How to Make Money in a Crypto Bear Market

Discover six strategies to earn profit during crypto downturns, from airdrops worth up to $15,000 to stablecoin yield farming. Learn how platforms like Aave, Compound, PancakeSwap, and more can help you thrive in a bear market.

Crypto Rich

April 18, 2025

Table of Contents

Investors enter what experts call a bear market when cryptocurrency prices drop by 20% or more over an extended period. These downturns bring declining portfolio values and widespread pessimism. Bear markets typically last between 6-18 months (with an average duration of 289 days), requiring patience from investors. However, bear markets aren't just about losses—they create unique opportunities for strategic investors.

Between 2021-2024, crypto projects distributed an estimated $49 billion in airdrops to Web3 communities, proving that profit potential exists even during market slumps. This article explores six practical strategies—Airdrops, Yield Farming, HODLing, Staking, Dollar-Cost Averaging, and Short Selling—that can help you navigate bear markets successfully.

While these methods offer earning potential during downturns, they require careful risk management and thorough research. Let's explore how you can stay engaged in the crypto ecosystem while making informed decisions during challenging market conditions.

Capitalizing on Airdrops

What Are Airdrops?

Airdrops are free token distributions that cryptocurrency projects use to reward early users or increase adoption. These tokens can range in value from a few cents to thousands of dollars. The Aptos airdrop, for example, rewarded some users with tokens worth approximately $15,000 for minimal participation effort.

Why They Work in Bear Markets

Bear markets typically see reduced activity across crypto platforms. By staying active when others retreat, you increase your chances of qualifying for valuable airdrops. The Blur NFT marketplace airdrop is a notable example, with some users receiving rewards worth up to $1 million simply for using the platform during its early stages.

How to Get Started

To position yourself for airdrops:

- Engage with emerging blockchain ecosystems through regular transactions, staking, governance votes, or providing liquidity

- Track potential opportunities using platforms like Defillama's airdrop dashboard

- Follow promising projects on X (Twitter), Telegram, and Discord for announcements

- Set up a secure wallet such as MetaMask (ideally connected to a hardware wallet like Ledger or Safepal)

- Participate in testnet activities or new decentralized applications (dApps)

Risks and Tips

Be cautious of phishing attempts and fake airdrops. Always verify links through official project channels. Since airdrop hunting requires time and effort, prioritize high-potential projects rather than pursuing every opportunity. Remember that rewards may take months to materialize, so patience is essential.

Airdrops provide a low-risk method to accumulate assets without risking capital losses—ideal for bear markets when traditional trading strategies face significant challenges.

Earning Through Yield Farming

What Is Yield Farming?

Yield farming involves locking your cryptocurrencies in decentralized finance (DeFi) protocols to earn interest or rewards. Typically, farmers provide liquidity to trading pools, enabling token swaps for other users. Think of it as earning bank interest but with potentially higher returns and greater risks.

Why It Works in Bear Markets

While asset prices may fall during bear markets, yield farming generates passive income regardless of market direction. Stablecoin pools, which offer returns between 4-12% Annual Percentage Yield (APY), minimize volatility exposure. Major DeFi platforms maintain active farming opportunities even during market downturns.

How to Get Started

Begin yield farming with these steps:

Choose from established platforms like:

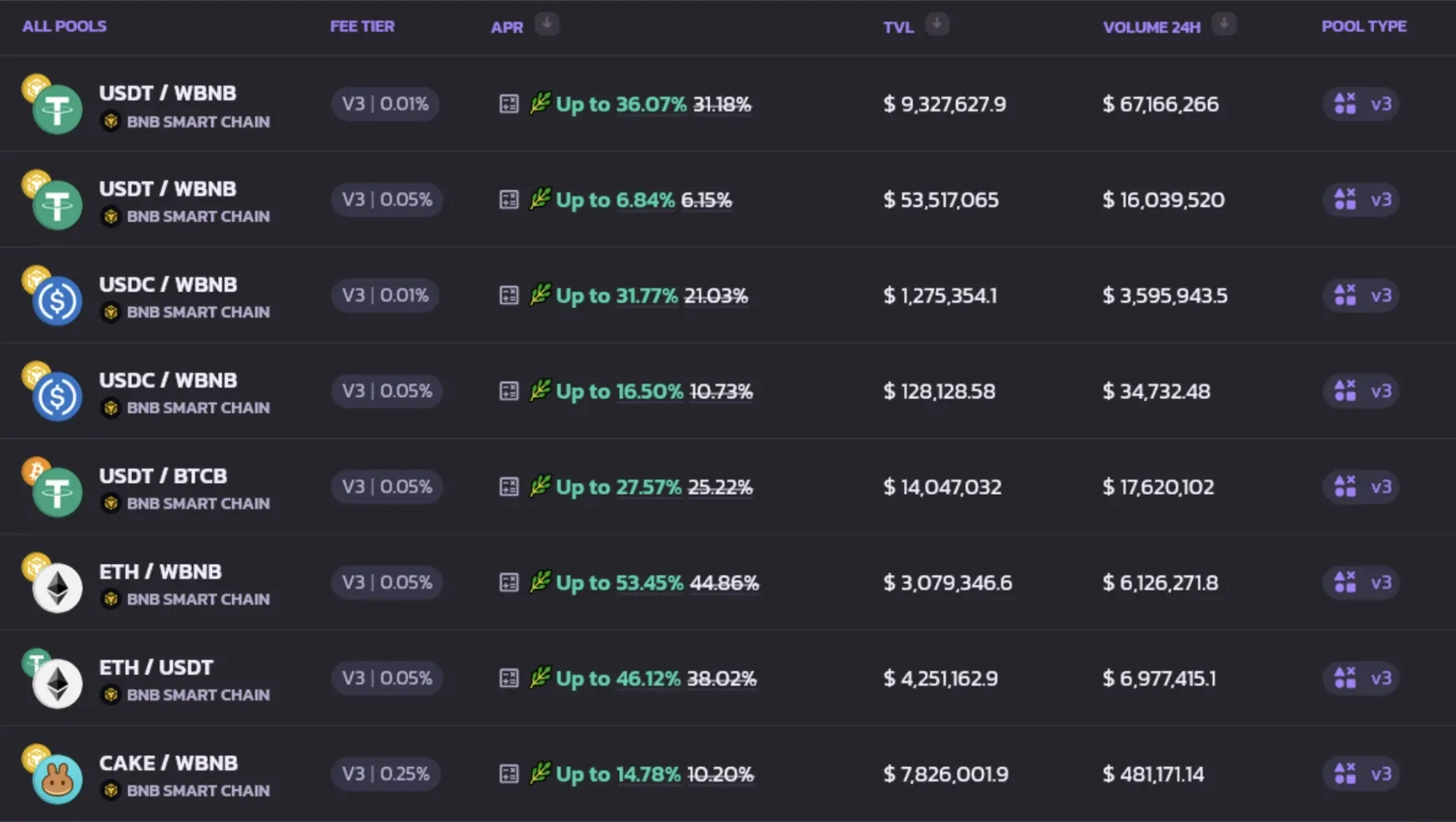

- PancakeSwap (a multichain DEX offering liquidity pools and farming)

- Uniswap (a leading DEX with concentrated liquidity features)

- SushiSwap (a multichain DEX with various liquidity pools)

- Aave (for lending and borrowing)

- Compound (for interest-earning deposits)

- Yearn Finance (for automated yield strategies)

These are just some of the many platforms available in the DeFi ecosystem. New protocols emerge regularly, so it's worth staying informed about the latest options.

After selecting a platform, you'll want to deposit assets into stablecoin pairs (such as USDT/USDC) to reduce price volatility risks. This approach helps shield your investment from the significant price swings common during bear markets.

Once your assets are deposited, regularly monitor available Annual Percentage Yields through each platform's dashboard. The interfaces vary between platforms, but all provide ways to track your potential returns and adjust your strategy as market conditions change.

Risks and Tips

Yield farming involves several risks, including impermanent loss (when asset prices in your pool move in opposite directions), smart contract vulnerabilities, and potentially high transaction fees depending on which blockchain you're using.

Start with small investments and thoroughly research before diving in. Each platform type offers different approaches:

- Lending platforms provide ways to earn interest by lending your assets

- DEXs allow you to earn fees by providing liquidity for traders

- Yield aggregators automatically optimize strategies across multiple protocols

For beginners, lending platforms typically offer the simplest entry point. As you gain experience, you can explore more complex strategies across different platforms and blockchains.

HODLing for the Long Term

What Is HODLing?

HODLing—a legendary term born from a typo in a 2013 late-night, panic-fueled forum post—has evolved into crypto's battle cry to "hold on for dear life" during market turbulence. Far from just a meme, it represents the iron-willed strategy of clutching your crypto through white-knuckle drops and stomach-churning volatility, refusing to sell despite the market's rollercoaster ride. True HODLers don't just weather the storm—they embrace it, armed with unwavering conviction that diamond hands will eventually be rewarded when the market turns.

Why It Works in Bear Markets

Bear markets offer attractive entry points for long-term investors. Historical data shows significant returns for those who purchase quality assets during downturns. For example, buying Ethereum at $1,500 during a bear market could yield returns of 300% if prices return to previous highs of $4,900 in the next bull run.

How to Get Started

To implement an effective HODLing strategy:

- Focus on established cryptocurrencies like Bitcoin or Ethereum, which have survived multiple market cycles

- Secure your assets in hardware wallets (such as Ledger or Safepal) to protect against exchange hacks

- Invest only disposable income that you won't need access to in the short term

Risks and Tips

HODLing through bear markets can be emotionally draining as portfolio values decline. Some projects may even fail to recover even when the broader market improves.

Research project fundamentals thoroughly—Bitcoin's fixed supply cap and Ethereum's ongoing technical upgrades provide strong cases for long-term viability. Consider combining HODLing with staking or yield farming to generate additional income while waiting for market recovery.

HODLing demands patience but significantly rewards investors who purchase strong projects at bear market prices.

Staking for Passive Rewards

What Is Staking?

Staking involves locking your cryptocurrencies in a Proof-of-Stake (PoS) blockchain to support network operations. In return, you earn rewards—typically 5-15% APY paid in additional tokens. This process helps secure the network while providing passive income for participants.

Why It Works in Bear Markets

Staking generates consistent returns regardless of market direction, offering a stable income source during price downturns. This makes it an excellent complement to HODLing, allowing you to increase your holdings even as prices fall. Platforms like PancakeSwap and other DeFi protocols offer various staking opportunities through their ecosystems.

How to Get Started

Begin staking with these steps:

- Choose PoS cryptocurrencies like Ethereum, Solana, Cardano, or BNB

- Stake directly through network wallets or join staking pools for smaller investments

- Use PancakeSwap to stake CAKE tokens in syrup pools for rewards, SushiSwap for xSUSHI staking, or explore Aave's safety module for staking AAVE tokens

- Explore liquid staking options (like Lido for Ethereum), which provide tokens representing your staked assets that can be used elsewhere in DeFi

Risks and Tips

Staking carries risks including slashing (penalties for network violations) and lock-up periods that restrict access to your funds. With platforms like Uniswap, staking often requires providing liquidity first, which introduces additional complexity and exposure to impermanent loss risks.

Choose established networks and staking platforms to minimize protocol risks. Consider diversifying your staked assets across multiple networks. For beginners, platforms with straightforward interfaces like BNB Chain’s PancakeSwap provide an accessible entry point to staking.

Staking provides a low-effort method to earn passive income during bear markets while supporting blockchain networks you believe in.

Dollar-Cost Averaging (DCA) to Build Positions

What Is DCA?

Dollar-Cost Averaging involves investing a fixed amount at regular intervals (for example, $100 monthly) regardless of current prices. This strategy automatically purchases more coins when prices are low and fewer when prices are high, averaging out your entry price over time.

Why It Works in Bear Markets

DCA allows investors to capitalize on lower prices during bear markets without trying to time the absolute bottom. This reduces stress and emotional decision-making while positioning your portfolio for significant gains when the market eventually recovers.

How to Get Started

Implement DCA with these steps:

- Allocate a budget for recurring purchases of high-quality assets like Bitcoin or Ethereum

- Use exchanges such as Binance, Kucoin, or Coinbase that offer automated DCA plans

- Transfer accumulated assets to a secure hardware wallet for long-term storage

Risks and Tips

While DCA reduces timing risk, it doesn't guarantee profits if the selected projects ultimately fail or if markets remain stagnant for extended periods. Maintain a consistent schedule regardless of short-term price movements to avoid emotional investing. Periodically review your selected projects to confirm their continued viability.

DCA provides a disciplined, low-stress approach to accumulate quality assets at favorable average prices during bear markets.

Short Selling for Advanced Traders

What Is Short Selling?

Short selling involves borrowing cryptocurrency at current prices, selling it immediately, then repurchasing it later at a lower price to return to the lender. The profit comes from the price difference. For example, shorting Ethereum from $3,000 to $2,500 would yield $500 profit per token (minus fees and interest).

Why It Works in Bear Markets

Bear markets, characterized by prolonged downward price trends, create ideal short-selling conditions. While most assets lose value during these periods, short sellers can generate profits precisely because of these declines.

How to Get Started

To begin short selling:

- Use platforms like Binance, Kucoin, or Kraken that support margin trading and short positions

- Start with small positions to test your strategy and manage leverage risks

- Implement stop-loss orders to limit potential losses if prices move against your position

Risks and Tips

Short selling carries significant risks, including potentially unlimited losses if prices rise sharply (as opposed to long positions, where losses are limited to your initial investment). This strategy is recommended only for experienced traders with robust risk management systems.

Additionally, short selling may not be accessible to all retail investors due to platform restrictions in certain regions or regulatory limitations. Many jurisdictions have specific requirements for margin trading accounts, and some countries restrict crypto shorting entirely.

Monitor market sentiment and news developments closely, as unexpected positive announcements can trigger rapid price increases that harm short positions. Consider using options or futures contracts to cap potential losses.

Short selling can be highly profitable during bear markets but requires experience, discipline, and careful risk management.

Making the Most of Crypto Bear Markets

Bear markets in cryptocurrency, while challenging, offer multiple strategies for generating returns. From collecting airdrops and yield farming to HODLing quality assets, staking for passive income, implementing dollar-cost averaging, or short selling for the experienced trader—opportunities exist for investors at all skill levels.

The most effective approach combines several strategies based on risk tolerance, available capital, and time commitment. For example, HODLing Bitcoin while staking Ethereum, using lending protocols for stable returns, and participating in potential airdrop opportunities creates a balanced approach to bear market investing.

For beginners, start with simpler, lower-risk strategies like stablecoin yield farming or HODLing established cryptocurrencies. As you gain experience, you can graduate to more complex approaches. Remember that emotional discipline and proper risk management are crucial during market downturns. Only invest funds you can afford to lose, diversify your strategies, and conduct thorough research before committing capital, DYOR (Do Your Own Research)!

Stay active in the crypto ecosystem to position yourself for success when the market eventually recovers. Resources like Coinmarketcap and Defillama can provide valuable information to guide your bear market journey.

The cryptocurrency market remains highly volatile, with significant risk of capital loss. While bear markets create opportunities, they also demand caution, patience, and strategic thinking to navigate successfully. To stay ahead, follow @BSCNews on X or visit our site at bsc.news to keep up with the latest crypto news.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens