Solana Q2: Revenue Slump While DeFi Growth Stays Strong

Messari’s Solana Q2 2025 report shows mixed performance with lower Chain GDP, strong DeFi TVL growth, and evolving memecoin and payments activity.

Soumen Datta

August 18, 2025

Table of Contents

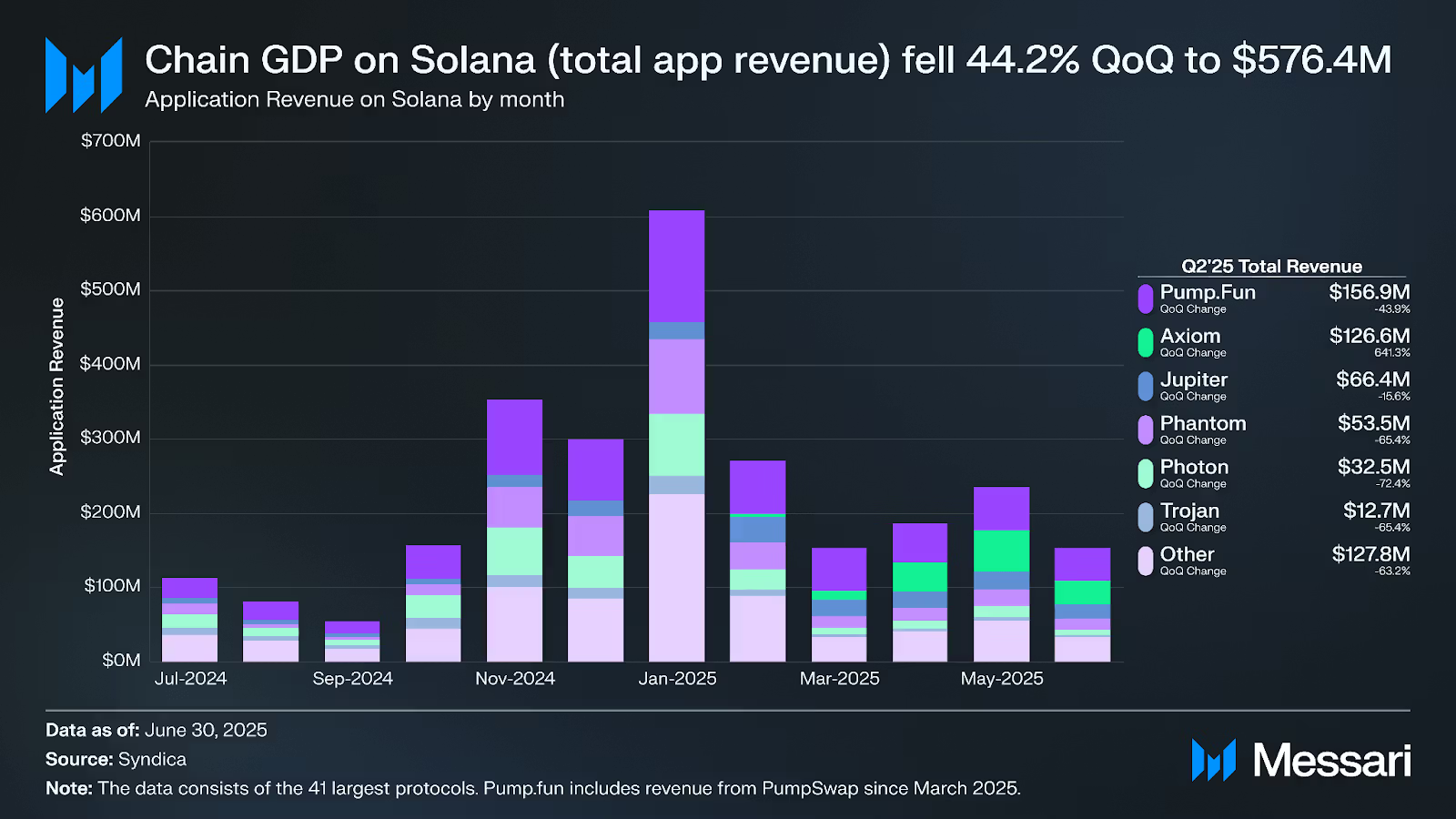

Messari’s Q2 2025 report shows that Solana’s network remained active despite revenue declines across applications and exchanges. While overall Chain GDP fell by 44.2% quarter-over-quarter (QoQ), Solana retained its position as the second-largest DeFi ecosystem by total value locked (TVL).

Growth in liquid staking, real-world assets (RWA), and decentralized infrastructure applications offset declines in decentralized exchange (DEX) volumes and NFT trading.

This article breaks down Solana’s Q2 performance across key areas: app revenues, DeFi, DEX activity, stablecoins, RWAs, staking, gaming, payments, and network security.

Chain GDP and Application Revenues

Solana’s Chain GDP dropped from $1 billion in Q1 to $576.4 million in Q2 2025, reflecting lower speculative activity. Application revenues varied widely:

- PumpFun: $156.9 million (down 43.9% QoQ)

- Axiom: $126.6 million (up 641.3% QoQ)

- Jupiter: $66.4 million (down 15.6% QoQ)

- Phantom: $53.5 million (down 65.4% QoQ)

- Photon: $32.5 million (down 72.4% QoQ)

The standout was Axiom, a trading platform launched in January 2025, which gained traction with memecoin traders through its SOL reward system.

Application Revenue Capture Ratio (App RCR)

Messari defines App RCR as the ratio of app revenue to Real Economic Value (REV). A higher RCR means applications are capturing more value from network activity.

- Q2 2025 App RCR: 211.6% (up 67.3% from Q1’s 126.5%)

This indicates that for every $100 spent in transaction fees, Solana applications generated $211.60 in revenue. The increase suggests more mature monetization across apps, even during a slowdown in speculative trading.

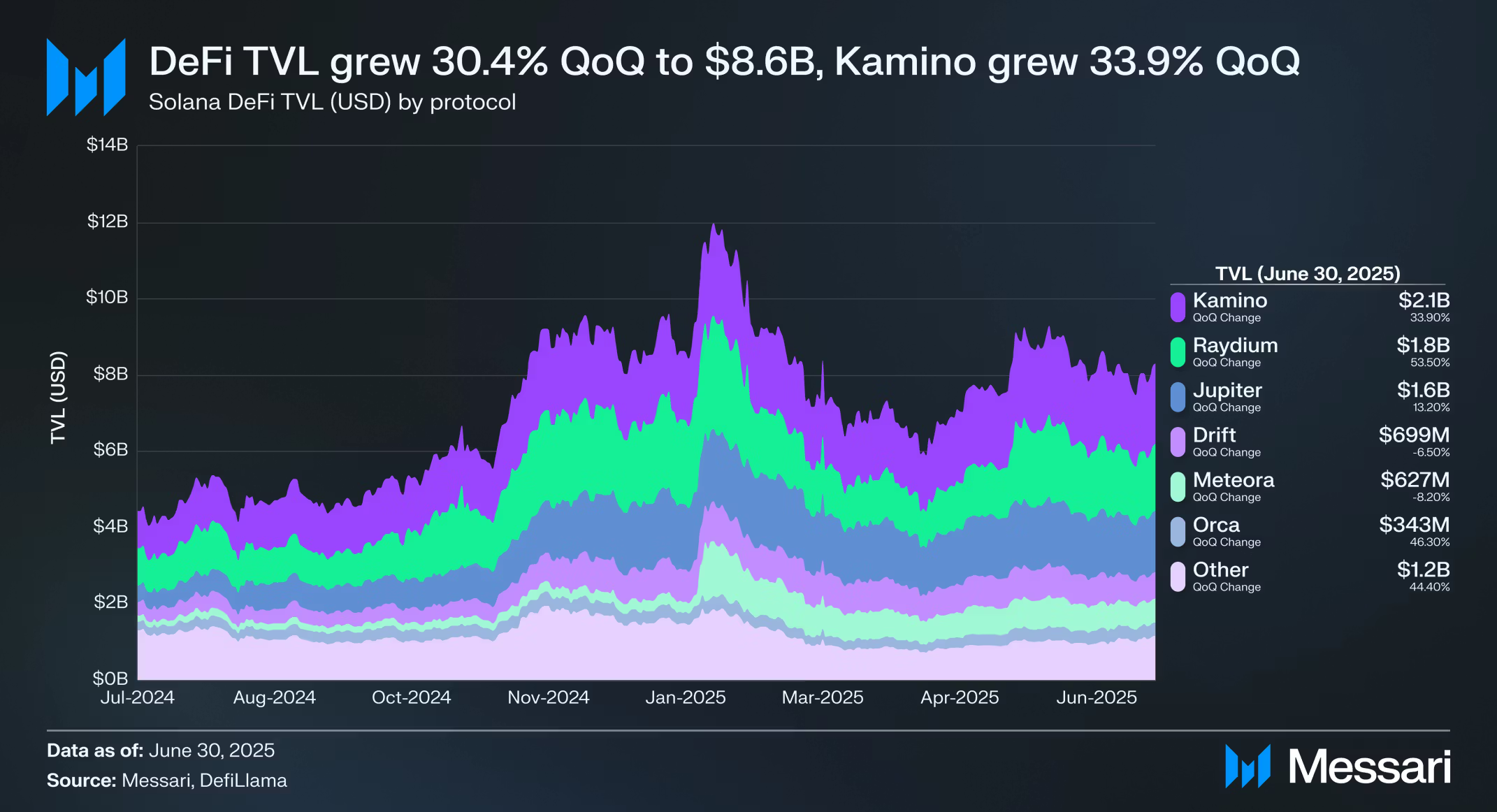

DeFi: Total Value Locked (TVL)

Solana’s DeFi ecosystem expanded, with TVL growing 30.4% QoQ to $8.6 billion. The network retained its second-place position behind Ethereum.

- Kamino: $2.1 billion TVL (33.9% QoQ growth)

- Raydium: $1.8 billion TVL (53.5% QoQ growth)

- Jupiter: $1.6 billion TVL (13.2% QoQ growth)

Kamino launched Lend V2 in May, crossing $200 million in deposits within weeks. Raydium reclaimed second spot with over 21% of Solana’s DeFi market share.

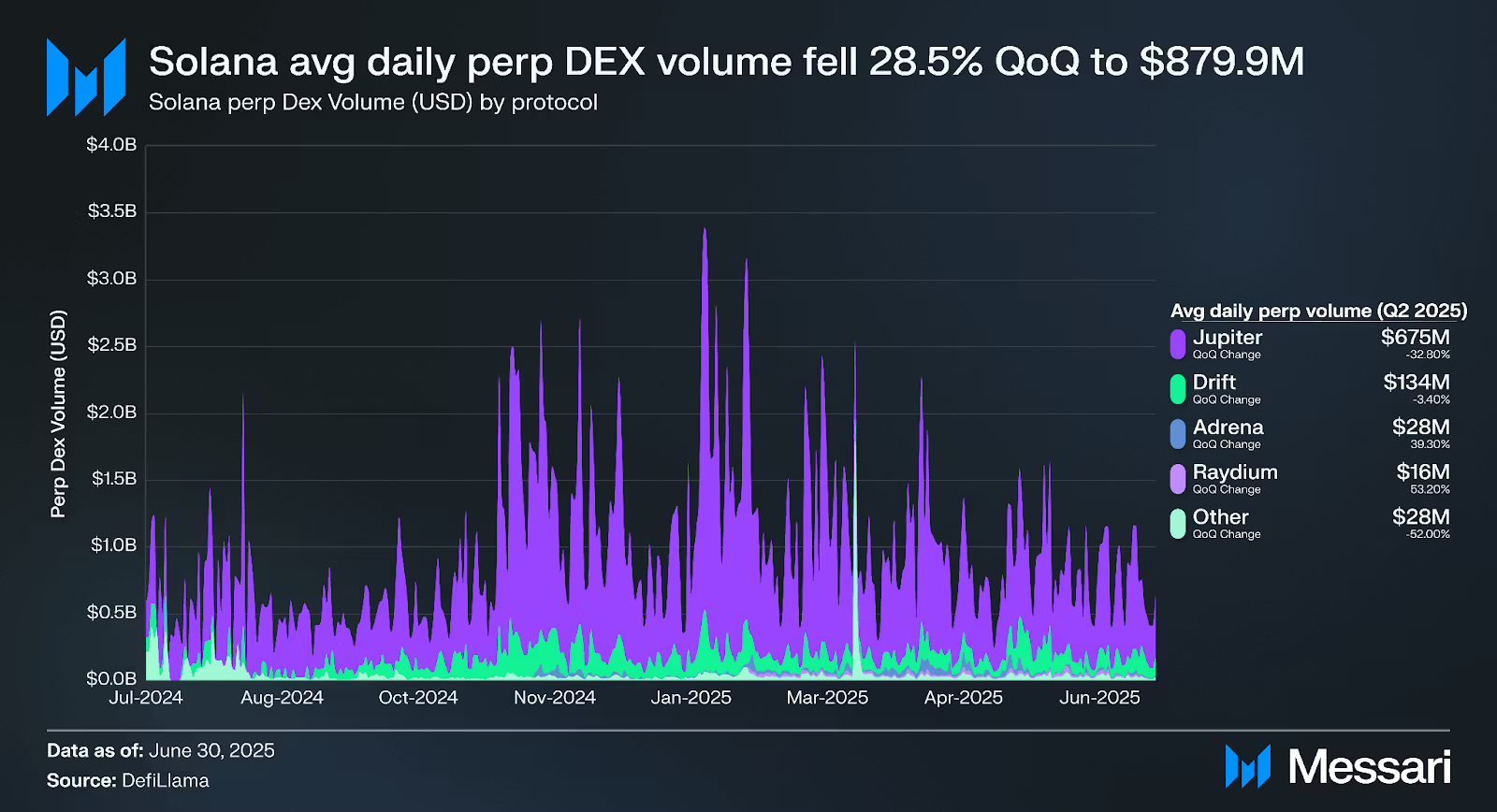

DEX Volumes and Memecoin Activity

Average daily spot DEX volume declined 45.4% QoQ to $2.5 billion, totaling $1.2 trillion for the first half of 2025. This drop was linked to reduced memecoin trading.

- Raydium: $701.1 million daily volume (down 64.9%)

- Orca: $560.5 million daily volume (down 37.5%)

- PumpFun: $544 million (up 124.3% QoQ after launching PumpSwap)

Despite lower overall volumes, PumpFun rose sharply after replacing Raydium as the primary trading venue for its tokens.

Stablecoins on Solana

Stablecoin market cap fell 17.4% QoQ to $10.3 billion, ranking Solana third among networks.

- USDC: $7.2 billion (down 25.2%, 69.5% market share)

- USDT: $2.3 billion (flat, 22.4% share)

- FDUSD: $303.6 million (up 192.3%)

The TRUMP token launch in January brought liquidity to Solana pairs, but Q2 saw outflows from USDC balances.

Real-World Assets (RWA)

RWAs continued to expand, reaching $390.6 million in value, a 124.8% YTD increase.

- Ondo Finance’s USDY: $175.3 million

- OUSG: $79.6 million

- ACRED: $26.9 million

- BlackRock’s BUIDL: $25.2 million

These tokenized assets brought institutional players like BlackRock and Apollo into the Solana ecosystem.

Liquid Staking

The liquid staking rate rose from 10.4% to 12.2% of circulating SOL. Over 64% of total SOL supply is staked.

- jitoSOL: $2.8 billion (38% share, down 6%)

- bnSOL: $1.4 billion (18.9% share, slightly down)

- jupSOL: $783.6 million (10.7% share, up 7.4%)

Consumer Ecosystem: NFTs and Gaming

NFT activity slowed, with average daily trading volume falling 46.4% QoQ to $979.5 million. Despite the decline, Solana continues to lead in creator royalties.

Gaming updates included:

- Solana Game Pass minted on Magic Eden in April.

- Star Atlas rolled out multiplayer upgrades.

- MixMob launched on iOS and Android as the first card-racing game on Solana.

- Shaga released its whitepaper for decentralized cloud gaming.

Payments and DePIN

Solana strengthened its payment and infrastructure use cases:

- Worldpay joined the Global Dollar Network.

- Fiserv and Circle partnered to advance stablecoin payments.

- Helium Mobile reached over 980,000 daily users.

- Hivemapper mapped 34% of global road coverage, adding Volkswagen and Lyft as partners.

Network Metrics and Security

- Transaction Fees: Average fee dropped 59.6% QoQ to $0.01.

- Validators: 1,058 active validators across 39 countries.

- Nakamoto Coefficient: Improved to 21, indicating stronger decentralization.

- Total Stake: $60 billion in Q2, up 25.2% QoQ.

Financial Metrics

- SOL Market Cap: $82.8 billion (up 29.8% QoQ), maintaining 6th place globally.

- Real Economic Value (REV): $272.3 million, down 53.9% QoQ.

- ETF Update: The SEC approved Rex Osprey’s Solana Staking ETF (ticker: SSK) in late June.

Conclusion

The Q2 2025 Messari report shows a mixed picture for Solana. Chain GDP and DEX volumes dropped, reflecting lower speculative activity. At the same time, DeFi TVL, RWAs, liquid staking, and infrastructure use cases expanded. Stablecoin balances fell but institutional adoption through RWAs and payment integrations gained momentum.

Solana’s performance in Q2 highlights a maturing ecosystem—with diversified use cases in DeFi, payments, and infrastructure—even as speculative trading slowed.

Resources:

Messari Solana Q2, 2025 report: https://messari.io/report/state-of-solana-q2-2025

REX-Osprey’s Solana staking ETF approval report by The Block: https://www.theblock.co/post/364222/rex-ospreys-solana-staking-etf-to-pass-on-100-of-rewards-to-shareholders-as-it-integrates-jitosol

Hivemapper global road coverage data: https://www.hivemapper.com/coverage

Read Next...

Frequently Asked Questions

1. What was Solana’s Chain GDP in Q2 2025?

Solana’s Chain GDP was $576.4 million, down 44.2% from Q1 2025.

2. How did Solana perform in DeFi during Q2 2025?

Solana’s DeFi TVL rose 30.4% to $8.6 billion, keeping it second among all networks.

3. What is Solana’s App RCR, and why is it important?

App RCR was 211.6% in Q2, meaning apps captured more revenue than total transaction fees, showing effective monetization.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens