A Comprehensive Guide to Ethereum’s PEPE Memecoin

Born in April 2023, the PEPE token on Ethereum has established itself as a major player in the memecoin sector. Here’s everything there is to know about it.

Jon Wang

September 1, 2025

Table of Contents

In today’s crypto landscape, the lifespan of memecoins is short. Most memecoins capture attention for a handful of minutes or, in rare cases, a few days or weeks. Very few such tokens are able to maintain value and attention for months or years - PEPE is one such exception.

Created back in early 2023, in the wake of the collapse of both the FTX exchange and the Terra/LUNA ecosystem, PEPE’s value has increased to several billion dollars. It reached an all-time high market cap of more than $10.4 billion in December 2024 - a figure greater than the current value of well-known assets such as AVAX, DOT and LTC.

As of September 2025, PEPE’s market capitalization remains above $4 billion, with daily trading volume typically measured in the hundreds of millions of dollars.

This article serves as a comprehensive overview of PEPE’s story through the crypto industry, including tokenomics, current state, past controversies, exchange listings, and more…

PEPE’s Origins & Early Days

Minted in April 2023 on the Ethereum blockchain, PEPE is younger than other early memecoins such as SHIB and DOGE, but is still considered an ‘OG memecoin’ by today’s standards.

PEPE draws its imagery and cultural significance from the iconic "Pepe the Frog" character created by artist Matt Furie in his 2005 comic "Boy's Club". The original Pepe was a laid-back anthropomorphic frog who became one of the most recognizable internet memes and has since percolated in the cryptocurrency space.

The memecoin’s launch capitalized on the nostalgic appeal of early internet culture to great effect. Despite controversial associations with the Pepe meme, the artwork has managed to decouple itself, at least within cryptocurrency, from any untoward political affiliations.

The project offered no utility or development plans whatsoever making it a memecoin in the purest of senses. Even today, the Pepe website offers a roadmap that is both absurd and meaningless.

PEPE’s Early Performance

PEPE became a crypto phenomenon very quickly and, less than a month after its creation, it had topped a market cap of nearly $1.5 billion, according to data from CoinMarketCap.

This was followed by a period of quiet wherein PEPE hovered around the $300-500 million mark. That was until February 2024 when the asset’s valuation surged from around $500 million to nearly $6.5 billion in the space of just four months.

In fact, at time of writing, PEPE’s market capitalization has not fallen below the $2.5 billion mark since April 2024, signalling a prolonged period of success and ability to maintain value, despite a total lack of underlying utility.

With that said, and despite PEPE’s impressive size and historical price action, the memecoin’s story has not been a perfect one…

Was PEPE Hacked? Controversy in August 2023

Though we now know the saga was far from a death sentence for the PEPE token itself, disaster struck the project in August 2023.

After some community members noticed some suspicious transactions involving the project’s presumed treasury wallet and the OKX, Kucoin and Binance exchanges, the official PEPE X/Twitter account made a shocking announcement.

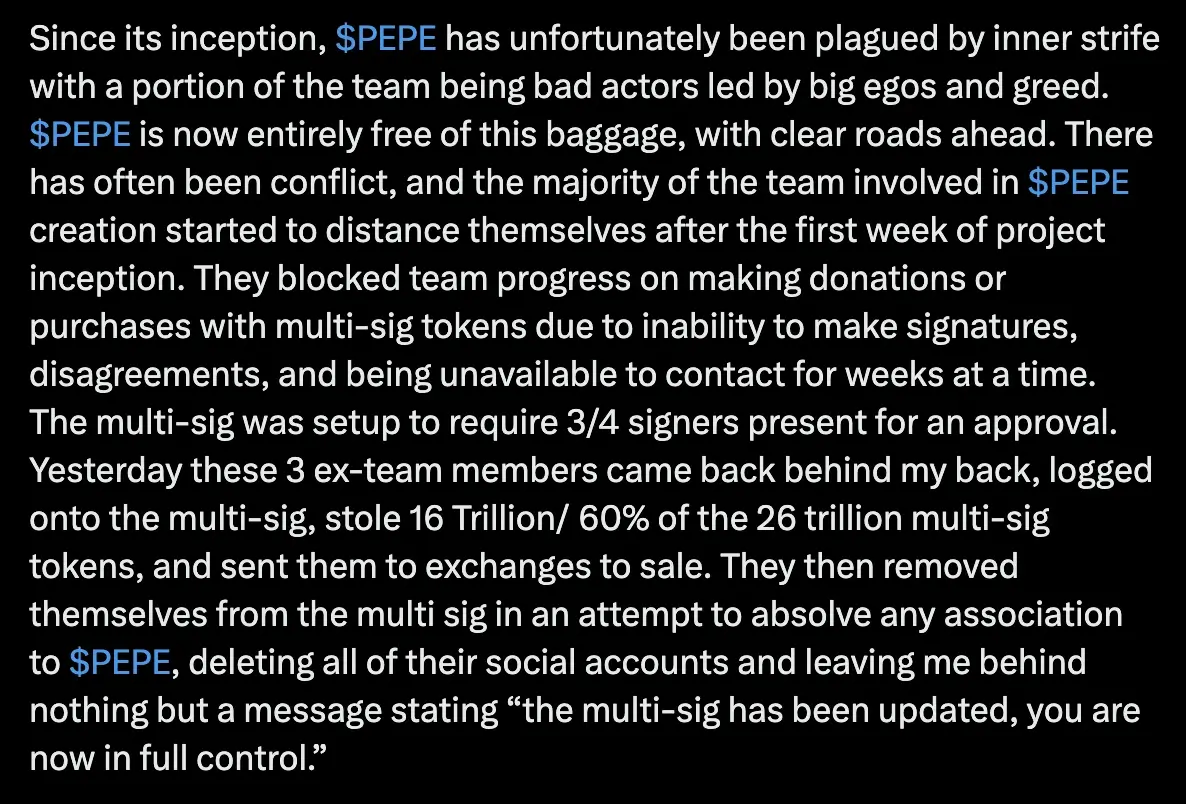

In short, it was announced that three of PEPE’s former team members, herein dubbed “bad actors led by big egos and greed”, accessed the project’s multi-signature wallet and “stole” some 16 trillion PEPE tokens.

This equated to a full 60% of the wallet’s funds. At the time, it was worth around $15 million. At today’s prices, that figure is closer to $155 million. The post further clarified that nearly all such tokens were quickly sold on exchanges, partially assuaging community fears of further sell pressure.

“Since its inception, $PEPE has unfortunately been plagued by inner strife with a portion of the team being bad actors led by big egos and greed… They blocked team progress on making donations or purchases with multi-sig tokens due to inability to make signatures, disagreements, and being unavailable to contact for weeks at a time”, added the announcement.

Interestingly, said bad actors removed themselves from the multi-sig, leaving only the message: “the multi-sig has been updated, you are now in full control.”

Core to the August 26th announcement was confirmation that both the wallet and the project’s X/Twitter account were now safe, the writer promising that they were “someone who has the best interests for everybody and $PEPE”.

Current Position

As mentioned, PEPE’s issues in August 2023 appear to have in no way hindered its success and appreciation in the long-term.

As of September 2025, PEPE holds a market capitalization of more than $4 billion. Though this is less than half of its all-time high of more than $10.4 billion, it still places PEPE high up amongst the crypto rankings.

At time of writing, PEPE sits at #31 on CoinMarketCap’s market cap leaderboard, and has beaten out well known assets with real utility, including NEAR, APT, ARB and KAS.

What’s more, PEPE remains a ‘Top-3’ memecoin, beaten out only by DOGE and SHIB, both of which were created before PEPE.

Being a household name when it comes to memecoins, it seems feasible that PEPE’s price may benefit from any overarching surge in memecoin interest, and could be buoyed by increased trading volumes across all memecoins in the sector.

A Look at PEPE’s Tokenomics and Distribution

PEPE's impressive size is reflected in its holder count and distribution.

According to Etherscan, and as of September 2025, more than 481,000 unique wallets hold the PEPE token. By contrast, the POPCAT memecoin on Solana, created just eight months after PEPE, features just 144,000 holders, per Solscan.

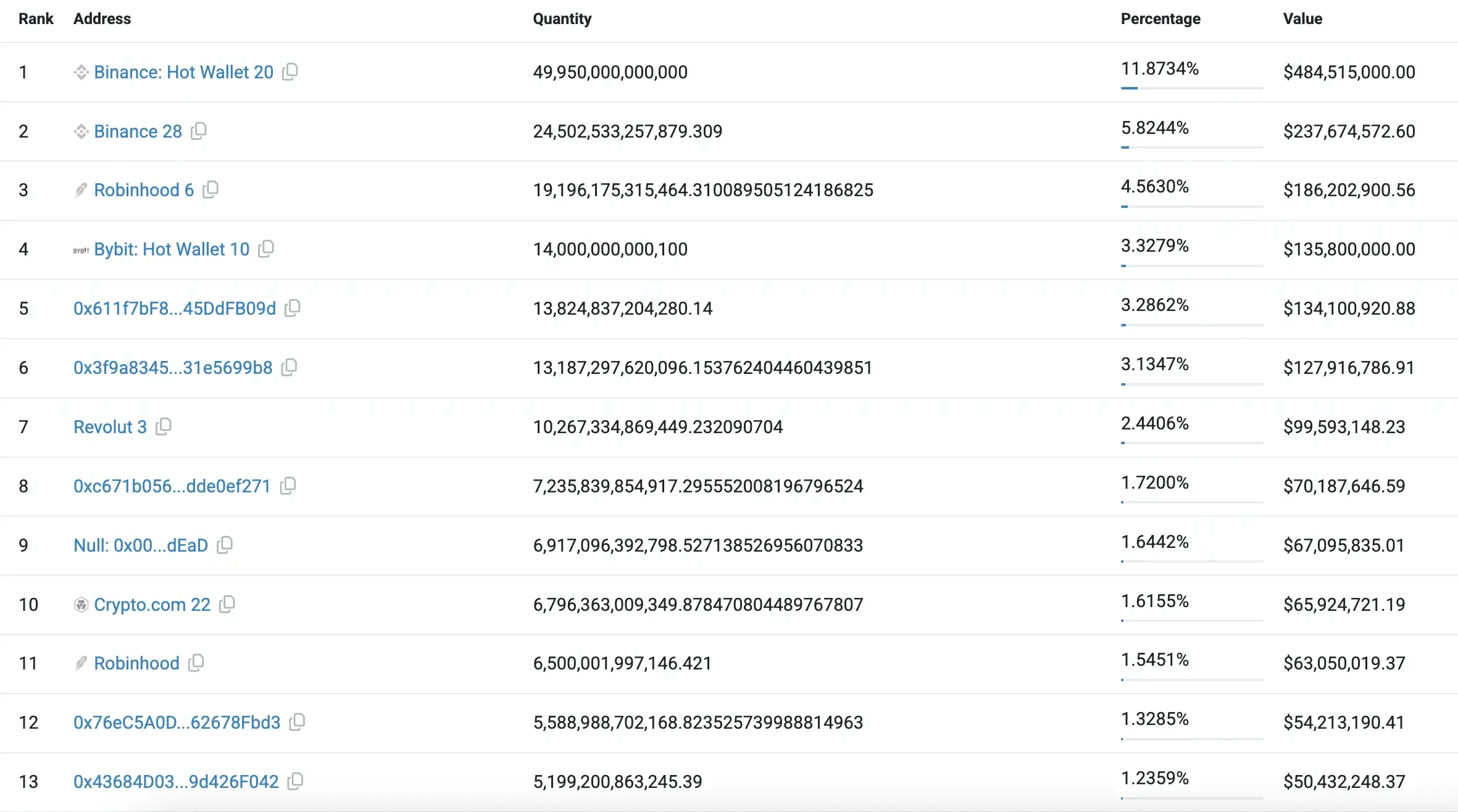

As of September 2025, only thirteen wallet addresses hold more than 1% of PEPE’s ~423 trillion token supply. Amongst these, there are six exchange-labelled addresses and one burn address holding nearly 7 trillion PEPE.

With that said, this still leaves five unmarked ‘whale’ addresses. Combined, those five wallets hold a staggering 10.66% of PEPE’s total supply. This is equivalent to around 45 trillion PEPE tokens worth around $440 million at current prices.

This is a concerning quantity of the token to be held across so few unidentified wallets and may give analysts and investors cause for concern. If just a handful of these unknown whales decided to dump their holdings in a short period of time, the result on PEPE’s price could be dramatic.

Where Can I Buy the PEPE Memecoin?

Given its massive size and capacity to generate large amounts of trading volume, PEPE is, unsurprisingly, listed on just about every major exchange that the cryptocurrency industry has to offer.

These include, but are not limited to:

- Binance

- Kucoin

- OKX

- Bybit

- Kraken

- Coinbase

- Upbit

- Bitget

- MEXC

- Gate

- HTX

- Bitfinex

The PEPE memecoin also has strong liquidity depth on Ethereum’s leading decentralized exchanges, such as Uniswap.

It is worth noting that with PEPE's existing presence on all tier-one cryptocurrency exchanges, it is practically impossible for any future listings to provide the project with bullish momentum. Assets sometimes see a boost in price shortly after an announcement that it will list on exchanges such as Binance and Coinbase. As PEPE is already listed on these exchanges, such momentum is likely behind it.

Does the PEPE Memecoin Still Have Potential in 2025 and 2026?

When it comes to the PEPE memecoin’s future price potential, there are several key factors that you may want to consider.

Size Isn’t Everything

Though PEPE’s more than $4 billion market cap is certainly impressive, it may prove a negative factor when it comes to potential price appreciation. For instance, a 100x on the PEPE memecoin from current prices is practically impossible. It would equate to a market cap of more than $400 billion, which would make PEPE more than twice as large as XRP and nearly four times as large as BNB at time of writing.

On the flipside, a large market cap may give investors confidence that the PEPE memecoin is unlikely to collapse entirely. While this seems a rational conclusion, it is not necessarily the case with crypto assets notoriously volatile and prone to collapse.

Exchange Listing Saturation

As mentioned, PEPE is listed on practically every major centralized exchange. While this is a reflection of the memecoin’s success, it also means that momentum typically received from news around listings on Binance and Coinbase is already behind it.

Given PEPE’s lack of partnerships and development, as a pure memecoin, it is difficult to see exactly where bullish momentum could originate for this memecoin giant.

A Rising Tide Lifts All Boats

It seems intuitive to say that PEPE’s performance may hinge greatly on the performance of the wider memecoin sector. PEPE is a top-three meme after DOGE and SHIB and greater excitement, trading volume and investment into the wider memecoin landscape could buoy PEPE to higher prices.

That said, this is not necessarily guaranteed and, given PEPE’s host chain, it may be that memecoin excitement on Ethereum specifically will result in more positive action than, for instance, a resurgent Solana memecoin scene.

Volatility on Steroids

PEPE’s massive valuation and consequent liquidity depth may shield the asset from the degrees of volatility and price swings exhibited by smaller memecoin assets. However, PEPE is ultimately still a memecoin and therefore prone to dramatic fluctuations in value.

One need look no further than the period from December 2024 to March 2025, when PEPE fell from a market cap of $10.43 billion to just $2.93 billion.

PEPE’s total lack of underlying utility may further add to these price swings, the asset having no fundamental value and therefore subject to speculation from investors.

Conclusion

The PEPE story is an incredible one, and its ability to reach a $10+ billion valuation with no utility or real value is a testament to just how crazy the cryptocurrency sector can be. This is even more fascinating when set against a background of venture-funded projects with clear use cases that fail to achieve even a fraction of PEPE’s market cap.

With that said, don’t be fooled by PEPE’s massive size. It is still just a memecoin and therefore prone to sharp and unexpected movements. Before investing in PEPE, make sure to consider your own risk tolerance and never invest more than you can afford to lose.

Sources:

- The official PEPE website: https://www.pepe.vip/

- PEPE’s official Twitter account: https://x.com/pepecoineth

- Etherscan: https://etherscan.io/token/0x6982508145454ce325ddbe47a25d4ec3d2311933

- CoinMarketCap: https://coinmarketcap.com/

Read Next...

Frequently Asked Questions

Where can I buy the PEPE memecoin?

PEPE is listed on the majority of leading cryptocurrency exchanges. These include Bybit, Binance, Coinbase, OKX, and many others. As an ERC20 token, it is also available to trade on decentralized exchanges such as Uniswap.

Was PEPE Hacked in August 2023?

Strictly speaking, PEPE was not hacked. In August 2023, at least according to the project’s social media communications, three ex-team members accessed the project’s de facto treasury wallet and made away with some 16 trillion PEPE tokens, the vast majority of which were sold shortly after on exchanges such as OKX, Bybit, Kucoin and Binance.

Is the PEPE memecoin a good investment?

PEPE is a memecoin with no underlying utility. Its value is therefore wholly reliant on speculation, rather than fundamentals. While its market cap of several billion may make it seem like a safer investment than other assets, this is not necessarily the case. All cryptocurrencies, especially memecoins, suffer from a great deal of volatility and cryptocurrencies also have the capability to fall to zero very quickly. You should always do your own research when investing in cryptocurrencies and never invest more than you can afford to lose.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Jon Wang

Jon WangJon studied Philosophy at the University of Cambridge and has been researching cryptocurrency full-time since 2019. He started his career managing channels and creating content for Coin Bureau, before transitioning to investment research for venture capital funds, specializing in early-stage crypto investments. Jon has served on the committee for the Blockchain Society at the University of Cambridge and has studied nearly all areas of the blockchain industry, from early stage investments and altcoins, through to the macroeconomic factors influencing the sector.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events