Which Cryptocurrencies Do Indians Prefer Most?

While Bitcoin remains the most popular asset to hold among Indian investors, the dynamics of trading and portfolio allocation are telling a more complex story.

Soumen Datta

April 23, 2025

Table of Contents

The Long-Term Favourites Still Rule

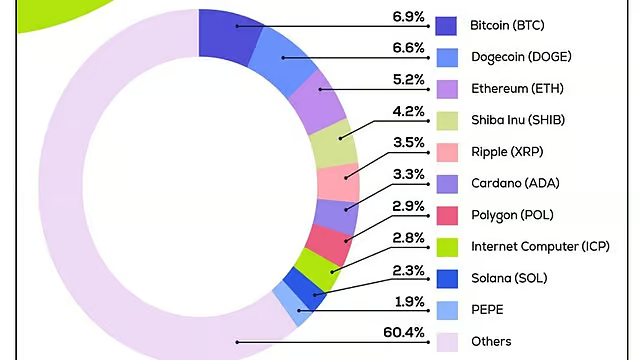

Despite the influx of new coins, Indian investors still lean heavily on the classics. Bitcoin remains the most held cryptocurrency across Indian portfolios, making up 6.9% of holdings, followed closely by Dogecoin at 6.6% and Ethereum at 5.2%. These figures, pulled from the Q1 2025 Crypto Investment Trends report by CoinSwitch, reflect a long-standing trust in proven blockchain assets.

Coins like Shiba Inu and Ripple (XRP) also feature prominently among India’s top five most-held assets. Their presence shows Indian investors still prioritize familiarity and reputation over hype. Shiba Inu holds 4.2%, and Ripple accounts for 3.5% of total holdings—demonstrating confidence in assets that have stood the test of time in the crypto market.

New Coins Are Entering the Scene

While legacy coins dominate in long-term holdings, emerging tokens are not far behind. Assets like Cardano (3.3%), Polygon (2.9%), Internet Computer (2.8%), and Solana (2.3%) round off the top 10. These assets have maintained their rankings since December 2024, showing that India’s crypto investors are starting to blend caution with curiosity.

Perhaps most notable is PEPE—a meme coin that has climbed to a top 10 spot with a 1.9% holding rate. Its rise reflects a growing trend among younger investors who are more willing to explore volatile tokens for potential high rewards. Loopring, which was once in the top 10, has now been edged out, suggesting that investor sentiment is gradually shifting to newer narratives.

Ripple Emerges as the Most Traded Coin

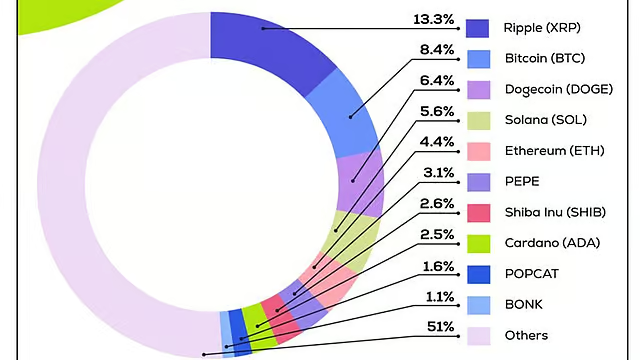

Ripple (XRP) has made headlines by becoming the most traded coin in India in Q1 2025. It accounts for a staggering 13.3% of all trading activity—surpassing the previous leader, Shiba Inu. Bitcoin and Dogecoin follow with 8.4% and 6.4% trading volume, respectively.

XRP’s surge in trading could be tied to global regulatory developments and renewed market confidence. The coin’s lower transaction cost and faster processing time might also be attracting more Indian traders looking for efficiency and speed.

Other actively traded coins include Solana (5.6%), Ethereum (4.4%), PEPE (3.1%), Shiba Inu (2.6%), and Cardano (2.5%). This mix shows a blend of both established assets and speculative tokens.

Meme Coins Gain Popularity Among the Youth

PEPE and BONK, two meme coins once considered fringe, are now gaining serious attention among young Indian investors. This generation is more inclined to take calculated risks, and meme coins—despite their volatility—offer the promise of explosive returns.

While such tokens are nowhere near the size of Bitcoin or Ethereum in terms of market cap, their appeal lies in accessibility and hype. They are cheaper to buy, easier to talk about, and often become viral investments thanks to community-driven marketing.

Global Influence Is Reshaping Indian Preferences

The shift in Indian investment behaviour is also tied to broader global trends. The crypto market received a fresh wave of legitimacy after the US, under the new Trump administration, pushed aggressively for crypto adoption. This has led many governments—including India’s—to revisit their digital asset policies.

India’s crypto environment, which was once weighed down by regulatory confusion, is now entering a new phase.

According to Bernstein analysts, the global crypto market cap could reach $7.5 trillion by the end of 2025. Bitcoin is expected to hit $3 trillion, while Ethereum may reach $1.8 trillion. Other leading blockchains like Solana and Avalanche could together account for $1.4 trillion.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens