Pi Network Price Analysis: Is a Breakout Looming After April’s Consolidation?

April’s price action shows Pi Network stabilizing within a symmetrical triangle. Learn what this means for the next possible market move.

Miracle Nwokwu

May 1, 2025

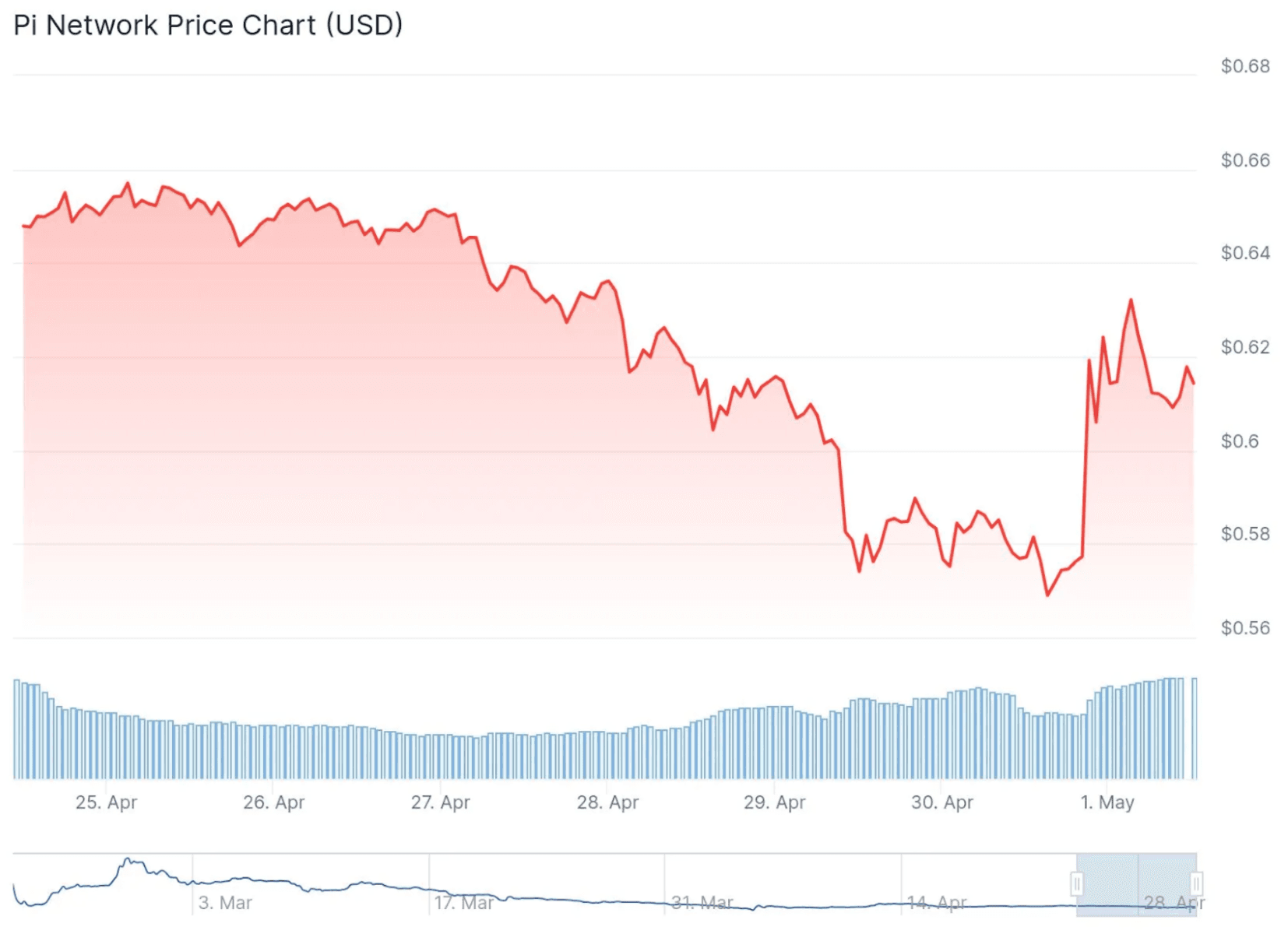

After briefly reclaiming the $1.79 mark on March 13, Pi Network (PI) has struggled to maintain upward momentum, with its price action tilting decisively bearish through the latter half of March. April, however, introduced a shift in sentiment—sellers appear to be losing steam, allowing PI to stabilize within a narrow consolidation range. The move followed a sharp drop to $0.40 on April 5, capping off a steep descent through a descending channel that tested buyers’ resolve.

Despite logging a 13.6% decline over the past month, PI has posted a notable 6.6% gain in the last 24 hours, according to Coingecko, hinting at early signs of a potential trend reversal. At the time of writing, PI trades at $0.614 with a market capitalization of $4.3 billion and a 24-hour trading volume of approximately $144 million.

In this article, we analyze PI’s current technical outlook and where the price might potentially be heading next:

Price Analysis and Technical Outlook

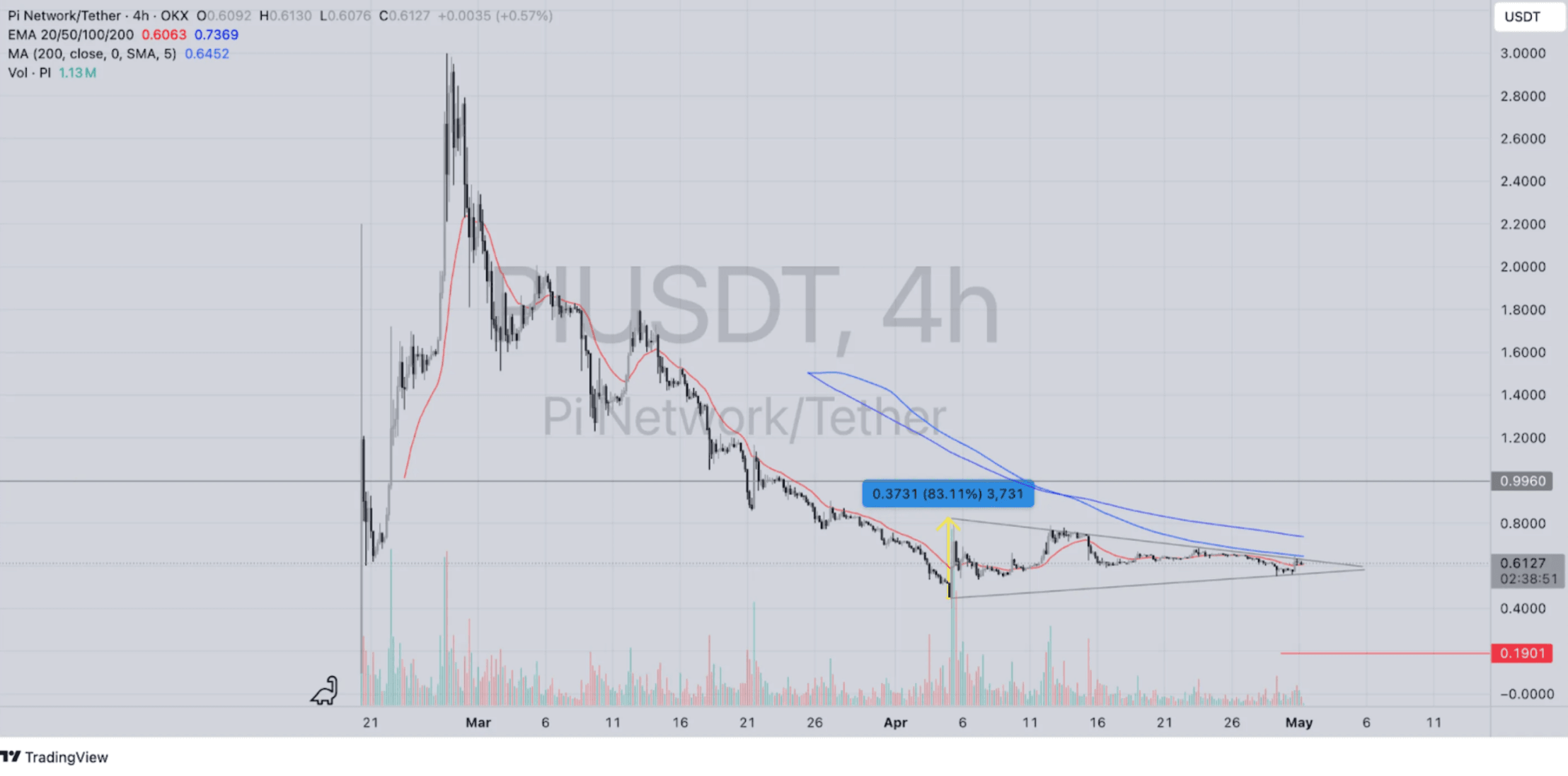

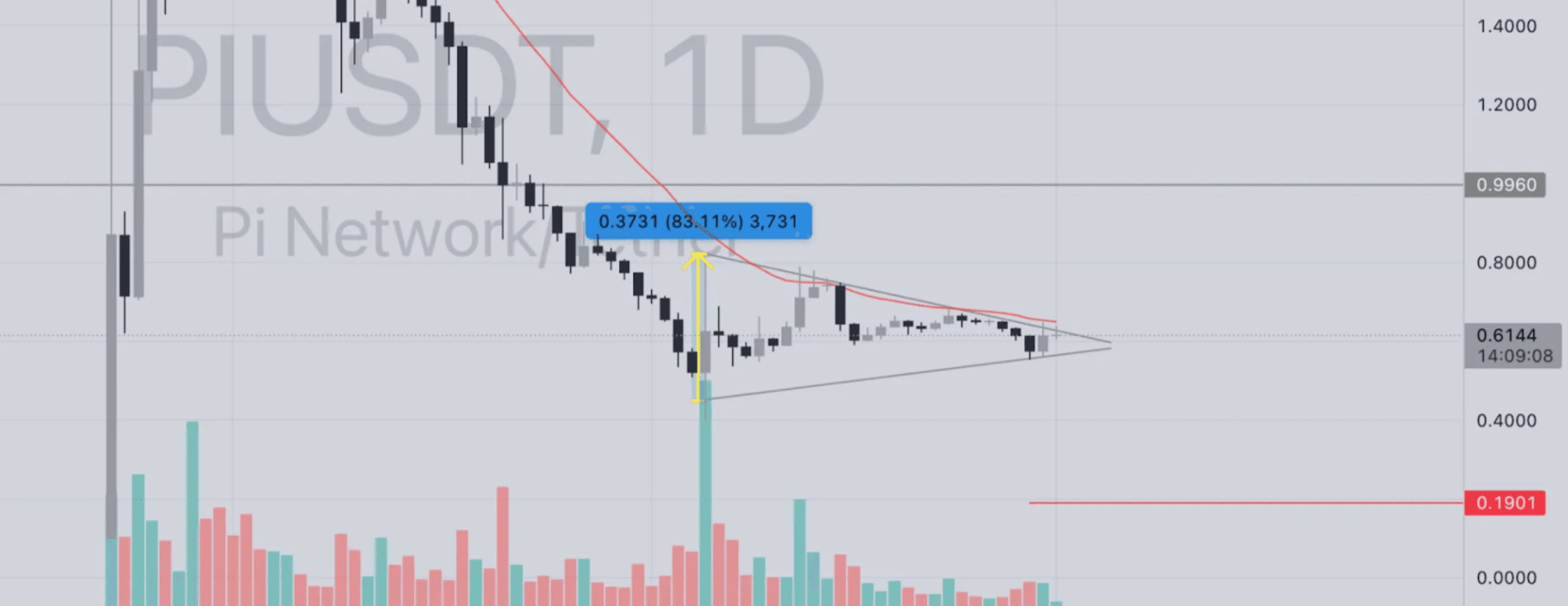

The Pi Network/Tether (PI/USDT) chart below reveals a symmetrical triangle pattern on the 4-hour timeframe. Since early April, the PI price action appears to be consolidating within a symmetrical triangle pattern, highlighted by the converging trend lines. This pattern typically suggests a period of indecision in the market, where buying and selling pressures are nearly balanced.

Generally, symmetrical triangles are considered neutral patterns, meaning they can break out in either direction. To determine the potential direction of the breakout, traders should monitor the PI price action closely for confirmation as it approaches the apex of the triangle. A break above the upper trend line would signal a bullish breakout, while a break below the lower trend line would indicate a bearish breakout.

The 20-period EMA (0.6063) is currently below the 50-period EMA (0.7369), which suggests a short-term downtrend. However, the price is currently hovering around the 200-period MA (0.6452), a significant area that could act as a support level if the price flips.

Expanding into the daily timeframe shows the upper trendline resistance corresponding with the 200-period exponential moving average (200DEMA) at $0.06498.

Potential Scenarios for traders:

Bullish Breakout:

If the PI price breaks and closes above the upper trend line of the triangle with increasing volume, it could signal the start of an upward trend. The potential target for this breakout could be the previous high around 0.8130 or even higher towards the $1 psychological level, depending on the strength of the breakout.

Bearish Breakout:

Conversely, if the price breaks below the lower trend line of the triangle with increasing volume, it could lead to further declines. The potential target for this breakout could be the previous low around 0.4000 or lower.

Continued Consolidation:

If the price remains within the triangle for an extended period, it could indicate continued indecision in the market. In this case, it's important to remain patient and wait for a clear breakout before making any trading decisions.

Earlier in March, Pi Network celebrated its sixth anniversary on Pi Day, marking the official launch of the Open Network. New releases included a .pi Domains Auction to enhance ecosystem functionality and expand real-world applications.

The first Open Network PiFest also commenced, allowing Pioneers to shop at local Pi-powered businesses using Pi. The event leveraged full Open Network connectivity to promote real-world adoption.

Pi Network’s price is approaching a critical juncture, with its consolidation pattern hinting at a decisive move ahead. Whether the breakout skews bullish or bearish will depend on market volume and broader market sentiment in the coming sessions. Traders should watch closely as PI nears the apex of its triangle formation—patience and timing will be key.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Miracle Nwokwu

Miracle NwokwuMiracle holds undergraduate degrees in French and Marketing Analytics and has been researching cryptocurrency and blockchain technology since 2016. He specializes in technical analysis and on-chain analytics, and has taught formal technical analysis courses. His written work has been featured across multiple crypto publications including The Capital, CryptoTVPlus, and Bitville, in addition to BSCN.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens