Makina ($MAK): Institutional DeFi Infrastructure Explained

Makina brings institutional-grade DeFi infrastructure with $MAK tokenomics, veMAK governance, and cross-chain strategy vaults. ICO November 25, 2025 on Legion.

Crypto Rich

November 24, 2025

Table of Contents

Makina is a DeFi protocol built for institutional-grade asset management across multiple blockchains. Professional asset managers can deploy complex strategies through non-custodial vaults called "Machines," and retail investors get transparent access to the same opportunities. The protocol hit $94 million in TVL within its first week, with deposit caps filling in just two days.

Why does this matter? Professional capital has largely stayed on the DeFi sidelines due to fragmented infrastructure and weak risk controls. Makina aims to change that by providing the programmable, cross-chain execution layer that institutional players need.

Who Is Behind Makina?

Jenna Zenk leads the project as CEO. She previously served as CTO of Melon Protocol (now Enzyme), giving her direct experience building onchain fund management infrastructure.

Makina closed a $3 million strategic round with aligned builders, angels, and funds including cyber•Fund, Bodhi Ventures, Interop VC, Steakhouse, Hypernative Labs, and others. The backers see Makina as key infrastructure for connecting institutional capital to DeFi yields and describe the project as a ground-up rebuild of DeFi asset management. Their thesis: existing solutions suffer from slow governance and limited cross-chain flexibility. Makina's architecture tackles both.

How Does Makina Work?

The protocol runs on a hub-and-spoke architecture built for cross-chain coordination and risk management.

Core Components

Two components form the foundation. "Machines" are vault smart contracts deployed on the Hub Chain, typically Ethereum Mainnet. Each Machine accepts a single Accounting Token for deposits, calculates share prices, and manages fees. When users deposit, they receive Machine Tokens (MTs), ERC-20 assets whose price tracks strategy performance. These tokens plug into the broader DeFi ecosystem, including Curve pools and other protocols.

"Calibers" handle execution on each supported chain. They open and close positions, harvest rewards, and execute swaps. Every strategy connects one Machine to multiple Calibers across Hub and Spoke Chains.

Here's what that looks like in practice: a manager spots a yield opportunity on Arbitrum, a arbitrage gap on Base, and wants to hedge via Aave on Ethereum. With Makina, they execute all three moves atomically through a single Machine. No manual bridging, no separate transactions, no timing risk between legs. The strategy either executes completely or not at all.

Each Machine also publishes a mandate at launch, outlining the strategy type, risk profile, and return expectations. Operators and Risk Managers use this as their guiding framework.

MakinaVM powers the execution layer. It supports atomic operations across multiple EVM-compatible chains without needing custom adapters or extra audits for each integration. Wormhole handles cross-chain messaging, while generalized Instructions allow rapid protocol integrations and on-the-fly strategy adjustments.

Risk Management Framework

Makina uses a four-layer risk management system:

- Pre-approved instructions define what operations each Machine can perform

- Onchain exposure limits cap risk at the protocol level

- Atomic unwinds via flash loans enable emergency exits. If a position turns dangerous, the protocol can borrow funds instantly, close the position, repay the loan, and settle the difference in a single transaction. No waiting, no liquidation queues.

- A Security Module provides risk underwriting and additional coverage

Operators handle strategy execution. Risk Managers oversee assets and protocols separately. This division keeps operational and risk functions independent.

Security Audits

Six independent audits preceded launch. Enigma Dark ran fuzz and invariant testing on Makina-Core in July 2025. SigmaPrime audited Core and Periphery contracts in August. ChainSecurity reviewed both contract sets in September. Cantina hosted a capture-the-flag competition in October. Ottersec completed the final Core and Periphery audit in November 2025. An ongoing bug bounty program runs through Cantina.

What Are Makina's Early Strategies?

Makina supports diverse strategy types: onchain yield aggregation, index products, long-short plays, delta-hedged positions, fixed income, and volatile token indexes. The modular design means Machines can expand with different manager contracts to fit each strategy's needs.

Three core strategies launched at debut: DUSD, DETH, and DBIT. All three have multi-year track records and started generating fees from day one. Target yields run in the 10-20% APY range, aimed at investors looking beyond declining traditional rates.

Season 0 kicked off on September 29, 2025, and focused on TVL growth and early depositors. Season 1 started on October 27, 2025, shifting toward active management and strategy optimization.

How Do $MAK Tokenomics Work?

$MAK is the native governance and utility token for Makina. Total supply sits at 1 billion tokens, issued as an ERC-20 on Ethereum Mainnet with 18 decimals. The model is designed to align incentives between operators, users, and the DAO.

Token Allocation

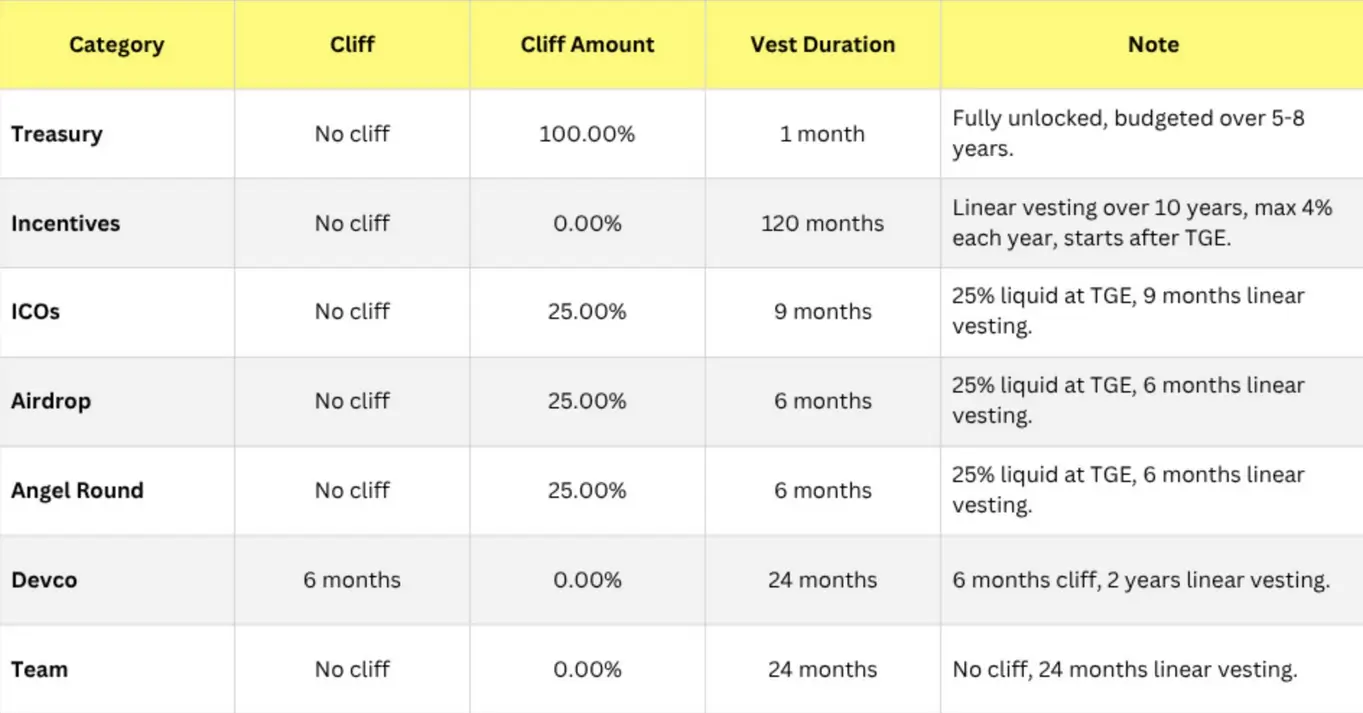

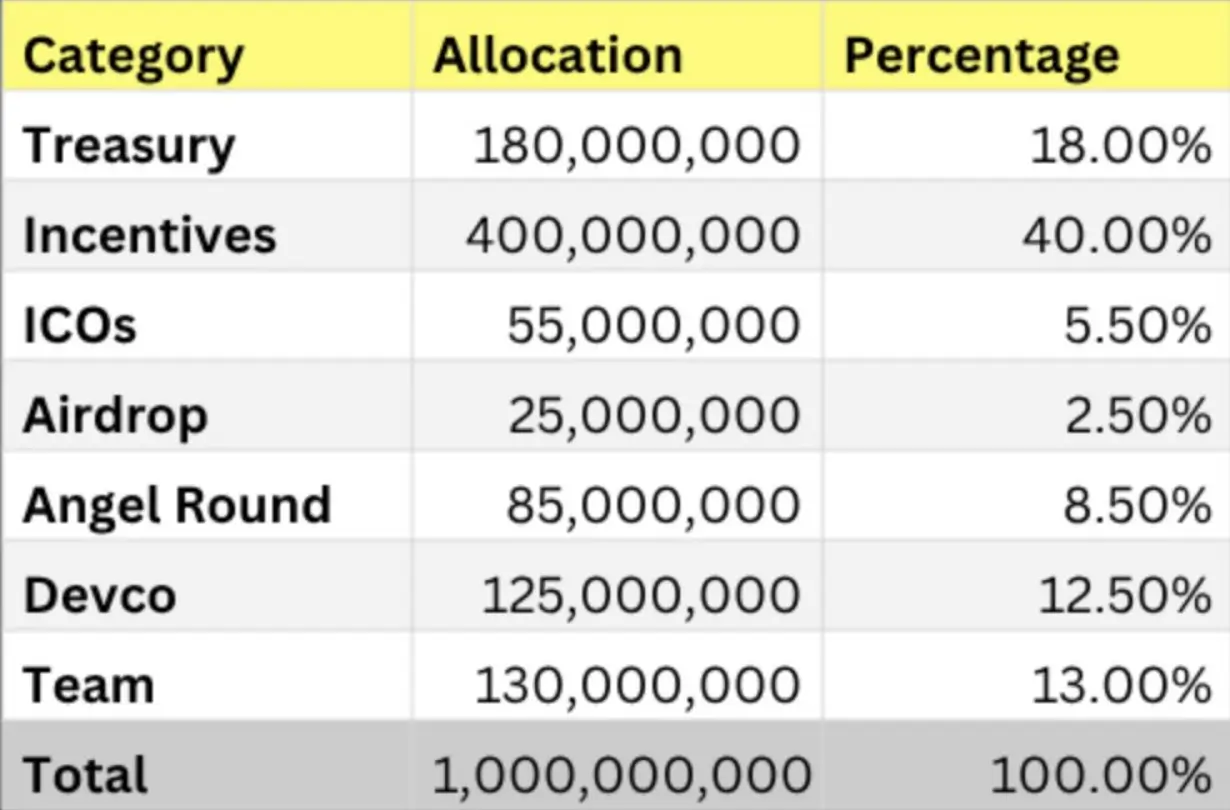

The total supply breaks down as follows:

- Incentives: 40% (400,000,000 tokens) for ecosystem rewards, linear vesting over 10 years with max 4% released annually

- Treasury: 18% (180,000,000 tokens) fully unlocked but budgeted over 5-8 years

- Team: 13% (130,000,000 tokens) with 24 months linear vesting, no cliff

- Devco: 12.5% (125,000,000 tokens) with 6 months cliff, then 24 months linear vesting

- Angel Round: 8.5% (85,000,000 tokens) with 25% at TGE, 6 months linear vesting

- ICOs: 5.5% (55,000,000 tokens) with 25% at TGE, 9 months linear vesting

- Airdrop: 2.5% (25,000,000 tokens) with 25% at TGE, 6 months linear vesting

The structure prioritizes long-term alignment. Team and Devco tokens vest over two years. Incentives release slowly over a decade. No single category dumps on day one.

veMAK Governance

Makina uses ve-tokenomics. After TGE, holders will stake and lock $MAK to mint non-transferable veMAK. Voting power scales with both the amount locked and the lock duration, so longer commitments mean stronger governance influence.

veMAK holders will control key protocol decisions:

- Permissions for new Machines

- Fee split configurations

- Contract parameters and safety settings

- Infrastructure agreements

Revenue and Value Accrual

Revenue comes from management and performance fees on Machines. The DAO negotiates how fees split between Operators and the protocol for each Machine. Protocol revenue funds development, maintenance, token buybacks, liquidity incentives, and distributions to veMAK holders.

Pre-TGE revenue goes toward post-TGE buybacks and liquidity. Strategic emissions boost organic yields by rewarding behaviors like DEX liquidity provision or Pendle yield token integrations, allocated based on TVL and performance.

As TVL grows, more operators join. More operators means more utility for the token. The flywheel is built in.

What Is the $MAK ICO Structure?

The $MAK token sale launches November 25, 2025 on Legion. Makina chose the platform for its compliance framework, reputation, and participant scoring system. Legion evaluates users based on X accounts, onchain activity, and GitHub commits to optimize allocations.

Pricing lands at a $35 million fully diluted valuation, matching the strategic round. Early public participants get the same terms as strategic backers.

Two-Tier Sale Structure

The ICO runs in two tiers:

- Priority ICO: 4.5% of total supply goes to Legion Ticket holders (Season 0 participants). They receive guaranteed allocations via connected wallets and can bid for additional allocations. Unexercised portions flow to over-bidders.

- Public ICO: 1% of the total supply opens to all Legion users, including Ticket holders who want additional allocation.

ICO participants receive 25% of their tokens at TGE, with the remaining 75% vesting linearly over 9 months.

No large VC carve-outs. No special terms beyond the strategic round. The goal is high float and organic distribution. TGE is set for Q1 2026, when Season 0 points convert to $MAK.

U.S., U.K., Chinese, and OFAC-sanctioned persons are excluded due to regulatory requirements.

How Does Makina Compare to Competitors?

DeFi asset management has several established players, each with trade-offs. Enzyme (formerly Melon Protocol) operates primarily on Ethereum and moves slowly on governance changes. Yearn Finance leans toward passive yield strategies with limited active management options. Set Protocol offers structured products but lacks cross-chain execution.

Makina's edge is scope and speed. MakinaVM supports atomic operations across six or more EVM chains and integrates with over 30 protocols out of the box. Enzyme, by comparison, remains largely single-chain. Adding new protocol integrations on competing platforms often requires custom adapters and fresh audits. Makina's generalized Instructions skip that bottleneck entirely.

The target user also differs. Makina builds for professional managers who need institutional-grade tooling, not retail yield farmers chasing passive returns. That positioning fits a broader trend: traditional finance is increasingly exploring DeFi, and it needs infrastructure it can trust.

What's Next for Makina?

The roadmap focuses on onboarding operators with different specializations and expanding tooling for broader adoption. As regulatory clarity improves and traditional yields stay compressed, the opportunity for institutional DeFi participation grows.

Makina is betting that professional capital will flow to protocols with proper infrastructure. Whether that thesis plays out depends on operator quality, strategy performance, and how the broader market evolves.

Conclusion

Makina has built the infrastructure that professional DeFi has been missing. The protocol combines cross-chain execution, serious risk controls, and a governance model that rewards long-term commitment. Six audits from top security firms show the team isn't cutting corners, and three strategies are already generating fees before TGE even happens.

The $MAK ICO on November 25, 2025 offers 5.5% of supply at $35 million FDV through Legion's two-tier structure. TGE follows in Q1 2026. For those tracking institutional DeFi plays, Makina is one to watch.

Visit the official Makina website for more information and follow @makinafi on X for updates.

Sources:

- cyber•Fund - Makina: The DeFi Execution Engine.

- Dewhales Capital - Investment Analysis Thread.

- Legion - Makina Partnership Announcement.

- Makina Official - Tokenomics Announcement.

- Makina Official - ICO Details.

- Makina Docs - Technical Documentation.

Read Next...

Frequently Asked Questions

What is Makina and how does it work?

Makina is a DeFi protocol that lets professional asset managers run multi-chain strategies through non-custodial vaults called Machines. Machines handle deposits and pricing on the Hub Chain, while Calibers execute trades on Spoke Chains via MakinaVM.

How does Makina generate revenue for token holders?

Machines charge management and performance fees. Protocol revenue funds development, buybacks, liquidity programs, and distributions to veMAK holders after TGE.

When is the $MAK ICO and what is the valuation?

The ICO launches November 25, 2025 on Legion at $35 million FDV. Priority ICO offers 4.5% to Ticket holders, Public ICO offers 1% to all users. TGE follows in Q1 2026.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens