Binance Deep Dive: The Exchange That Shaped Crypto's Future

Complete Binance analysis: 280M users, spot trading, futures, staking, and BNB blockchain. Deep dive into the world's largest crypto exchange.

Crypto Rich

September 1, 2025

Table of Contents

Binance's journey from Shanghai startup to crypto infrastructure leader demonstrates how technical excellence and strategic adaptability create lasting competitive advantages. The platform's comprehensive ecosystem serves the complete spectrum of cryptocurrency users while establishing the operational standards that define modern digital asset exchanges.

What makes Binance extraordinary isn't just its size—it's the integrated infrastructure that extends far beyond trading. Native BNB blockchain, NFT marketplaces, institutional custody, beginner-friendly mobile apps. Unified in one environment, users access virtually every crypto service without needing to switch platforms.

The numbers reveal unprecedented scale. Binance captured 41.1% of global spot trading volume in June 2025, processing $8.39 trillion in the most recent quarter while adding 30 million new users from emerging markets. But raw volume only scratches the surface of Binance's influence across tokenomics, blockchain development, and institutional services that power the broader crypto economy.

What Makes Binance the World's Largest Exchange?

Binance achieved its dominant position through aggressive innovation and user-first design during crypto's explosive growth phase. Competitors focused on regulatory compliance or institutional services. Binance took a different approach. The company built integrated infrastructure serving everyone—retail traders buying their first Bitcoin, hedge funds executing complex derivatives strategies.

Unified architecture provides Binance's core advantage. Users access spot trading, futures contracts, staking rewards, NFT marketplaces, and payment services through a single interface. Integration eliminates the friction of managing multiple accounts across different services—a significant barrier that limited mainstream crypto adoption for years.

Speed and reliability form Binance's technical foundation. Millions of transactions per second during peak periods. No downtime when early competitors crashed. Performance becomes critical during volatile market conditions when users need immediate access to funds and trading positions.

Fee structure reflects Binance's scale advantages. Standard trading fees start at 0.1%. BNB token holders receive discounts up to 25%. Volume-based tiers reduce costs further for active traders, while maker-taker models incentivize liquidity provision. Economics create network effects where increased usage drives down costs for everyone.

The service operates without a traditional headquarters, adapting to local regulations while maintaining consistent quality worldwide. This structure proved essential during regulatory crackdowns that forced a geographic pivot from China to Malta, ultimately leading to a distributed model.

Who Founded Binance and Why?

Binance's creation story illustrates how technical expertise, combined with strategic timing, can build industry-defining platforms. The exchange emerged from founder Changpeng Zhao's vision to create a truly global cryptocurrency trading platform that could serve both retail and institutional clients at an unprecedented scale.

The Visionary Behind the Exchange

Changpeng Zhao, universally known as CZ, founded Binance with a background perfectly suited for crypto's technical demands. Born in China and educated in Canada, Zhao studied computer science at McGill University before spending years building high-frequency trading systems at Bloomberg and Fusion Systems. His experience with low-latency financial infrastructure proved invaluable when crypto trading required similar performance.

The Perfect Storm of Timing

Binance's July 2017 launch came at the perfect moment—and the worst possible time. China's impending ban on cryptocurrency trading created urgency among local exchanges, but it also provided an opportunity for a new platform designed for global operations.

Key factors that enabled Binance's rapid success:

- Strategic funding: Zhao raised $15 million through BNB token sales

- Global vision: Built infrastructure for worldwide operations from day one

- Technical expertise: High-frequency trading background enabled superior performance

- Market timing: Launched during peak ICO boom before regulatory crackdowns

Building the Foundation Team

Zhao's crypto journey began in 2013 when he sold his house to buy Bitcoin, fully committing to the industry. He joined Blockchain.info's wallet team and later became CTO at OKCoin in 2014, where he met Yi He, his future co-founder. Yi He brought media expertise and marketing skills that complemented Zhao's technical abilities, creating a partnership that drove Binance's early success.

Within months, Binance achieved what other exchanges had taken years to accomplish. The exchange processed over $1 billion in daily volume by early 2018, attracting users through superior performance and aggressive token listing strategies. Zhao's decision to relocate operations ahead of regulatory pressure demonstrated the strategic thinking that kept Binance ahead of competitors who waited too long to adapt.

Leadership Transition and New Direction

Yi He's contributions extended beyond marketing into strategic partnerships and community building. Her media background helped Binance communicate effectively with users during crises, while her business development work secured key integrations and listings that drove growth. Together, Zhao and Yi He created a platform that strikes a balance between technical excellence and user experience.

Zhao's leadership ended in November 2023 when he resigned as part of a $4 billion settlement with U.S. authorities over anti-money laundering violations. Richard Teng, a former regulator from Abu Dhabi and Singapore, assumed CEO responsibilities with a mandate to strengthen compliance. This transition marked Binance's evolution from a founder-led startup to an institutionally managed global enterprise.

How Binance Survived Every Crypto Crisis

Early Regulatory Challenges

Binance's eight-year history reads like a masterclass in crisis management, with each challenge strengthening the platform's resilience and global reach. The exchange faced its first major test before even launching when China banned cryptocurrency trading in September 2017, just months after BNB token sales began.

Rather than abandon the project, Zhao relocated servers and operations to Japan, then Malta. The exchange demonstrated agility that became its signature advantage. While competitors scrambled to adapt to regulatory changes, Binance's distributed infrastructure allowed rapid geographic pivots without service interruption.

The 2019 Security Breach Response

The 2019 security breach tested Binance's crisis response capabilities. Hackers stole 7,000 Bitcoin, worth approximately $40 million, through sophisticated phishing attacks that compromised user accounts. Instead of downplaying the incident, Zhao immediately disclosed full details and covered all losses through the Secure Asset Fund for Users. Transparent response, combined with comprehensive security upgrades, actually strengthened user confidence rather than undermining it.

Regulatory Pressure and Compliance Evolution

Key regulatory challenges Binance has navigated:

- UK restrictions (2021): Banned regulated activities, driving compliance investments

- U.S. investigations: Money laundering and tax compliance probes

- Malta clarification (2020): Lost regulatory haven status, forced further decentralization

- Data sharing controversies: Cooperation with Russian authorities amid geopolitical tensions

Rather than fight these actions, Binance invested heavily in compliance infrastructure, hiring hundreds of regulatory specialists and implementing know-your-customer procedures that exceeded industry standards.

The FTX Collapse Test

The 2022 FTX collapse created an existential crisis for all crypto exchanges, as users withdrew billions in funds, fearing the potential contagion effects. Binance processed withdrawal requests worth over $6 billion in a single week while maintaining full reserves, proving its financial stability when competitors failed stress tests. Zhao's decision to briefly consider acquiring FTX's assets, then withdraw due to due diligence concerns, demonstrated prudent risk management that preserved Binance's position.

Leadership Transition and Settlement

The 2023 settlement with U.S. authorities represented Binance's largest crisis and most significant transformation. Paying $4 billion in fines while admitting to anti-money laundering violations could have crippled the exchange. Instead, the resolution removed regulatory uncertainty, allowing new leadership to focus on sustainable growth rather than legal battles.

Crisis management lessons that strengthened Binance's operations:

- China ban: Proved the importance of regulatory diversification

- Security breach: Led to industry-leading protection measures

- Regulatory scrutiny: Drove compliance investments for institutional adoption

- FTX collapse: Demonstrated value of conservative financial management

What Can You Do on Binance's Platform?

The exchange's infrastructure encompasses virtually every crypto-related service users might need, from basic trading to advanced financial products that rival traditional markets in sophistication.

Core Trading Features

Binance's trading infrastructure serves both retail investors and institutional clients through sophisticated order-matching and liquidity-provision systems.

Spot Trading Excellence

- Spot trading forms the foundation, supporting hundreds of cryptocurrency pairs with deep liquidity and tight spreads

- Advanced order types include stop-losses, trailing stops, and one-cancels-other combinations for sophisticated strategies

- Real-time charts through TradingView integration offer technical indicators like RSI, MACD, and Bollinger Bands

Professional Derivatives Trading

- Perpetual contracts offer up to 125x leverage for amplified positions

- Quarterly futures settle to index prices with USD-margined and coin-margined options

- Both hedging and speculation strategies accommodate different risk preferences

Passive Income Opportunities

Beyond active trading, Binance provides multiple ways for users to generate returns on cryptocurrency holdings through staking and lending programs.

Binance Earn Programs

The Binance Earn program transforms idle cryptocurrency holdings into yield-generating assets through multiple mechanisms. Simple savings accounts offer guaranteed returns, while flexible staking allows users to earn rewards on proof-of-stake tokens without lockup periods. Liquidity farming provides higher yields for users willing to provide capital to decentralized protocols.

Early Access Investment

Binance Launchpad gives users early access to promising blockchain projects through token sales and airdrops. The platform's vetting process and allocation systems create opportunities for retail investors to participate in deals typically reserved for venture capital firms. Recent launches include Zentry and World of Dypians, both of which offer exclusive access through the Binance Alpha program.

Ecosystem Services

The platform extends beyond trading into comprehensive blockchain services that support the broader cryptocurrency economy.

Digital Asset Infrastructure

Key services that complete Binance's offering:

- NFT marketplace: Digital collectibles trading integrated with the broader ecosystem

- Binance Pay: Cryptocurrency payments for merchants and peer-to-peer transfers

- Trust Wallet and Binance Wallet integration: Self-custody solutions with referral rewards up to 80%

- Educational resources: Binance Academy covering blockchain basics to advanced trading

Institutional Solutions

Professional services include custody solutions for large cryptocurrency holdings, over-the-counter trading for minimal market impact, and lending facilities that provide liquidity without requiring asset sales. These services position Binance as infrastructure for hedge funds, family offices, and corporate treasuries.

How Does BNB Token Power the Binance Ecosystem?

The asset started as a simple utility instrument for fee discounts but evolved into the foundation of an entire blockchain network worth billions in total value locked. Launched initially as an ERC-20 standard on Ethereum in July 2017, BNB underwent a sophisticated migration that transformed it into the cornerstone of the company's expanded infrastructure.

BNB's Technical Migration Timeline

The token's evolution demonstrates Binance's strategic expansion from exchange operator to blockchain infrastructure provider.

The asset underwent sophisticated development reflecting the company's expanding scope beyond exchange services.

In April 2019, BNB migrated from Ethereum to Binance Chain, becoming a native BEP-2 standard on the newly launched Beacon Chain. This proof-of-stake authority consensus network provided governance capabilities and basic transaction functionality.

September 2020 marked the next major evolution with the introduction of Binance Smart Chain, an Ethereum Virtual Machine-compatible parallel chain that enabled the development of smart contracts and decentralized applications. BNB became the gas token for this network, operating under the BEP-20 standard, which facilitates everything from simple transfers to complex DeFi protocols.

In 2022, Binance rebranded the ecosystem to BNB Chain, initially encompassing both the Beacon Chain for consensus and the Smart Chain for programmability. However, in 2024, the Beacon Chain was retired through the BNB Chain Fusion, migrating all functions to the Smart Chain for a more streamlined, secure, and efficient structure while maintaining high throughput for interactive applications.

Tokenomics and Supply Management

Binance implements deflationary mechanisms to create long-term value appreciation.

The tokenomics model includes quarterly burning mechanisms that permanently remove BNB from circulation based on exchange revenues and network usage. Starting with a total supply of 200 million tokens, over 60 million have been burned since inception, reducing circulation toward an eventual cap of 100 million tokens. These burns create deflationary pressure that theoretically supports long-term value appreciation.

Multiple Utility Layers

The token's diverse applications across trading, blockchain operations, and ecosystem participation create sustained value propositions for holders.

BNB's utility creates sustained demand across multiple ecosystem functions:

- Trading fee discounts reduce costs up to 25% for active users

- Launchpad participation requires BNB holdings for token sales access

- Staking rewards provide passive income while supporting network security

- Gas token functionality facilitates BNB Chain smart contract operations

Transaction fees typically cost pennies, making the network attractive for applications requiring frequent user interactions. This utility creates organic demand that extends far beyond Binance exchange users.

DeFi Integration and Ecosystem Growth

BNB's role in decentralized finance has expanded significantly as BNB Chain’s layer-one chain has attracted major protocols. PancakeSwap became the largest decentralized exchange by volume on the network, while Venus Protocol provides lending and borrowing services. These applications create additional utility and demand for BNB beyond Binance's centralized services.

Major DeFi protocols on BNB Chain:

- PancakeSwap: Leading decentralized exchange with billions in volume

- Venus Protocol: Comprehensive lending and borrowing platform

- Alpaca Finance: Leveraged yield farming opportunities

Additionally, the Binance Alpha program uses BNB staking to determine allocation rights for new token launches, creating additional holding incentives for long-term investors.

Why Does Binance Dominate Trading Volume?

Binance's market dominance stems from network effects, technical infrastructure, and strategic decisions that compound over time to create sustainable competitive advantages. Understanding these factors explains why the platform maintains leadership despite intense competition.

Market Dominance Factors

The platform's massive user base generates the deep liquidity that attracts institutional traders and market makers. When hedge funds need to execute million-dollar trades with minimal price impact, they naturally gravitate toward exchanges with the deepest order books. This institutional activity further improves liquidity for retail users, creating a virtuous cycle.

Key competitive advantages that sustain Binance's leadership:

- Unmatched liquidity: Consistently exceeds the combined volume of the five largest competitors

- Technical reliability: Stable operations during 10-20x volume spikes when competitors crash

- Integrated ecosystem: Reduces friction across multiple use cases and services

- Global infrastructure: Distributed operations adapt to local regulations worldwide

Infrastructure Excellence

The exchange's technical infrastructure handles peak loads that would crash smaller platforms. During major market movements when crypto trading volume spikes 10-20x normal levels, Binance maintains stable operations while competitors experience outages. Users remember these reliability differences during crucial trading moments.

Real-time matching engines process millions of orders per second with sub-millisecond latency. For high-frequency traders and automated systems, these performance characteristics determine platform selection. Once institutional traders establish infrastructure connections, switching costs create platform lock-in effects.

Integrated Service Benefits

Unlike specialized exchanges that excel in specific areas, Binance's integrated infrastructure reduces friction across multiple use cases. A user can stake tokens for rewards, trade derivatives for hedging, participate in token launches, and manage NFT collections all within the platform, without needing to leave or maintain multiple account relationships.

This integration becomes particularly valuable for international users who face banking restrictions when moving funds between different service providers. Binance's comprehensive offering eliminates many of these friction points while providing competitive rates across all services.

Is Binance Safu?

Binance's security model combines multiple layers of protection with transparent communication about risks and incidents. The platform's track record includes both significant breaches and industry-leading responses that ultimately strengthened overall security posture.

Core Security Infrastructure

The Secure Asset Fund for Users represents Binance's most visible commitment to security. Established in 2018, this insurance fund allocates 10% of trading fees to cover user losses from security incidents. The fund's most significant test came during the 2019 hack, when it fully compensated affected users without requiring lengthy claims processes.

Essential security measures protecting user assets:

- Cold storage: The majority of user funds are stored offline in secure facilities

- Multi-signature wallets: Multiple approvals required for large transactions

- Real-time monitoring: Automated systems detect suspicious activity patterns

- Regular audits: Third-party firms identify vulnerabilities before exploitation

User Protection Tools

User-facing security tools allow individuals to customize their protection levels. Two-factor authentication (2FA) using time-based codes or hardware keys protects account access. Withdrawal whitelisting restricts fund transfers to pre-approved addresses. Device management systems alert users to login attempts from new locations or devices.

Incident Response Excellence

The exchange's incident response demonstrates security effectiveness through transparency and rapid remediation. When the AIO project suffered a wallet breach in September 2025, Binance immediately implemented trading restrictions while ensuring user funds remained secure. This proactive approach contrasts favorably with exchanges that minimize problems until they become unavoidable.

Understanding the Risks

However, centralized exchange risks remain inherent to Binance's model. Users must trust the platform's security measures and operational integrity, which can create counterparty risk that decentralized alternatives avoid. Regulatory actions could freeze assets or limit access, as demonstrated by various government investigations.

Risk mitigation strategies Binance employs:

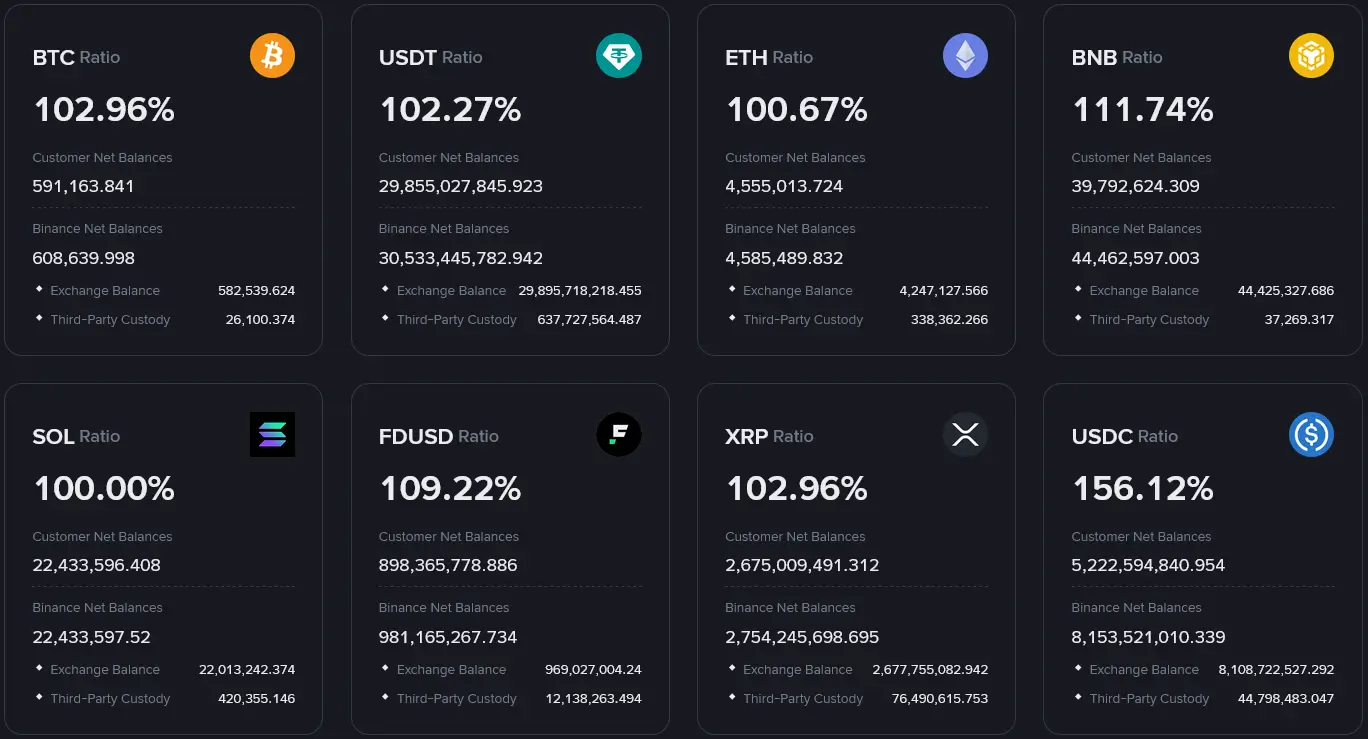

- Reserve transparency: Proof-of-reserves reports verify customer deposits match held assets

- Regulatory licenses: Multiple jurisdictions provide legal clarity and operational protection

- Insurance coverage: SAFU fund covers security incidents and operational failures

- Compliance investments: Thousands of specialists ensure regulatory adherence

What Regulatory Issues Has Binance Faced?

Binance's regulatory journey reflects the broader cryptocurrency industry's evolution from unregulated innovation to institutional oversight, with the exchange serving as both a pioneer and a cautionary tale for global compliance efforts.

The 2023 Settlement Resolution

The 2023 settlement with U.S. authorities marked the culmination of years-long investigations into anti-money laundering violations and sanctions evasion. Binance agreed to pay $4 billion in penalties while admitting to facilitating transactions with sanctioned entities and failing to implement adequate compliance controls. CZ's personal fine of $50 million and brief prison sentence demonstrated serious consequences for regulatory violations.

Settlement outcomes that improved Binance's position:

- Legal clarity: Resolved major regulatory uncertainties

- New leadership: Richard Teng brought compliance expertise from regulated jurisdictions

- Institutional credibility: Enhanced trust among professional investors

- Operational focus: Shifted from legal battles to sustainable growth

Current Regulatory Landscape

Current regulatory challenges vary significantly by jurisdiction. The UK's Financial Conduct Authority maintains restrictions on regulated activities, while European authorities evaluate Binance's compliance with Markets in Crypto-Assets regulations. Asian markets generally show more acceptance, with Japan approving Binance's re-entry through the acquisition of Sakura Exchange.

Ongoing legal matters include probes in France and Nigeria regarding regulatory compliance, while FTX's estate filed a $1.8 billion lawsuit in 2024 seeking to recover funds from previous transactions. These cases remain in various stages of resolution.

Binance's proactive compliance strategy includes:

- Licensing pursuits: Operations in Dubai benefit from clear cryptocurrency frameworks

- Traditional partnerships: Collaborations with established financial institutions provide legitimacy

- Compliance investment: Thousands of specialists implement enhanced procedures

- Transaction monitoring: Detailed systems exceed industry standards

Improving Regulatory Relations

Recent developments suggest improving regulatory relationships. The SEC dropped its lawsuit against Binance in May 2025, ending one of the most significant remaining legal challenges. Paxos Trust's $48.5 million settlement with New York regulators over Binance-related activities resolved another compliance issue without direct impact on the exchange.

Looking forward, regulatory clarity in major markets could unlock significant growth opportunities. Institutional investors and corporations require legal certainty before adopting cryptocurrency infrastructure on a large scale. Binance's compliance investments position the exchange to benefit from regulatory maturation while competitors struggle with legal uncertainty.

What's New at Binance Recently?

The platform's recent developments demonstrate continued evolution toward community-driven growth and institutional adoption while maintaining its innovative edge in cryptocurrency services.

Innovation and Community Growth

User engagement and product development drive Binance's current strategy across multiple initiatives aimed at expanding access and enhancing functionality.

Recent developments focus on community growth, product innovation, and strategic partnerships that expand the platform's reach beyond traditional trading services. The platform experienced significant user growth, with 30 million new registrations from emerging markets, demonstrating the global expansion of crypto beyond developed economies.

Binance Alpha Program

Binance Alpha launched as an exclusive program for early access to promising blockchain projects. Users earn points through platform engagement, unlocking allocation rights for token airdrops and trading competitions. Recent launches included Zentry, which airdropped 4,000 tokens to qualified users, and World of Dypians, offering 750 tokens to participants with sufficient points.

Key Alpha program benefits:

- Early access: Token launches before public availability

- Competitive rewards: Trading competitions with millions in prizes

- Point-based allocation: Fair distribution based on platform engagement

- Exclusive opportunities: Access to vetted projects and airdrops

Enhanced User Services

The wallet referral program creates earning opportunities for users who promote Binance's self-custody solutions. Referrers earn up to 80% commission on fees generated by new users, incentivizing community growth while expanding wallet adoption. This model leverages network effects to compete with dedicated wallet providers.

Technical improvements include enhanced over-the-counter services with instant settlements in 15 minutes, customizable two-factor authentication triggers, and advanced arbitrage bot controls. Grid trading parameters received updates that improve automated strategy performance, while backtesting tools help users optimize approaches using historical data.

Strategic Partnerships and Compliance

Regulatory cooperation and institutional service expansion characterize Binance's current approach to partnerships.

Strategic partnerships expanded Binance's law enforcement cooperation. Collaboration with Chainalysis helped freeze nearly $50 million in illicit funds from cryptocurrency scams, demonstrating the platform's commitment to combating financial crime. These partnerships strengthen regulatory relationships while protecting legitimate users.

VIP user growth recently reached 21%, reflecting growing institutional adoption. Enhanced services for high-volume traders include aggregated liquidity for minimal slippage and algorithmic execution options that optimize large order fills. These improvements position Binance for continued growth in institutional market share.

Emerging Market Expansion

Global growth initiatives and controversial listings demonstrate Binance's continued expansion strategy beyond traditional markets.

New token listings continue driving user engagement, with World Liberty Financial generating significant attention due to its connections with prominent political figures. While controversial, such listings demonstrate Binance's willingness to support projects that attract mainstream interest.

Research initiatives focus on emerging themes like restaking protocols and stablecoin innovations. These efforts enable users to understand evolving market dynamics, positioning Binance at the forefront of industry developments.

How Does Binance Make Money?

Binance's revenue model spans multiple streams that leverage its dominant market position and comprehensive service infrastructure. Trading fees remain the primary source of income, generated from billions of dollars in daily volume across spot and derivatives markets.

Primary Revenue Streams

Core revenue generation focuses on trading activities and platform services that scale with user growth and market activity.

Trading Fee Structure

The fee structure varies by user tier and payment method:

- Standard rates: 0.1% for spot trades, reduced through BNB token usage

- Volume discounts: VIP users with substantial trading get rates as low as 0.02%

- Market maker rebates: Liquidity providers earn rebates for tight spreads

- Leverage premiums: Futures trading generates higher fees due to complexity

Revenue scales with platform growth while incentivizing increased usage through volume-based discounts.

Derivatives and Advanced Products

Futures trading generates higher fees due to the use of leverage and increased complexity. Funding rates for perpetual contracts create additional revenue streams when traders pay to maintain leveraged positions. These fees compound during volatile periods when trading activity peaks and demand for leverage increases.

Ecosystem Revenue Sources

Beyond core trading, Binance generates income through blockchain services and financial products that extend platform utility.

Earn Products and Staking

Binance Earn products generate revenue through lending and staking services. The platform acts as an intermediary between users seeking yields and protocols requiring capital, capturing spreads on interest rates. Simple savings products offer guaranteed returns funded by Binance's treasury operations, while flexible staking earns fees from validator rewards.

Token Listings and Launchpad

Launchpad and token listing fees provide significant one-time revenues:

- Project payments: Substantial fees for access to Binance's user base

- BNB requirements: Token holders participate in launches using BNB

- Quality criteria: Platform selection ensures projects maintain listing value

- Exclusive access: Premium pricing for early-stage investment opportunities

Blockchain Operations

BNB Chain operations generate fees through network usage. Every transaction, smart contract execution, and token transfer requires BNB payments that flow to network validators. Binance's stake in the network's success aligns incentives between exchange operations and blockchain development.

Institutional and Partnership Revenue

High-value clients and strategic alliances provide premium revenue streams that complement retail trading income.

Professional Services

Institutional services command premium pricing due to specialized requirements:

- Custody solutions: Secure storage for hedge funds and corporations

- OTC trading: Large block trades with minimal market impact

- Lending facilities: Liquidity provision without requiring asset sales

- White-label services: Technology licensing to other platforms

These clients generate disproportionate revenue relative to retail users while requiring dedicated relationship management.

Strategic Partnerships

Revenue diversification through partnerships extends Binance's reach while creating additional income streams.

Partnership revenues include referral programs with wallet providers, payment processors, and financial institutions. Binance earns commissions on user activity generated through partner channels as it expands its reach into new markets and demographics.

The quarterly BNB burning mechanism demonstrates revenue transparency by permanently removing tokens based on exchange profits. These burns indicate substantial earnings while creating deflationary pressure that benefits all token holders.

What Are Binance's Biggest Competitors?

Binance faces competition across multiple dimensions, from specialized trading platforms to comprehensive cryptocurrency infrastructures that challenge different aspects of its business model.

Western Market Competition

Regulatory compliance and institutional focus define competitive dynamics in developed Western markets.

Coinbase: Regulatory Compliance Leader

Coinbase represents the primary competitor in Western markets, emphasizing regulatory compliance and institutional services over pure trading volume. The U.S.-based exchange commands premium valuations due to legal clarity and public company transparency, attracting investors who prioritize compliance certainty over feature breadth.

Key Coinbase advantages:

- Regulatory clarity: Clear legal status in major Western markets.

- Public company transparency: SEC-compliant financial reporting.

- Institutional focus: Dedicated services for professional investors.

- Brand recognition: Mainstream awareness and trust.

Asian Market Rivals

Direct feature competition characterizes the battles among Asian cryptocurrency exchanges, where platforms rapidly match offerings.

Direct Feature Competition

OKX and Huobi challenge Binance in Asian markets with similar product offerings and fee structures. These exchanges compete directly on trading volume and feature innovation, often matching Binance's token listings and derivatives offerings within days of launch. Market share battles in these regions involve aggressive promotion and localized service delivery.

Specialized Competitors

Kraken focuses on security and institutional services, positioning itself as an alternative for sophisticated users. The exchange's compliance record and advanced trading features attract clients who value reliability over comprehensive product suites. Its recent expansion into derivatives trading creates more direct competition with Binance's offerings.

Emerging Competitive Threats

New models, DeFi, and the integration of traditional finance present long-term challenges to centralized exchange dominance.

Decentralized Alternatives

Decentralized exchanges like Uniswap and PancakeSwap offer alternative models that eliminate counterparty risk and regulatory oversight:

- Self-custody: Users maintain control of private keys

- Censorship resistance: No central authority can freeze accounts

- Global access: Available regardless of geographic restrictions

- Innovation pace: Rapid deployment of new features and protocols

While trading volumes remain smaller, these platforms attract users who prioritize self-custody and censorship resistance. Their growth could eventually challenge centralized exchange dominance if user experience improvements continue.

Traditional Finance Integration

Traditional financial institutions pose emerging competitive threats as cryptocurrency adoption increases. Companies like PayPal, Square, and Robinhood integrate crypto services into existing customer relationships, potentially capturing users who prefer familiar brands over specialized exchanges.

Binance's Competitive Position

Market leadership requires balancing current advantages with emerging challenges from regulatory and technological shifts.

Sustainable Advantages

Binance's competitive advantages include unmatched scale, comprehensive service integration, and global operational capabilities:

- Liquidity depth: Deepest order books across hundreds of trading pairs

- Service breadth: Most comprehensive cryptocurrency infrastructure

- Global reach: Operations in more jurisdictions than competitors

- Technical reliability: Proven scalability during market volatility

Strategic Challenges

However, regulatory restrictions in key markets create opportunities for compliant competitors to capture market share in lucrative jurisdictions. The exchange must strike a balance between innovation leadership and regulatory requirements that enable access to institutional capital.

Regional competitors maintain advantages in specific markets through local partnerships and regulatory relationships. Bitfinex dominates certain institutional segments, while platforms like Gemini appeal to compliance-focused users in regulated jurisdictions.

The competitive landscape continues evolving as traditional finance embraces cryptocurrency and decentralized alternatives mature. Binance's long-term success depends on maintaining innovation leadership while addressing regulatory requirements that enable access to institutional capital.

Should You Use Binance?

The exchange offers compelling advantages for users seeking extensive cryptocurrency services, but individual circumstances should determine selection based on risk tolerance, regulatory environment, and feature requirements.

User Profile Considerations

Different user types benefit from Binance's services in distinct ways, making platform suitability highly dependent on individual needs and experience levels.

Active Traders

For active traders, Binance provides unmatched liquidity, competitive fees, and advanced trading tools that rival professional platforms:

- Deep order books: Minimal slippage on large trades across hundreds of pairs

- Advanced order types: Stop-losses, trailing stops, OCO combinations

- Professional tools: Real-time charts, technical indicators, API access

- Derivatives access: High leverage trading with comprehensive risk management

Casual Investors

Casual cryptocurrency investors benefit from Binance's integrated infrastructure that eliminates the complexity of managing multiple accounts:

- Simple interfaces: Mobile apps and web platforms designed for beginners

- Educational resources: Binance Academy covering basics to advanced concepts

- Passive income: Staking rewards and savings accounts for portfolio growth

- Comprehensive access: Spot trading, NFTs, and payment services in one platform

Risk Assessment

Understanding potential risks helps users make informed decisions about platform usage and security practices.

Security and Counterparty Risk

Security-conscious users should weigh centralized exchange risks against convenience benefits:

- Protection measures: SAFU insurance fund, cold storage, multi-signature security

- Counterparty risk: Must trust the platform's operational integrity and security

- Track record: Demonstrated competent crisis management over eight years

- Alternative options: Self-custody eliminates counterparty risk entirely

Regulatory Considerations

Regulatory considerations vary significantly by jurisdiction:

- U.S. restrictions: Limited access to advanced features, separate Binance.US platform

- European compliance: Evolving MiCA regulations require evaluation

- Asian access: Generally full platform access with local adaptations

- Emerging markets: Comprehensive services are often available

Professional and Institutional Use

Enterprise-level users require specialized services and regulatory clarity that Binance increasingly provides through dedicated offerings.

Enterprise Requirements

Institutional users and corporations require regulatory clarity that Binance increasingly provides through licensing efforts and compliance investments:

- Professional services: Custody solutions, OTC trading, dedicated support

- Regulatory compliance: Licenses in multiple jurisdictions provide legal clarity

- Operational reliability: Proven infrastructure handles institutional volume requirements

- Risk management: Comprehensive tools and reporting for fiduciary requirements

Alternative Considerations

Platform alternatives serve different needs and risk profiles depending on user priorities and geographic location.

Competitive Options

Different platforms excel in specific areas:

- Coinbase: Superior regulatory clarity in Western markets

- Decentralized exchanges: Eliminate counterparty risk through self-custody

- Traditional brokerages: Familiar interfaces for cryptocurrency exposure

- Regional platforms: Local partnerships and specialized market access

Conclusion

Binance's dominance in cryptocurrency infrastructure stems from its ability to evolve in response to market demands while maintaining operational excellence. The exchange's eight-year journey from a Chinese startup to a global leader showcases remarkable adaptability in the face of regulatory challenges, security incidents, and market crashes.

Today's Binance serves users from first-time Bitcoin buyers to institutional hedge funds through integrated services that eliminate friction across multiple use cases. Under Richard Teng's leadership, regulatory compliance transformed from an afterthought to a core competency, positioning the platform for institutional adoption as cryptocurrency markets mature.

The comprehensive ecosystem demonstrates how technical excellence and strategic adaptability create sustainable competitive advantages in rapidly evolving markets.

Visit the official Binance website and follow @binance on X for updates.

Recent Binance Coverage:

- What is Binance Square & How Does it Work?

- Binance Makes History With Full FSRA Approval in Abu Dhabi

- What is Binance Academy: Research Into The Hub For Free Crypto And Blockchain Education

- What is Binance Junior and How Does it Work?

- Binance Expands Into Private-Bank-Style Services With New Prestige Program

Sources:

- Binance Official Blog and Press Releases (2017-2025)

- U.S. Treasury Department Settlement Announcement (November 2023)

- SEC Regulatory Filings and Press Releases (2023-2025)

- Reuters Financial News Coverage

- Official X/Twitter Updates from @binance

- Binance Revenue and Usage Statistics (Business of Apps, 2025)

- Wikipedia: Binance Exchange History and Operations

- CoinMarketCap Exchange Rankings and Data

Read Next...

Frequently Asked Questions

What makes Binance the largest cryptocurrency exchange?

Binance processes over $8 trillion in quarterly trading volume and serves more than 280 million users globally. Its comprehensive ecosystem integrates spot trading, derivatives, staking, NFTs, and institutional services.

How does BNB token provide value to users?

BNB offers trading fee discounts up to 25%, Launchpad access, staking rewards, and serves as the gas token for BNB Chain smart contracts. Additionally, quarterly burns reduce supply based on platform revenue.

What are Binance's main competitive advantages?

Binance maintains the deepest liquidity across hundreds of pairs, offers comprehensive services integration, and operates proven infrastructure that handles massive volume without downtime during market volatility.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens