Core DAO’s Bullish Metrics: By the Numbers

Core DAO's growth features $327M TVL, 239.8M staked CORE, 4,940 BTC staked, 1M weekly users, and 600% developer growth.

UC Hope

September 5, 2025

Table of Contents

Since launching its mainnet, Core DAO has emerged as a notable player in the blockchain space, particularly through its integration with Bitcoin's infrastructure. The protocol has focused on creating a secure and efficient Layer-1 network that appeals to developers and users alike. This approach has led to consistent expansion in its ecosystem, drawing interest from both retail and institutional participants who seek reliable ways to engage with Decentralized Finance (DeFi) tied to Bitcoin, AKA BTCFi.

The project's emphasis on non-custodial staking and low-cost transactions has contributed to its upward trajectory. By leveraging Bitcoin's established security features, Core DAO has fostered an environment where applications in DeFi, gaming, and non-fungible tokens can thrive. This strategic alignment has supported steady growth, positioning the network as a viable option for those looking to utilize Bitcoin holdings more actively without compromising custody.

What is Core DAO?

The Core blockchain operates as an Ethereum Virtual Machine (EVM)-compatible Layer 1 network. It uses a consensus mechanism called Satoshi Plus, which draws security from Bitcoin through a combination of Delegated Proof of Work from Bitcoin miners and Delegated Proof of Stake via CORE tokens. This setup also includes non-custodial Bitcoin staking. The network launched in January 2023 and focuses on integrating Bitcoin's security features to support decentralized finance applications, gaming, and non-fungible tokens.

Core describes itself as a chain aligned with Bitcoin, enabling users to earn yields on Bitcoin holdings without transferring custody. The network secures about 90% of Bitcoin's hash rate, which contributes to its transaction processing capacity. It handles over 100 decentralized applications across various sectors. Above all, transaction fees remain low, often below $0.01, and the chain processes around 300,000 transactions daily. These elements address common challenges in blockchain scalability and security.

The ecosystem includes protocols for lending, restaking, and other financial services. For instance, Colend holds a total value of $147.71 million, while Pell Network manages $34.58 million, according to Defillama. This concentration in lending and restaking points to a maturing DeFi sector on the chain, which boasts over $300 million in TVL as of writing.

Key On-Chain Metrics

Data from September 5, 2025, highlights several metrics that indicate network activity. TVL stands at $327.18 million, with a 2.40% increase in stablecoin market capitalization over the past seven days.

Staked CORE tokens amount to 239.8 million, which helps secure the network and influences the token supply through burning mechanisms. Earlier in 2025, staking surpassed 210 million CORE tokens, indicating a trend of increasing activity. Bitcoin staking totals 4,940.455 BTC, valued at over $250 million at current prices. The staking process allows Bitcoin holders to participate without risking principal, secured by roughly 75% of Bitcoin's hash rate.

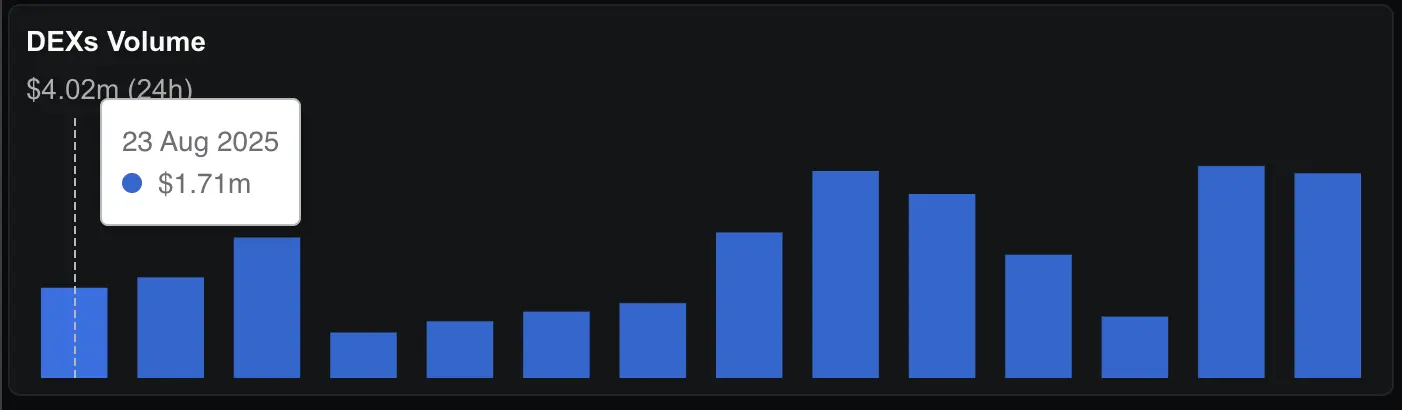

The ecosystem supports over 116 protocols, with weekly active users exceeding 1 million, reflecting high engagement levels. Daily transactions average over 300,000, supporting fee generation for network rewards. Decentralized exchange volume has increased 75.4% in the past seven days, reaching $19.09 million.

Median gas fees are under $0.01, which aids in accessibility for users. Staking yields range from 4% to 6% annually for dual staking of Bitcoin and CORE tokens, with variations based on tiers from base to Satoshi levels. These yields are generated from emissions and transaction fees, averaging approximately 5% for assets secured via hardware, such as Ledger.

In terms of developer activity, the protocol boasts over 250 active builders, with a 600% year-over-year increase. In 2024, the network added more than 2,000 new developers, and activity surged by 827%. Core ranks second in developer count among Bitcoin-aligned finance projects.

Growth Trends in 2025

Throughout 2025, Core's metrics have shown upward movement. The total value locked hovered around $300 million in the second quarter and has stabilized at $304 million, with bridged assets at $229 million and native assets at $ 75 million. The stablecoin market capitalization is $5.81 million, primarily in USDT, and has increased by 2.4% weekly.

The numbers speak for themselves.

— Core DAO 🔶 (@Coredao_Org) September 4, 2025

Core is the home of Bitcoin DeFi. 🔶 https://t.co/9Pw3LKOP8x

Dual staking, combining Bitcoin and CORE, has expanded. By April 2025, it included 45 million CORE and 5,000 BTC, growing to 210 million CORE later that month and 7,200 BTC by May. This mechanism allocates 15% of minted liquid-staked Bitcoin to purchase and stake CORE tokens, generating demand.

User and transaction volumes have increased, with over 1 million weekly active users and more than 300,000 daily transactions. Decentralized exchange volume rose 132% quarter-over-quarter in the second quarter, and application revenue averages $4,600 daily. Gaming applications reached all-time highs, with seven major decentralized applications launching within two weeks.

These trends align with Bitcoin's dormant capital, estimated at $1.2 trillion, which could serve as a potential source for further inflows.

Partnerships and Recent Developments

Core has formed partnerships with institutions such as BitGo, KODA, Maple Finance, Copper, and Hex Trust to support compliant dual staking. These collaborations target regions like Asia-Pacific and the Middle East, offering annual percentage yields of 4% to 6%. BitGo's integration facilitates institutional participation.

Hardware integrations include Ledger support for direct Bitcoin timelocking, which provides access to approximately 25% of Bitcoin held in hardware wallets. Additionally, Garden Finance offers Bitcoin bridging in under 30 seconds. Some key protocol updates feature Rev+, which shares fees with builders and stablecoin issuers, and the Theseus Hard Fork for developer incentives.

On the Incentive front, the blockchain platform introduced the $100,000 accelerator for Bitcoin finance projects and Core Missions for user onboarding, replacing the earlier Ignition program. Meanwhile, a $200 million ecosystem fund was established in collaboration with exchanges Bitget and MEXC.

All these initiatives represent the platform's progress in enhancing its ecosystem as the leading Bitcoin-aligned chain in the blockchain industry.

Conclusion: Charting the Path Forward for Core DAO

As Core DAO continues to solidify its position as a premier Bitcoin-aligned Layer-1 network, its future plans center on deepening ecosystem integration, expanding institutional adoption, and fostering innovation in BTCFi. Building on its robust metrics, the protocol is poised for accelerated growth through strategic initiatives.

Key next steps include scaling dual staking mechanisms to unlock more of Bitcoin's $1.2 trillion dormant capital, with enhanced yields of 4-6% via partnerships like those with BitGo, KODA, and Hex Trust. Hardware integrations will further democratize access, while protocol upgrades like Rev+ and the Theseus Hard Fork aim to incentivize builders and stablecoin issuers through fee-sharing models. Additionally, the $100,000 accelerator program and Core Missions for user onboarding will drive developer influx and dApp proliferation across DeFi, gaming, and NFTs.

By maintaining low fees, securing Bitcoin's hash rate, and prioritizing non-custodial solutions, Core DAO is set to evolve into a cornerstone of Bitcoin-powered decentralized finance, potentially capturing greater market share as blockchain interoperability advances in the coming years.

Sources:

- Core DAO Defillama - https://defillama.com/chain/Core

- State of Core DAO in Q2 - https://messari.io/report/state-of-core-q2-2025

- Core DAO Partnerships - https://www.coindesk.com/business/2025/02/17/bitcoin-staking-platform-core-joins-crypto-lender-maple-and-custodians-bitgo-copper-hex-trust

Read Next...

Frequently Asked Questions

What are some key protocols and TVL figures in Core DAO's DeFi ecosystem?

Core DAO's DeFi sector features over 116 protocols with a total TVL of $327.18 million. Notable examples include Colend with $147.71 million in TVL and Pell Network at $34.58 million, focusing on lending and restaking.

What is Satoshi Plus consensus, and how does it benefit Core DAO?

Satoshi Plus is Core DAO's unique consensus mechanism that combines Delegated Proof of Work from Bitcoin miners with Delegated Proof of Stake using CORE tokens. This hybrid approach leverages Bitcoin's security—securing about 90% of its hash rate—while enabling non-custodial staking, low transaction fees under $0.01, and efficient processing.

How does non-custodial Bitcoin staking work on Core DAO, and what are the yields?

Satoshi Plus is Core DAO's unique consensus mechanism that combines Delegated Proof of Work from Bitcoin miners with Delegated Proof of Stake using CORE tokens. This hybrid approach leverages Bitcoin's security—securing about 90% of its hash rate—while enabling non-custodial staking, low transaction fees under $0.01, and efficient processing.

How does non-custodial Bitcoin staking work on Core DAO, and what are the yields?

Satoshi Plus is Core DAO's unique consensus mechanism that combines Delegated Proof of Work from Bitcoin miners with Delegated Proof of Stake using CORE tokens. This hybrid approach leverages Bitcoin's security—securing about 90% of its hash rate—while enabling non-custodial staking, low transaction fees under $0.01, and efficient processing.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens