Arbitrum Deep Dive: Layer 2 Scaling Ethereum's Future

Arbitrum leads Ethereum Layer 2 scaling with 35.3% market share, 2.06B transactions, and $17.80B TVL through optimistic rollup technology.

Crypto Rich

August 7, 2025

Table of Contents

Arbitrum has emerged as Ethereum's most successful Layer 2 scaling solution, commanding 35.3% of the L2 market through its optimistic rollup technology that reduces transaction costs while maintaining Ethereum's security guarantees. Developed by Offchain Labs, this scaling infrastructure has processed over 2.06 billion transactions, secured $17.80 billion in Total Value Locked (TVL) as of August 7, 2025, and saved users 4.01 million ETH in gas fees.

The numbers paint a compelling picture of sustained growth and real-world utility that extends far beyond typical blockchain metrics.

What Makes Arbitrum Different from Other Layer 2 Solutions?

Arbitrum's architecture centers on optimistic rollups, a technology that assumes transaction validity unless challenged within a seven-day dispute window. This differs from zero-knowledge rollups used by competitors like Polygon zkEVM or StarkNet, which prove correctness upfront through complex mathematical proofs.

The system works by processing transactions through sequencers that bundle multiple operations into single batches before posting compressed data to the Ethereum mainnet. Users get near-instant confirmations while keeping Ethereum's base layer security through the dispute resolution mechanism.

Core Technical Architecture

Arbitrum's technical foundation relies on several interconnected components that work together to process transactions efficiently while maintaining security.

Users submit transactions to Arbitrum sequencers, which order and execute them in an Ethereum Virtual Machine (EVM) compatible environment. Think of these sequencers as the first point of contact—they provide immediate transaction confirmations while staying compatible with existing Ethereum tooling and applications.

The system then compresses transaction batches and posts them to Ethereum as calldata. This creates an immutable record on the base layer while dramatically reducing the data footprint through smart compression techniques that preserve all necessary information for transaction verification.

Security comes through a fraud proof system with a seven-day challenge period where any validator can dispute invalid state transitions. When disputes arise, the system uses interactive fraud proofs that break down contested computations into smaller steps. This continues until reaching a single instruction that Ethereum can verify directly, ensuring even complex disputes get resolved efficiently without overwhelming the base layer.

Bounded Liquidity Delay Protocol

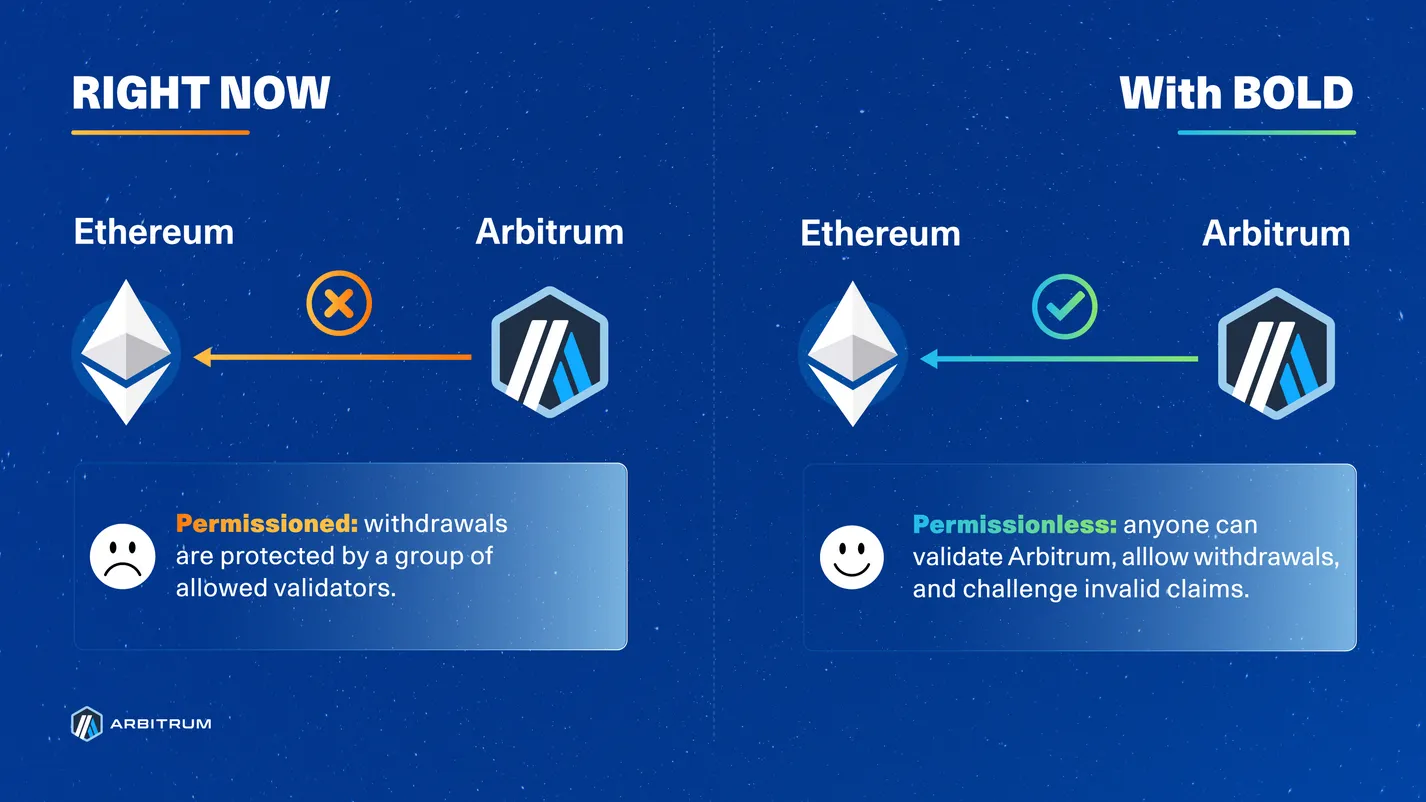

The recently implemented BoLD protocol is a major step forward in decentralized validation. This system enables permissionless validation through an "all-vs-all" dispute mechanism where multiple validators can simultaneously challenge the same assertion.

Traditional dispute systems handle challenges one at a time, creating potential bottlenecks. BoLD takes a different approach by resolving conflicts through a tournament-style elimination process. This prevents bad actors from delaying finality through repeated frivolous challenges while ensuring legitimate disputes get proper consideration.

The protocol maintains security by requiring validators to post bonds when making challenges. This creates real economic incentives for honest behavior—successful challengers recover their bonds plus rewards, while unsuccessful challengers forfeit their stakes to the protocol treasury.

Additional Technical Features

Arbitrum supports Stylus for writing smart contracts in Rust or C++, expanding development beyond Solidity's limitations. This opens the door for developers from diverse programming backgrounds while potentially improving contract performance and security.

Transaction fees split into L1 (Ethereum posting) and L2 (execution) components, typically costing 10-100x less than Ethereum mainnet. Block times are optimized at 250ms as of 2025, with specialized chains like Converge pushing it down to 50ms (planned Q4 2025) for applications that need ultra-low latency.

History and Background

Arbitrum's roots trace back to 2018 when Offchain Labs was founded by Ed Felten, Steven Goldfeder, and Harry Kalodner—former Princeton researchers who saw blockchain scalability as the key challenge facing mass adoption. Their project aimed to solve Ethereum's high gas fees and congestion through optimistic rollups, a technology that assumes transactions are valid unless someone challenges them.

Foundation and Early Development

2021 Foundation: Arbitrum One launched as Ethereum's first production-ready optimistic rollup. DeFi protocols seeking lower transaction costs flocked to the platform immediately, with early adopters like Uniswap and SushiSwap providing the liquidity foundation that would fuel ecosystem growth.

2022 Expansion: The team introduced Arbitrum Nova for data availability optimization and Arbitrum Orbit for custom chain deployment. These weren't just incremental updates—they transformed Arbitrum from a single scaling solution into a comprehensive infrastructure platform that others could build on.

Decentralization and Governance

2023 Decentralization: The ARB token airdrop distributed governance rights to over 625,000 addresses, establishing the Arbitrum DAO. This marked the protocol's evolution from centralized development to community governance, though not without some early coordination challenges.

2024-2025 Maturation: Recent developments include permissionless validation through BoLD, multi-language smart contract support via Stylus, and major institutional partnerships with companies like Robinhood and PayPal. The platform has clearly moved beyond the experimental phase into mature infrastructure territory.

What Are Arbitrum's Key Technical Advantages?

Arbitrum's technical implementation delivers measurable improvements over both the Ethereum mainnet and competing L2 solutions. The platform's architecture provides speed, cost savings, and functionality while keeping the security guarantees that make Ethereum valuable for serious applications.

Performance Metrics and Capabilities

Current performance specs show significant improvements over Ethereum's base layer across multiple metrics. Transaction throughput benefits from block times optimized to 250 milliseconds, with some Arbitrum Orbit chains hitting 50-millisecond finality for applications that can't afford to wait.

Gas costs are typically 10-100x cheaper than Ethereum mainnet. The rollup spreads Ethereum's security costs across many transactions in each batch.

The platform maintains full EVM compatibility, which means existing Ethereum tooling and smart contracts work without modification. This extends to development frameworks like Hardhat and Foundry, wallet integrations, and block explorers, reducing friction for developers who want to move from mainnet.

Storage optimization includes enhanced gas limits and improved efficiency for complex applications. These improvements particularly benefit data-intensive applications, such as gaming and NFT marketplaces, that require frequent state updates without incurring excessive fees.

Advanced Features and Recent Upgrades

Arbitrum's commitment to innovation extends beyond basic scaling to include cutting-edge features that address evolving market demands.

Stylus Runtime Integration

This upgrade enables a significant expansion of smart contract capabilities beyond the standard EVM environment. Developers can now write contracts in Rust and C++, giving them access to mature programming ecosystems with extensive libraries and optimization tools. The WebAssembly (WASM) execution environment—a portable binary instruction format—delivers measurable performance improvements for computation-heavy applications while maintaining security through deterministic execution and formal verification capabilities.

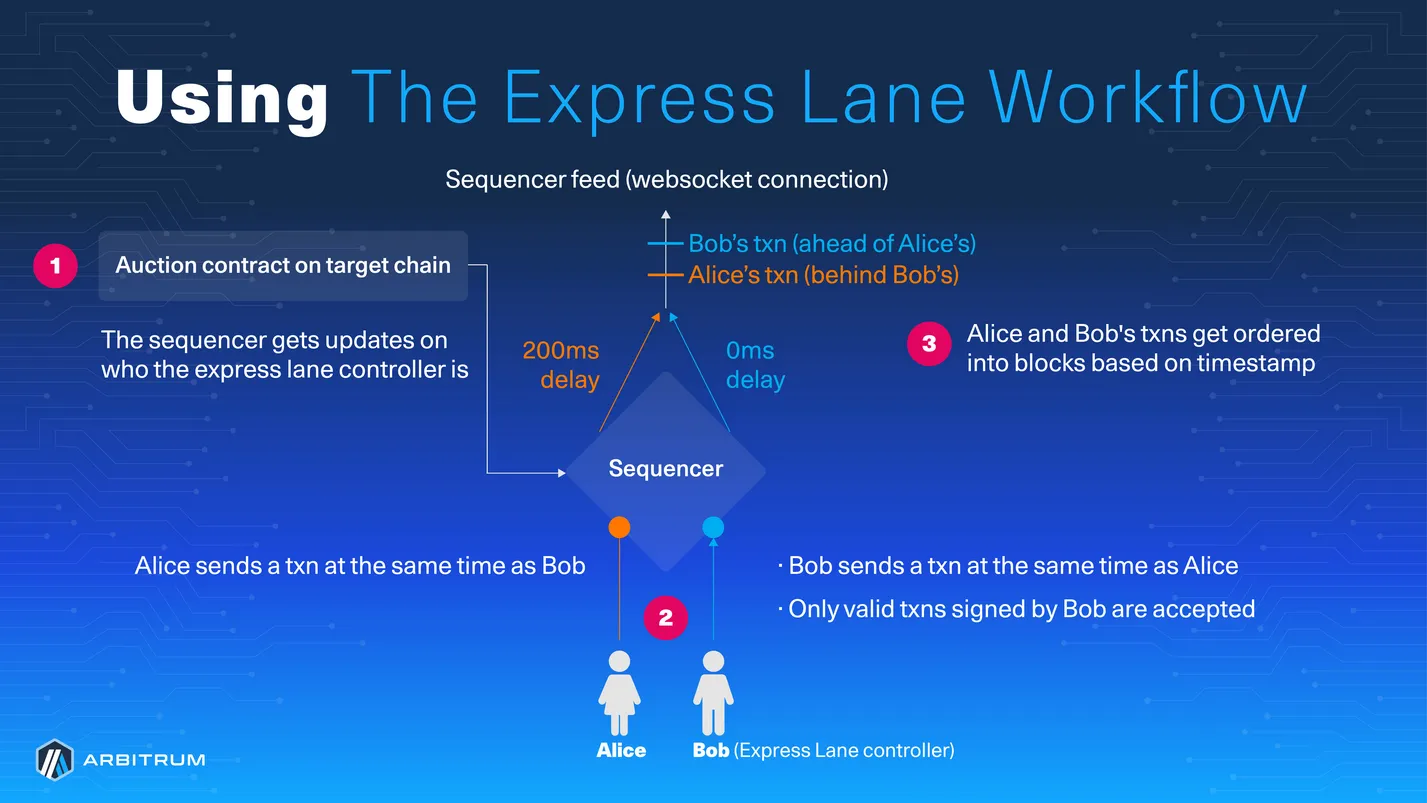

Timeboost MEV Protection

This feature introduces a transparent approach to transaction ordering through competitive auctions. Users can bid for priority placement in blocks, creating a fair and predictable ordering mechanism that eliminates hidden MEV (Maximal Extractable Value) extraction—the profit opportunities that arise from reordering transactions. The system generated $2,491 in revenue for the Arbitrum DAO during its first day of operation, showing both user adoption and the potential for sustainable protocol funding through transparent fee mechanisms.

Privacy Enhancements

Fhenix's Fully Homomorphic Encryption (FHE) integration enables confidential computations directly on the blockchain. This technology addresses privacy concerns in DeFi applications by allowing mathematical operations on encrypted data without revealing underlying values. The implementation opens possibilities for private trading, confidential governance, and institutional applications that require data privacy while maintaining blockchain transparency for auditability.

How Does Arbitrum's Governance Structure Function?

The Arbitrum DAO operates through a structured governance process that balances community participation with technical expertise. This decentralized approach ensures protocol decisions reflect stakeholder interests while maintaining the technical rigor necessary for critical infrastructure.

Decision-Making Process and Community Involvement

The governance lifecycle starts with informal discussions on community forums where ideas get refined through collaborative input. Proposals that gain traction move to temperature checks, which gauge community sentiment before formal submission. This preliminary process helps filter ideas and ensures only well-developed proposals proceed to official voting.

Successful temperature checks advance to formal on-chain voting through platforms like Tally and Snapshot. ARB token holders can propose protocol upgrades, allocate treasury funds, and guide ecosystem development through this transparent mechanism. The voting process includes multiple phases to ensure adequate consideration time and prevent rushed decisions that could harm the network.

The DAO controls significant resources, including substantial ARB token reserves and ETH holdings for strategic ecosystem investments. Recent governance decisions show both the system's functionality and its challenges. The controversial 7,500 ETH investment proposal in non-native projects sparked extensive debate about resource allocation priorities, while the 35 million ARB allocation for real-world asset initiatives showed consensus around strategic growth areas.

Technical Governance and Protocol Updates

Protocol upgrades require careful consideration of security implications and backward compatibility. The community has successfully implemented major updates like BoLD and Timeboost through this structured governance process, proving the system's ability to evolve while maintaining stability.

Technical proposals undergo rigorous review by both community members and core developers. This multi-layered approach ensures changes meet both user needs and technical requirements while preserving the security properties that make the network valuable.

Which Projects Drive Arbitrum's Ecosystem Growth?

Arbitrum hosts over 900 decentralized applications spanning multiple sectors, with particular strength in DeFi, gaming, and real-world assets. This diverse ecosystem shows the platform's versatility and its ability to support various use cases while maintaining performance and security standards.

DeFi Protocol Landscape

The DeFi sector represents Arbitrum's most mature and successful application category, with several protocols achieving significant scale and innovation.

Perpetual Trading Dominance

GMX has become the leading decentralized perpetual futures platform, featuring a unique liquidity provision model through its GLP token. This creates a diversified basket of assets that provides liquidity for traders while generating yield for token holders. The design eliminates the need for traditional market makers while ensuring deep liquidity across multiple trading pairs.

Decentralized Exchange Innovation

Camelot is Arbitrum's premier native DEX, incorporating advanced features like concentrated liquidity and sophisticated yield farming mechanisms. The platform's integration with the broader Arbitrum ecosystem creates synergies that benefit both traders and liquidity providers. Uniswap V3's presence adds liquidity depth and established trading infrastructure for major token pairs.

Yield Strategy Evolution

Pendle's yield trading platform recently introduced Boros to enable onchain funding rate markets. This innovation lets traders access funding rate exposure similar to centralized exchanges while maintaining the transparency and composability benefits of DeFi protocols.

Gaming and NFT Integration

The gaming sector showcases Arbitrum's ability to handle high-frequency transactions while keeping costs low enough to make blockchain gaming economically viable.

Blockchain Gaming Success

Pirate Nation is a good example of how properly designed blockchain games can achieve mainstream appeal through accessible gameplay and sustainable tokenomics. The game's success validates Arbitrum's capability to handle gaming transaction volumes without compromising user experience or creating prohibitive costs.

NFT Infrastructure Development

Magic Eden's comprehensive marketplace integration provides professional-grade trading functionality for digital collectibles. Various native collections, including Smol Brains, showcase the creative potential of community-driven projects built specifically for the Arbitrum ecosystem.

Institutional and Traditional Finance Integration

The expansion into traditional finance represents one of Arbitrum's most significant growth vectors, bridging conventional financial services with decentralized alternatives.

Robinhood Wallet's support for Arbitrum brings traditional finance users into DeFi through familiar interfaces and simplified onboarding processes. OKX Wallet provides similar functionality for international users, expanding Arbitrum's global reach without requiring users to learn entirely new systems.

PayPal's expansion of PYUSD to Arbitrum demonstrates institutional confidence in the platform's stability and regulatory compliance capabilities. The integration enables efficient multi-chain payment processing while leveraging Arbitrum's cost advantages for everyday transactions.

Partnerships with established institutions like Franklin Templeton, Spiko, and WisdomTree enable tokenization of traditional financial instruments. These collaborations create bridges between conventional finance and DeFi protocols, potentially unlocking trillions of dollars in traditional assets for blockchain-based applications. The platform currently (August 7, 2025) hosts $4.20 billion in stablecoin market cap, demonstrating increasing institutional confidence.

What Recent Developments Shape Arbitrum's Current Status?

The period from February to August 2025 saw accelerated development across multiple fronts, showing Arbitrum's commitment to continuous innovation and ecosystem expansion. The developments span technical upgrades, strategic partnerships, and community initiatives that collectively strengthen the platform's position in the L2 landscape.

Major Technical Infrastructure Upgrades

The first half of 2025 brought significant technical advancements that strengthened Arbitrum's infrastructure and expanded its capabilities.

February 2025

This month marked a pivotal moment with the deployment of the BoLD protocol, representing a significant milestone in decentralization. The upgrade enabled permissionless validation on both Arbitrum One and Nova, letting any validator participate in the network's security without requiring approval from centralized entities. The implementation shows Arbitrum's commitment to progressive decentralization while maintaining security and performance standards.

At the same time, Offchain Labs introduced a universal intent engine designed to enhance cross-chain interoperability, to achieve sub-3-second cross-chain swaps across EVM chains. This technology addresses one of the most pressing challenges in the multi-chain ecosystem by enabling seamless interactions between different blockchain networks. Users no longer need to understand complex bridging mechanisms to move assets across chains.

April 2025

This period brought the integration of Converge as a specialized Arbitrum chain, showcasing the flexibility of the Orbit framework for custom implementations. The month also saw Timeboost's launch, introducing MEV auction functionality that creates sustainable revenue streams for the DAO while giving users predictable transaction ordering options.

May 2025

Development expanded through node client diversity with Nethermind and Erigon support, reducing single-point-of-failure risks and improving network resilience. The Fhenix integration for confidential computing capabilities enabled privacy-preserving applications within the broader DeFi ecosystem. Additionally, the DAO approved 35 million ARB for real-world asset acceleration partnerships with Franklin Templeton, Spiko, and WisdomTree.

Ecosystem Growth and Strategic Partnerships

The summer months of 2025 focused on user experience improvements and high-profile collaborations that expanded Arbitrum's reach.

June 2025

June delivered significant user experience improvements through the Pectra upgrade, enabling advanced features like one-click token swaps and gas sponsorship mechanisms. These enhancements reduce friction for new users while providing developers with tools to create more intuitive applications. The month also featured the launch of Trailblazer 2.0, which secured $1 million in funding for agentic DeFi development, as well as a deepened collaboration between Robinhood.

July 2025

High-profile partnerships dominated this period, including PayPal's PYUSD stablecoin expansion and the comprehensive Open House builder program announcement with dedicated tracks for learning, building, and hacking. These initiatives show Arbitrum's appeal to both institutional partners seeking reliable infrastructure and grassroots developers building innovative applications.

August 2025

Early August has already showcased ecosystem maturity through multiple significant launches. Boros by Pendle introduced sophisticated onchain funding rate markets that compete with centralized exchange mechanisms, demonstrating impressive early traction with over $800,000 in collateral secured within three hours of launch. The $10 million audit program launch reinforced the platform's commitment to security as it scales, while the Yap AI community engagement mission and Open House application opening demonstrated a focus on sustainable growth through developer and user engagement.

The Open House program continues with ongoing workshops, including specialized sessions like "Stylus for Solidity developers" that help existing Ethereum developers transition to Arbitrum's expanded programming capabilities. Arbitrum has also been featured prominently in Ethereum's recent ecosystem updates, highlighting integrations like Robinhood and emerging AI applications as key indicators of broader blockchain adoption.

What Challenges Does Arbitrum Face Moving Forward?

Despite its market leadership, Arbitrum confronts specific challenges that could impact its competitive position.

Sequencer Centralization remains the primary technical concern. While BoLD enables permissionless validation, transaction ordering still depends on Offchain Labs' sequencers. This creates potential censorship risks and represents a single point of failure that could impact network availability. Users must trust sequencers to include transactions fairly and promptly.

Competitive Pressure intensifies from multiple fronts. Zero-knowledge rollups like Polygon's zkEVM offer superior finality without fraud proof delays, potentially attracting applications requiring fast withdrawals. Meanwhile, Base and other OP Stack chains fragment the optimistic rollup market, splitting developer attention and liquidity.

Ethereum's Scaling Roadmap poses a longer-term challenge. Planned improvements through sharding and proto-danksharding could significantly enhance mainnet performance. If successful, these upgrades might reduce demand for Layer 2 solutions by making Ethereum itself more scalable and cost-effective.

The platform must continue innovating across these fronts to maintain its current advantages as the competitive landscape evolves.

What Does Arbitrum's Future Development Roadmap Include?

Arbitrum's trajectory focuses on expanding beyond traditional DeFi into artificial intelligence, real-world assets, and improved cross-chain functionality. These strategic directions position the platform to capitalize on emerging opportunities while addressing existing limitations.

Emerging Technology Integration

Arbitrum's future development focuses on three key areas:

- AI Integration: Trailblazer 2.0 provides $1 million in funding for AI-powered DeFi applications, targeting automated trading strategies, yield optimization, and risk management systems that could attract institutional users.

- Privacy Features: Building on Fhenix FHE integration, future developments may include zero-knowledge proofs for confidential transactions, addressing regulatory and competitive concerns that limit institutional DeFi participation.

- Cross-Chain Interoperability: The universal intent engine aims for seamless, low-latency interactions across EVM chains, potentially positioning Arbitrum as a central hub in the multi-chain ecosystem.

Strategic Growth and Security Initiatives

Arbitrum's growth strategy focuses on three core areas:

- Real-World Assets: The 35 million ARB allocation supports partnerships with institutions like Franklin Templeton to tokenize traditional assets, bridging conventional finance with DeFi infrastructure

- Developer Support: Programs like Open House provide educational resources and funding to maintain a strong builder ecosystem, creating sustainable competitive advantages through network effects

- Security Investment: The $10 million audit program ensures robust security standards as the ecosystem scales and becomes a more attractive target for potential threats

Conclusion

Arbitrum has established itself as Ethereum's premier scaling solution through methodical technical development, strategic partnerships, and sustained ecosystem growth. With over 2.06 billion transactions processed, $17.80 billion in TVL as of August 7, 2025, and daily active users in the hundreds of thousands, the platform demonstrates real-world utility that extends beyond speculative trading.

The combination of optimistic rollup technology, comprehensive DeFi ecosystem, and expanding institutional partnerships positions Arbitrum as a critical infrastructure layer for blockchain adoption. Recent developments in AI integration, real-world assets, and privacy enhancements show continued innovation that addresses emerging market demands.

The platform's success in saving users over 4 million ETH in gas fees while maintaining security standards validates the optimistic rollup approach for mainstream blockchain applications.

For more information on Arbitrum's latest developments, visit arbitrum.io and follow @arbitrum on X for the latest updates.

Sources:

- L2BEAT - Arbitrum TVL.

- Arbitrum Foundation - Official documentation.

- Arbitrum docs - technical specification.

- Offchain Labs - Technical specifications and development updates.

- Arbitrum research - Technical information.

- DefiLlama - DeFi protocol analytics and TVL tracking.

- Arbitrum DAO - Community governance discussions and voting records.

- CoinMarketCap - Market data.

Read Next...

Frequently Asked Questions

How does Arbitrum maintain security while processing transactions off-chain?

Arbitrum inherits Ethereum's security through its optimistic rollup design, which posts all transaction data to Ethereum mainnet and allows a seven-day challenge period for dispute resolution. The fraud proof system ensures that any invalid state transitions can be contested and reversed, making the system as secure as Ethereum itself.

What are the main differences between Arbitrum and other Layer 2 solutions?

Arbitrum uses optimistic rollups that assume transaction validity unless challenged, while solutions like Polygon zkEVM use zero-knowledge proofs that mathematically prove transaction correctness upfront. This makes Arbitrum more EVM-compatible but results in longer withdrawal times compared to zk-rollups.

Can developers easily migrate existing Ethereum applications to Arbitrum?

Yes, Arbitrum provides full EVM compatibility, meaning existing Ethereum smart contracts can deploy without modification. The platform supports all standard development tools like MetaMask, Hardhat, and Foundry, making migration seamless for most applications.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens