Will Ethereum (ETH) Fall Below $1,000?

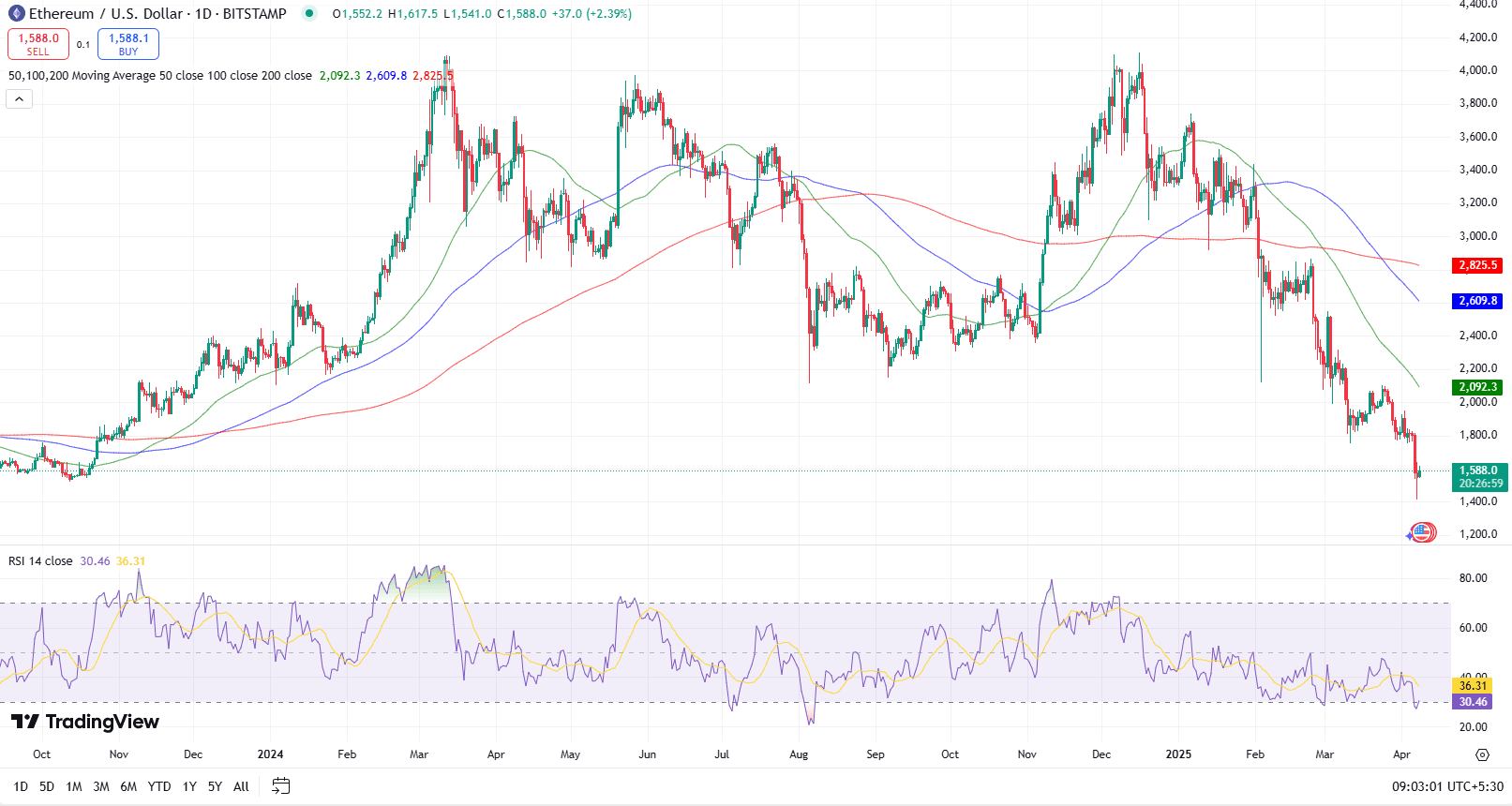

Ethereum (ETH) is currently trading around $1,582, after breaking below key support at $1,754. Technical indicators suggest bearish momentum, with prices stuck below all major moving averages (50, 100, 200-day).

Soumen Datta

April 8, 2025

Table of Contents

Ethereum is under pressure again. After losing the critical $1,800 support level, the second-largest cryptocurrency by market cap has slipped into a deeper downtrend. Over the past seven days, ETH has dropped more than 13%, trading around $1,588 at the time of writing.

Market watchers are now asking the big question: Could Ethereum fall below $1,000?

Let’s explore what’s driving this decline and whether the $1,000 zone is truly in play.

Ethereum Crashes Below $1,800 – Bearish Signals Intensify

The breakdown below $1,800 has triggered alarm across the crypto market. Analyst Andrew Kang recently called Ethereum “overvalued,” pointing to its $215 billion market cap as excessive for what he considers a “negative growth” asset.

Since Kang’s comments, Ethereum’s market cap has dropped to $191 billion. His statement appears timely, with the decline validating his bearish view. Kang forecasts a range of $1,000 to $1,500 as a more realistic valuation zone.

If the downward pressure persists, Ethereum could fall further toward the lower end of that range.

Liquidations Accelerate the Sell-Off

As price drops, leverage unwinds. According to CoinGlass, nearly $1.3 billion in long positions were liquidated in a single weekend — ETH accounted for roughly one-third of that wipeout.

This wave of forced selling pushed Ethereum’s year-to-date losses to over 55%. Compared to Solana’s 45% and BNB’s 22% drop, Ethereum is leading the downside among top cryptocurrencies.

With another 9% drop, an additional $70 million in ETH liquidations could hit the market. This potential oversupply could deepen the current slide.

Macro Factors Weigh on Crypto Confidence

The broader macro landscape isn’t helping either. Investors remain cautious due to global trade tensions and fears of a possible economic slowdown.

Even the prospect of a U.S. interest rate cut isn’t generating the usual optimism. Despite Donald Trump pushing for rate cuts, Fed Chair Jerome Powell remains cautious, saying it’s too early to predict the path of monetary policy.

This uncertainty limits appetite for risk assets like Ethereum. While a rate cut could eventually benefit crypto, sentiment remains fragile.

Ethereum Upgrade Delay Adds to Pressure

Another factor hurting investor confidence is the delay of Ethereum’s much-anticipated Pectra upgrade. Originally scheduled for April, developers have now pushed it back to May 7. While they’ve provided no specific reason, the delay adds to the current market discomfort.

Upgrades often drive bullish narratives, but delays tend to sap momentum — especially when sentiment is already low.

Derivatives Data Shows Bears in Control, But Not Fully Committed

Despite the heavy selling, Ethereum derivatives show a more moderate stance. The put-call skew sits at 10% — bearish but far from panic levels. By contrast, in May 2024, this metric spiked to 20% during a major ETH crash.

Futures data also offers mixed signals. On April 7, ETH’s monthly futures premium rose to 4%, up from 2% on March 31, according to CoinTelegraph. While still below the neutral 5% mark, this shows that some traders are not fully pricing in a collapse below $1,000.

The market appears bearish — but not in full-blown capitulation mode yet.

CME Futures Gaps Hint at Long-Term Upside Potential

Interestingly, Ethereum’s CME futures chart shows three significant gaps that remain unfilled:

- $2,550–$2,625

- $2,890–$3,050

- $3,917–$3,933

According to the “CME gap theory,” asset prices tend to return to fill these voids over time. Although this may not happen soon, it leaves the door open for a strong rebound later in the year.

With Q2 2025 just beginning, Ethereum still has room to revisit these levels — but only if a broader market recovery takes hold.

TVL Reaches New High, Showing Onchain Strength

Despite the weak price action, Ethereum’s fundamentals are showing surprising strength. The total value locked (TVL) in Ethereum reached an all-time high of 29.5 million ETH on April 6 — a 22% increase over the previous month.

This suggests continued developer activity and user interest, especially within the DeFi ecosystem. Ethereum still dominates the decentralized finance space and is widely used as collateral, even during downturns.

That said, the same strength in DeFi also increases Ethereum’s vulnerability during crashes, as leveraged positions get liquidated quickly.

Extreme Fear Sets In, But RSI Offers Hope

The Crypto Fear & Greed Index has dropped to 19 — firmly in the “Extreme Fear” category. Historically, these levels often signal that a bottom could be forming.

Meanwhile, the Relative Strength Index (RSI) has dipped into oversold territory. This indicator doesn’t confirm a bottom but signals that the recent price drop has been unusually steep.

In the past, when RSI rebounded from these levels, Ethereum has often rallied — sometimes by over 100% in the following months.

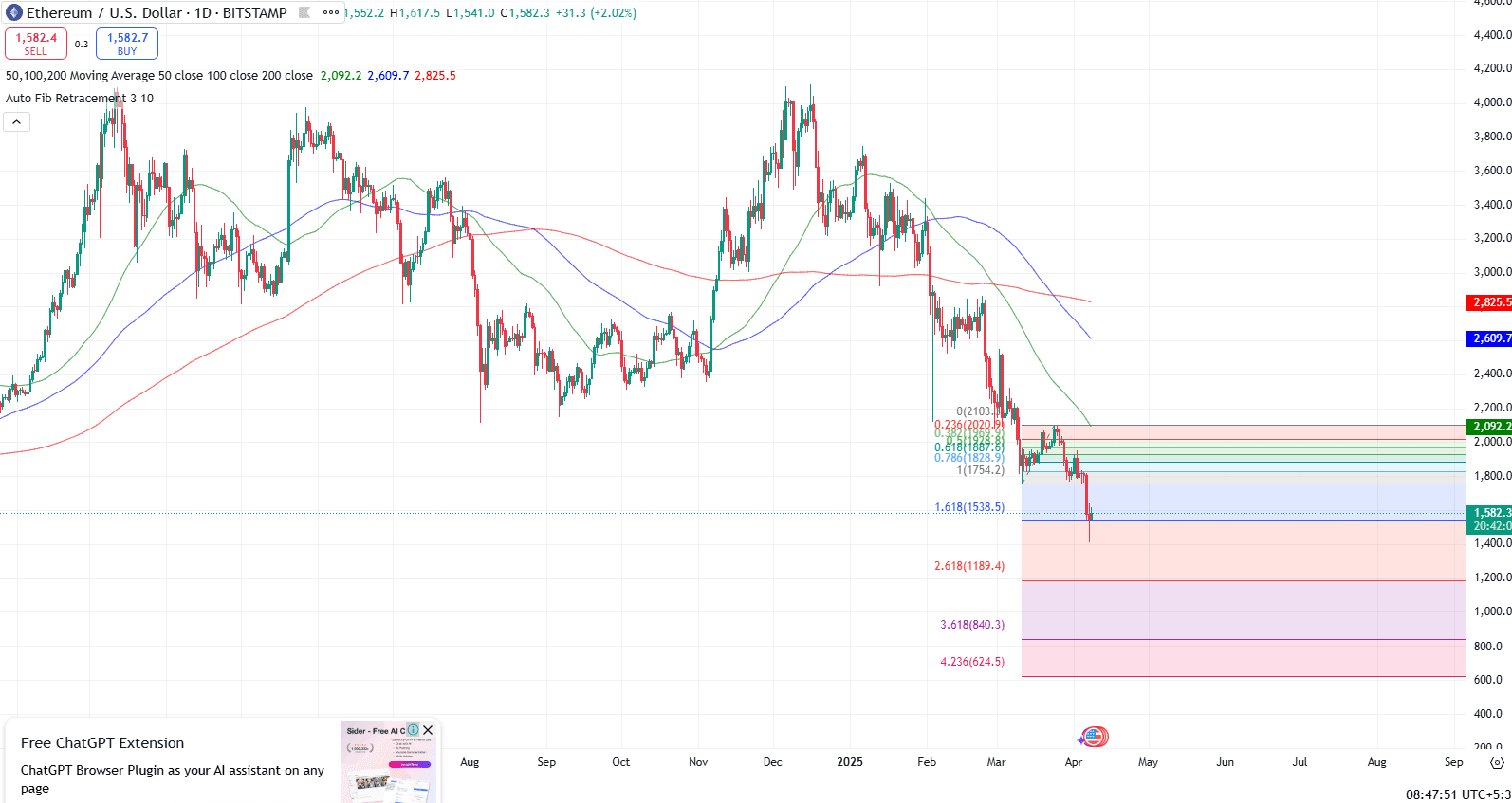

Analysis Based on Fibonacci Levels

Retracement Levels (Resistance on upward bounces):

- 0.236 Fib: $2,020 — initial resistance

- 0.382 Fib: $1,887 — tested and rejected

- 0.618 Fib: $1,828 — heavy rejection zone, acting as strong resistance

- 0.786 Fib: $1,628 — price now hovering around this zone

Extension Levels (Downside targets if bearish trend continues):

- 1.618 Fib: $1,538 — just touched recently (short-term support zone)

- 2.618 Fib: $1,189 — strong psychological and technical support if breakdown continues

- 3.618 Fib: $840 — last hit during 2022 crash

- 4.236 Fib: $624 — extremely bearish long-tail scenario

Chart Insights & Current Structure:

- ETH broke below key support near $1,750–$1,800 (1.0 Fib level).

- It bounced off 1.618 extension ($1,538) — this is acting as current short-term support.

- Candle wick suggests buying pressure near $1,540, but not strong enough to break above $1,628 (0.786 retracement).

- If price cannot reclaim $1,628 and close above $1,750, downside continuation is likely.

Possible Near-Term Targets

If Price Recovers:

- Resistance #1: $1,628 (0.786 Fib) – current battleground

- Resistance #2: $1,754 (Fib 1.0) – strong breakout confirmation needed here

- Resistance #3: $1,887–$2,020 – previous rejection zone + Fib cluster

If Price Breaks Below $1,538:

- Support #1: $1,500 – psychological round number

- Support #2: $1,400 – minor horizontal support

- Support #3: $1,189 (2.618 Fib) – major breakdown target

- Capitulation Zone: $840 (3.618 Fib) – extreme bear case (if market crashes hard)

For now, many traders are staying cautious and avoiding fresh long positions.

Could Ethereum Fall Below $1,000?

Yes — a dip below $1,000 is possible, especially if macro conditions worsen and liquidation pressure continues. Analyst predictions and technical indicators suggest that ETH could revisit the $1,000–$1,500 zone before stabilizing.

However, Ethereum’s strong onchain metrics, rising TVL, and unfilled CME futures gaps hint at a potential recovery over the long term.

For now, ETH is in a high-risk zone. Caution is advised for short-term traders. Long-term holders may view this as an accumulation opportunity — provided they can stomach the volatility.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events