TRON (TRX): Powering the Decentralized Internet

Discover how TRON (TRX) powers decentralized applications with 2,000 TPS, minimal fees, and a $26 billion market cap. Learn about TRX tokenomics, use cases, and market performance in 2025.

Crypto Rich

May 15, 2025

Table of Contents

What is TRON? Understanding the Blockchain Platform

TRON (TRX) is working to transform how the internet handles content and transactions. Processing 92% of global USDT transactions, this decentralized blockchain outpaces Ethereum in stablecoin volume. Founded by Justin Sun in 2017, TRON eliminates middlemen, letting creators monetize content directly while connecting with their audiences.

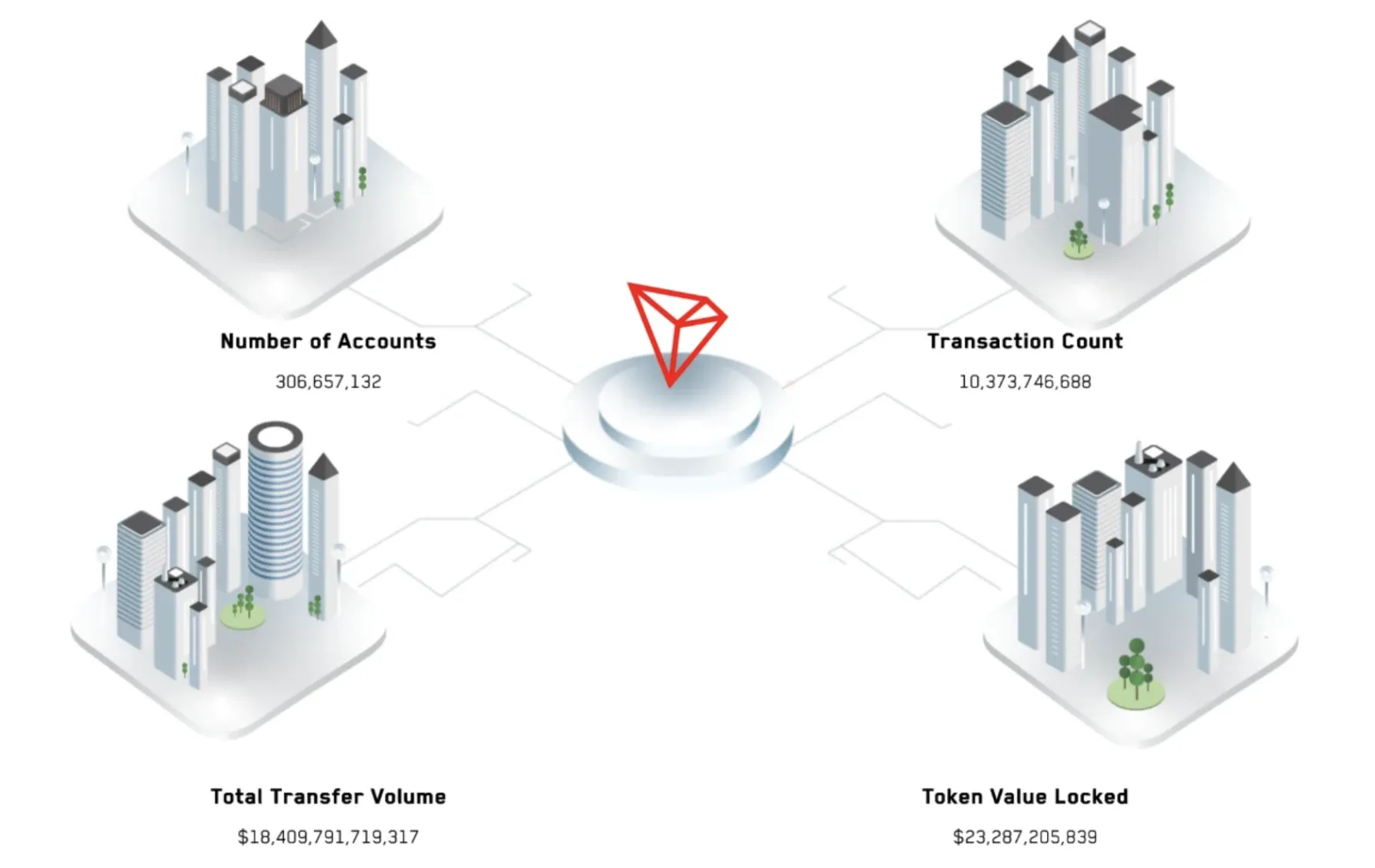

With 305 million accounts and processing 2,000 transactions per second, TRON dwarfs Bitcoin's 3-6 TPS and Ethereum's 25 TPS. This high-speed, low-cost infrastructure powers a thriving ecosystem of decentralized applications and smart contracts through the TRON Virtual Machine (TVM).

TRON's journey began as an Ethereum-based ERC-20 token before migrating to its own mainnet in June 2018. Now governed by the TRON DAO (Decentralized Autonomous Organization), the platform envisions a Web3 future where content creators bypass Big Tech intermediaries.

A pivotal moment came with TRON's 2018 acquisition of BitTorrent, tapping into a network of over 1 billion users. This strategic move transformed BitTorrent's peer-to-peer file-sharing protocol into a cornerstone of decentralized content distribution, cementing TRON's position as a Web3 pioneer in 2025.

Essential Use Cases for TRX in the Digital Economy

TRX powers the TRON blockchain as its native cryptocurrency across multiple functions:

Transaction Processing

TRX covers network transaction costs through TRON's unique bandwidth and energy model. Users receive free transaction quotas based on their TRX holdings, effectively making transfers nearly costless. Since March 2025, the gas-free USDT feature has eliminated even these minimal fees for stablecoin transfers, driving wider adoption among everyday users.

Network Governance and Staking

Holders freeze TRX to obtain "Tron Power," enabling them to vote for super representatives. These 27 elected validators process transactions and maintain network security. April 2025 saw major validator P2P.org join as a super representative, enhancing the network's staking infrastructure. Stakers earn up to 9% Annual Percentage Rate (APR) through platforms like JustLend, making TRX an attractive passive income source.

Content Creator Economy

Content creators receive TRX payments directly from fans, bypassing platforms like YouTube that typically take 30-45% in fees. This direct model enables creators to retain more revenue while maintaining closer connections with their audiences. Creators can also issue their own TRC-10 or TRC-20 tokens, creating token-based economies around their communities and content.

Decentralized Finance (DeFi) Operations

TRON's DeFi ecosystem includes lending platform JustLend and decentralized exchange SunSwap, processing 8.3 million daily transactions. With $6.64 billion Total Value Locked (TVL) as of May 2025, these protocols provide accessible financial services without traditional banking barriers. The ecosystem saw dramatic growth in December 2024, reaching $13.68 billion TVL as users sought yield opportunities.

Stablecoin Transactions

TRON hosts over $73 billion in USDT (Tether), surpassing Ethereum as the preferred blockchain for stablecoin transfers. The network processes 92% of all USDT transactions worldwide, with volume growing approximately $200 million daily since March 15, 2025. TRX is also used to mint USDD, TRON's algorithmic stablecoin, which maintains a robust 130% collateral ratio to ensure stability.

Gaming and NFTs

The TRON gaming ecosystem features platforms like WINkLink, where gamers use TRX for in-game transactions and rewards. Meanwhile, APENFT marketplace has forged partnerships with digital artists and traditional galleries, bringing NFT technology to mainstream collectors. Gaming transactions account for approximately 12% of network activity, showing strong growth in this entertainment sector.

Accessibility and Payments

TRON's May 7, 2025 partnership with MoonPay enables U.S. users to purchase TRX directly with fiat currency, eliminating complex onboarding barriers. This integration drove a 12% volume surge within a week of launch. Payment options extend to real-world spending through Spend credit card integration and dedicated TRON ATMs, bridging the gap between cryptocurrency and everyday transactions.

TRX Tokenomics: Supply, Distribution, and Economic Model

Token Supply Metrics

TRON has approximately 100 billion TRX tokens in total, with 94.9 billion in circulation as of May 2025. While there's no maximum supply cap, TRX implements deflationary mechanisms through strategic token burning, particularly when minting USDD stablecoins. Each USDD minted requires TRX to be removed from circulation, creating upward pressure on price as utility increases.

Initial Distribution

The 2017 Initial Coin Offering (ICO) distributed TRX across four segments:

- 40% to ICO participants (40 billion TRX)

- 15.75% to private investors (15.75 billion TRX)

- 34% to the TRON Foundation (34 billion TRX)

- 10% to Peiwo Huanle, Justin Sun's company (10 billion TRX)

Critics note that 45% allocated to the founder and project exceeded typical distributions in comparable blockchain projects, raising early concerns about centralization that the move to TRON DAO aimed to address.

Inflation and Reward Structure

The TRON network generates a block every 3 seconds. Super representatives receive 32 TRX per block, while nodes receive 16 TRX, resulting in approximately 500 million TRX in annual inflation (about 0.5% of supply). Daily issuance amounts to 5.05 million TRX, with 91% derived from voting rewards and 9% from block rewards.

This reward structure incentivizes network participation, with stakers earning up to 9% APR by freezing their TRX. The balance between new issuance and token burning maintains relative price stability while supporting network security.

Resource Allocation Model

TRON uses bandwidth and energy as internal pricing mechanisms—essentially free transaction quotas allocated to TRX holders. This system distributes network resources proportionally to stakeholders, eliminating gas fees that plague other networks during congestion. The model functions similarly to a decentralized central bank, balancing supply-demand dynamics to keep transaction costs negligible even during peak usage.

Market Performance and Position in 2025

Current Market Metrics

As of May 15, 2025, TRX trades at $0.27 USD per token, following a 4.8% rally triggered by the MoonPay integration. Daily trading volume ranges from $737 million to $1.2 billion, demonstrating strong liquidity across major exchanges.

The market capitalization ranges between $24.65 billion and $26.21 billion, positioning TRX as the 9th or 10th largest cryptocurrency by market value. This top-10 ranking reflects investor confidence in TRON's utility, particularly as it generates $2.8 billion in annual fee revenue—capturing 48% of the blockchain fee market share in early 2025.

Historical Price Milestones

TRX reached its all-time high (ATH) of $0.4407 on December 3, 2024, representing a nearly 100% surge from earlier levels. This remarkable rally coincided with explosive growth in TRON's DeFi ecosystem, which reached $13.68 billion TVL amid increased stablecoin adoption. Despite the current price sitting approximately 40% below this peak, the token has maintained substantial value compared to its previous cycle.

Trading Activity and Adoption

Recent trading volumes show consistent market engagement:

- $1 billion changes hands daily on average

- Weekly volume reaches $7.03 billion

- Monthly volume totals $26.68 billion

TRX accounts for approximately 0.72-1% of the total cryptocurrency market capitalization. The token is listed on over 160 exchanges worldwide, including major platforms like Binance, KuCoin, and HTX, though it remains unavailable on Coinbase. This broad exchange presence ensures global accessibility for traders and investors seeking exposure to TRON's ecosystem.

Recent Developments Shaping TRON's Ecosystem

Stablecoin Expansion

USDT on TRON has grown by approximately $200 million per day since March 15, 2025. The network processes 10 million daily transactions, generating $2 million in daily revenue. This stablecoin dominance drives much of TRON's utility, bolstered by the March 2025 introduction of gas-free USDT transfers, which eliminated even the minimal fees previously required.

DeFi Resurgence

TRON's Total Value Locked (TVL) increased to $13.68 billion by December 2024, driven by heightened activity in lending protocols, memecoins, and centralized trading via HTX integration. This resurgence represented a 105% year-over-year growth, reflecting increased confidence in TRON's financial infrastructure amid broader market recovery.

Strategic Partnerships and Integrations

May 7, 2025 saw TRON partner with MoonPay to enable direct fiat-to-TRX purchases for U.S. users, significantly lowering entry barriers. This integration drove a 12% volume increase within its first week. Meanwhile, March 19-20, 2025 marked TRX's expansion to Solana, enhancing cross-chain interoperability.

Samsung continues supporting TRC-10 and TRC-20 tokens through its Blockchain Keystore, bringing TRON to millions of device users worldwide. Additionally, P2P.org joined as a super representative on April 30, 2025, strengthening the network's validation infrastructure.

ETF Developments and Regulatory Landscape

Canary Capital filed for a TRON Spot ETF with staking rewards in early 2025, potentially offering traditional investors regulated exposure to TRX. However, SEC approval remains uncertain.

In March 2023, the SEC sued Justin Sun and the TRON Foundation, alleging unregistered securities sales and wash trading practices. However, in a significant development three months ago, the SEC requested a court pause in its lawsuit against Sun and three of his businesses, signaling a potential resolution. This move aligns with the agency's changing approach to crypto enforcement. While uncertainty remains, this pause suggests the regulatory climate for TRON could be improving.

Security Challenges

A May 3, 2025 social engineering attack compromised the TRON DAO X account, resulting in fraudulent posts promoting a suspicious contract address. While no core protocol was affected, this incident highlighted cybersecurity risks in the ecosystem. TRON responded swiftly by implementing two-factor authentication across all social channels and conducting comprehensive wallet audits to prevent future breaches and safeguard users.

TRON's Position in the Blockchain Landscape

TRON has carved out a unique position through its focus on content distribution and stablecoin transactions. The network handles 92% of all USDT transfers globally, demonstrating its practical utility for cross-border remittances.

With 2,000 transactions per second and near-zero costs, TRON meets demands that Bitcoin and Ethereum often struggle with. This makes it ideal for microtransactions and high-frequency trading activities.

The platform's Ethereum EVM compatibility allows developers to port their code with minimal changes. This accelerates development and brings established projects to the ecosystem, creating a versatile environment for decentralized applications.

Despite challenges like the SEC lawsuit, plagiarism allegations, and the May 2025 X (Twitter) hack, TRON continues expanding its technical capabilities. Samsung's support brings blockchain access to mainstream users, while MoonPay simplifies onboarding for newcomers.

Future Outlook and Conclusion

TRON's creator-focused model and $73 billion USDT volume position it to lead Web3's content and finance sectors, giving it a unique edge over rivals like Solana and Polygon. As creators seek alternatives to high-fee platforms, TRON could capture significant market share in the growing creator economy.

TRON's stablecoin infrastructure creates a foundation for financial inclusion in regions with limited banking access. The potential ETF approval would represent a major milestone, though regulatory uncertainty remains a significant hurdle.

TRON stands at the intersection of content, finance, and technology—delivering practical blockchain solutions across multiple sectors. Despite regulatory challenges and security incidents, the platform's growing ecosystem suggests it will remain a significant player in the decentralized internet for years to come.

To learn more about TRON's technology and latest developments, visit the official website at trondao.org. For real-time updates and announcements, follow TRON on X @trondao.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens