Trump-Linked WLFI Crashed 5 hours Before October Meltdown — Here’s What Happened

Trump-linked WLFI token dropped 5 hours before October 2025's $6.93B crypto liquidation event. Data shows political tokens may signal crashes early.

Soumen Datta

February 16, 2026

Table of Contents

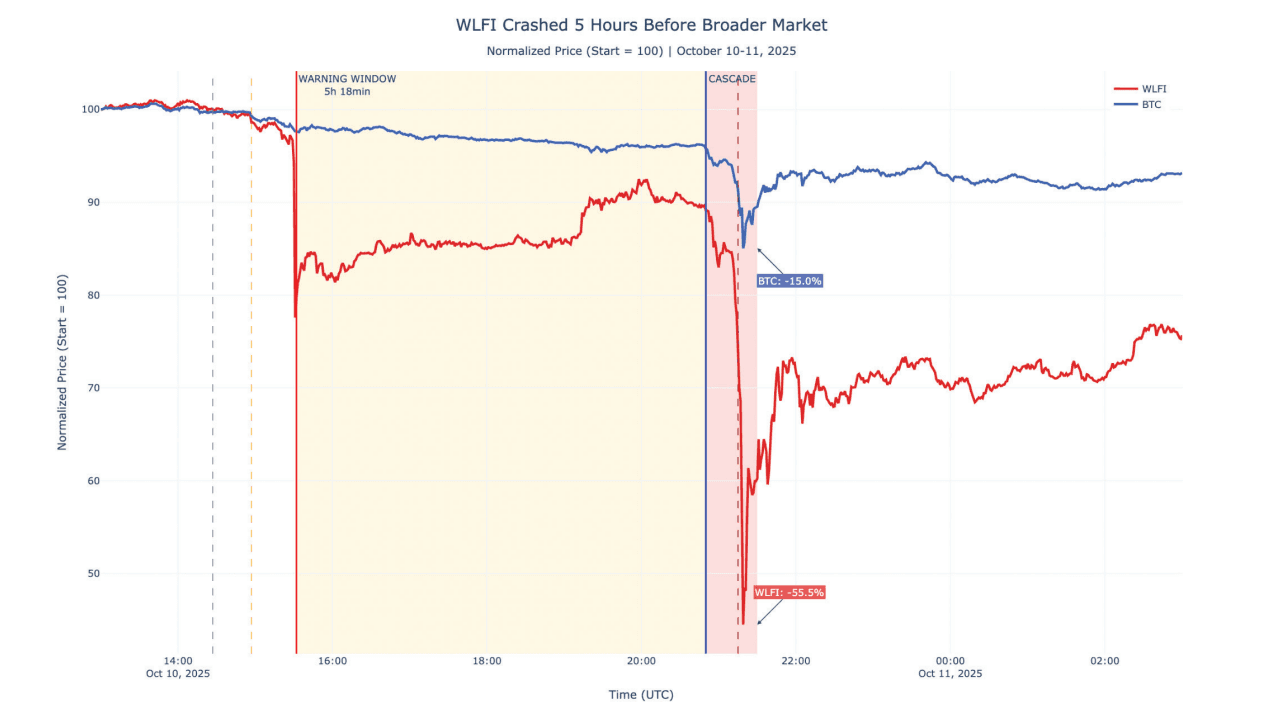

World Liberty Financial Token (WLFI), a cryptocurrency affiliated with former President Donald Trump, began falling more than five hours before the massive October 10, 2025 market crash that wiped out $6.93 billion in leveraged positions, according to a new report from blockchain analytics firm Amberdata. Bitcoin was still trading near $121,000 when WLFI started its decline at 3:32 PM UTC, showing no visible signs of stress until the broader market collapsed at 8:50 PM.

The sequence raises questions about whether political tokens with concentrated ownership can serve as early warning indicators for market-wide liquidation events. During those five hours, WLFI fell 45% while Bitcoin dropped only 6%, creating a divergence that went largely unnoticed by traders focused on traditional market benchmarks.

What Happened On October 10, 2025?

At 2:57 PM UTC on October 10, news broke of a Trump administration tariff announcement targeting Chinese imports. Just three minutes later, trading volume in WLFI exploded to $474.26 million in a single hour, representing 21.7 times its normal baseline of $21.89 million, according to the report. To put this in perspective, more WLFI changed hands in that one hour than in the previous 20 hours combined.

By 3:32 PM, WLFI's price began dropping sharply. Bitcoin, however, remained stable near $121,000. Ethereum showed no significant movement. Broader market conditions appeared normal.

Five hours and eighteen minutes later, at 8:50 PM UTC, the cryptocurrency market experienced one of its most severe crashes on record. Bitcoin fell 15% to roughly $102,850. Ethereum dropped 20%. Small-cap altcoins declined between 60% and 70%. The selloff triggered $6.93 billion in forced liquidations within just 40 minutes as automated trading systems unwound overleveraged positions across thinning orderbooks.

The Five-Hour Warning Window

The Amberdata analysis reveals that WLFI provided observable signals throughout the afternoon that something was breaking in crypto markets, even as Bitcoin and other major assets continued trading normally.

Volume Spike After Tariff News

The three-minute gap between the tariff announcement and WLFI's volume explosion is significant. Retail traders typically need time to digest news, analyze implications, and execute trades. But WLFI's volume spike happened almost immediately, suggesting that either very sophisticated traders recognized the threat instantly or holders with political connections had advance positioning.

Large holders were clearly exiting. A 21.7x volume increase represents distribution at scale, not normal market activity. Someone wanted out fast.

Price Divergence Between WLFI And Bitcoin

The price comparison tells the story of the warning window:

- 3:32 PM: WLFI begins falling. Bitcoin stable at $121,000

- 5:00 PM: WLFI down 15%. Bitcoin barely down 2%

- 7:00 PM: WLFI down 30%. Bitcoin down 4%

- 8:50 PM: WLFI down 45%. Bitcoin down 6% but about to collapse

For over five hours, WLFI signaled extreme stress while Bitcoin continued along its normal path. Traders watching Bitcoin saw nothing concerning. Traders watching WLFI saw a token in freefall.

Why Did WLFI Move First?

Several technical factors explain why WLFI preceded the broader market crash, creating an early warning signal that most participants missed.

Concentrated Ownership Structure

Unlike Bitcoin's distributed ownership across millions of independent holders, WLFI features concentrated allocation among Trump family entities, political advisors, and affiliated investors, per Amberdata analysis. This ownership structure allows for rapid coordinated action. When one significant holder adjusts positioning, others within the same network can respond within minutes rather than hours.

This concentration matters during market stress. A small number of large holders can execute significant selling pressure quickly, especially when they potentially share access to similar political intelligence or policy briefings. Whether through superior analysis of public tariff news or other information channels, WLFI's holder base demonstrated coordinated selling behavior that preceded broader market panic.

Elevated Leverage Signals

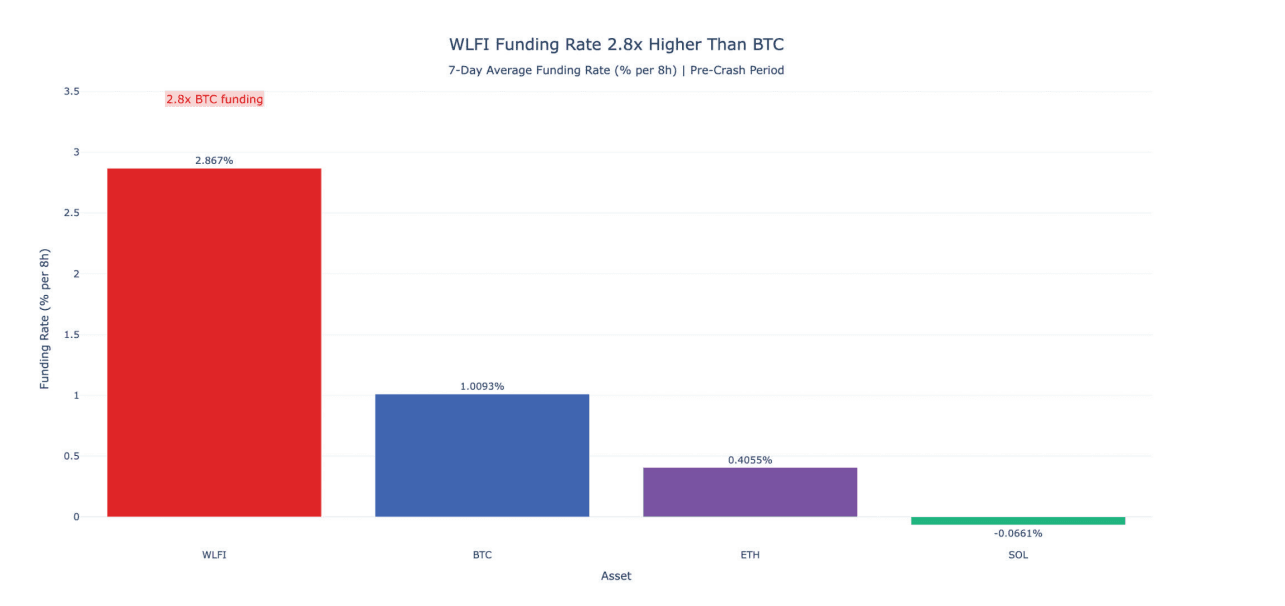

WLFI's funding rate reached 2.87% per eight hours on October 10, compared to Bitcoin's 1.01%. This represents a 2.8x differential. In perpetual futures markets, funding rates measure the cost that long position holders pay to short sellers. WLFI's rate translated to approximately 131% annualized borrowing costs.

Traders maintaining long positions at these rates face continuous pressure. The elevated funding indicates positioning stress. Holders were paying substantial premiums to maintain exposure, suggesting vulnerability. When WLFI started falling, these overleveraged positions faced immediate liquidation pressure.

The token also exhibited realized volatility of 671.9% annualized compared to Bitcoin's 84.3%, creating an 8x amplification factor. High-beta assets typically show first-mover behavior during market dislocations because they reflect amplified sensitivity to systematic risk. When Bitcoin experiences a 1% move, WLFI tends to move approximately 8%, compounding dramatically during larger drawdowns.

How The Cascade Spread Across Markets

WLFI's relatively small market capitalization means it could not directly impact Bitcoin's liquidity. However, the token's decline likely contributed to triggering a leverage cascade through cross-margin portfolio effects.

Modern crypto derivatives platforms use cross-margin systems where multiple assets serve as collective collateral for leveraged positions. A trader's entire portfolio, not individual positions, backs margin requirements. When WLFI dropped 50%, the effects propagated through several channels:

- Portfolio collateral value declined as WLFI positions lost value

- Reduced collateral triggered maintenance margin calls across all positions

- Traders were forced to liquidate positions in liquid assets like Bitcoin and Ethereum to restore margin compliance

- These forced sales created downward price pressure, triggering additional margin calls across other market participants

The sequential nature of the crash supports this contagion mechanism. Small-cap altcoins like UNI (down 70.97%), AAVE (down 69.98%), and AVAX (down 69.73%) experienced severe declines first. Mid-cap assets like SOL fell 32.88%. Large-cap Ethereum dropped 20.27%. Bitcoin, the most liquid reserve asset, declined 14.96%.

This ordering reflects differences in structural vulnerability. Assets with higher leverage ratios and thinner orderbook depth experienced stress earlier and more severely, consistent with cross-margin contagion where initial losses in high-volatility assets reduce overall portfolio collateral and force progressive liquidation of more liquid assets.

Could Traders Have Seen This Coming?

The information asymmetry demonstrated on October 10 was observable rather than hidden. Three quantifiable metrics provided advance warning, all visible in public data feeds:

- Volume spike: 21.7x baseline increase at 3:00 PM UTC

- Funding rate stress: Triple-digit annualized borrowing costs

- Volatility divergence: 8x Bitcoin's realized volatility

WLFI's orderbook depth also signaled fragility. At market open, WLFI maintained just $1.79 million in depth within 0.2% of market price, compared to Bitcoin's $311 million. This represents a 174x liquidity differential. During the selloff, WLFI's orderbook depth collapsed 99.49% to approximately $10,000 at peak stress.

The challenge is that WLFI's small market capitalization made it easy for participants to dismiss its relevance to broader market dynamics. Most traders focus on Bitcoin and Ethereum as primary indicators. However, politically connected tokens with concentrated ownership and elevated leverage can function as canaries in the coal mine during stress events.

The template from October 10 provides a systematic framework: watch for unusual volume spikes in political tokens following policy announcements, monitor funding rate differentials that indicate unsustainable positioning costs, and track volatility divergence between high-beta political assets and benchmark cryptocurrencies.

Conclusion

The October 10, 2025 crash demonstrates that politically affiliated tokens can serve as early indicators of systematic market stress. WLFI's five-hour advance decline provided observable signals through volume, funding rates, and price divergence. These metrics appeared in public blockchain data accessible to all market participants, though few recognized their significance before $6.93 billion in liquidations materialized.

As cryptocurrency markets rebuild leverage and political volatility persists, tokens with concentrated political connections will likely continue exhibiting first-mover behavior during stress events. The quantifiable warning signals exist. The question is whether market participants will monitor them.

Resources

Report by Amberdata: Coincidence or Signal? Did WLFI Telegraph Crypto’s $6.93B Meltdown

Report by CoinTelegraph: Study suggests WLFI could act as an ‘early warning signal’ in crypto

Report by CoinDesk: Why The Market Crashed On October 10, And Why It’s Struggling to Bounce

Read Next...

Frequently Asked Questions

Did WLFI holders have insider information about the crash?

The data cannot definitively prove insider knowledge. However, the three-minute response time between the tariff announcement and WLFI's volume spike suggests either extremely sophisticated rapid analysis or pre-positioned orders. WLFI's concentrated ownership among Trump-affiliated entities creates an information environment distinct from typical cryptocurrencies. Whether through superior political expertise or advance awareness, holders demonstrated selling behavior that preceded broader market stress by over five hours.

How much warning time did WLFI provide before the main crash?

WLFI began falling at 3:32 PM UTC on October 10, 2025. The broader market cascade started at 8:50 PM UTC, creating a five-hour and eighteen-minute warning window. During this period, WLFI dropped 45% while Bitcoin declined only 6%, creating a clear divergence signal that most traders missed.

Can political tokens predict future crypto crashes?

Political tokens with concentrated ownership, elevated leverage, and thin liquidity tend to show first-mover behavior during market stress. They function as high-beta assets that amplify systematic risk signals. While not predictive tools, they can serve as early warning indicators when combined with other metrics like funding rates, volume spikes, and orderbook depth. The October 10 pattern provides a framework for monitoring these signals systematically.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens