (BNB) through a regulated, stock market-traded product.

What Is the S-1 Filing, and Why Does It Matter?

The S-1 registration form is the first formal step in launching an ETF. It provides the SEC and potential investors with detailed information about the proposed fund, its structure, and its risk profile. The submission doesn't guarantee approval, but it opens the door to regulatory scrutiny.

VanEck filed the document under the name “VanEck BNB ETF”. The firm had already registered this ETF in Delaware on April 2, showing prior intent and preparation. This filing, however, makes the move public and transparent.

For investors, the S-1 is more than paperwork. It means VanEck is ready to offer exposure to BNB in a form that's both accessible and regulated—without needing to touch crypto exchanges or custody wallets.

A Strategic Expansion Beyond Bitcoin and Ethereum

VanEck has built a reputation as a first mover in crypto ETFs. It was one of the earliest issuers to gain approval for spot Bitcoin and Ethereum ETFs in the U.S., and it hasn’t slowed down.

In recent months, VanEck has filed similar applications for Solana and Avalanche ETFs, putting it at the forefront of the altcoin ETF trend. The addition of BNB, the native token of Binance’s ecosystem, adds another top-tier crypto asset to its expanding roster.

BNB is the fifth-largest cryptocurrency by market cap. It powers transactions on the BNB Chain, supports DeFi applications, and plays a key role in Binance’s vast network.

Why a BNB ETF Matters for the Market

A BNB ETF would carry several advantages for both retail and institutional investors:

1. Accessibility: ETFs can be traded using regular brokerage accounts. This removes the friction of setting up crypto wallets or using unfamiliar platforms.

2. Regulatory Comfort: For risk-averse investors, a regulated ETF offers a safer route to crypto exposure.

3. Liquidity Boost: Wider participation could drive more liquidity for BNB, potentially reducing volatility and strengthening price support.

4. Legitimacy for Binance: An SEC-approved product that tracks Binance Coin would reflect positively on Binance’s broader ecosystem.

5. Institutional Interest: Pension funds, asset managers, and financial advisors are more likely to invest in regulated ETFs than in raw crypto assets.

The ETF structure also improves transparency, requiring regular disclosures, audited reports, and clearly defined custody mechanisms. This makes it easier for professional investors to include crypto in portfolios while staying compliant with internal risk frameworks.

Will the SEC Approve It?

The SEC has historically been wary of crypto ETFs. Its concerns include market manipulation, liquidity, custody solutions, and investor protection. But recent events suggest the tide may be turning.

In January 2024, the SEC approved the first spot Bitcoin ETFs. Shortly after, it greenlit Ethereum-based ETFs. These approvals set the stage for other altcoins to follow—albeit under close regulatory watch.

The SEC will likely examine the pricing data sources, custody mechanisms, and trading behavior of BNB before issuing a decision.

Still, VanEck’s history of navigating regulatory processes adds weight to the filing.

Other firms are following suit. 21Shares and other asset managers are also exploring ETF products beyond Bitcoin and Ethereum.

Bloomberg ETF analysts estimate a 90% approval probability for a Litecoin ETF, while Solana and XRP face more uncertain paths. Avalanche’s growing usage in institutional projects—such as Franklin Templeton’s tokenized fund—improves its chances.

What Happens Next?

The SEC will now begin its review of the S-1 filing. It may request amendments, seek clarifications, or hold public comment periods before making a final decision.

In parallel, VanEck could submit a 19b-4 form, which is needed for the ETF to be listed on an exchange. This two-step process—S-1 for registration, 19b-4 for listing—is standard for ETFs involving novel asset classes.

There’s no clear timeline. Some ETF approvals take months, while others stall for years. Much depends on market sentiment, political influence, and ongoing legal developments in the crypto space.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events