Everything We Know About Immunefi’s IMU Token

Immunefi's IMU token powers a scalable Web3 security ecosystem, incentivizing threat data for AI defenses via protocols, researchers, and community staking.

UC Hope

January 12, 2026

Table of Contents

The IMU token is the economic core of Immunefi’s security platform, designed to directly answer a central question in Web3 infrastructure: how can decentralized systems continuously pay for real, measurable security as onchain value grows? IMU addresses this by creating a shared incentive layer that rewards protocols, security researchers, and users for producing and supporting high-quality threat data, thereby strengthening Immunefi’s AI-driven Security OS. Rather than treating security as a one-time expense, IMU embeds it in an ongoing economic cycle tied to real defensive outcomes.

This article examines key details about the Immunefi token ahead of its January 2026 launch, including its role in the ecosystem, tokenomics, supply and allocations, and how it is expected to function in practice.

Overview of Immunefi and the IMU Token

Immunefi operates as a full-stack security platform for the Web3 ecosystem. Its services span bug bounty coordination, audits, continuous monitoring, real-time alerts, and exploit prevention. By late 2025, the platform reported securing more than $180 billion in assets across over 650 protocols on more than 15 blockchains. According to Immunefi’s disclosures, this coverage accounts for roughly 93 percent of total DeFi value locked.

The platform’s track record is closely tied to bug bounties. More than 5,000 vulnerabilities have been responsibly disclosed through Immunefi, with over $120 million paid out to researchers. Around 30 individual researchers have each earned more than $1 million, indicating sustained participation rather than sporadic engagement.

The IMU token represents a structural shift in how this activity is funded and coordinated. Instead of relying solely on bilateral bounty agreements between protocols and researchers, IMU introduces a shared economic layer. Tokens are used to incentivize the submission of actionable threat data, to stake for enhanced security services, and to align all participants around long-term platform health.

As of writing, the IMU token is listed on Coinbase’s roadmap, indicating it has passed initial internal reviews, though this does not guarantee a listing date.

What is the IMU Token Designed to Do?

IMU is positioned as the value creation asset of the Immunefi ecosystem. Its primary function is not speculative trading but coordination: it is meant to ensure that as the onchain economy grows, the incentives to secure it scale at the same pace.

At a high level, IMU supports three interconnected groups:

- Protocols seeking ongoing, end-to-end security coverage

- Security researchers and technologists producing vulnerability discoveries and threat intelligence

- Users and community members who benefit from safer protocols and can support security activity directly

By tying rewards to measurable contributions, such as valid vulnerability reports, increased protocol coverage, or community-backed security initiatives, the token creates what Immunefi describes as a self-reinforcing security flywheel.

How the IMU Security Flywheel Works

The IMU economic model is built around a single feedback loop in which each participant strengthens the next.

Protocols: Credits and Commitments

Protocols that integrate with Immunefi can earn IMU credits by improving their security posture. These credits reflect actions such as expanding monitoring coverage or participating in structured bounty programs.

Protocols can also stake IMU to unlock discounted pricing and access to premium security features within the Immunefi Magnus ecosystem. The staking mechanism is designed to make deeper security commitments economically rational as protocol value and risk exposure increase.

Researchers: Boosted Rewards Through Staking

Security researchers can stake IMU to unlock higher reward tiers. This system increases payouts for high-impact work and encourages long-term alignment with the platform rather than one-off submissions.

By raising effective compensation for skilled researchers, Immunefi aims to attract and retain technical talent in an environment where exploits are increasingly automated and time-sensitive.

Communities: The Patrons Program

The Patrons Program extends participation beyond protocols and researchers. Community members can bond IMU behind individual researchers or specific projects.

- Bonding among researchers helps them reach higher contribution tiers, increasing the rewards available for valid submissions. Patrons share in those rewards proportionally.

- Project-level bonding directly supports their security initiatives. In return, patrons earn rewards tailored to each project.

In both cases, staking IMU ties economic return to demonstrable improvements in ecosystem security.

Viewed as a whole, the flywheel follows a repeatable sequence: protocols invest in security, researchers secure protocols, communities amplify incentives, and the resulting data improves Immunefi’s AI defenses. Each cycle increases the platform’s effectiveness and coverage.

IMU and AI-Driven Security

A central technical role of IMU is to incentivize the generation of threat data that trains Immunefi’s AI systems. This data includes exploit patterns, vulnerability classes, and real-world attack behavior observed across multiple chains.

As more high-quality data is contributed, the AI models improve, enabling faster detection and automated defenses. In an environment where smart contracts and autonomous agents can be attacked within minutes of deployment, this feedback loop is critical.

IMU effectively functions as the payment rail for this data pipeline. Contributors are rewarded not for abstract participation, but for producing inputs that measurably improve system defenses.

Launch Details and Funding History

The Token Generation Event for IMU is scheduled for January 22, 2026. The date was confirmed in an official announcement on January 8, 2026.

Immunefi’s mission is to make the onchain world safe from hacks, so it can scale to trillions in value.

— Immunefi (@immunefi) January 8, 2026

Now, the journey reaches a whole new level.

The Immunefi token (IMU) goes live on January 22.

Join the community to be part of the most important mission in crypto. pic.twitter.com/hIz5OxJnEu

Immunefi has raised a total of $29.5 million across three funding rounds prior to the token launch. In November 2025, the project conducted a public token sale on CoinList, raising $5 million at a fully diluted valuation of $133.7 million. The sale ran for seven days, starting November 12, and used a first-come, first-served structure.

Tokens from the CoinList sale are expected to be distributed to participant wallets once the token is listed and transferable.

No official post-launch valuation has been disclosed. Market pricing will be determined after listing, with some community speculation influenced by IMU’s inclusion on Coinbase’s roadmap and expectations of listings on major exchanges such as Binance.

IMU Tokenomics and Supply

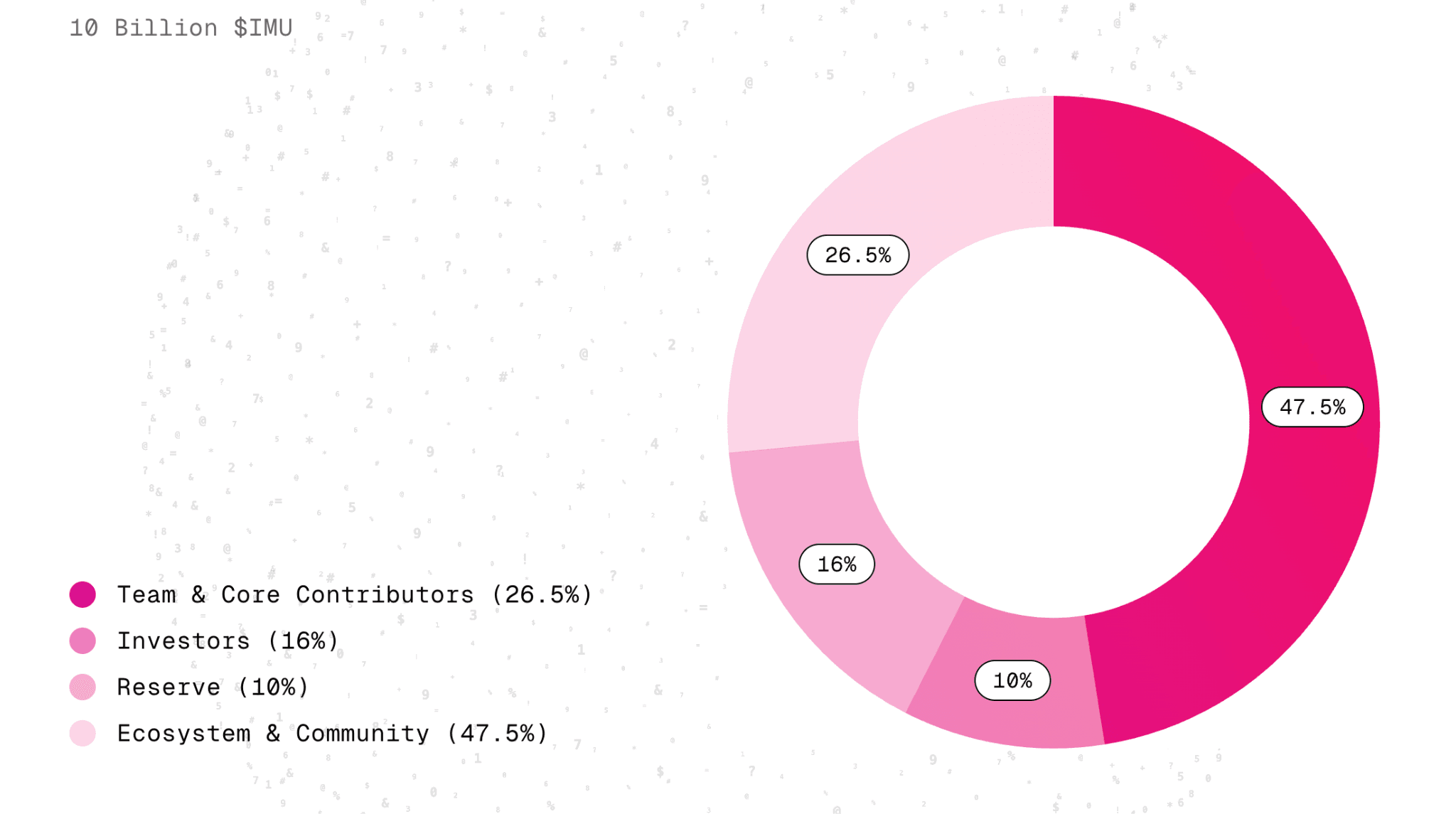

IMU has a fixed total supply of 10 billion tokens. The allocation is structured to prioritize ecosystem participation and long-term alignment over short-term liquidity.

Ecosystem and Community: 47.5%

Nearly half of the supply is allocated to ecosystem and community initiatives. This includes incentives for vulnerability disclosures, staking rewards, partnerships, airdrops, and programs such as Shield My Bags.

This allocation is intended to ensure that the token’s primary distribution path is through active participation rather than passive holding.

Team and Core Contributors: 26.5%

Team and core contributor tokens are locked and vest over 36 months from the listing date. This schedule ties compensation to continued development and platform performance over time.

Early Backers: 16%

Early backers, including participants in prior funding rounds and the CoinList sale, receive 16 percent of the supply. These tokens unlock over a three-year period to reduce near-term sell pressure and align incentives.

Reserve: 10%

The remaining 10 percent is held in reserve by the treasury. This allocation is intended to support future ecosystem expansion, grants, or unforeseen operational needs.

All major allocations, except certain community incentives, are subject to vesting. This design aims to prevent sudden supply shocks while maintaining flexibility for growth.

Growth-Linked Emissions Model

IMU uses a growth-linked release philosophy. Token emissions are designed to activate only when specific contribution events occur, such as:

- A protocol expanding its security coverage

- A researcher submitting a validated vulnerability

- A community initiative successfully backing security activity

This approach ties token distribution to real output rather than arbitrary schedules, reinforcing the utility-first design of the tokenomics.

Utilities Beyond Core Bounties

In addition to its role in bounties and staking, IMU is integrated into several user-facing tools.

One example is Shield My Bags, a free wallet scanning tool that assesses portfolio exposure to known risks. Users can earn points by sharing scan results or referring others. These points are redeemable for future rewards, including potential airdrops tied to IMU.

While governance functionality has not yet been fully detailed, IMU is expected to support community voting on certain ecosystem decisions, including integrations and reward structures.

Regulatory and Structural Considerations

The IMU whitepaper is structured in accordance with the EU Markets in Crypto-Assets Regulation (MiCA). It outlines the token’s role, governance approach, and risk framework within the European regulatory context.

This alignment suggests that Immunefi has considered compliance and disclosure standards in its token design, which is relevant for institutional participants evaluating long-term exposure.

Conclusion

The IMU token formalizes the economic layer of Immunefi’s security platform by tying incentives directly to measurable defensive outcomes. Its design centers on sustaining high-quality vulnerability research, funding continuous protocol protection, and enabling community participation in security decisions.

With a fixed supply, long-term vesting, and growth-linked emissions, IMU reflects a utility-driven tokenomics model focused on maintaining security as onchain value scales. As Immunefi moves toward its January 2026 launch, IMU is a structural component of how Web3 security is funded and coordinated, rather than a speculative add-on.

Sources:

- Immunefi Website: IMU Token snapshot

- Documentation: IMU Token extensive information

- ICODROPS: Immunefi Total raise

Read Next...

Frequently Asked Questions

What is the main purpose of the IMU token?

IMU is used to incentivize vulnerability discovery, fund protocol security commitments, and align researchers, protocols, and users around improving onchain security.

When will IMU launch?

The Token Generation Event is scheduled for January 22, 2026. As of mid-January 2026, the token is not yet tradable.

How is IMU different from typical memecoins?

IMU is not a memecoin. Its distribution and value are tied to measurable security contributions and platform usage rather than social or speculative dynamics.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens