Sei Network Analysis: High-Performance Layer 1 Blockchain Ecosystem Review

Sei Network TVL surged 1000% to $626M in 2025. Analysis of high-performance Layer 1 blockchain technology, gaming adoption, and DeFi ecosystem growth.

Crypto Rich

August 6, 2025

Table of Contents

Sei Network is a high-performance Layer 1 blockchain built specifically for high-frequency trading, DeFi, and real-time applications. In 2025, it achieved over 1000% growth in total value locked, surging from $61 million to $626 million in just six months. Built with the Cosmos SDK and Tendermint consensus, Sei delivers sub-400ms finality while maintaining the security and decentralization that blockchain users expect.

This rapid expansion signals a growing institutional appetite for performance-optimized infrastructure designed specifically for financial applications. While traditional finance continues to explore blockchain integration, Sei's specialized trading architecture and regulatory alignment provide it with strategic advantages over general-purpose competitors.

What Makes Sei Network Different from Other Layer 1 Blockchains?

Sei Network sets itself apart through specialized architecture optimized for trading and financial applications. Rather than trying to serve all use cases like general-purpose blockchains, this high-frequency trading blockchain targets activities that demand minimal latency and maximum throughput.

Core Technical Advantages

- Sub-400ms Block Finality: Near-instantaneous confirmation enables real-time trading experiences

- Native Order Matching: Built-in functionality eliminates external dependencies that slow transactions

- Front-Running Protection: Prevents common exploitation tactics in decentralized trading

- Parallel Execution: Processes multiple transactions simultaneously instead of one by one

- Purpose-Built Design: Architecture crafted specifically for DeFi, gaming, and AI applications

This focused approach allows Sei to optimize specifically for financial use cases where every millisecond matters. General-purpose chains can't match this level of specialization because they spread resources across too many different applications.

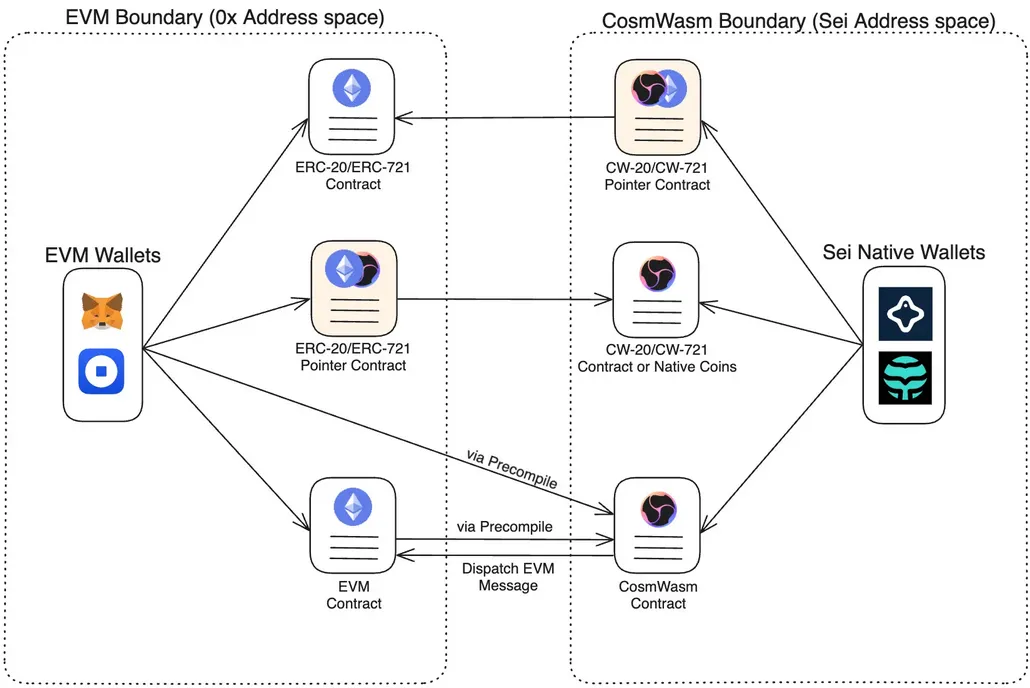

Sei V2 Delivers EVM Compatibility

The Sei V2 upgrade, which went live in July 2024, introduced parallelized Ethereum Virtual Machine capabilities that support up to 28,300 batched transactions per second. This maintains full compatibility with existing Ethereum developer tools while delivering institutional-scale throughput. With full EVM compatibility, developers can deploy Ethereum-native dApps without rewriting smart contracts, easing migration and onboarding.

The upgrade also provides native support for stablecoins and tokenized assets, making it easier for traditional financial institutions to integrate blockchain technology into their operations.

How Has Sei Network's Ecosystem Evolved Since Launch?

Sei launched its mainnet in 2023 and has since built a diverse ecosystem spanning DeFi, gaming, artificial intelligence, and decentralized science. The real acceleration began in early 2025 when ecosystem maturation kicked into high gear. TVL grew tenfold while user metrics smashed previous records.

Major DeFi Protocols Drive Growth

Several major DeFi protocols have chosen Sei as their home, demonstrating real institutional-scale adoption across lending, trading, and staking:

- Yei Finance: This money market protocol reached over $270 million in USDC supplied by July 2025

- Takara Lend: Has accumulated more than $100 million in TVL through mid-2025 for its lending services

- Filament Finance: Ranks among the top 60 DeFi protocols globally by revenue generation

- Splashing Protocol: Manages liquid staking for 10 million SEI tokens

These numbers reflect actual economic activity, rather than speculative trading volumes that can inflate many blockchain metrics.

Gaming Applications Surprise Everyone

Gaming turned out to be Sei's unexpected growth catalyst, with the network achieving leadership metrics during peak activity periods:

- Empire of SEI: MMORPG with over 67,000 unique active wallets

- AstroKarts: Racing game that spiked network activity during Q1 2025

- Botwars Ascendance: Strategy game with steady user base expansion

- Operation Safe Place: FPS/tower defense hybrid showing strong retention

In Q1 2025, Sei surpassed 10 million monthly users and hit a DAU (Daily Active Users) peak of 937,000 — proving that performant blockchain infrastructure enables mainstream gaming adoption.

AI and DeSci Projects Show Promise

Artificial intelligence and decentralized science represent emerging sectors with substantial funding backing their development:

- SideShift.ai: AI-powered trading and exchange platform integration

- ChainGPT: AI blockchain infrastructure and tools development

- ai/accelathon: Major hackathon featuring over $1 million in prizes for developers

- Stadium Science: Hosts DeSci events exploring genetic data privacy solutions

These initiatives position Sei for expansion beyond traditional DeFi and gaming into cutting-edge blockchain applications that could define the industry's next phase.

Who Are the Founders Behind Sei Network?

Jeff Feng and Jayendra Jog founded Sei Labs with a specific mission: create blockchain infrastructure optimized for trading and financial applications. Their vision addressed performance limitations that had prevented widespread blockchain adoption in high-frequency financial activities where milliseconds determine profitability.

Early on, the founding team secured strategic backing from prominent venture capital firms. Multicoin Capital joined during the seed round, while Coinbase Ventures, Delphi Digital, and GSR Ventures provided additional institutional support. This investment enabled extensive research into specialized blockchain architecture designed specifically for trading infrastructure.

The Sei Development Foundation Takes Shape

The Sei Development Foundation operates as a U.S.-based nonprofit organization that advances network adoption and engages with policymakers. The foundation strategically positions Sei as an "America-first" blockchain, aligning with regulatory developments like the GENIUS Act for stablecoin regulation.

This positioning anticipates increasing regulatory clarity and institutional adoption within the U.S. market. The founders' technical backgrounds in trading systems and blockchain architecture directly influenced Sei's specialized design philosophy, which focuses on solving specific problems that plague decentralized trading platforms: latency, throughput, and front-running protection.

Community-Driven Governance Powers Network Evolution

Sei Network utilizes a decentralized, on-chain governance system built on the Cosmos SDK, allowing SEI token holders to propose, discuss, and vote on protocol updates. This community-driven model ensures network evolution while maintaining focus on high-performance trading and financial applications.

The governance process remains permissionless; any holder with sufficient SEI can participate, although proposals require a minimum deposit of 1,000 SEI to prevent spam. Key proposal types include parameter adjustments (such as block times or fees), software upgrades (like the V2 implementation), community pool spending for ecosystem grants, and text proposals for non-binding community signaling.

How Sei's Voting Process Works

The governance mechanism operates through a structured process designed for broad community participation. Proposals begin with a deposit phase requiring the 1,000 SEI minimum threshold. Once met, proposals enter a 7-day voting period, during which staked SEI holders can vote 'Yes', 'No', 'NoWithVeto', or 'Abstain'.

Voting power corresponds directly to staked token amounts, with a 40% participation quorum required for validity. Successful proposals need at least 50% Yes votes (excluding vetoes) for passage. The NoWithVeto option provides a safeguard against harmful proposals - if it reaches 33.4%, the proposal fails and deposits are burned.

Successful proposals execute automatically through on-chain code, with major upgrades coordinated through validator signaling. This system has facilitated critical network improvements, including the V2 parallelized EVM rollout that enabled Sei's current performance capabilities. As of mid-2025, active proposals focus primarily on ecosystem funding and performance optimizations, reflecting the network's continued maturation.

What Are Sei Network's Core Technical Capabilities?

Sei Network's technical architecture prioritizes the performance metrics that matter most for financial applications: speed, reliability, and institutional-scale throughput. The Sei blockchain's specialized design delivers measurable advantages over general-purpose networks through carefully targeted optimizations.

Consensus and Core Performance

The blockchain achieves sub-400ms block finality through optimized Tendermint consensus. This enables transaction speeds that rival centralized systems - a crucial requirement for high-frequency trading, where delays create arbitrage opportunities that cost users money.

The network's core technical specifications include several standout features:

- WebAssembly Integration: Enhanced smart contract performance through WASM support

- Native Order Matching: Eliminates external matching engines that add latency

- Unlimited Horizontal Scaling: Scaling capabilities without performance degradation

- Carbon-Neutral Operations: Environmental sustainability through efficient consensus mechanisms

- Full Development Lifecycle: Support spanning testnets to mainnet deployment

How Parallel Processing Changes Everything

Parallel transaction processing represents Sei's most significant technical innovation. Instead of handling transactions one by one like traditional blockchains, Sei processes multiple transactions simultaneously. This approach dramatically improves throughput compared to sequential processing architectures.

The Sei V2 upgrade, launched in July 2024, further advances this with parallelized EVM capabilities while maintaining full compatibility with Ethereum tools. The upgrade delivers up to 28,300 batched transactions per second with sub-400ms finality - performance levels that can handle institutional-scale trading volumes.

The Roadmap to Google-Scale Performance

Looking ahead, the forthcoming Giga upgrade aims for 5 gigagas per second processing capacity in internal testnet environments, which would translate to approximately 250,000 TPS. Currently in devnet testing, this upgrade specifically targets "Google-scale" performance for payments, finance, and AI applications. The goal reflects Sei's ambition to support mainstream adoption that extends far beyond crypto-native applications into traditional financial services.

What Recent Developments Have Shaped Sei Network's Growth?

Sei showed remarkable maturation throughout 2025. TVL skyrocketed from under $61 million to peak at $688.5 million on July 18, representing over 1000% growth in just six months. Current levels sit around $600 million as of August, reflecting typical market volatility while maintaining strong fundamentals.

Q1 2025: Building the Foundation

February through March 2025 marked a period of intense infrastructure development with several strategic integrations:

- ElizaOS Integration: AI agent development framework went live.

- ZeroHash Partnership: API access opened for institutional trading infrastructure.

- LayerZero Integration: Cross-chain connectivity expanded interoperability options.

- TVL Milestone: Network crossed the $300 million mark as new games launched.

Two major gaming platforms, AstroKarts and Bombpixel, launched during this period. Their success demonstrated Sei's capability to support consumer applications that require both high throughput and low latency—a combination that had proven difficult for other blockchains.

Q1 Summary: Foundations laid with major integrations and early gaming launches that proved technical capabilities.

Q2 2025: Technical Breakthroughs and Institutional Interest

April through May brought significant technical milestones and growing institutional attention:

- Giga Upgrade Testing: Devnet achieved 28,300 TPS during preliminary testing phases

- 23andMe Exploration: SDF explored potential acquisition for genetic data privacy applications

- All-Star Hackathon: Extended developer competition with increased prize pools for participants

- TVL Growth: Network approached the $500 million mark, demonstrating sustained adoption

The Giga upgrade testing results particularly excited developers and institutional observers. Achieving over 28,000 TPS in testing environments suggested that Sei's ambitious performance targets weren't just marketing promises - they were technically achievable goals.

Q2 Summary: Giga testing validated throughput claims while institutional interest and developer activity increased significantly.

Q3 2025: Infrastructure Goes Mainstream

June through August marked the period when Sei's infrastructure truly came of age, highlighted by significant regulatory approval:

- Japan FSA Approval: Japan Financial Services Agency approved SEI for trading in July 2025, expanding access to the Japanese market

- Native USDC Launch: Circle partnership enabled seamless stablecoin flows without bridging

- CCTP V2 Goes Live: Cross-Chain Transfer Protocol enhances interoperability across networks

- Ondo Finance Integration: USDY tokenized Treasuries launched for institutional market access

- Backpack Integration: Popular wallet and exchange processed over $139 billion in trading volume

- Record-Breaking Metrics: TVL peaked at $688.5 million while daily active users hit 937,000

- Gaming Leadership: Sei surpassed Solana in weekly active wallets during peak usage periods

Recent August developments include the Etherscan explorer launch for better transaction tracking, ai/accelathon deadline extension to August 24, and scheduled MetaMask integration. The SEC also clarified liquid staking regulations, removing a regulatory cloud that had been hanging over protocols like Splashing.

Q3 Summary: Sei gained regulatory approval and crossed record TVL/DAU milestones, establishing mainstream infrastructure credibility.

Which Key Partnerships Drive Sei Network's Growth?

Strategic partnerships have proven essential to Sei Network's rapid ecosystem expansion. The network has focused on three critical areas: liquidity provision, infrastructure development, and institutional adoption. These collaborations address fundamental infrastructure needs while expanding utility beyond crypto-native applications.

Financial Institution Partnerships Create Real Value

Circle's partnership stands out as particularly transformative. Native USDC support processes billions in seamless stablecoin transactions without requiring users to bridge assets between networks. This integration demonstrates the institutional-scale liquidity capabilities that trading applications absolutely require to function properly.

Ondo Finance integration launched USDY tokenized U.S. Treasury securities, providing both institutional and retail participants with access to traditional financial instruments through blockchain infrastructure. This partnership shows how Sei bridges conventional finance with decentralized systems in practical, measurable ways.

CoinShares has created SEI exchange-traded products that enable global investors to access regulated financial instruments. This development signals growing institutional recognition of Sei's infrastructure capabilities beyond speculative trading applications.

Infrastructure Partners Enhance User Experience

Several infrastructure partnerships have dramatically improved network accessibility and development capabilities:

- Etherscan Integration: Provides familiar transaction tracking for EVM-compatible applications

- Backpack Wallet: Has processed over $139 billion in trading volume since integration

- Chainlink CCIP: Cross-Chain Interoperability Protocol enables secure asset transfers between networks

- Bungee Protocol: Offers gasless transaction options that significantly improve user experience

- MetaMask Integration: Scheduled August 6 launch will expand wallet accessibility for millions of users

DeFi Protocol Integrations Expand Options

Financial protocol partnerships have expanded stablecoin options and cross-chain capabilities in meaningful ways:

- Frax Finance: sfrxUSD integration adds yield-bearing stablecoin options for users

- Symbiosis Protocol: Cross-chain swap capabilities connect multiple blockchain networks

- Union Build: BTCfi testnet development focuses on Bitcoin-based applications

These partnerships collectively drive billions in stablecoin flows and decentralized exchange volumes. The numbers demonstrate Sei's ability to attract real economic activity rather than just speculative trading volumes that artificially inflate many blockchain metrics. These partnerships provide credible validation of Sei's technical and regulatory readiness for real-world adoption, especially among institutions.

What Challenges Does Sei Network Face Moving Forward?

Despite impressive growth metrics, the Sei Layer 1 confronts several significant challenges that affect all emerging blockchain platforms competing against established networks with larger ecosystems and deeper developer communities.

Regulatory Landscape Creates Both Opportunities and Risks

Regulatory uncertainty particularly impacts stablecoin regulation and DeFi applications, which could significantly affect the growth trajectory. Sei's U.S.-focused approach positions the network to benefit from favorable regulatory developments, such as Project Crypto; however, changing political conditions could just as easily impact this strategic advantage.

Recent SEC clarification on liquid staking provided regulatory certainty for protocols like Splashing. However, broader DeFi regulation continues evolving, and the network's alignment with U.S. policy through the Sei Development Foundation creates both opportunities and dependencies on American regulatory frameworks that could shift with future administrations.

Ecosystem Development Requires Sustained Investment

Long-term ecosystem development depends heavily on attracting and retaining high-quality projects and developers. The network must provide competitive incentives while building sustainable economic models for genuine ecosystem health rather than short-term growth metrics that don't translate into lasting value.

Market volatility affects all blockchain platforms, and Sei's rapid growth trajectory may face severe tests during potential market downturns. Maintaining user activity and TVL during adverse market conditions will reveal whether the ecosystem possesses fundamental strength beyond favorable market conditions that have supported recent growth.

Comprehensive interoperability requires ongoing development to ensure seamless integration with other blockchain networks and traditional financial systems. While partnerships address immediate connectivity issues, technical interoperability across different blockchain architectures remains complex and resource-intensive to implement properly.

Conclusion

Sei Network has established itself as a performance-focused blockchain infrastructure specifically designed for trading and financial applications. The network's 1000%+ TVL growth to a peak of $688.5 million in 2025, combined with leading gaming adoption metrics and institutional partnerships, demonstrates market validation of its specialized approach.

The Sei blockchain's ecosystem spans DeFi, gaming, AI, and decentralized science applications, indicating successful diversification beyond pure trading infrastructure. With gaming driving user adoption and DeFi protocols achieving significant TVL, the Sei Layer 1 demonstrates sustainable growth across multiple verticals.

Future developments, including the Giga upgrade and continued institutional adoption, position Sei Network as a significant infrastructure player in high-performance blockchain applications. As regulatory clarity increases and traditional finance explores blockchain integration, Sei's specialized capabilities and strategic U.S. regulatory alignment support continued growth potential in both crypto-native and traditional financial sectors.

Visit the official Sei Network website and follow @SeiNetwork on X for the latest updates.

Sources:

- Sei Network Official Documentation

- Sei Development Foundation - Announcements

- Sei ecosystems - project identification

- Circle - Native USDC Integration

- CoinShares - SEI ETP information

- Ondo Finance blog - “USDY is Coming to the Sei Network”

- DeFiLlama TVL Data and Protocol Analytics for Sei Ecosystem

- Cryptorank.io - Funding information

Read Next...

Frequently Asked Questions

What makes Sei Network faster than other blockchains?

Sei achieves high performance through specialized architecture, including parallel transaction processing, sub-400ms block finality via optimized Tendermint consensus, native order matching, and WebAssembly smart contract execution. The Sei V2 upgrade, live since July 2024, delivers up to 28,300 batched TPS through parallelized EVM implementation.

How does Sei Network support traditional finance integration?

Sei enables traditional finance through native USDC support via Circle partnership, tokenized Treasury securities through Ondo Finance (USDY), institutional-grade trading tools, and regulatory alignment with U.S. policies, including the GENIUS Act. The network's architecture prioritizes features needed for high-frequency trading and institutional adoption, including sub-400ms finality and native order matching.

What are the main applications built on Sei Network?

Sei's ecosystem includes DeFi protocols like Yei Finance (money market reaching $270M+ USDC supplied by July 2025) and Takara Lend ($100M+ TVL through mid-2025), gaming applications including Empire of SEI MMORPG (67,000+ unique active wallets) and AstroKarts racing game, AI projects like SideShift.ai and ChainGPT for blockchain infrastructure, plus infrastructure tools including Splashing liquid staking protocol (10 million SEI staked).

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events