Why Is the SEC Delaying Ethereum Staking Proposal?

Initially expected in mid-April, the decision now has a revised review date set for June 1, with a final deadline in October 2025.

Soumen Datta

April 15, 2025

Table of Contents

The U.S. Securities and Exchange Commission (SEC) has postponed its decision on Grayscale’s request to allow staking in its Ethereum exchange-traded funds (ETFs). Originally, the SEC was set to decide on this issue by April 17, 2025, but it has now pushed the deadline to June 1, 2025, with a final ruling expected by October 2025.

This delay has drawn mixed reactions, especially in light of similar decisions regarding other crypto-related ETF proposals. While the SEC takes its time to evaluate these proposals, global markets are moving ahead with similar offerings, raising questions about the U.S.'s regulatory stance on digital assets.

What Is Grayscale's Proposal?

Grayscale has two key products tied to Ethereum— the Grayscale Ethereum Trust (ETHE) and the Mini Ethereum Trust (ETH). The company’s proposal seeks to upgrade these products by enabling staking.

Staking involves locking up Ethereum (ETH) in a way that helps maintain the Ethereum network, rewarding stakers with passive income. The move is seen as a potential game-changer for Grayscale’s Ethereum ETFs, as it could make them more attractive by offering regular income through staking rewards.

The idea is to allow ETF holders to stake their Ethereum holdings and Grayscale would turn these funds into income-generating products. This could be especially beneficial in a market where Ethereum’s price has faced some volatility, offering investors a way to generate returns beyond just price appreciation.

However, the SEC has expressed caution, with regulators reportedly concerned about the broader implications of staking for the U.S.-listed ETFs.

SEC's Cautious Approach

The SEC’s decision-making process has always been deliberate, especially when it comes to innovative products like crypto ETFs. In this case, the Commission has raised concerns about how staking could affect investors, market liquidity, and taxation.

Why Is the SEC Hesitant?

The primary issue for the SEC revolves around the regulatory framework governing staking rewards. Currently, no U.S.-listed ETF has been granted approval to offer staking rewards to investors, making this an uncharted territory for regulators.

Staking in Ethereum, which typically yields annual rewards ranging from 2% to 7%, has already been adopted in other jurisdictions, such as Canada, Hong Kong, and Europe.

For Grayscale, this delay presents an opportunity to address the SEC's concerns. The company has made it clear that any staking rewards would be handled by Grayscale itself, with Coinbase Custody still holding the ETH assets. This ensures that no investor funds would be mixed up, adding an extra layer of security and transparency.

In-Kind Redemptions and Further Delays

In addition to the staking proposal, the SEC also delayed decisions on other important aspects of crypto ETFs. The agency pushed back its ruling on the proposal to allow in-kind redemptions for both Bitcoin and Ethereum ETFs.

In-kind redemptions allow investors to redeem ETF shares directly for the underlying assets (e.g., Bitcoin or Ethereum), without triggering taxable events. This mechanism is already in place in many global markets, but the SEC has yet to approve it for U.S.-based ETFs.

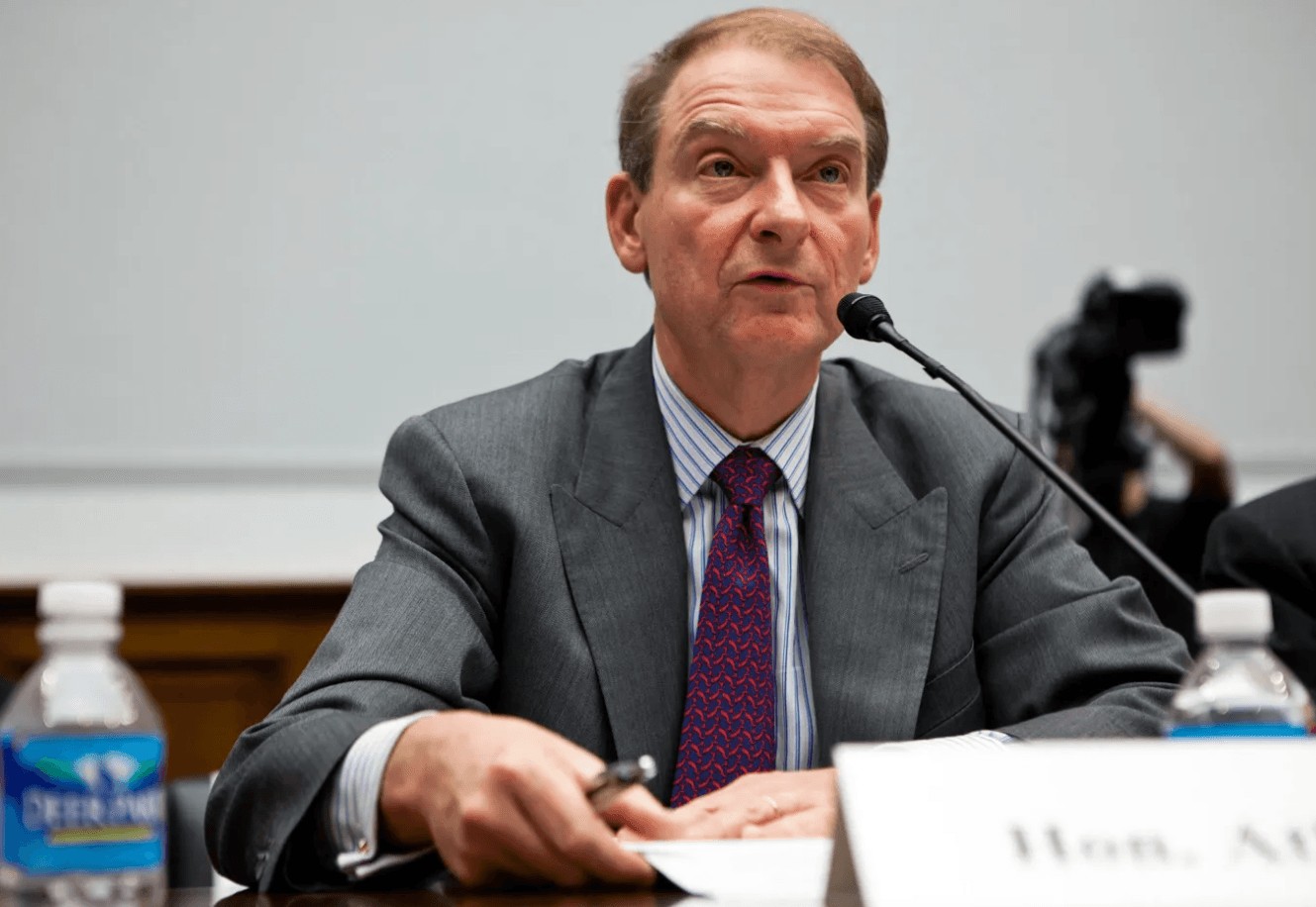

Paul Atkins and the Changing SEC Leadership

The SEC’s reluctance to approve staking for Grayscale’s Ethereum ETFs is seen by some as a reflection of the cautious leadership of Gary Gensler, the current SEC chairman. Under Gensler, the SEC has taken a more regulatory-heavy approach to cryptocurrency, emphasizing concerns over investor protection and market stability.

However, there are signs that things may change soon. Paul Atkins, who has been nominated as the new SEC head, is viewed by many as more favorable to crypto innovation. Atkins has been described as bolder in his approach and more willing to embrace digital assets as part of the future of finance.

Atkins has not yet officially taken office, with procedural steps still in progress. But many in the industry are hopeful that his leadership will bring about a more balanced regulatory framework that supports innovation while ensuring investor protection.

The Road Ahead for Grayscale and Crypto ETFs

Grayscale’s proposal to allow staking in its Ethereum ETFs is just one of many attempts by crypto firms to innovate in the space. As the SEC faces increasing pressure to make decisions, the stakes for U.S. crypto businesses are growing higher.

In the coming months, the crypto community will be eagerly awaiting the SEC’s final decision on staking Grayscale's Ethereum ETFs. The outcome could have profound implications for the future of crypto investment in the U.S., potentially influencing the regulatory environment for years to come.

As the industry continues to grow and evolve, one thing is clear: regulatory clarity will be key to unlocking the full potential of crypto ETFs and the broader digital asset market.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens