Can You Make Money Off Ledger's $4 Billion IPO?

Ledger eyes a $4 billion NYSE IPO in 2026. Here's how retail investors can profit from the hardware wallet giant's public debut.

Crypto Rich

January 23, 2026

Table of Contents

Yes, but the opportunities come with risk proportional to crypto's famously wild swings. The French hardware wallet maker is reportedly targeting a New York Stock Exchange listing valued at $4 billion or more, roughly triple its $1.5 billion valuation from 2023. Whether you profit will likely depend on timing, market sentiment, and your stomach for volatility.

Ledger has hired Goldman Sachs, Jefferies, and Barclays to manage the offering. That heavyweight lineup signals serious intent. With revenues reportedly hitting triple-digit millions in 2025 and roughly $100 billion in Bitcoin under user custody, the company believes Wall Street is finally ready for a crypto security pure-play.

How Did Ledger Become a $4 Billion Company?

The story starts in 2014 Paris, where a group of crypto enthusiasts built the first Ledger wallet during Bitcoin's chaotic early days. Fast forward to 2026, and Ledger has transformed from a niche gadget maker into the vault keeper for a small country's worth of digital assets.

The growth accelerated dramatically in 2025. Chainalysis data shows over $3.4 billion stolen in crypto hacks throughout the year, up from prior years and punctuated by massive incidents like the $1.5 billion Bybit hack. The ghost of FTX already haunted investors, and these fresh losses reinforced why keeping crypto on exchanges no longer made sense. Self-custody became the obvious answer, and Ledger was ready to catch the wave.

Black Friday and holiday sales pushed revenues into nine-figure territory. The company now draws 40% of its business from the United States, which explains both the NYSE listing choice and the expansion of its New York team. As CEO Pascal Gauthier told the Financial Times, America is where "capital concentration for crypto is highest."

Is a $4 Billion Valuation Reasonable?

Valuations in crypto can feel like guesswork. But there are ways to sanity-check the number.

Assume 2025 revenues landed around $400 million (a reasonable midpoint based on reports of "hundreds of millions"). A $4 billion enterprise value means investors are paying roughly 10 times revenue. That's aggressive for most industries, but not outrageous for a growth company in tech or crypto.

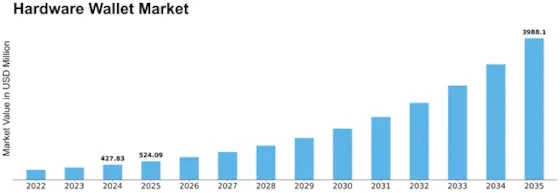

Consider the hardware wallet market itself. Industry estimates peg the global market at $720 million in 2026, growing to $2.58 billion by 2031 at a 29% compound annual growth rate. Ledger commands somewhere between 50% and 70% of that market, dwarfing competitors like Trezor and Ellipal. If adoption accelerates, and Bitcoin ETFs plus institutional interest suggest it might, Ledger is well-positioned to capture that growth.

For comparison, look at Circle. The USDC stablecoin issuer went public in 2025 at an $8 billion valuation and later traded at multiples well above 50 times forward revenue during peak enthusiasm. Coinbase has traded at 15 to 20 times revenue during bull markets. Traditional hardware companies like Garmin sit closer to four to six times revenue.

Ledger blends both worlds. Hardware sales are one-time purchases, but services like Ledger Recover and enterprise custody could add recurring revenue. If crypto sentiment stays positive, paying 10 times revenue looks reasonable. A market reversal would significantly pressure that multiple.

What Are the Ways to Profit?

Several strategies exist, each with different risk profiles.

The most direct approach is buying shares on the open market once Ledger is listed. Most retail investors won't get IPO allocations, but that's not necessarily a disadvantage. The key date to watch is the lock-up expiration, typically around six months after listing. That's when insiders can sell, and volatility often spikes. Patient buyers may find better entry points than day-one purchasers.

For the more adventurous, options present a leveraged opportunity once the stock begins trading. Picture a scenario where a major exchange hack drives wallet sales through the roof. Call options in that environment could multiply quickly.

Then there's the long-term hold approach. Treat Ledger like an early Tesla bet. If the company evolves into a full-stack crypto bank with custody, DeFi integrations, and institutional services, today's $4 billion valuation might look like a bargain in five years.

What Could Go Wrong?

Plenty.

Ledger has faced trust issues before. The 2023 seed phrase recovery controversy angered users who felt the company was compromising the core principle of self-custody. A fresh security incident or data breach could crater sentiment fast. Regulatory friction adds another layer. EU privacy laws and U.S. securities requirements don't always play nicely together. A listing might invite scrutiny Ledger would rather avoid.

Crypto's cyclical nature presents the biggest structural risk. When Bitcoin crashes 50%, and history shows it can, hardware wallet demand dries up. People don't buy hardware wallets when they're watching their portfolios bleed. Revenue sustainability matters because hardware sales are lumpy, not recurring like software subscriptions.

Competition shouldn't be ignored either. Newer entrants like Tangem and even phone-based wallet solutions are chipping away at the market. If convenience trumps security for the next generation of users, Ledger's moat could narrow.

The post-IPO reality check phase catches many tech companies. After the initial hype fades, shares often drop 30% to 50% as investors reassess fundamentals. Some observers on social media are already calling the IPO a "desperation move" in uncertain markets. Others frame it as "Phase 2 institutional buildout." Both perspectives carry some truth.

The Bottom Line

Ledger's IPO represents a genuine test of whether crypto infrastructure companies can succeed in traditional markets. The $4 billion valuation isn't cheap, but it's defensible if self-custody continues its march toward mainstream adoption. Multiple paths to profit exist, from buying shares post-listing to options plays to long-term conviction bets.

Just remember that crypto's volatility cuts both ways. Approach with clear eyes and a strategy you can stick with through turbulence.

To learn more, visit Ledger's official website and follow them on X at @Ledger.

Sources

- Financial Times - Reporting on Ledger's IPO plans and CEO statements

- Chainalysis - Data on crypto theft statistics for 2025

- Market Research Future - Hardware wallet market size projections

Read Next...

Frequently Asked Questions

When is Ledger expected to go public?

Ledger has not announced a specific IPO date, but reports indicate the company is actively preparing for a New York Stock Exchange listing in 2026 with major investment banks already on board.

How much is Ledger worth?

Ledger is targeting a valuation of $4 billion or higher for its IPO, up from $1.5 billion in its last private funding round in 2023, driven by significant revenue growth throughout 2025.

Can regular investors buy Ledger IPO shares?

Retail investors typically cannot access IPO shares directly. However, once Ledger is listed on the NYSE, anyone with a brokerage account can buy shares on the open market immediately after trading begins.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens