What is Core DAO (CORE) and How Does it Work?

Discover Core DAO (CORE), the innovative Bitcoin-powered blockchain combining PoW security with PoS scalability. Learn about its $800M market cap, growing ecosystem with $900M TVL, and unique Satoshi Plus consensus mechanism. Complete guide to tokenomics, use cases & 2024 developments.

Jon Wang

January 30, 2025

Table of Contents

Core DAO has emerged as a leading force in the Bitcoin-focused blockchain space since its launch in January 2023. This comprehensive guide explores Core DAO's innovative technology, its native CORE token, and the rapidly growing ecosystem that has attracted millions of users worldwide.

Key Takeaways

- Core DAO is an EVM-compatible layer-one blockchain powered by Bitcoin

- Features a unique Satoshi Plus consensus mechanism combining PoW and PoS

- Boasts over 343 million transactions and 5 million active wallets

- Native CORE token has multiple utilities including staking and governance

- Nearly $900 million in Total Value Locked (TVL) across its ecosystem

Understanding Core DAO's Technology

Core DAO represents a groundbreaking approach to blockchain technology, born from a debate between Bitcoin and Ethereum enthusiasts. The project combines the security of Bitcoin with the programmability of Ethereum-style smart contracts, creating a unique value proposition in the cryptocurrency space.

The Satoshi Plus Consensus Mechanism

At the heart of Core DAO's innovation is its Satoshi Plus consensus mechanism, which cleverly combines two established approaches:

- Delegated Proof of Work (DPoW): Leverages Bitcoin mining pools for network security

- Delegated Proof of Stake (DPoS): Enables network scalability through CORE token staking

This hybrid approach allows Core DAO to maintain high security standards while achieving the scalability necessary for modern blockchain applications.

CORE Token: Purpose and Tokenomics

The CORE token serves as the backbone of the Core DAO ecosystem, with a current market capitalization of approximately $800 million, at time of writing. This native asset plays several crucial roles within the network:

Primary Use Cases

- Transaction fee payment (gas fees)

- Network staking for decentralization

- Governance participation

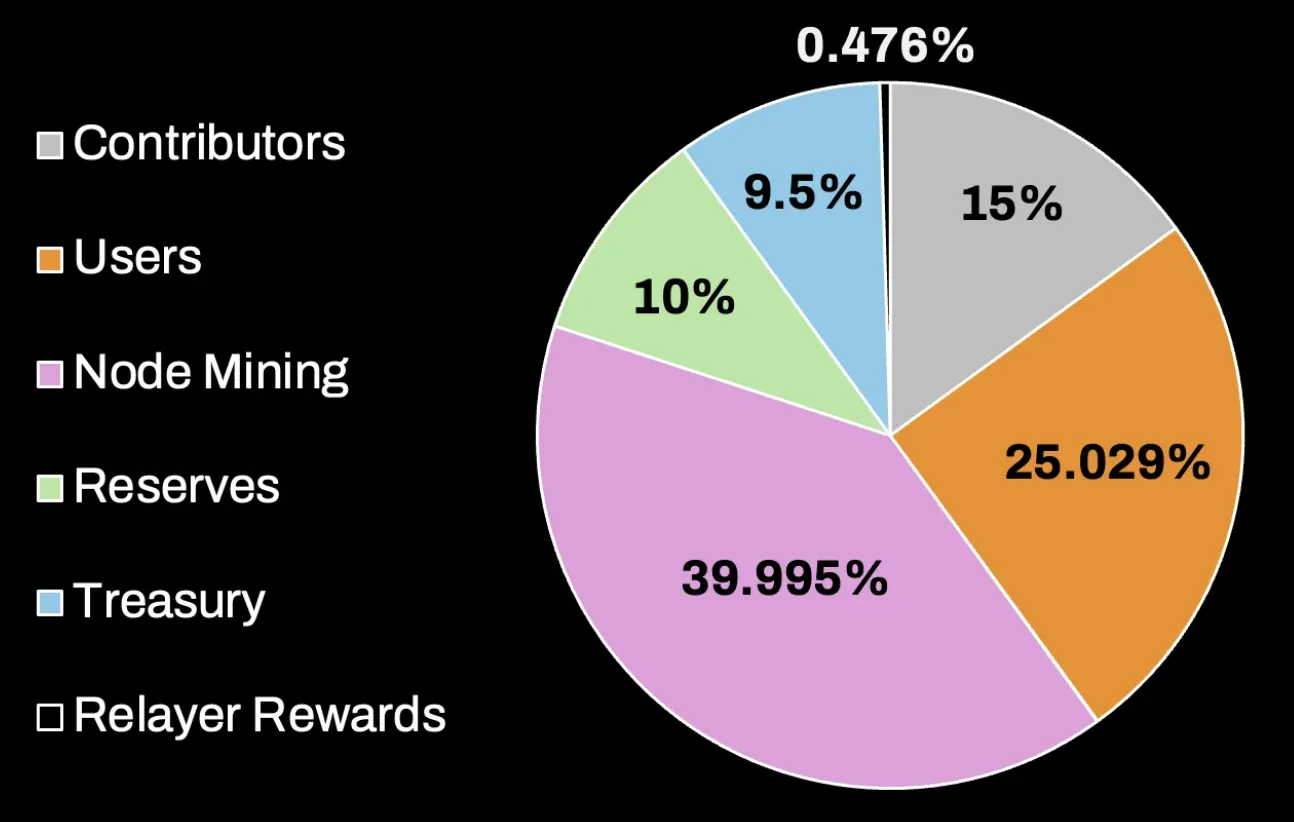

Token Distribution and Supply

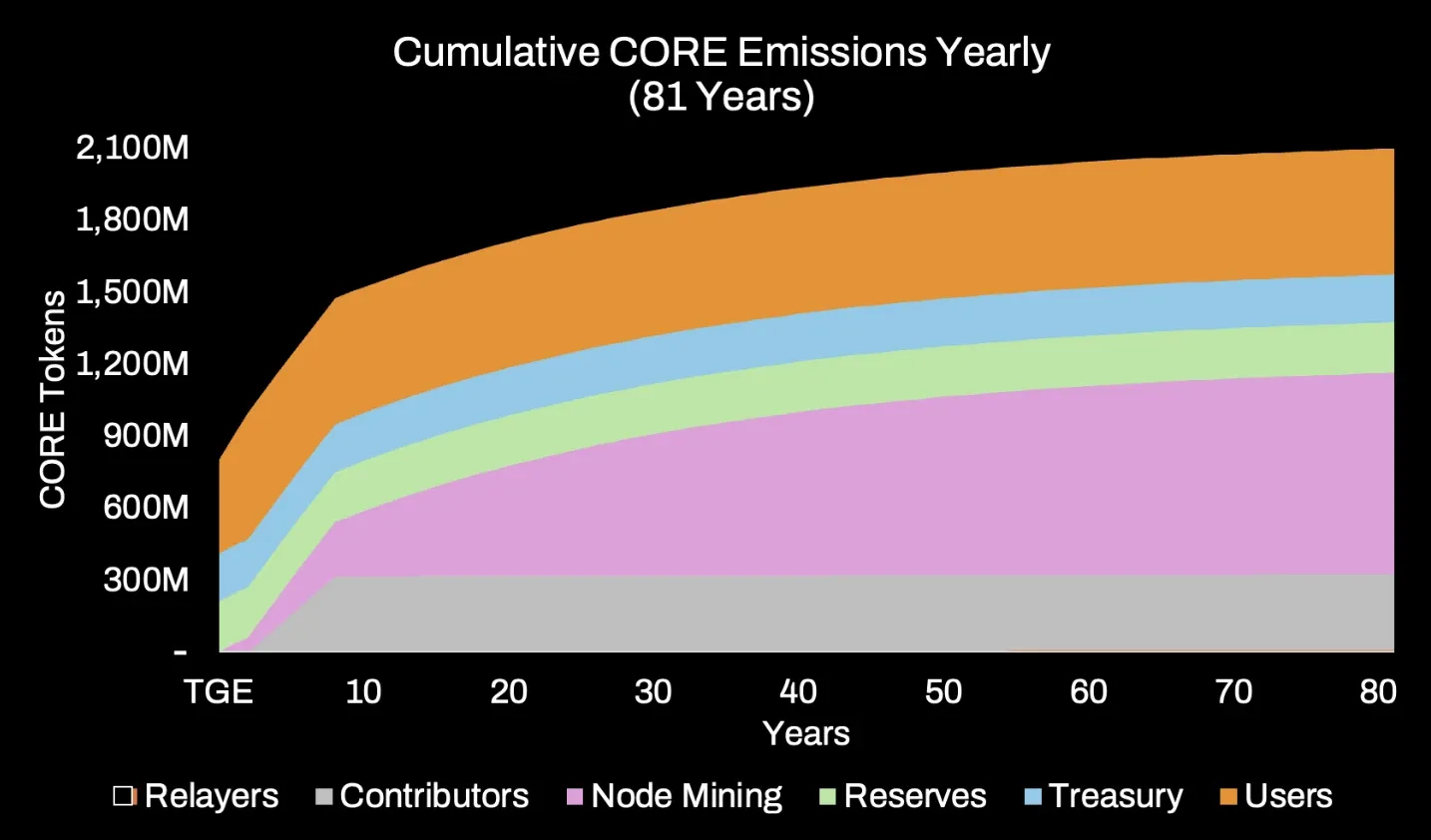

Core DAO's tokenomics follow a carefully planned structure with a maximum supply of 21 billion CORE tokens, distributed over an 81-year period:

- 39.995% - Node-mining rewards

- 25.029% - Community airdrops

- 15% - Network contributors

- 10% - Reserves

- 9.5% - Treasury

- 0.476% - Relayer rewards

A notable feature is the token's deflationary mechanism, where a portion of transaction fees and block rewards are burned based on DAO decisions.

The Growing Core DAO Ecosystem

Core DAO has established itself as a major player in the DeFi space, with a Total Value Locked (TVL) approaching $900 million, at time of writing. This impressive figure surpasses several well-established blockchain networks, including Polygon and Optimism.

Notable Projects in the Ecosystem

- Colend

- Lending and borrowing protocol

- Over $100 million TVL

- Focuses on advancing BitcoinFi

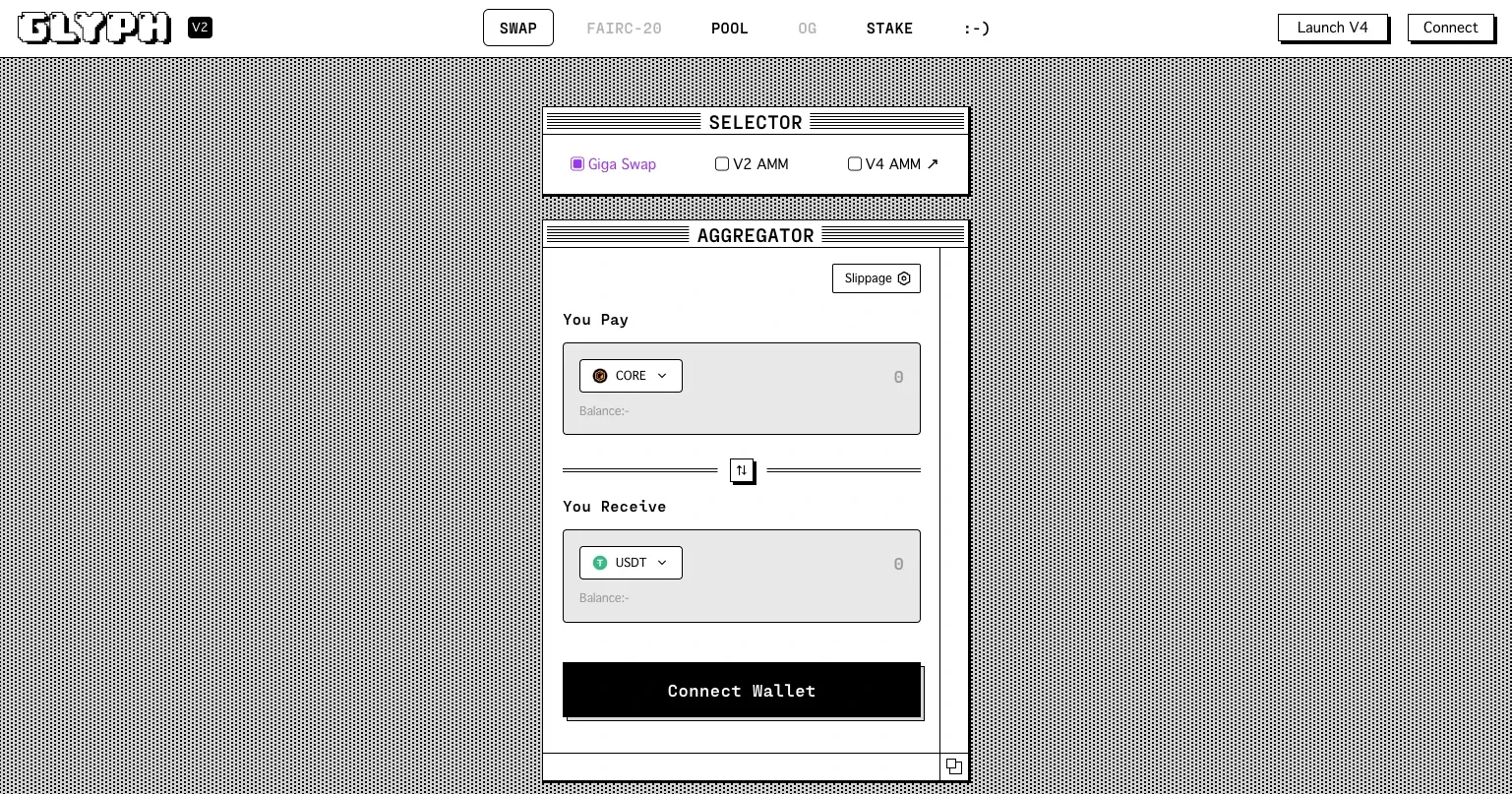

- Glyph

- Bitcoin-centric decentralized exchange

- Inspired by successful DEX models like Uniswap and Curve

- Provides essential trading infrastructure

- BitFLUX

- Bitcoin liquidity platform

- Incubated by Core Ventures

- Enables BTC yield generation

The ecosystem currently supports 94 different projects, according to Core’s website, demonstrating significant developer interest and platform viability.

Recent Developments and Future Prospects

Core DAO continues to evolve rapidly, with several significant developments in 2024:

Technical Advancements

- Launch of coreBTC for wrapped Bitcoin functionality

- Development of enhanced lstBTC implementation

- Ongoing network upgrades and optimizations

Ecosystem Initiatives

- Core Venture Network launch for ecosystem development

- Ignition Drop program implementation

- Enhanced Bitcoin-focused use cases and incentive systems

Community and Network Statistics

Core DAO's impressive growth is reflected in its community metrics:

- 2 million+ X/Twitter followers

- 270,000+ Discord members

- 5 million active wallets

- 343 million+ processed transactions

- 175 million CORE tokens delegated

Conclusion

Core DAO represents a significant innovation in the blockchain space, successfully bridging the gap between Bitcoin's security and Ethereum's programmability. With its robust tokenomics, growing ecosystem, and strong community backing, Core DAO has positioned itself as a major player in the future of decentralized finance and Bitcoin-focused blockchain applications.

The platform's combination of technical innovation, community growth, and ecosystem development suggests strong potential for continued expansion and adoption in the evolving blockchain landscape. As the project continues to develop and attract new users and developers, it maintains its position as one of the most promising blockchain platforms in the cryptocurrency space.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Jon Wang

Jon WangJon studied Philosophy at the University of Cambridge and has been researching cryptocurrency full-time since 2019. He started his career managing channels and creating content for Coin Bureau, before transitioning to investment research for venture capital funds, specializing in early-stage crypto investments. Jon has served on the committee for the Blockchain Society at the University of Cambridge and has studied nearly all areas of the blockchain industry, from early stage investments and altcoins, through to the macroeconomic factors influencing the sector.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events