What is Venus Protocol: DeFi on BNB

Venus Protocol is a leading multi-chain DeFi platform, offering innovative lending and borrowing solutions. Explore Venus's advanced infrastructure, strategic expansion, and ecosystem development.

Crypto Rich

February 21, 2025

Table of Contents

Venus Protocol, launched in November 2020 on BNB Chain (formerly Binance Smart Chain), has grown into one of the ecosystem's most significant decentralized finance platforms. As a non-custodial, algorithmic money market, Venus has transformed the DeFi lending landscape by enabling users to lend, borrow, and mint synthetic assets with unprecedented efficiency.

What is Venus Protocol?

Venus Protocol is a sophisticated lending and borrowing platform bringing traditional finance to DeFi. Users can supply various cryptocurrencies to earn interest or borrow against collateral. A key platform innovation is VAI, a synthetic stablecoin that maintains a 1:1 USD peg through algorithmic mechanisms.

The protocol features dual interest rate models (Jump Rate and Whitepaper Rate), and since the launch of Venus V4, stable rate markets and real-time collateral evaluation systems have been introduced. Risk management utilizes isolated pools for high-volatility tokens backed by a three-tiered risk fund system (ProtocolShareReserve, RiskFund, and ReserveHelpers) that handles fee accumulation and shortfall management through structured auctions.

Security is ensured through Venus's Resilient Oracles, integrating trusted sources like Chainlink, RedStone, Pyth Network, and Binance Oracles.

Security remained a cornerstone with comprehensive audits from CertiK, Quantstamp, PeckShield, OpenZeppelin, Code4rena, Hacken, and Cantina, alongside continuous monitoring and community-governed risk parameters.

Venus in Numbers

According to Venus Protocol's January 2025 performance report, the platform achieved remarkable growth throughout 2024, demonstrating its significant position in the DeFi ecosystem:

- 2024 Financial and Market Performance:

- Total Value Locked (TVL): Reached $1.9 billion across all chains, positioning Venus as 6th among lending protocols

- Net Deposits: Grew 58.3% during 2024 to reach $1.69 billion

- Fee Generation: Increased 106% over the year to $105.2 million

- Protocol Reserves: Rose 61.5% throughout 2024 to $142 million

- Bad Debt Reduction: Achieved 99.9% reduction in 2024, from $100M to $36K

XVS Tokenomics

The XVS token is the cornerstone of Venus Protocol's DAO governance system, with a fixed supply of 30 million XVS and a current circulating supply of 16,56 Million XVS tokens. The governance structure has proven highly effective, as demonstrated by recent metrics showing staking participation increasing by 17% to reach 7.9 million tokens. The token holder base has grown substantially, expanding by 21% to nearly 80,000 addresses, reflecting increasing confidence in the protocol and its governance model.

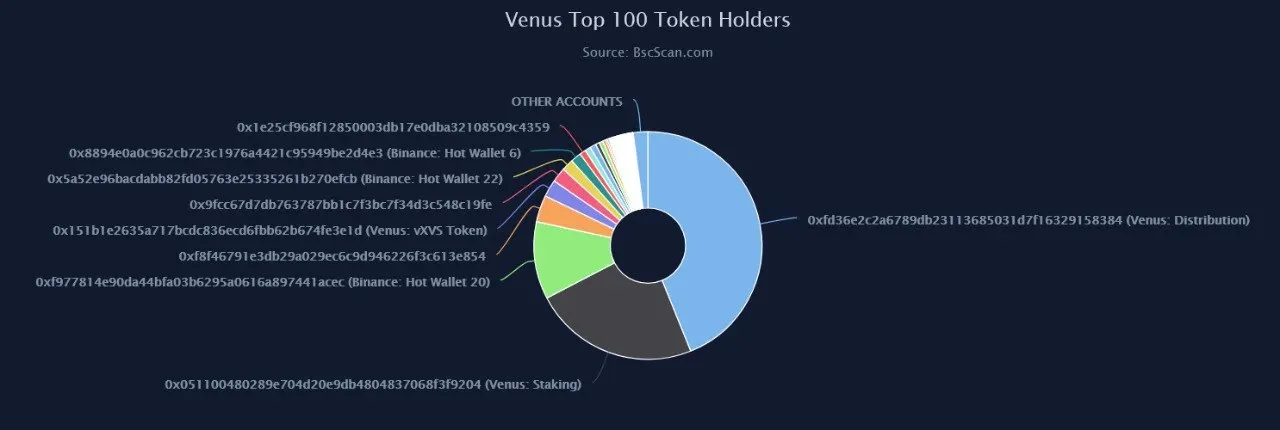

Token Distribution and Market Presence

Venus Protocol maintains a healthy token distribution with nearly 80,000 holders on BNB Chain. The majority of top holders consist of smart contracts and exchange wallets, with only four undisclosed addresses holding more than 0.5% of the supply. This distribution pattern ensures governance power remains well-distributed among stakeholders.

Venus Prime: Innovative Rewards Program

Venus Protocol has introduced Venus Prime, a incentive program within Venus Tokenomics v3.1. What sets this program apart is its self-sustaining nature – rather than relying on external funding, rewards are generated directly from protocol revenue, focusing on major markets including USDT, USDC, BTC, and ETH.

The program centers around unique Soulbound Tokens that boost user rewards. To participate, users must stake at least 1,000 XVS for 90 consecutive days to mint a non-transferable Prime Token, with a current limit of 500 tokens on BNB chain. The reward system uses a sophisticated Cobb-Douglas function that factors in staked amounts (capped at 100,000 XVS) and market participation levels. This structure creates meaningful incentives – for example, users staking 1,200 XVS while actively participating in markets can see significant APY improvements, fostering both protocol engagement and user benefits.

Developments and Expansion

Venus Protocol's growth strategy has focused on expanding access and utility across multiple blockchain networks. The protocol's omnichain infrastructure, powered by LayerZero's XVS bridges, enables seamless cross-chain operations. This integrated system currently manages over $1.9 billion in TVL across all chains, with full omnichain governance planned for 2025 to further enhance cross-chain management capabilities.

This expansion has positioned Venus as a truly cross-chain lending platform with sophisticated integrations across various ecosystems:

- Active Networks and Integration:

- BNB Chain: Home network with established liquidity

- Ethereum: Core integration with the largest DeFi ecosystem

- Arbitrum One: Enhanced scalability solution

- opBNB: Optimized BNB Chain scaling solution

- zkSync Era: Advanced zero-knowledge infrastructure

- Optimism: Layer-2 optimization deployment

- Base: Emerging network expansion

- Uniswap's Unichain: Latest platform integration

A notable recent development is the February 2025 announcement of a possible strategic soft merger with THENA, a trading hub and liquidity layer on BNB Chain. This initiative, pending DAO approval, aims to enhance yield opportunities and improve capital efficiency within the ecosystem.

Innovation Pipeline and 2025 Roadmap

Looking ahead, Venus Protocol has outlined an ambitious roadmap for 2025. The first quarter will see the deployment of Venus V5, alongside the the launch of the Arbitrum and ZKsync-Ignite Grants program. The protocol has also formed strategic partnerships with industry leaders like Chaos Labs, implementing advanced risk management tools such as the Edge Risk Oracle and TwoKinksInterestRate models.

Additional partnerships with LidoFinance, FraxFinance, and CurveFinance among others have expanded the protocol's ecosystem integration. The recent launch on Uniswap's Unichain further demonstrates Venus Protocol's commitment to accessibility and cross-chain functionality.

Conclusion

Venus Protocol's journey from its launch in 2020 to its current position as a leading DeFi Lending platform demonstrates the potential of decentralized finance. Through careful risk management, strategic expansion, and continuous innovation, Venus has established itself in the DeFi ecosystems.

The protocol's impressive growth metrics, successful multi-chain expansion, and robust governance model position it strongly for continued success. Providing essential financial services to an expanding global user base.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens