Uniswap & the UNI Token: Explained

Explore Uniswap's groundbreaking developments in 2025, including V4's launch across 12 networks, Unichain L2 solution, and the revolutionary Hook System. Learn how these innovations are reshaping the future of decentralized finance.

Crypto Rich

February 19, 2025

Table of Contents

Uniswap stands as the world's leading decentralized exchange (DEX), transforming how digital assets are traded on the blockchain. What started as an experimental automated market maker (AMM) on Ethereum has evolved into the backbone of decentralized finance (DeFi), processing trillions in trading volume and setting new standards for permissionless trading.

Uniswap's Evolution

Uniswap began as an automated market maker on Ethereum and has since redefined decentralized trading. From its first version to current implementation, each protocol upgrade has introduced precise, measured improvements to trading efficiency and user experience. These iterations have consistently expanded trading capabilities while maintaining the core principle of decentralization.

The launch of Uniswap v4 on January 31, 2025, across 12 blockchain networks represents the most significant upgrade in the protocol's history. This expansion demonstrates Uniswap's commitment to accessibility and cross-chain functionality, bringing its innovative trading mechanisms to a broader audience.

Uniswap V4: Technical Advancements

Uniswap v4 introduces two key architectural improvements: the Hook System and Singleton Architecture. These technical advances redefine the capabilities of decentralized exchanges, offering unprecedented control over trading mechanics and improved operational efficiency.

The Hook System represents a paradigm shift in pool customization. It allows developers to create external smart contracts that can modify the behavior of liquidity pools at specific points during operations. This innovation enables:

- Custom AMM creation with unique pricing curves

- Advanced trading features including limit orders

- Dynamic fee strategies based on market conditions

- Specialized oracle implementations for accurate pricing

The Singleton Architecture, another groundbreaking feature of v4, consolidates all pools under a single smart contract called the PoolManager. This architectural choice brings several significant advantages:

First, pool creation becomes more efficient as it only requires state updates rather than full contract deployments. This change dramatically reduces gas costs for users and improves the overall efficiency of the protocol.

Second, the streamlined architecture enables more efficient multi-hop swaps and complex trading operations. By processing these operations through a single contract, the protocol can optimize gas usage and improve transaction throughput.

Third, the introduction of flash accounting allows for internal tracking of token balances with settlement at the end of transactions. This approach minimizes the number of token transfers needed, further reducing gas costs and improving efficiency.

Unichain: The Next Frontier in Scaling

February 11, 2025, marked another milestone with the launch of Unichain, Uniswap's dedicated Layer 2 scaling solution. This development addresses one of the most persistent challenges in DeFi: transaction costs and speed.

Unichain represents a collaborative achievement across the DeFi ecosystem. Optimism, Flashbots, and Paradigm research teams contributed open-source code, while Uniswap Labs serves as the primary technical provider and operates the Unichain Sequencer. The Uniswap Foundation continues to support this ecosystem through grants and developer support.

The UNI Token: Governance and Value Alignment

The UNI token is more than just a governance token; it represents a stake in the future of decentralized exchange. With approximately 600 million tokens circulating out of a fixed supply of 1 billion, UNI attempts to create a direct alignment between the protocol's success and token holder value.

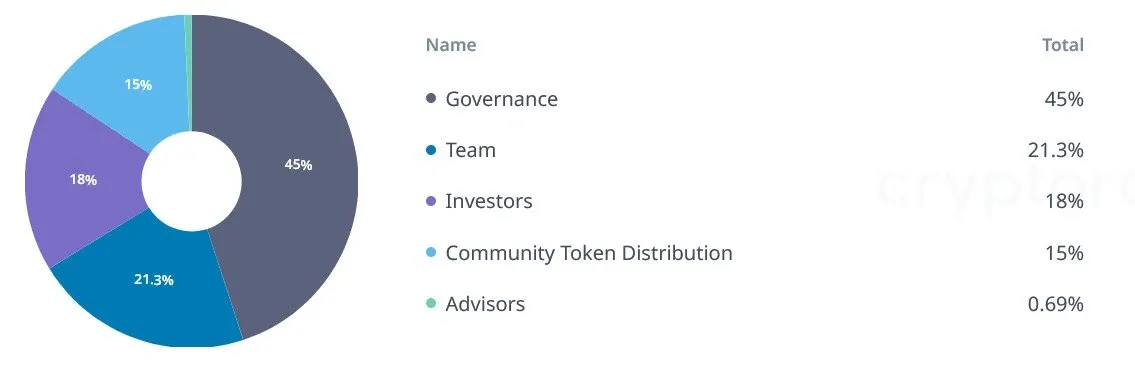

The token's distribution model emphasizes community ownership and long-term sustainability:

Anyone who had used Uniswap protocol before September 2020 was eligible and received the initial airdrop of 400 UNI tokens, (worth about $1200 at drop, but later would become worth $12,000), establishing a broad base of exited and engaged participants. Ongoing distribution to liquidity providers and developers ensures continued ecosystem growth while team allocations align with long-term incentives.

Governance in Action

The Uniswap DAO has processed over 300 governance proposals, with several key decisions shaping the protocol's development. Notable governance decisions include activating protocol fees on specific pools, allocating $20 million for the Uniswap Foundation, and the deployment of v4 across multiple chains.

Governance participation has increased substantially, with recent proposals averaging 50-60 million UNI tokens in voting participation. Major technical proposals require a quorum of 40 million UNI tokens with a 50% approval threshold. This structure has enabled swift technical upgrades while carefully overseeing protocol changes.

Key governance initiatives in recent months include:

- Implementation of dynamic fees for specific trading pairs

- Expansion of the foundation's developer grants program

- Deployment of Unichain infrastructure

- Updates to oracle price feed mechanisms

- Treasury diversification through strategic investments

Integration and Ecosystem Impact

Uniswap's adoption spans multiple chains, with Ethereum, Arbitrum, and Polygon emerging as key networks for trading activity. The protocol's trading volume metrics, tracked on platforms like DeFi Llama, consistently position it as one of the leading decentralized exchanges.

Major DeFi protocols integrate directly with Uniswap's infrastructure. Aave uses Uniswap for liquidation processes, Maker utilizes Uniswap price feeds for collateral valuation, and numerous lending protocols implement Uniswap's flash loan functionality. These integrations extend beyond simple token swaps, with protocols leveraging Uniswap's smart contracts for core functionality.

Looking Forward

Several key factors shape Uniswap's development path. United States regulatory requirements continue to evolve, requiring careful navigation while maintaining decentralized operations. The protocol's distributed governance structure provides flexibility to adapt to these changing requirements.

The successful deployment of Unichain and the Hook System establishes a technical foundation for specific improvements in trading speed, cost reduction, and cross-chain functionality. These implementations create clear paths for scaling transaction throughput and expanding cross-chain capabilities.

Conclusion

Uniswap has evolved from an automated market maker into essential DeFi infrastructure, demonstrating practical applications of blockchain technology in financial markets. The combination of v4's technical capabilities, Unichain's scaling solutions, and community-driven governance through UNI tokens establishes a robust foundation for decentralized trading.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events