Bybit Exchange: Complete Guide to the Derivatives Giant

Bybit serves 70M+ users globally, with derivatives trading, spot markets, and Web3 tools. Complete guide to features, security, and services.

Crypto Rich

December 31, 2025

Table of Contents

Bybit is a cryptocurrency derivatives exchange serving over 70 million users in most markets outside the United States. The platform processes more than $17 billion in daily trading volume and holds roughly 16% of the global derivatives market, second only to Binance. Founded in 2018, it has expanded from a perpetual contracts specialist into a full-service crypto hub offering spot trading, staking, fiat on-ramps, and Web3 integration through its Unified Trading Account system.

The February 2025 security breach put that infrastructure to the test. North Korea's Lazarus Group extracted approximately $1.5 billion in Ethereum through sophisticated malware that manipulated transaction approvals. Bybit continued processing withdrawals throughout the incident, demonstrating both the platform's financial reserves and its operational resilience. For an exchange built on the promise of reliability during volatile moments, the breach was the ultimate stress test.

Who Founded Bybit and How Did It Start?

Ben Zhou launched Bybit in March 2018 in Singapore. Before crypto, Zhou worked at XM, a global forex brokerage, where he learned how traditional trading platforms handled high-volume, high-stakes environments. That experience shaped his vision for Bybit: a "battle-tested machine" built to perform when markets moved fastest.

The founding team saw clear problems with existing crypto exchanges. Order matching slowed to a crawl during market crashes. Liquidity pools were too thin, causing painful slippage on larger trades. Interfaces confused professional traders who needed speed and precision. Rather than build another spot exchange to compete with Binance or Coinbase, Zhou bet on derivatives. Perpetual contracts were gaining traction, and the infrastructure serving them was weak.

That bet paid off. By focusing narrowly on derivatives first, Bybit built deep expertise in a complex product category before expanding. Growth came through organic channels: referral programs, community initiatives, and word-of-mouth among traders who cared about execution quality. No massive marketing campaigns. By 2020, Bybit had carved out a serious position in derivatives trading.

Key Milestones in Bybit's Development

The platform evolved steadily from derivatives specialist to a comprehensive crypto ecosystem.

- 2019: Perpetual contracts launched with up to 100x leverage on major pairs. Deep liquidity and fast execution during volatile conditions built Bybit's early reputation among serious traders.

- 2020-2021: Spot trading and earn products arrived during the crypto bull market. The user base expanded from derivatives specialists to millions of retail traders exploring crypto for the first time.

- 2022: Headquarters relocated from Singapore to Dubai, taking advantage of the UAE's crypto-friendly regulatory environment. The move signaled commitment to operating within clear legal frameworks.

- 2023: The Unified Trading Account launched, letting users manage spot, derivatives, and margin positions from a single account with shared collateral across products.

- 2024: Industry recognition followed with "Best Blockchain Company of the Year" awards. Web3 wallet integration aimed to bridge centralized and decentralized trading, though the feature was later restructured for security reasons.

- 2025: Bybit Alpha rolled out for on-chain trading without traditional wallet requirements or gas fees. A Taxbit partnership addressed growing demand for automated tax compliance tools.

What Trading Features Does Bybit Offer?

Bybit caters to traders across the experience spectrum. Beginners can use copy trading to mirror successful traders automatically. Institutions get OTC desks, custom pricing, and dedicated account managers. The infrastructure underneath supports low-latency execution with more than 20 integrated tools for charting, analysis, and automation.

Derivatives remain the core business and the product category that built Bybit's reputation. Perpetual contracts, traditional futures with expiration dates, and options span more than 2,000 trading pairs. Leverage ranges from a conservative 5x to an aggressive 200x on select pairs. The matching engine processes thousands of transactions per second and has maintained performance through market events that crashed competing platforms.

Spot trading has grown substantially since launching in 2020. Over 2,459 cryptocurrencies now trade on the platform, from majors like Bitcoin and Ethereum to newly launched tokens through Bybit's launchpad events. The Token Splash program promotes new listings with campaigns designed to spark early liquidity and trading interest.

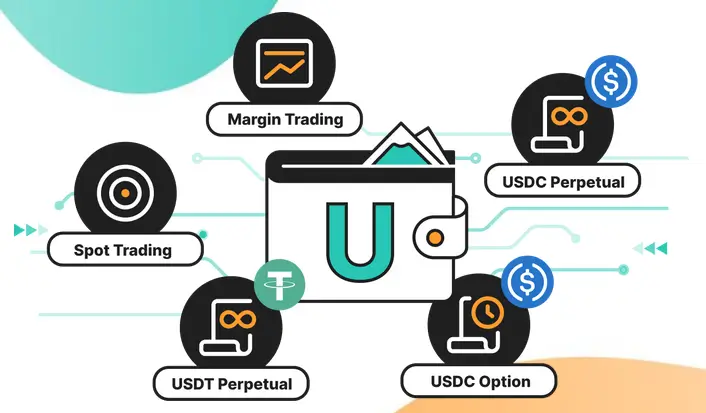

How Does the Unified Trading Account Work?

The Unified Trading Account addresses a persistent frustration for active traders: juggling multiple balances across different product types. UTA lets assets in one category serve as collateral for positions in another. A Bitcoin spot holding can back a leveraged Ethereum futures trade without requiring a separate deposit.

The system recalculates account value and margin requirements in real time. When one position moves against a trader, profits elsewhere can offset losses, potentially preventing liquidation. This cross-margining approach improves capital efficiency and gives traders more flexibility to pursue complex strategies.

UTA also connects to earn products and DeFi features. Users can stake assets while maintaining them as trading collateral, earning yield on funds that would otherwise sit idle as margin. Alpha Farm extends this into decentralized finance, linking with protocols like Raydium and Orca on Solana for liquidity provision without separate wallets or gas fees.

What Earn Products Does Bybit Offer?

Beyond trading, Bybit provides several ways to generate returns on idle crypto.

- Staking: Programs cover major proof-of-stake assets with varying yields and lock-up periods

- Liquidity farming: Simplified access to DeFi protocols without navigating complex decentralized applications directly

- Savings products: Fixed and flexible terms across various cryptocurrencies for predictable returns

- BYUSDT: A stablecoin product that swaps 1:1 with USDT while doubling as margin collateral, keeping funds ready for trading opportunities

How Does Bybit Handle Fiat Currency?

Fiat on-ramps create friction for new crypto users. Bybit addresses this through multiple channels suited to different regions and banking situations.

One-Click Buy and Direct Purchases

One-Click Buy offers the simplest path from traditional currency to crypto. Users can purchase popular cryptocurrencies directly with credit/debit cards or via bank transfers in dozens of fiat currencies. Processing times and fees vary by method and region. Credit cards process faster but carry higher fees. Bank transfers cost less but take longer to settle.

Peer-to-Peer Trading Marketplace

P2P trading serves users in regions with limited banking access or who want payment methods unavailable through standard channels. The marketplace connects buyers and sellers directly, with Bybit providing escrow to protect both parties throughout each transaction.

More than 300 payment methods work globally, from traditional bank transfers to local mobile payment apps. Takers pay zero platform fees, making P2P cost-effective for those willing to accept posted rates. Advertisers set their own prices and terms, and competition often pushes rates below exchange-based purchases. A reputation system displays each trader's completion rate, response time, and transaction history.

What Security Measures Does Bybit Use?

Bybit's security infrastructure combines technical safeguards with operational procedures designed to protect assets at multiple levels.

Core Security Features

The platform employs several layers of protection:

- Multi-signature wallets requiring multiple authorized parties to approve large withdrawals

- Cold storage in air-gapped systems for the majority of user deposits

- Proof-of-reserves audits with publicly available reports confirming customer balances are fully backed

- Escrow protection for P2P trades with dispute resolution procedures

- KYC verification for full platform access and higher withdrawal limits

Only funds needed for daily operations are held in hot wallets, limiting exposure in the event of a breach.

The February 2025 Security Breach

In February 2025, Bybit suffered a major attack attributed to North Korea's Lazarus Group. Hackers stole between $1.4 billion and $1.5 billion in Ethereum from hot wallet systems in one of the largest exchange breaches in crypto history.

The attack used sophisticated malware that manipulated the transaction approval process. Rather than stealing private keys directly, the malware tricked legitimate signing systems into authorizing transfers that appeared valid to security protocols. The breach exposed vulnerabilities in hot wallet management that even well-funded exchanges face against state-sponsored hackers.

Bybit kept running throughout. Trading, deposits, and withdrawals continued without pause, backed by reserves and insurance mechanisms. The decision to maintain operations demonstrated financial strength, though it raised questions about whether earlier security measures were adequate.

Recovery came faster than many expected. Bybit partnered with Zodia Custody in April 2025 to strengthen asset security protocols. By May, Bitcoin liquidity had rebounded to pre-hack levels according to Kaiko analysis. The platform closed its ETH gap quickly through a combination of inflows and loans, normalizing operations without lasting user impact. Roughly 28% of the stolen funds remain untraceable, but the breach's operational effects proved temporary.

In response, Bybit rebuilt its wallet infrastructure with new architectures. The keyless Web3 wallet feature from 2024 was discontinued in favor of tighter protocols. The incident reinforced that security requires continuous investment rather than a one-time solution.

Where Is Bybit Licensed to Operate?

Bybit holds licenses in multiple jurisdictions where clear regulatory frameworks exist for crypto exchanges.

Licensed Regions

The platform operates with regulatory approval in:

- Austria

- Cyprus

- Dubai, UAE (headquarters since 2022)

The Dubai headquarters places Bybit in one of the most developed crypto regulatory environments globally. The UAE's Virtual Assets Regulatory Authority provides detailed requirements covering custody, capital reserves, and operational standards.

Bybit has aligned with the EU's DAC8 directive and the Crypto-Asset Reporting Framework through its Taxbit partnership. These tools generate automated tax reports, helping users meet obligations in participating countries.

Restricted Markets

The United States remains the most significant restricted market. Bybit blocks U.S. users due to the complex regulatory landscape for crypto derivatives. This limits access to a massive trader pool but avoids legal complications that have caught other exchanges serving Americans without proper registration.

What Is the User Experience Like on Bybit?

Bybit offers both Lite and Pro versions of its mobile app, recognizing that beginners and professionals have different needs.

Lite strips out advanced features, presenting a clean interface focused on basic spot purchases and portfolio tracking. New users can buy Bitcoin without confronting derivatives complexity, order types, and leverage settings.

Pro mode opens everything: comprehensive charting tools, multiple order types, leverage controls, and the full range of trading pairs. Version 5.4 added personalized insights suggesting earning opportunities based on user activity patterns.

Support runs 24/7 across multiple channels. Response times can stretch during high-volume market swings when tickets pile up, but the infrastructure handles routine inquiries efficiently.

Community and Engagement

Bybit's X account has grown to nearly 5 million followers, serving as the primary channel for announcements and community interaction. The platform actively gathers feedback through social media engagement.

- VIP programs reward high-volume traders with lower fees, dedicated account managers, and early access to new products

- Affiliate programs pay users who bring in new traders, creating distributed marketing with aligned incentives

- Events like VIP galas and conference sponsorships build relationships beyond transactions

What Partnerships Has Bybit Formed?

Bybit's partnerships span infrastructure, DeFi protocols, institutional services, and compliance technology.

Key Collaboration Areas

- DeFi and Web3: Integrations with Solana-based protocols like Raydium and Orca for liquidity farming. The Byreal project explores real-world asset tokenization.

- Institutional custody: Anchorage Digital handles custody for products like bbSOL, meeting institutional demand for regulated custody separate from trading venues.

- Compliance technology: Taxbit powers automated tax reporting as regulatory scrutiny increases globally.

- Ecosystem development: Contributions exceeding $500 million to the Mantle treasury support Layer 2 infrastructure development.

- Events and tools: Partnerships with conferences and analytics platforms like KaitoAI extend platform capabilities.

These collaborations add functionality Bybit could not build alone while connecting the platform to emerging trends across the crypto ecosystem.

How Does Bybit Compare to Other Exchanges?

The exchange market is intensely competitive. Bybit positions itself primarily against Binance, OKX, and Bitget in derivatives, with each platform attracting different user segments.

Bybit's derivatives focus built early advantages in liquidity depth and order book quality for perpetual contracts. Binance leads overall volume, but Bybit holds a strong position in the specialized derivatives segment. Professional traders often maintain accounts across multiple platforms, selecting execution venues based on liquidity for specific pairs rather than brand loyalty.

Expansion into spot trading, earn products, and Web3 services responds to competitive pressure from platforms offering comprehensive solutions. Users increasingly expect a single destination rather than multiple apps for different activities.

Regulatory positioning creates tradeoffs. Staying out of the U.S. shrinks the addressable market but avoids compliance costs and legal risks that burden exchanges pursuing American customers.

What Challenges Has Bybit Faced?

Beyond the February 2025 breach, Bybit navigates ongoing regulatory and competitive pressures.

Regulations shift rapidly in crypto. Rules permissible today may face restrictions tomorrow in any jurisdiction. Bybit's multi-license strategy aims for geographic flexibility, but changes in Dubai, Cyprus, or Vienna could force operational adjustments.

Competition is squeezing margins as the exchange business becomes increasingly commoditized. Platforms battle over fees, features, and promotional incentives. Maintaining differentiation while achieving profitability demands constant innovation.

Does Bybit Offer Any Unique Services?

Several features distinguish Bybit from competitors by addressing needs others have overlooked.

Islamic Accounts structure products to comply with Shariah principles on interest, opening the platform to Muslim traders in the Middle East and Southeast Asia, where standard trading products may conflict with religious obligations.

Bybit Alpha bridges centralized and decentralized trading. Users execute on-chain without managing seed phrases, paying gas in native tokens, or navigating blockchain interfaces. The feature makes DeFi accessible to less technical users while preserving self-custody benefits.

Copy trading lets beginners mirror successful traders automatically, doubling as a learning tool while potentially generating returns for those lacking time or expertise.

mETH collateral allows users to stake ETH for mETH, use that mETH as trading collateral, and continue earning staking yields while backing leveraged positions. Capital works twice without forcing a choice between staking and trading.

Conclusion

Bybit has built a substantial position in crypto derivatives while expanding into spot markets, earn products, and DeFi integration. The platform serves over 70 million users through infrastructure designed for high-volume, high-stakes trading environments.

The Unified Trading Account system simplifies portfolio management across product types. Fiat on-ramps through P2P and direct purchases provide global accessibility. Licenses in Dubai, Cyprus, and Austria establish regulatory credibility.

Security remains an ongoing focus following the 2025 breach. The platform's ability to maintain operations throughout the incident demonstrated financial reserves and operational discipline. Continued infrastructure investment addresses vulnerabilities exposed by state-sponsored attackers.

For traders seeking derivatives liquidity, unified account management, and simplified access to DeFi opportunities, Bybit offers a tested option built through seven years of focused development.

Visit the official website at bybit.com for more information and follow @Bybit_Official on X for updates.

Sources:

- Bybit: Official Platform Data and Press Releases

- Elliptic: Lazarus Group Attribution and February 2025 Breach Investigation

- CoinBureau: Bybit Exchange Review and Derivatives Market Analysis

- CryptoPotato: Bybit Platform Features and Industry Comparisons

- Bybit Official X: CEO Ben Zhou Statements and Platform Communications

Read Next...

Frequently Asked Questions

Is Bybit safe to use after the 2025 hack?

Bybit maintained withdrawals throughout the February 2025 breach and has since rebuilt its wallet infrastructure. The platform runs proof-of-reserves audits and stores most assets in cold storage, though all exchanges carry inherent risk.

Can U.S. residents use Bybit?

No. Bybit blocks U.S. users due to regulatory restrictions on crypto derivatives and has no current plans to pursue American licensing.

What is the maximum leverage available on Bybit?

Up to 200x on select pairs, though limits vary by asset. Major pairs like BTC/USDT typically cap at 100x, with smaller or newer pairs set lower.

Does Bybit require KYC verification?

Basic accounts access limited features without KYC. Full platform use and higher withdrawal limits require identity verification including government ID.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens