Token Review: Berachain's New BERA

Discover everything about Berachain's BERA token in this comprehensive review. Learn about its utility, tokenomics, and market potential as the native gas token of this innovative EVM-identical Layer-1 blockchain

Jon Wang

February 6, 2025

Table of Contents

In the ever-evolving landscape of blockchain technology, Berachain has emerged as one of the most anticipated projects of 2025. With its innovative approach to consensus mechanisms and robust backing from industry leaders, the platform's native token, BERA, has captured the attention of crypto enthusiasts and investors alike. This comprehensive review delves into everything you need to know about the BERA token, from its fundamental use cases to its tokenomics and potential risks.

What is Berachain and Why Does it Matter?

Berachain represents a significant advancement in blockchain technology as an EVM-identical layer-1 blockchain. Backed by prestigious venture capital firms including Framework, Polychain, and Hack VC, the project has established itself as a serious contender in the L1 space. What sets Berachain apart is its unique "Proof-of-Liquidity" consensus mechanism, which implements a sophisticated multi-token model incorporating BERA, BGT, and the HONEY stablecoin.

Understanding the BERA Token: Core Functions and Utility

The BERA token serves as the backbone of the Berachain ecosystem, fulfilling two essential functions:

Gas Token

Similar to ETH on the Ethereum network, BERA acts as the native gas token for Berachain. Users must hold BERA to execute transactions and interact with the ecosystem, hopefully creating natural demand for the token.

Staking Mechanism

BERA plays a crucial role in network security through its staking mechanism. Validators can stake BERA tokens to participate in block validation, with larger stakes increasing the likelihood of being selected to propose blocks and earn rewards through token emissions.

BERA Tokenomics: A Deep Dive

Initial Supply and Inflation

Just before BERA was launched, the project team shared details of its tokenomics. BERA has a total supply at genesis of some 500 million tokens. It will then undergo inflation of 10% per year through emissions. However, the rate here is subject to change based on network governance decisions.

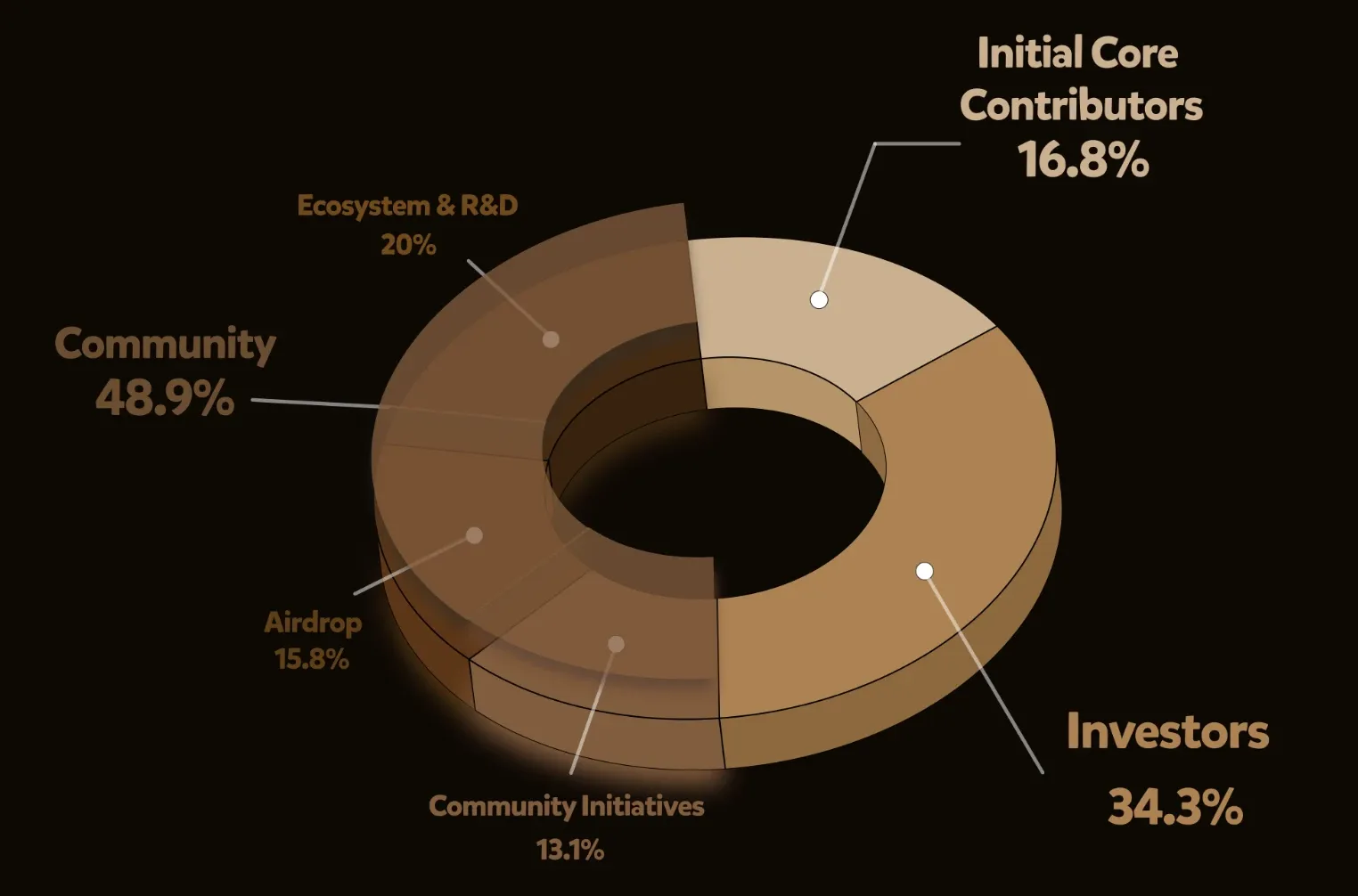

Token Distribution

The initial 500 million BERA tokens are allocated across five strategic categories:

- Initial Core Contributors (16.8%)

- Allocated to advisors and Big Bera Labs team members

- Investors (34.3%)

- Distributed among Seed, Series A, and Series B investors

- Community Airdrops (15.8%)

- Targeted at various community segments

- Future Community Initiatives (13.1%)

- Reserved for ecosystem development incentives

- Research and Development (20%)

- Focused on developer programs, node operations, and protocol improvements

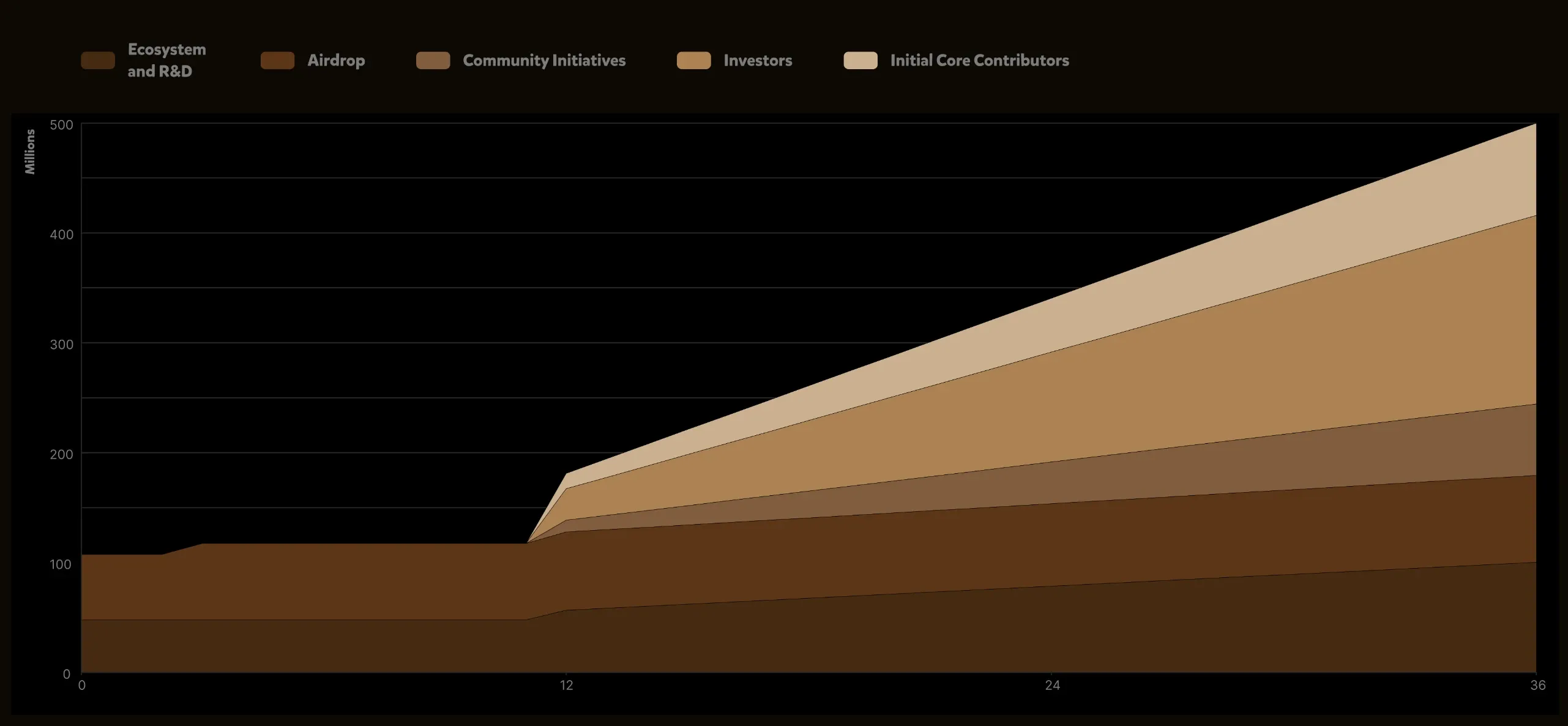

Token Release Schedule and Vesting

The BERA token's release schedule has been carefully structured in an attempt to ensure sustainable distribution over time. At launch, approximately 20% of the total supply will be unlocked, with minimal supply increases planned for the first year of operation through February 2026. A significant milestone occurs in February 2026, when one-sixth of the remaining allocations will be unlocked in a single event. Following this, the final five-sixths of the token supply will be gradually released over a two-year period, providing a seemingly measured approach to token distribution that aims to maintain market stability while meeting the needs of various stakeholders.

Community Engagement: The BERA Airdrop

Berachain has demonstrated a strong commitment to community involvement through its comprehensive airdrop program, which allocates a substantial 15.75% of the total token supply to various community segments. The largest portion of this allocation, comprising 6.9% of the total supply, has been designated for holders of Bong Bears NFTs who have bridged their assets to the new L1. The remaining airdrop tokens will be distributed across several key community demographics, including active testnet users and Binance HODLers, ensuring broad participation in the ecosystem from its earliest stages. This strategic distribution approach aims to foster a robust and engaged community while rewarding early supporters of the project.

BERA Token Analysis: Strengths and Considerations

Positive Factors

- Strong Ecosystem Foundation

- Backed by reputable investors

- Novel L1 solution with growing community support

- Clear Utility

- Essential for network operations

- Integral to network security through staking

- Community-Centric Distribution

- Significant airdrop allocation (15.8%)

- Focus on community engagement

- Controlled Initial Supply

- Limited inflation in first year

- Clear vesting schedule

Risk Considerations

- Token Distribution Concentration

- Large insider allocation (51.2%)

- Potential sell pressure from team and investors after February 2026

- Unlock Events

- Significant token cliff in February 2026

- Possible market impact from airdrop recipients (short-term)

- Governance Limitations

- Lack of governance utility compared to other L1 tokens

- Governance functions handled by non-transferrable BGT token

- Market and Competition Risks

- Volatile cryptocurrency market conditions

- Highly competitive L1 blockchain space

Conclusion

The BERA token represents a crucial component of the Berachain ecosystem, with clear utility and a well-structured distribution model. While the project shows promise through its strong backing and innovative technology, potential investors should carefully consider the various risk factors, particularly the concentration of tokens among insiders and the significant unlock events planned for 2026.

As with any cryptocurrency investment, thorough due diligence is essential, and investors should be prepared for potential volatility and market uncertainties. The success of BERA will likely be closely tied to Berachain's ability to establish itself as a dominant player in the competitive layer-1 blockchain space.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Jon Wang

Jon WangJon studied Philosophy at the University of Cambridge and has been researching cryptocurrency full-time since 2019. He started his career managing channels and creating content for Coin Bureau, before transitioning to investment research for venture capital funds, specializing in early-stage crypto investments. Jon has served on the committee for the Blockchain Society at the University of Cambridge and has studied nearly all areas of the blockchain industry, from early stage investments and altcoins, through to the macroeconomic factors influencing the sector.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events