Core’s Latest News: Growth, Integrations & Partnerships

Core DAO's August 2025 updates highlight institutional partnerships, new DeFi protocols, ecosystem growth metrics, and community events aimed at expanding Bitcoin staking.

UC Hope

August 26, 2025

Table of Contents

Core DAO, the Bitcoin-aligned EVM-compatible blockchain, released several updates over the past week, focusing on institutional integrations, technical launches, ecosystem metrics, and community events.

These developments included partnerships with custody providers, new staking protocols, performance data from a quarterly report, and the start of reward campaigns, all aimed at expanding Bitcoin staking and Decentralized Finance (DeFi) activities on the network. With this in mind, this report examines these updates, highlighting the protocol’s progress within the blockchain ecosystem.

Institutional Partnerships Expand Core DAO's Reach

Core DAO announced a partnership with Hex Trust on August 20, 2025, to integrate dual staking of Bitcoin and CORE tokens into institutional custody systems. Hex Trust, a digital asset custodian, now supports self-custodial Bitcoin yield generation for clients in the Asia-Pacific, Middle East, and North Africa regions. This setup enables institutions to stake Bitcoin without transferring custody, thereby maintaining compliance standards while earning an approximately 5% annual yield. Media reports noted this move as part of a broader trend toward regulated access to Bitcoin DeFi.

On August 21, P2P.org joined the Core network as a validator. As an infrastructure provider, P2P.org contributes enterprise-grade resources to the Bitcoin-secured consensus mechanism, which relies on proof-of-stake validation. This addition aims to enhance network decentralization and reliability, supporting higher transaction throughput.

A case study highlighted in the Core Insider newsletter, published around August 23, detailed BitGo's use of Core for Bitcoin yield. The custody service utilizes qualified infrastructure to facilitate non-custodial staking, allowing users to retain control of their assets. The study reported that this integration aligns with institutional demands for secure, compliant yield options on Bitcoin holdings.

Technical Developments and Protocol Launches

Several technical updates emerged during the week, including hardware wallet integrations and new DeFi protocols:

Ledger Hardware Wallet Integration: The Core app for Ledger hardware wallets went live, as noted in the August 23 newsletter. Users can now timelock Bitcoin and stake CORE tokens directly from Ledger devices, securing transactions with hardware-level protection while earning approximately 5% annual percentage yield.

Vault Layer AI Agents Paper: Vault Layer released a paper on AI-driven agents for automating Bitcoin staking and DeFi interactions. These agents integrate with Molten DEX, a decentralized exchange on Core, to handle automated token swaps. The system utilizes smart contracts to execute strategies, thereby reducing the need for manual intervention in yield farming.

BITS Financial Launch: New protocols have been launched, including BITS Financial, a Bitcoin yield hub that simplifies the process. Users deposit currency, receive BITS tokens, select a strategy, and earn yields. This protocol operates under compliance frameworks, positioning Core as a venue for regulated Bitcoin DeFi activities.

Colend Boosted Yields: Colend introduced boosted yields, offering an annual percentage yield of over 40% on stCORE through a subscription model. Additional rates include 30% on USDT and 17% on SolvBTC.b, a Bitcoin-backed token. These options provide varied yield opportunities tied to Bitcoin assets.

Molten Finance Yield Farming: Molten Finance started yield farming features without requiring liquidity provider lockups or high-risk contracts. The protocol emphasizes secure, composable farming, where users can combine strategies across DeFi applications on Core.

ASX Capital NFT Launch: On August 21, ASX Capital launched an NFT for on-chain real estate investment. Priced at $10 per mint with a supply of 5,000, the NFT offers around an 8.5% annual percentage rate in dividends paid monthly in ASX tokens, plus potential property appreciation. This initiative opens U.S. real estate exposure to global users via Core's blockchain.

lstBTC Promotion: lstBTC, a liquid staking token for Bitcoin, was promoted on August 25. Custodied by BitGo and CopperHQ, and managed by Maple Finance, lstBTC allows users to stake Bitcoin while maintaining liquidity for DeFi use. It features composability, enabling integration with other protocols on Core.

These launches build on Core's EVM compatibility, which supports Ethereum-style smart contracts while aligning with Bitcoin's security model through non-custodial staking.

Ecosystem Metrics and Performance Data

The newsletter included data from Messari's second-quarter report. Staked value on Core reached $706 million in Bitcoin and CORE tokens, marking a 30% increase quarter-over-quarter. Of Bitcoin stakers, 60% also staked CORE, indicating dual participation in the network's consensus.

Decentralized exchange volume rose 132% quarter-over-quarter, attributed to the Theseus Hardfork. This upgrade activated fee sharing and smart contract hooks, allowing developers to customize transaction logic.

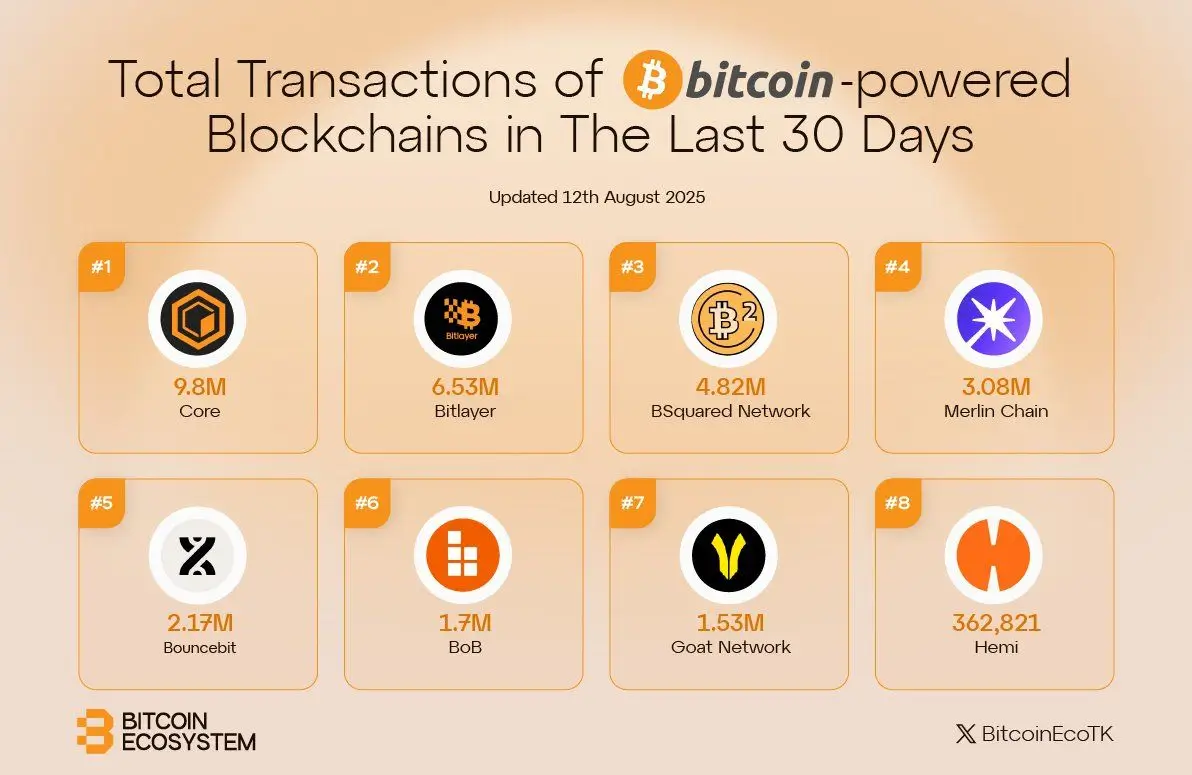

Core-led Bitcoin-aligned chains in transaction metrics over the past 30 days, with 9.8 million transactions, 601,800 active wallets, and over 846,000 transactions processed. These figures position Core as a high-transactions-per-second layer for Bitcoin-related activities.

Gaming applications experienced growth, with decentralized app activity increasing by more than 370%. Pixudi, a gaming dApp, reached 198,600 unique active wallets, while World of Dypians maintained over 243,000 users. This data highlights retail adoption in non-financial sectors on Core.

A blog post on August 24 discussed "Core SZN," focusing on retail engagement with Bitcoin through staking and other DeFi opportunities. It noted Bitcoin's transition from holding to active use via Core's tools. Since the Rev+ program launched, nearly 10 new protocols have been deployed on Core.

Community Events and Campaigns

Core DAO launched its first Missions campaign with Molten Finance on August 22, running through September 5. Participants earn up to 50,000 stCORE rewards based on trading volume: $1 million unlocks 10,000 stCORE, scaling to 50,000 at $5 million. Eligible swaps cover Core-native tokens, Bitcoin-format assets, and stablecoins. Wallet registration is required.

1/ 50,000 stCORE up for grabs! 🚨

— Core DAO 🔶 (@Coredao_Org) August 22, 2025

The first Core Mission is here with @moltendex .

Swap. Earn. Repeat.

Here’s what you need to know to get started. 🧵👇 pic.twitter.com/4NPzy3yQob

On August 25, the protocol announced the next Bitcoin Fusion event, scheduled to take place at TOKEN2049 in Singapore. The series, previously held in Dubai, Las Vegas, and New York, discusses Bitcoin's role in DeFi and staking.

Significantly, Developer Relations Office Hours resumed on August 26 at 2 p.m. UTC. These sessions allow interactions with Core contributors for project guidance and questions, supporting builder engagement.

Conclusion

Core DAO's updates demonstrate its capabilities in non-custodial Bitcoin staking, EVM-compatible smart contracts, and proof-of-stake consensus secured by Bitcoin. The network supports yields of around 5% on staked Bitcoin, integrates with custody providers like Hex Trust and BitGo, and processes high transaction volumes, with 9.8 million transactions in the last 30 days.

Protocols such as BITS Financial and Colend offer specific yield rates, while events like Missions campaigns provide reward structures tied to activity. These elements enable institutional and retail users to engage with Bitcoin DeFi on the Layer 1 blockchain.

Sources:

- Core Insider Issue 7, Core DAO Blog: https://coredao.org/blog/core-insider-issue-7

- Core DAO Official X Account @Coredao_Org

- BitGo Case Study: https://www.bitgo.com/resources/case-studies/coredao/

- Core DAO Partnership with Hex Trust: https://blockchainreporter.net/core-partners-with-hex-trust-to-offer-institutional-bitcoin-staking-across-apac-and-mena/

Read Next...

Frequently Asked Questions

What partnerships did Core DAO announce in late August 2025?

Core DAO partnered with Hex Trust for institutional dual staking and added P2P.org as a validator, enhancing custody and network security.

What are the key metrics from Core DAO's Q2 2025 report?

Staked value hit $706 million, up 30% quarter-over-quarter, with DEX volume rising 132% and 9.8 million transactions in 30 days.

What new protocols were launched on Core DAO in August 2025?

Protocols include BITS Financial for Bitcoin yields, Colend with an APY of over 40% on stCORE, and ASX Capital's real estate NFT offering with an APR of 8.5%.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens