BNB Chain’s DeFi Protocol: What is Lista DAO?

Operating primarily on the BNB Chain and Ethereum, it offers users the ability to stake BNB and receive slisBNB, a liquid staking token that accrues rewards while maintaining liquidity.

Soumen Datta

April 14, 2025

Table of Contents

Lista DAO has officially launched its open-source liquidity and lending platform, Lista Lending on BNB Chain. With the debut, Lista DAO brings decentralized borrowing, liquid staking, and its own stablecoin—lisUSD—under one unified framework.

Backed by Binance Labs and designed to operate across both BNB Chain and Ethereum, Lista DAO introduces a suite of tools for users to earn, borrow, and build without needing to liquidate their assets.

What is Lista DAO?

Lista DAO is a decentralized autonomous organization that runs an open-source DeFi protocol. Its mission is straightforward: let users unlock liquidity from crypto assets while still holding onto them. The platform enables borrowing of lisUSD, a stablecoin that isn’t just pegged to the dollar—it’s designed to be stable but decentralized, earning it the nickname “destablecoin.”

The protocol supports assets like BNB, ETH, and stablecoins. In doing so, it positions lisUSD as a currency for trading, staking, and payments, even in unstable markets.

The Dual-Token Model: LISTA and lisUSD

Central to Lista DAO is its dual-token structure:

- LISTA: The governance token. Holders can vote on protocol upgrades, stake for rewards, and pay fees. The total supply is capped at 1 billion, with around 18% currently circulating.

- lisUSD: A decentralized stablecoin. It’s minted when users lock up collateral via Collateralized Debt Positions (CDPs). Think of lisUSD as a loan that doesn’t require you to sell your crypto. This gives users instant liquidity, without losing exposure to long-term holdings.

This design mimics the model that made MakerDAO a success, but Lista DAO aims to be more nimble—thanks to its emphasis on cross-chain functionality, high-yield mechanisms, and meme-friendly liquidity.

Lista Lending: Rewiring DeFi Lending Models

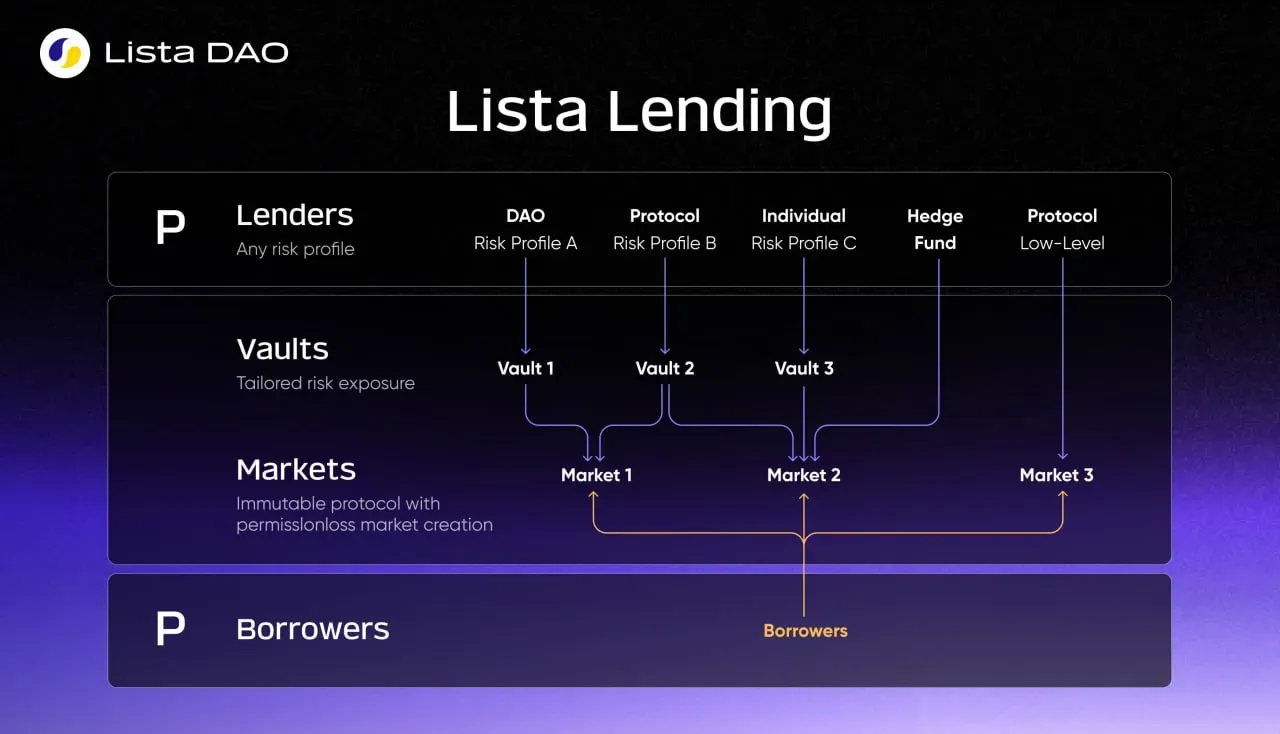

At the heart of Lista DAO’s offering is Lista Lending, a permissionless peer-to-peer lending engine inspired by protocols like Morpho. While many DeFi platforms rely on large, shared liquidity pools, Lista Lending moves in a different direction.

Instead, it uses a vault and market system:

- Vaults are collections of assets that are distributed across multiple lending markets. Vault managers, known as curators, ensure risk is controlled. Deposits and withdrawals are seamless, with no lock-up period.

- Markets are isolated lending pools. Each pairs one loan asset with one collateral asset—like BNB/USDT. Since every market is separate, risks are contained. No protocol-wide contagion. Anyone can create a market, without needing governance approval.

This model reportedly gives users more control. Whether you’re a borrower, a supplier, or a protocol looking for efficient capital allocation—Lista Lending lets you customize your exposure.

Who Can Use Lista Lending?

Suppliers can be individuals, DAOs, hedge funds—anyone looking to earn yield. They can deposit directly into vaults or target specific lending markets.

Borrowers have the flexibility to choose loan terms and collateral types that suit their risk profile. With variable interest rates and curated Participants of Lista Lending (Image: Lista DAO), Lista Lending builds a diverse landscape for on-chain borrowing.

The Bigger Vision: Lista DAO’s 2025 Roadmap

Lista DAO isn’t stopping with lending and stablecoins. The team has laid out a clear plan for the future, focusing on three key areas:

Boosting veLISTA Utility

Users who lock their LISTA tokens receive veLISTA, a vote-escrowed version with added perks. New incentives include:

- Lower interest rates

- Delayed liquidation protections

- Exclusive perks and tiered staking rewards

- A buyback-and-burn model will also support token value.

Scaling lisUSD Adoption

Lista DAO plans to expand lisUSD beyond BNB Chain. Ecosystems lacking reliable stablecoins—particularly emerging chains—are key targets. With lisUSD already integrated into memecoin trading pairs, it has potential to become DeFi’s meme-friendly stablecoin of choice.

Cross-Chain Growth of clisBNB

Liquid staking is a major pillar. Through partnerships with StakeStone, Solv, and others, Lista aims to push its clisBNB token across multiple blockchains, including Ethereum. This will unlock access to Binance’s Launchpool, Megadrop, and more—with estimated returns up to 30% APR.

Fusing DeFi with Meme Culture

- The recent lisUSD–Four.Meme Partnership makes lisUSD the first stablecoin positioned for meme token liquidity. It’s now part of pools with popular BNB-based memes like CHEEMS and TST.

- The slisBNB–Pendle Finance Integration creates a new breed of DeFi product:

- YT-clisBNB (Yield Token): Auto-earns Binance Launchpool airdrops.

- PT-clisBNB (Principal Token): Offers fixed returns—perfect for conservative investors.

- LP-clisBNB: Combines staking rewards with Launchpool access and liquidity incentives.

Bitcoin Enters the Picture with SolvBTC.BNB

Lista DAO’s partnership with Solv Protocol introduces SolvBTC.BNB—a Bitcoin-native yield-bearing asset. BTC holders can now earn BTC-denominated rewards across BNB Chain, something rarely seen in DeFi.

This product combines the stability of BTC with the flexibility of Binance’s incentive programs.

By offering:

- A scalable, secure stablecoin (lisUSD)

- Flexible lending through curated vaults

- Liquid staking with real incentives

- Integration with meme culture and DeFi protocols

Lista DAO aims to build something that goes beyond simple crypto lending.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens