WLFI Price Rises as Mar-a-Lago Conference Begins

WLFI surged over 20% as the World Liberty Forum kicked off at Mar-a-Lago, featuring Goldman Sachs, Nasdaq, and Coinbase CEOs among nearly 400 attendees.

Crypto Rich

February 18, 2026

Table of Contents

World Liberty Financial's WLFI token jumped roughly 20% on February 18 as the Trump family-backed DeFi project opened its inaugural World Liberty Forum at Mar-a-Lago in Palm Beach, Florida. The token was trading near $0.12 at the time of writing, pushing the market cap to approximately $3.25 billion. The rally came alongside fresh whale accumulation and a new partnership with $3.5 trillion financial services provider Apex Group, announced live at the event.

The invitation-only forum brought together nearly 400 executives, regulators, and industry figures for discussions on digital assets, stablecoins, AI, and the future of U.S. financial infrastructure. WLFI had been building hype for weeks through countdown posts and speaker reveals on X, and the turnout suggests the effort paid off.

Who showed up at Mar-a-Lago?

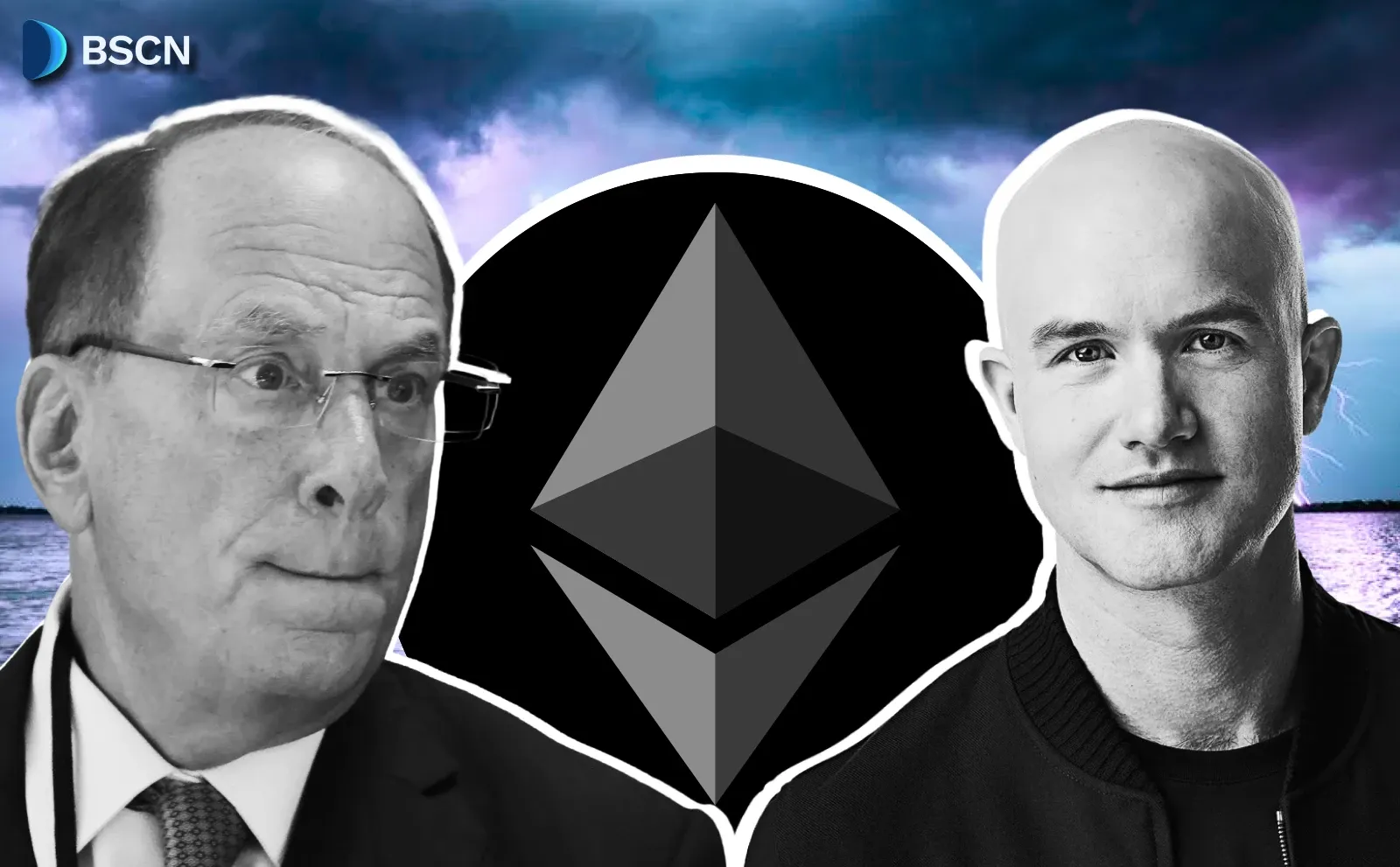

The speaker list reads like a cross-section of Wall Street and crypto royalty. Goldman Sachs CEO David Solomon, Nasdaq CEO Adena Friedman, and NYSE President Lynn Martin represented traditional finance. Franklin Templeton CEO Jenny Johnson, who oversees $1.7 trillion in assets, also attended.

On the crypto side, Coinbase CEO Brian Armstrong and BitGo CEO Mike Belshe were confirmed. CFTC Chairman Michael Selig's presence drew attention, particularly after his recent social media posts about establishing clear regulatory frameworks for digital assets. U.S. Senators Ashley Moody (R-FL) and Bernie Moreno (R-OH), along with SBA Administrator and former Senator Kelly Loeffler, added a political dimension.

Then there were the wildcards. FIFA President Gianni Infantino, celebrity investor Kevin O'Leary, and musician Nicki Minaj rounded out a lineup that stretched well beyond finance into sports, media, and entertainment. The forum was hosted by WLFI co-founders Donald Trump Jr., Eric Trump, and Zach Witkoff.

What drove the price spike?

The 20%-plus move appears to be a textbook "buy the rumor" event. On-chain data showed major outflows in the lead-up to the forum, including 313 million $WLFI tokens (~$33-34 million) moved from Binance to private wallets, alongside additional whale purchases in the millions. Those kinds of exchange outflows typically signal accumulation and reduce immediate selling pressure.

Not everyone is convinced the rally has legs. One analyst cited by Decrypt pointed to a 40% spike in open interest and negative funding rates heading into the move, calling it a short squeeze rather than organic demand. WLFI remains down roughly 27% over the past 30 days and sits about 60% below its 2025 all-time high of $0.46.

The broader crypto market stayed relatively flat on the day, with Bitcoin still stuck below $70,000. That isolation suggests the move was event-driven rather than part of a wider market trend.

What was announced at the forum?

The biggest reveal was a strategic collaboration with Apex Group, a global financial services firm managing over $3.5 trillion in assets. Under the deal, Apex will pilot WLFI's USD1 stablecoin as a payment rail for subscriptions, redemptions, and distributions across its tokenized fund ecosystem. Apex will also explore listing WLFI tokenized assets on the London Stock Exchange Group's Digital Market Infrastructure platform, subject to regulatory approval.

USD1 has grown into the fifth-largest dollar-pegged stablecoin by circulation, with over $5 billion in supply. The stablecoin is central to WLFI's broader ambitions, which include the recently announced World Swap platform targeting cross-border forex and remittances, and a pending national trust bank charter application filed with the Office of the Comptroller of the Currency.

WLFI also announced plans for a mobile app that would link traditional bank accounts with digital asset wallets and give users access to tokenized holdings.

What about the political side?

The forum didn't happen in a vacuum. WLFI continues to face scrutiny over potential conflicts of interest tied to the Trump family's involvement. A UAE-linked entity reportedly purchased a 49% stake in WLFI for $500 million shortly before President Trump's inauguration, a deal that prompted Representative Ro Khanna to launch a formal investigation in early February. Democrats on the Judiciary Committee have previously accused the family's crypto ventures of leveraging the presidency for financial gain.

The event also came ahead of expected legislative discussions around the CLARITY Act, which aims to define how the SEC and CFTC split oversight of digital assets. Officials from both agencies were in attendance.

Whether the forum represents genuine institutional validation or a well-produced networking event for a politically connected project depends largely on where you stand. What's harder to argue with is the sheer concentration of financial power in one room, and the market clearly noticed.

Sources:

- Business Wire Official press release on forum reaching capacity with nearly 400 confirmed participants and full speaker list

- CoinDesk Coverage of the Apex Group partnership to pilot USD1 stablecoin in traditional fund operations

- The Block Reporting on the 18% WLFI rally and USD1 surpassing $5 billion in circulation

- Stocktwits Market data on the 22% WLFI surge, whale token purchases, and CLARITY Act context

- Decrypt Analyst commentary on short squeeze dynamics including open interest and funding rate data

- DL News Background on WLFI's political scrutiny, UAE stake, and USD1 market position

- CoinMarketCap Live WLFI price and market cap data

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events