Project Review: Core DAO (CORE)

To some, Core DAO is one of the most underappreciated projects in the cryptocurrency industry. But what is it? How does it work? What is the CORE token? All this and much more…

Jon Wang

January 31, 2025

Table of Contents

Launched in January 2023, Core DAO has rapidly established itself as a leading force in the Bitcoin-focused blockchain space. Founded by an anonymous team of developers, the project has grown exponentially to become one of the most compelling blockchain ecosystems in the industry, with many analysts describing its native CORE token as potentially undervalued. The platform's unique approach to combining Bitcoin's security with smart contract functionality has attracted significant attention from both investors and developers.

In this article, we’ll examine all aspects of Core DAO. We’ll cover everything from ‘What is Core and how does it work?’ through to the CORE token itself, its tokenomics. Make sure to check out our analysis section at the end of the article.

Community Growth and Market Presence

Core DAO has demonstrated remarkable growth since its inception, building one of the most engaged communities in the cryptocurrency space. Current metrics showcase its impressive scale:

- Over 2 million XTwitter followers

- Nearly 270,000 Discord members

- 5 million active wallets

- 343 million processed on-chain transactions according to the project

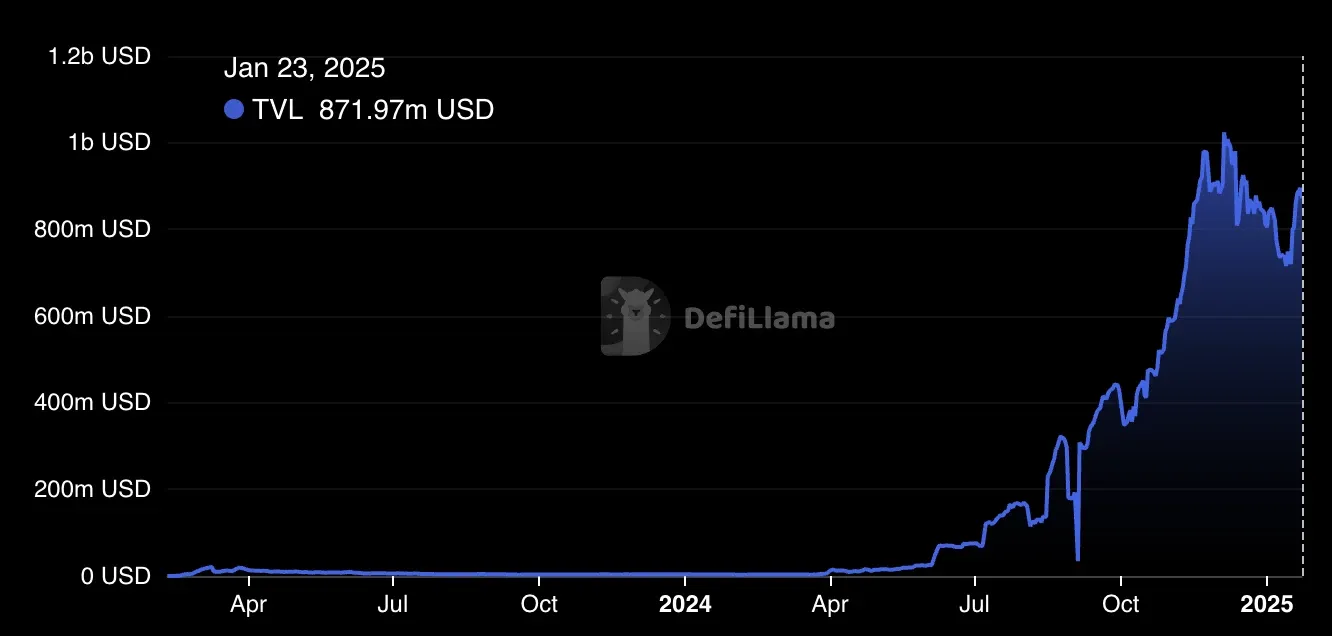

- Close to $900 million Total Value Locked (TVL) at time of writing

- Market capitalization approaching $800 million (down from $3 billion ATH in April 2024)

The significant disparity between Core DAO's TVL and market capitalization has led many market analysts to suggest that the CORE token may be substantially undervalued compared to its ecosystem's actual utilization and growth potential.

Technical Infrastructure and Innovation

Satoshi Plus Consensus Mechanism

Core DAO distinguishes itself through its innovative approach to blockchain consensus. The project's origin story is particularly interesting, emerging from a debate between two friends who held opposing views on Bitcoin and Ethereum. Rather than choosing sides, they developed a novel solution that would combine the strengths of both networks.

Instead of adopting traditional Proof-of-Work or Proof-of-Stake mechanisms, the project implements its novel Satoshi Plus Consensus Mechanism, which brings together:

Delegated Proof of Work (DPoW) which…

- Leverages Bitcoin mining pools for security

- Ensures robust network protection

- Maintains direct connection to Bitcoin's infrastructure

- Provides time-tested security measures

Delegated Proof of Stake (DPoS)

- Enables superior network scalability

- Currently supports 175 million delegated CORE tokens according to the project’s website

- Facilitates efficient transaction processing

- Allows for community participation in network security

Network Architecture

As an EVM-compatible layer-one blockchain powered by Bitcoin, Core DAO creates a unique bridge between Bitcoin's security and Ethereum's programmability. This innovative architecture allows developers to build applications that benefit from both ecosystems while maintaining their own unique identity.

CORE Token Analysis

Fundamental Utility

The CORE token serves as the backbone of the ecosystem with three primary functions:

- Gas fee payment for network transactions

- Staking mechanism (including unique Bitcoin staking capabilities)

- Governance participation for network development and decision-making

Comprehensive Tokenomics

Supply Distribution

Core DAO implements a carefully structured token distribution model that draws inspiration from Bitcoin while adapting to modern blockchain needs:

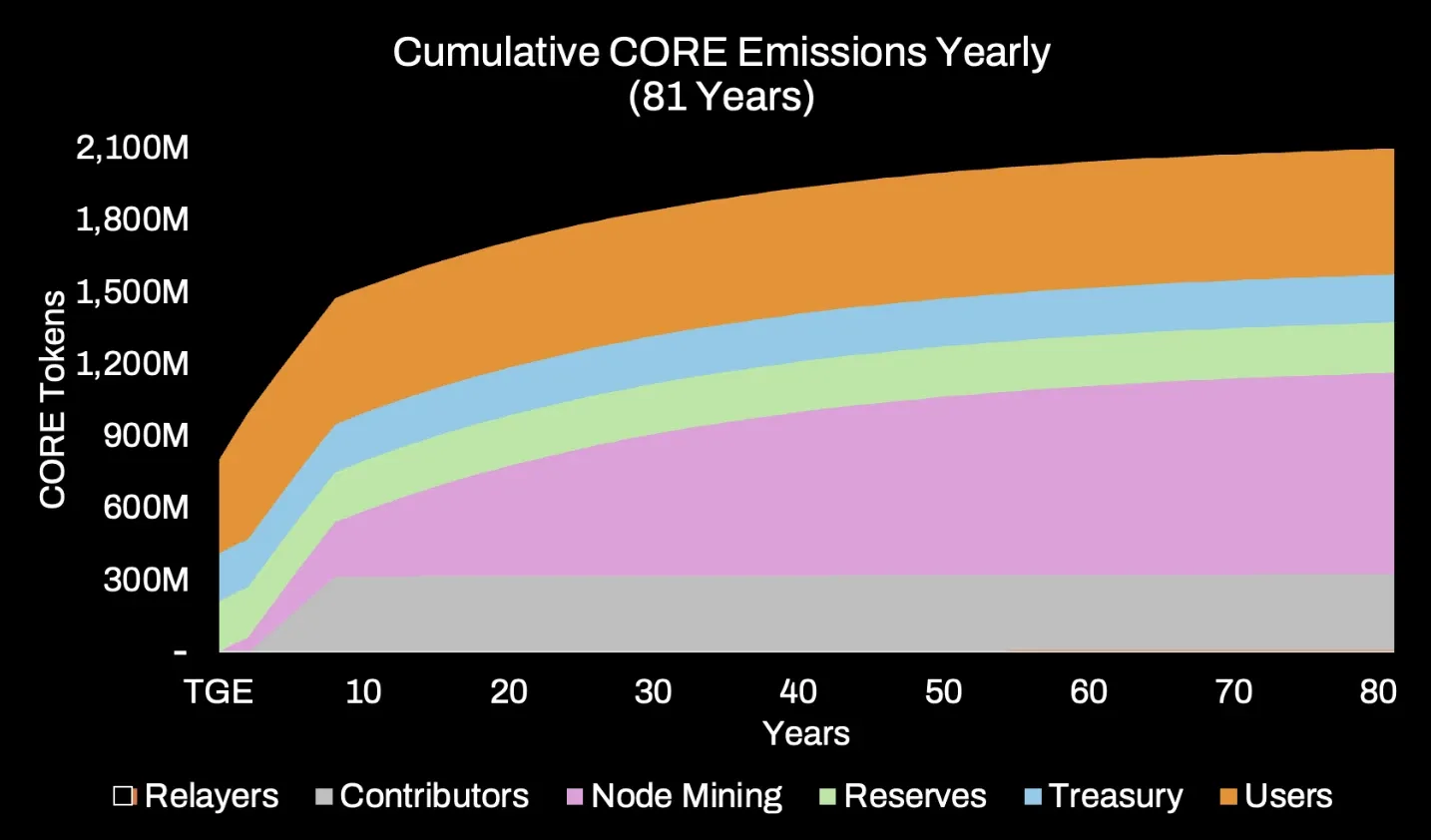

- Maximum supply: 2.1 billion CORE tokens (inspired by Bitcoin's 21 million)

- Distribution timeline: 81 years for full supply release

- Current circulating supply maintains scarcity while ensuring adequate liquidity

- Deflationary mechanics through transaction fee burning

Allocation Structure

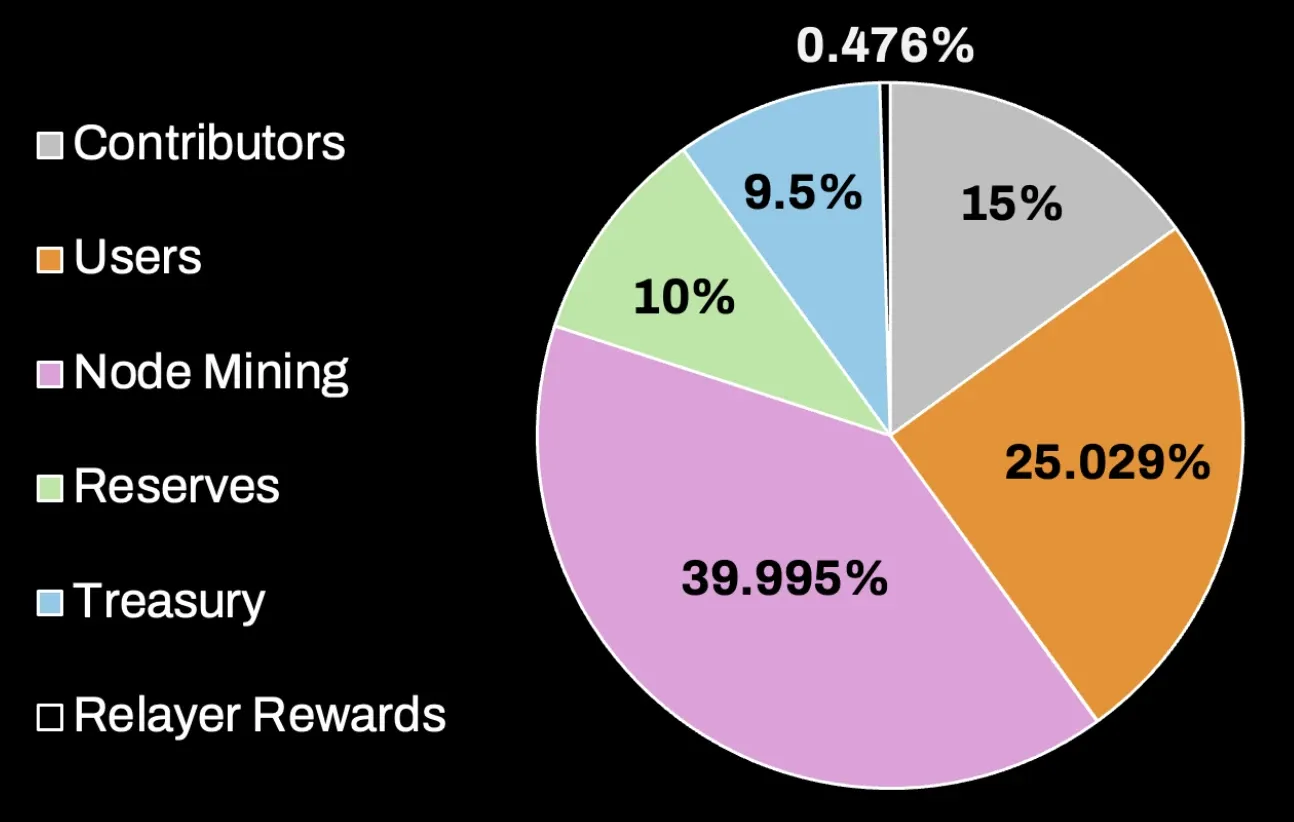

The project's token allocation demonstrates a focus on long-term sustainability and balanced distribution:

- 39.995% - Node-mining rewards (network security incentivization)

- 25.029% - Community airdrops (participation encouragement)

- 15% - Contributor allocation (development and maintenance)

- 10% - Reserve holdings

- 9.5% - Treasury allocation

- 0.476% - Relayer rewards (security enhancement)

Deflationary Mechanics

A unique aspect of CORE's tokenomics is its deflationary mechanism:

- Portion of transaction fees/block rewards are burned

- Burn rate determined through DAO governance

- Community-driven supply management

Ecosystem Development and Applications

Current DeFi Integration

Core DAO has established an impressive ecosystem with nearly $900 million TVL, surpassing established networks like Polygon, Blast, and Optimism, at time of writing. The platform hosts an extensive network of 94 different projects, according to its ecosystem page, with several standout protocols. To name a very small handful:

Key Projects

- Colend

- Leading lending and borrowing protocol

- Focused on advancing BitcoinFi

- Over $100 million TVL

- Enables efficient capital utilization

- Provides critical DeFi infrastructure

- Glyph

- Core ecosystem's primary DEX

- Bitcoin-centric trading platform

- Implements best practices from Uniswap, Curve, and Convex

- Facilitates efficient token swaps

- Provides essential liquidity services

- BitFLUX

- Core Ventures incubated project

- Bitcoin liquidity platform

- Enables BTC yield generation

- Enhances ecosystem attractiveness

- Drives Bitcoin integration

Recent Developments and Initiatives

Technical Advancements

The past year has seen significant technical progress for Core DAO:

- Introduction of coreBTC as a wrapped Bitcoin solution

- Development of enhanced lstBTC implementation

- Continuous network upgrades and optimizations

- Infrastructure improvements for scalability

- Enhanced security measures

Growth Programs

Core DAO has launched several initiatives to accelerate ecosystem development:

- The active Core Venture Network for project incubation

- Implementation of Ignition Drop program

- Ecosystem development grants

- Community incentive programs

- And more…

Market Position and Opportunities

Bitcoin DeFi

Core DAO's position in the BitcoinFi sector offers unique advantages:

- Growing interest in Bitcoin-based DeFi solutions

- First-mover advantage in several key areas

- Strong integration with Bitcoin infrastructure

- Expanding use cases for Bitcoin holders

Competitive Analysis

While facing competition in the Bitcoin DeFi space, Core DAO maintains several distinguishing features:

- Established network effects

- Substantial TVL compared to competitors

- Strong community engagement

- Comprehensive development ecosystem

Investment Considerations

Positive Factors

- Established Market Position

- Strong community engagement

- Significant TVL relative to market cap

- Growing ecosystem adoption

- Proven track record

- Technical Foundation

- Innovative consensus mechanism

- Bitcoin network security integration

- Scalability capabilities

- Continuous development

- Tokenomics Structure

- Deflationary mechanisms

- Long-term distribution schedule

- Clear utility cases

- Community-driven governance

Risk Considerations

- Market Variables

- Cryptocurrency market volatility

- Competitive pressure

- BitcoinFi sector dependency

- Project Structure

- Anonymous founding team

- Market cap growth limitations (given its current size)

- Ecosystem competition (BitcoinFi is a growing sector)

Trading Availability

CORE maintains strong market presence through listings on major exchanges, according to CoinMarketCap:

Analysis

Core DAO represents a significant innovation in the blockchain space, successfully bridging Bitcoin's security with smart contract functionality. The platform's impressive growth metrics, including its substantial TVL compared to market cap, suggest potential undervaluation. However, investors should carefully consider both opportunities and risks.

The project's continued development, growing ecosystem, and strong community engagement position it well for potential future growth. With its unique consensus mechanism and Bitcoin-focused approach, Core DAO offers a compelling value proposition in the evolving landscape of decentralized finance.

For those considering investment, the platform's established presence, technical innovations, and clear token utility present attractive features. However, as with any cryptocurrency investment, careful consideration of market conditions, risk tolerance, and investment timeline remains essential.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Jon Wang

Jon WangJon studied Philosophy at the University of Cambridge and has been researching cryptocurrency full-time since 2019. He started his career managing channels and creating content for Coin Bureau, before transitioning to investment research for venture capital funds, specializing in early-stage crypto investments. Jon has served on the committee for the Blockchain Society at the University of Cambridge and has studied nearly all areas of the blockchain industry, from early stage investments and altcoins, through to the macroeconomic factors influencing the sector.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens