Polymarket Guide: How to Trade on Prediction Markets

Learn how Polymarket works, how to trade on real-world events, and why this prediction market processed $7.5B in 2025. Complete beginner guide.

Crypto Rich

December 10, 2025

Table of Contents

Prediction markets went mainstream in 2025, and Polymarket led the charge.

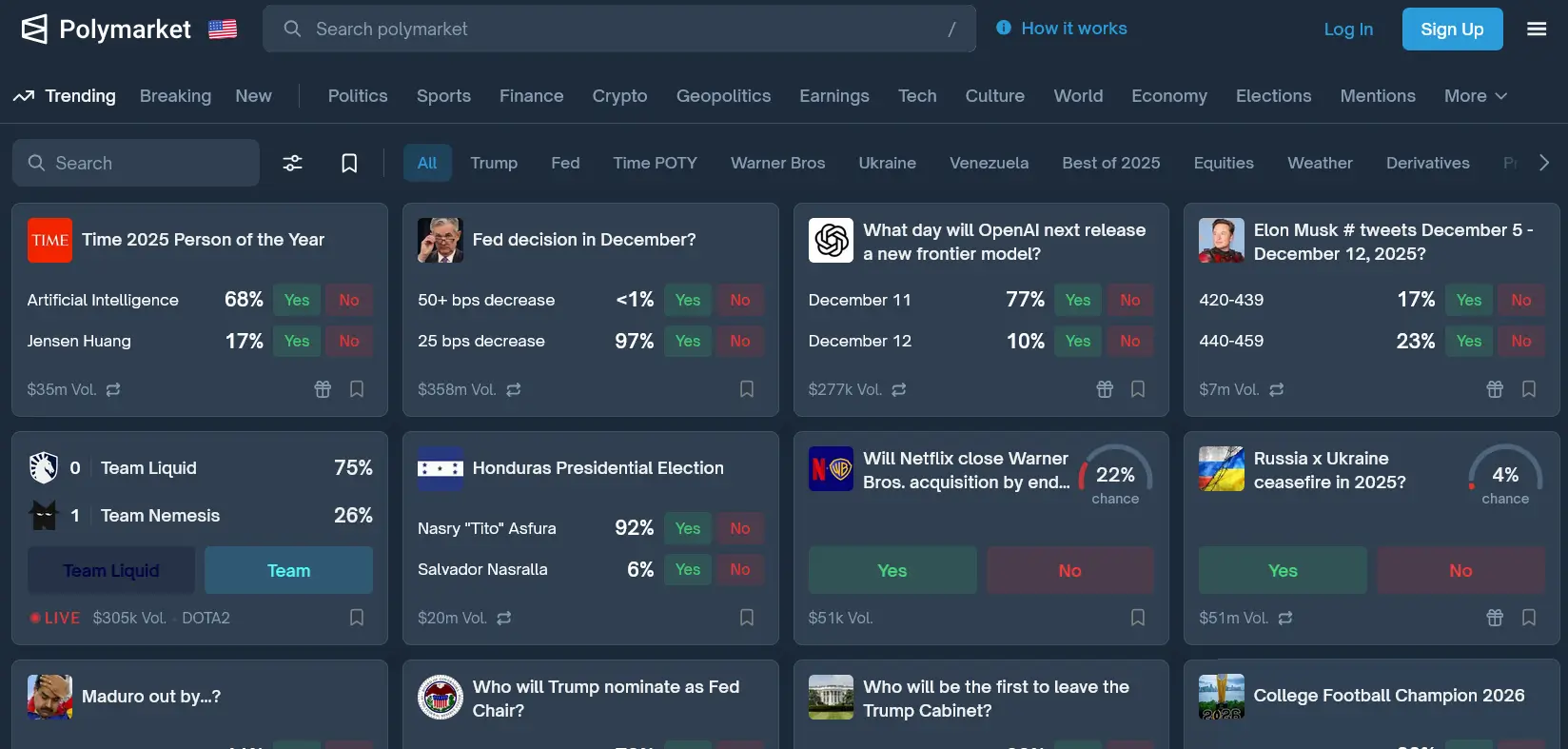

Polymarket is a decentralized prediction market built on the Polygon blockchain. Users buy and sell shares representing outcomes of real-world events, from elections to Bitcoin price targets. The platform processed over $7.5 billion in trading volume through 2025, making it the largest prediction market by a wide margin. In October 2025, Intercontinental Exchange (ICE), parent company of the New York Stock Exchange, invested up to $2 billion at a $9 billion valuation. If you want to see what all the attention is about, explore the live markets yourself.

Unlike traditional betting platforms with fixed odds set by bookmakers, Polymarket prices move based on supply and demand. Users trade USDC stablecoin on outcomes ranging from election results and Fed rate decisions to Bitcoin price targets and sports matchups. The platform charges no trading fees and requires no KYC for basic access.

What Is a Prediction Market and How Does It Work?

A prediction market is a trading platform where participants buy and sell shares based on the probability of future events. Share prices range from $0.01 to $1.00, with the price reflecting how likely the market thinks that outcome is.

The mechanics are straightforward. Each market presents a question with a binary outcome, typically "Yes" or "No." If you believe an event will occur, you buy "Yes" shares. If you think it will not happen, you buy "No" shares.

When a market resolves, winning shares pay $1.00 per share, while losing shares become worthless. Your profit equals the difference between your purchase price and $1.00 per share.

Consider this example: A market asks whether Bitcoin will reach $150,000 by year's end. "Yes" trades at $0.35, implying the market assigns a 35% probability to this outcome. If you buy 100 shares for a total of $35 and Bitcoin reaches that target, you receive $100. Your profit is $65.

Key concepts for new traders include:

- Share price equals implied probability (a $0.60 share means 60% likelihood)

- Prices fluctuate as traders buy and sell based on new information

- You can sell shares before resolution to lock in profits or cut losses

- Liquidity depth affects slippage on larger orders

How Does Polymarket Differ from Traditional Betting?

Polymarket works fundamentally differently from sportsbooks and betting exchanges. Traditional platforms set odds through internal risk models and take a cut from every wager. Polymarket functions as a peer-to-peer marketplace where prices emerge from trader activity.

This blockchain-based approach creates several key differences.

Zero Platform Fees

Polymarket charges no trading, deposit, or withdrawal fees. The only costs users incur are network fees from third-party services, such as exchanges, when moving USDC to the platform. This fee structure contrasts sharply with traditional betting platforms that typically take 5% to 10% of winnings.

Smart Contract Settlement

All trades execute through smart contracts on the Polygon network. When markets resolve, the system automatically processes payouts based on verified outcomes. You don't need to trust a central operator to honor winning bets.

Self-Custody of Funds

Users maintain control of their funds through wallet-based access rather than depositing with a centralized operator. Your keys, your coins. This eliminates the counterparty risk associated with traditional betting platforms that hold user balances.

Transparent Order Books

Every transaction is recorded on the blockchain. You can verify market activity, liquidity depth, and trading history through public blockchain explorers. This transparency lets you analyze market dynamics that stay hidden on traditional platforms.

What Markets Can You Trade on Polymarket?

Polymarket hosts prediction markets across a wide range of categories. The platform gained mainstream attention during the 2024 U.S. presidential election, during which traders wagered more than $3.3 billion on the outcome. Markets correctly signaled Donald Trump's victory while many traditional polls predicted a closer race.

Current market categories include:

- Politics: Presidential elections, congressional races, policy decisions, international elections across dozens of countries

- Finance: Federal Reserve rate decisions, Bitcoin and Ethereum price targets, corporate earnings, equity market movements

- Technology: AI model releases from OpenAI and competitors, SpaceX IPO valuation, product launches

- Sports: NFL, NBA, NHL, college sports, FIFA World Cup, individual game outcomes

- Current Events: Geopolitical developments, climate predictions, cultural milestones

As of December 2025, the Bitcoin price prediction market carries $97 million in volume. The 2028 Presidential Election Winner market has accumulated $144 million despite being nearly three years from resolution. Markets on Fed rate decisions regularly see hundreds of millions in trading activity. You can browse all active markets here to see what is trending.

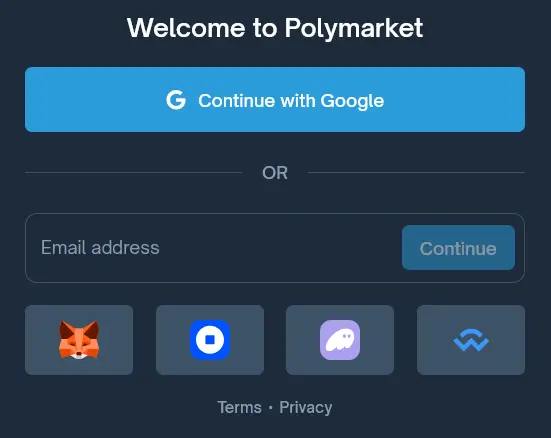

How Do You Get Started with Polymarket?

Setting up a Polymarket account takes about five minutes. Create an account, fund it with USDC, and place your first trade.

For U.S. users, there is now a mobile option. Polymarket launched its iOS app in December 2025, rolling it out via a waitlist, with over 200,000 signups in the first week. The app initially focuses on sports markets, with other categories coming later.

Account Creation Process

Visit Polymarket and select your signup method. The fastest option uses email authentication. Enter your email address, and Polymarket sends a magic link that automatically creates your account and generates a platform wallet.

For users who prefer complete control, connect an existing Ethereum-compatible wallet like MetaMask. This option provides full self-custody but requires more technical familiarity.

Funding Your Account

Polymarket uses USDC, a dollar-pegged stablecoin, on the Polygon network for all transactions. How you fund your account depends on what crypto you already hold.

If you have USDC on a centralized exchange like Coinbase or Kraken, withdraw directly to your Polymarket wallet address. Choose the Polygon network for faster and cheaper transfers. Ethereum deposits work too, but incur higher gas fees and take longer to arrive.

New to crypto? Non-U.S. users can buy USDC directly with credit or debit cards through integrated payment providers. U.S. users typically need to purchase USDC on an exchange first, then transfer it over.

Important: Always verify you are sending USDC on the Polygon network. Sending tokens on the wrong network can result in permanent loss of funds.

Placing Your First Trade

Navigate to any market and review the current prices, trading volume, and resolution date. Pick "Yes" or "No" based on your prediction, then enter either the number of shares or the USDC amount you want to trade.

Market orders fill immediately at current prices. Limit orders let you set a target price and only execute when the market reaches that level. Use limit orders to get better entry prices during volatile periods.

How Does Market Resolution Work?

Polymarket uses UMA's Optimistic Oracle system to verify event outcomes. When an event concludes, a proposer submits the result along with a bond. If no one disputes the proposed outcome within the challenge period, the market resolves and the payout process is automatically triggered.

The system creates strong incentives for accurate reporting. Proposers who submit incorrect outcomes lose their bond to successful challengers. This mechanism has accurately resolved thousands of markets across diverse categories.

For complex or disputed outcomes, Polymarket maintains a Market Integrity Committee that provides guidance on resolution criteria. Market pages detail the specific conditions that determine each outcome, reducing ambiguity.

Once a market resolves, visit the market page to redeem winning shares. The process converts your shares to USDC in your Polymarket wallet. You can then withdraw the funds to an external wallet or use them for additional trading.

What Are Polymarket's Advantages Over Competitors?

Polymarket did not become the largest prediction market by accident. A few key factors set it apart.

Liquidity Depth

Higher trading volumes attract more traders, creating a self-reinforcing cycle. Major markets on Polymarket offer tighter spreads and less slippage than competitors. This liquidity edge matters most when you are placing larger positions.

Market Variety

Polymarket hosts markets on topics that traditional betting platforms avoid. Political outcomes, economic indicators, and technology developments rarely appear on sportsbooks. This breadth attracts traders with specialized knowledge across different domains.

Regulatory Progress

The platform has made significant strides toward regulatory compliance. In July 2025, Polymarket acquired QCEX, a CFTC-regulated exchange and clearinghouse. This acquisition enabled the platform to begin relaunching U.S. operations in December 2025, initially with sports markets.

The Commodity Futures Trading Commission's classification of the platform as dealing in commodities rather than securities provides a clearer regulatory footing than many cryptocurrency projects face.

Institutional Backing

Polymarket raised ~$255M pre-ICE (incl. $150M in early 2025) from investors including Founders Fund, Coinbase Ventures, Dragonfly, and Blockchain Capital, plus the $2B from ICE.

Nate Silver, founder of polling analysis site FiveThirtyEight, joined as an advisor in 2024. This institutional support signals confidence in the platform's long-term viability.

What Risks Should Users Understand?

Prediction markets carry real risks. Before you trade, understand what you are getting into.

The most obvious risk is simply being wrong. Prices move based on crowd sentiment, and if your prediction misses, you lose your entire position. There is no partial payout. Losing shares become worthless when the market resolves.

Liquidity matters too. Smaller markets have thin order books, which means larger positions can experience significant slippage. Always check liquidity indicators before placing substantial trades, especially on newer or less popular questions.

Smart contract risk exists on any blockchain platform. Polymarket's contracts have processed billions without major exploits, but undiscovered vulnerabilities remain a theoretical possibility.

Regulatory risk varies by location. U.S. residents faced restrictions after a 2022 CFTC settlement, though domestic operations are now relaunching through regulated channels. Other countries have taken their own positions on the legality of prediction markets.

Finally, oracle manipulation is a theoretical concern. UMA's dispute mechanism has proven robust so far, but users should understand exactly how specific markets will resolve before committing significant capital.

What Does Polymarket's Future Look Like?

Polymarket enters 2026 with serious momentum.

The biggest catalyst is U.S. expansion. Full access through the regulated QCEX venue could substantially increase trading volumes as political, economic, and cultural markets roll out beyond the initial sports offerings.

Mainstream recognition is growing. TIME included Polymarket on its 2025 list of Most Influential Companies, and media outlets now routinely cite Polymarket odds alongside traditional polling data.

The ICE partnership goes beyond the headline investment. Plans include distributing Polymarket data through ICE's financial information networks, which could put prediction market odds in front of traditional finance audiences for the first time.

Technical development continues on the trading interface and mobile apps, with potential expansion to additional blockchain networks. Meanwhile, Polymarket's success has inspired competitors to build out a broader prediction market ecosystem.

One thing crypto traders are watching closely: a potential $POLY token. Prediction markets tracking a 2025 token launch show roughly 15% odds. Nothing official has been announced, but airdrop hunters are paying attention given the platform's volume and institutional backing.

Conclusion

Polymarket has established itself as the leading prediction market through zero trading fees, blockchain transparency, and deep liquidity across diverse categories. The platform's accuracy during the 2024 election demonstrated the forecasting power of incentivized crowd predictions.

The infrastructure runs on Polygon with USDC settlements, enabling fast transactions at minimal cost. Users maintain self-custody of funds, and resolution occurs through UMA's oracle system with economic incentives for accurate reporting.

With institutional backing from ICE and regulated U.S. operations now launching, Polymarket offers accessible entry into prediction markets for both crypto-native users and newcomers. Whether you want to trade on elections, crypto prices, or sporting events, the platform makes it straightforward to put your predictions to work.

Ready to get started? Visit Polymarket to browse live markets and place your first trade. Follow @Polymarket on X for the latest updates.

[Disclaimer: This article contains affiliate links relating to one or more of the companies/organizations mentioned above. BSCN stands to benefit from readers following the links and engaging with the relevant platforms. All platforms, in particular those involving cryptocurrency and/or iGaming, carry risk. You should always do your own research before engaging with any platforms and always consult a financial advisor before making any investment or financial decisions. Recognizing that the laws and regulations involving online gambling and online sports betting are different everywhere, you expressly acknowledge and agree that it is your sole responsibility and obligation to ensure that any online gambling or sports betting activities that you undertake are legal in your relevant jurisdiction.]

Sources:

- Polymarket Official Documentation - Platform mechanics and trading guides

- Bloomberg - U.S. relaunch and regulatory developments

- Wikipedia: Polymarket - Company history

- TIME100 Most Influential Companies 2025 - Industry recognition

- Covers.com - December 2025 U.S. launch details

- Cryptorank.io - Funding Round Data

Read Next...

Frequently Asked Questions

Is Polymarket legal in the United States?

Polymarket restricted U.S. access following a 2022 CFTC settlement but began relaunching domestic operations in December 2025 through QCEX, a regulated exchange it acquired. U.S. users can join a waitlist for access, with sports markets available first, followed by other categories.

Does Polymarket charge trading fees?

No. Polymarket charges zero platform fees for trading, deposits, or withdrawals. Users only pay network fees to third-party services like exchanges when transferring USDC onto the platform. This makes Polymarket significantly cheaper than traditional betting platforms.

What cryptocurrency does Polymarket use?

Polymarket uses USDC (USD Coin) on the Polygon network for all transactions. USDC is a stablecoin pegged 1:1 to the U.S. dollar. Users can purchase USDC on exchanges like Coinbase and transfer it to their Polymarket wallet.

How accurate are Polymarket predictions?

The platform demonstrated notable accuracy during the 2024 U.S. presidential election, correctly predicting Trump's victory despite many polls predicting a closer race. That said, prediction markets reflect crowd sentiment, not certainty. Prices are probability estimates, and they can be wrong.

Can you make money on Polymarket?

Yes. If your predictions are right more often than market prices suggest, you can profit. Winning shares pay $1.00 each regardless of what you paid. But prediction markets carry real risk, and losing positions become worthless. Only trade with money you can afford to lose.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens