Chainlink’s LINK Token: Full 2025 Analysis

Chainlink has become a cornerstone of the entire cryptocurrency ecosystem, but few truly understand its LINK token and why it's so important. Learn now.

UC Hope

July 8, 2025

Table of Contents

Chainlink, a leading decentralized oracle platform, has become a cornerstone of blockchain technology by connecting smart contracts to real-world data. At the heart of this ecosystem lies the $LINK token, a cryptocurrency driving the network’s operations.

This article offers an in-depth analysis of the LINK token, examining its tokenomics, use cases, current value, and key integrations within the blockchain and Web3 ecosystems.

Inside Chainlink and the LINK Token

As mentioned earlier, Chainlink is a decentralized oracle network that enables blockchain smart contracts to securely access off-chain data, including price feeds, weather information, and compliance records. This functionality is critical for applications in Decentralized Finance (DeFi), tokenized assets, and traditional finance. Its native asset, LINK, powers the network by facilitating payments, staking, and potentially governance.

With a total supply of 1 billion tokens and over 600M in circulation, LINK is a vital component of Chainlink’s ecosystem. Its utility and integrations with major institutions, such as Mastercard, among others, have made it a prominent player in the cryptocurrency market.

LINK Tokenomics: A Fixed Supply and Utility-Driven Model

Total Supply and Circulation

The LINK token has a fixed total supply of 1 billion, with no additional tokens to be minted. This scarcity model supports potential value appreciation as demand grows. According to CoinMarketCap data, 678M tokens are in circulation.

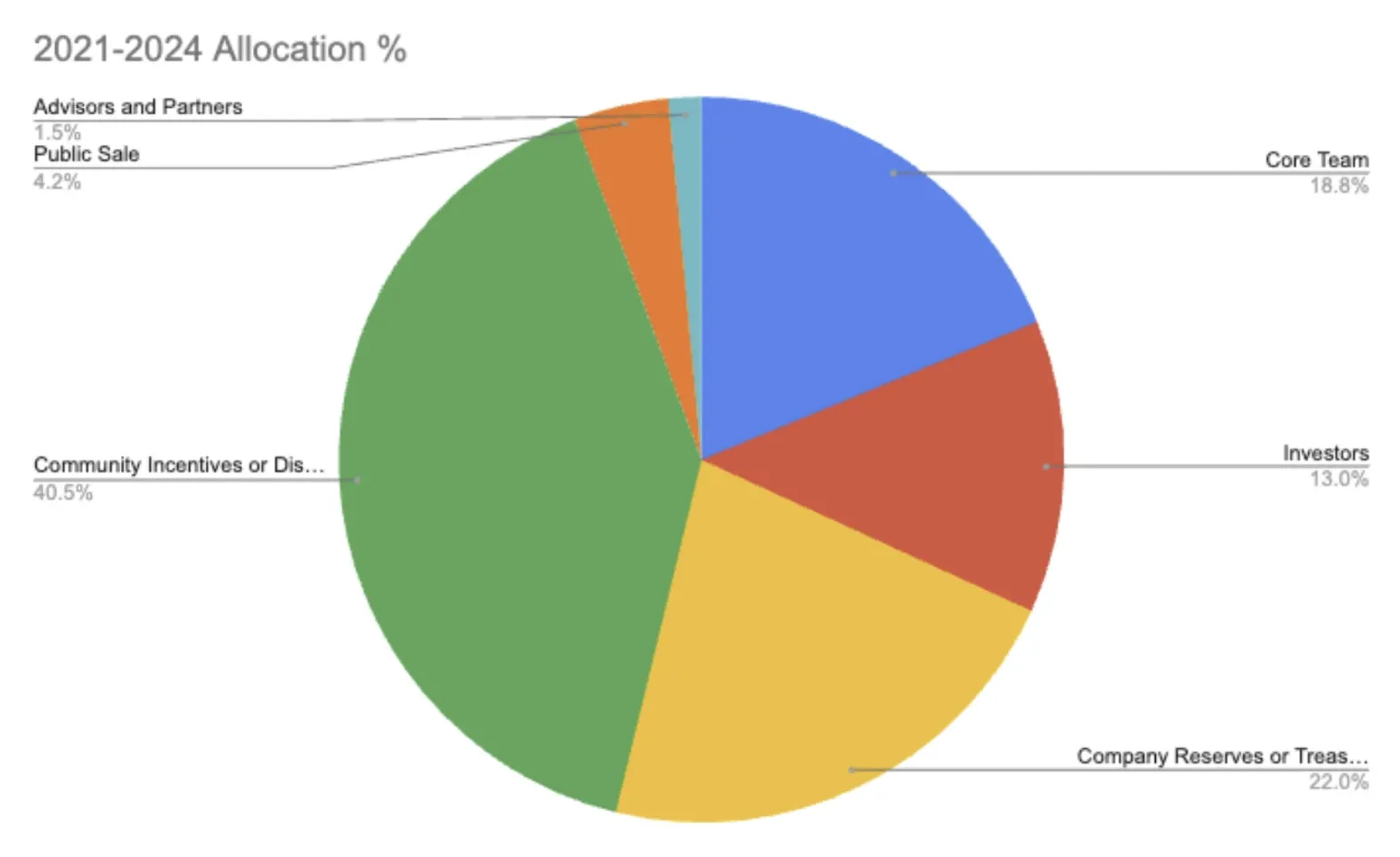

Initial Token Allocation

Upon its launch, the LINK token’s distribution was divided among three categories, a simpler structure compared to the industry standard of 5–7 partitions, as shown in the image above. The allocation is as follows:

- Node Operators & Ecosystem (35%): 350 million LINK tokens were allocated for ecosystem development and maintenance, including incentives for node operators. This share aligns with market standards, which typically range from 35% to 47% for ecosystem purposes.

- Company (30%): 300 million LINK tokens were reserved for Chainlink Labs, the project’s development team. This allocation is within the market norm of 20–30% for company use, supporting operational and strategic initiatives.

- Public Sale (35%): 350 million LINK tokens were distributed through public sales to a broad range of investors. Notably, this share exceeds the average market allocation for public sales by over seven times, as industry standards typically allocate around 5% for this purpose.

Utility of LINK

LINK serves multiple functions within the Chainlink ecosystem:

1. Payment for Node Operators: Node operators who provide data to smart contracts are paid in LINK. This incentivizes reliable data delivery.

2. Staking and Collateral: Operators stake LINK as collateral to guarantee data accuracy. Incorrect data risks forfeiting staked tokens.

3. Paying for Services: Users of the Chainlink network pay with LINK for accessing data feeds and other services.

4. Potential Governance: While not yet implemented, LINK could enable token holders to vote on network upgrades, enhancing decentralization.

This utility-driven model ties LINK’s value to network activity, with increased adoption likely to boost demand.

Use Cases: Powering Blockchain Applications

Chainlink’s ability to bridge blockchains with real-world data makes it indispensable for various sectors. The LINK token underpins these use cases, which include:

Decentralized Finance (DeFi)

DeFi platforms rely on Chainlink for accurate price feeds and financial data. Protocols such as decentralized exchanges and lending platforms utilize Chainlink oracles to ensure secure and reliable transactions. LINK’s role in facilitating these data feeds is critical to DeFi’s growth.

Tokenized Assets

Tokenized real-world assets, such as real estate or commodities, require data like proof of reserve or net asset value (NAV). Chainlink provides this information to ensure transparency and compliance. LINK powers these data feeds, supporting the tokenized asset market.

Traditional Finance Integration

Chainlink bridges blockchain with traditional finance by supplying identity and compliance data. Partnerships with institutions like Swift and Euroclear highlight its role in enabling banks and asset managers to adopt blockchain technology. LINK facilitates these integrations, driving institutional adoption.

Cross-Chain Interoperability

As blockchains move toward interoperability, Chainlink enables secure data transfer between networks. This functionality, powered by LINK, enables seamless communication across ecosystems such as Ethereum and Polygon.

Decentralized Compute

Chainlink’s off-chain computation capabilities expand the functionality of smart contracts. By handling complex calculations off-chain, Chainlink supports advanced applications, with LINK incentivizing node operators.

General Decentralized Applications (dApps)

Chainlink provides any data dApps require, from gaming to supply chain management. LINK’s versatility makes it a foundational tool for blockchain developers.

LINK Token Value: Current Price and Market Dynamics

LINK is currently priced at $13.29, with a market capitalization of approximately $9 billion and a fully diluted valuation of $13.33 billion. This price reflects LINK’s utility and adoption across blockchain sectors.

Factors Driving Value

Several factors influence LINK’s value:

- Utility Demand: As more projects integrate Chainlink, demand for LINK to pay node operators and stake collateral grows.

- Fixed Supply: With 1 billion tokens in circulation, increased adoption can drive price appreciation.

- Network Effects: More node operators and integrations enhance Chainlink’s reliability, boosting LINK’s value.

- Technological Advancements: Developments like cross-chain interoperability and decentralized compute increase Chainlink’s appeal.

Key Integrations: Bridging Blockchain and Real-World Systems

Chainlink’s integrations with blockchain and traditional sectors underscore the importance of LINK. Notable partnerships include:

- Financial Institutions: Collaborations with Swift, Euroclear, and Fidelity enable blockchain adoption in cross-border payments and asset management. LINK powers these data feeds.

- Telecommunication Providers: Partnerships with Deutsche Telekom, Swisscom, and Vodafone integrate Chainlink with Web2 infrastructure, enhancing its credibility.

- Web3 Infrastructure: Integration with Infura ensures compatibility with blockchain development tools, supporting developers.

- DeFi Protocols: Chainlink’s data feeds are integral to leading DeFi platforms, driving LINK demand.

- Tokenized Assets: Chainlink supports tokenized asset projects with compliance and transparency data, powered by LINK.

These integrations position Chainlink as a trusted oracle network, with LINK as its economic backbone.

Conclusion: The Future of LINK

As blockchain adoption grows, Chainlink’s role as a decentralized oracle network will likely expand, driving demand for LINK. Its integrations with major institutions and advancements in cross-chain interoperability and tokenized assets position it for long-term success. For investors, developers, and blockchain enthusiasts, LINK remains a token to watch.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events