Pi Network's PI Token: Analysis and Review

At the heart of Pi Network's ecosystem is the PI token. Check out our deepdive and review into its tokenomics and future.

UC Hope

March 17, 2025

Table of Contents

Pi Network has grown into one of the most intriguing crypto platforms in the Decentralized Finance (DeFi) industry, boasting over 60 million engaged Pioneers. With its Open Network phase already live, the project has shifted from a closed ecosystem to a fully operational blockchain, allowing Pi coins to be used for real-world transactions and integrated into Decentralized Applications (dApps).

At the heart of PI’s transition lies Pi Network's tokenomics, the economic model governing $PI creation, distribution, and utility. Based on data from the Pi Core team, let us unpack the asset’s foundational details and current status.

PI Token Supply and Allocations

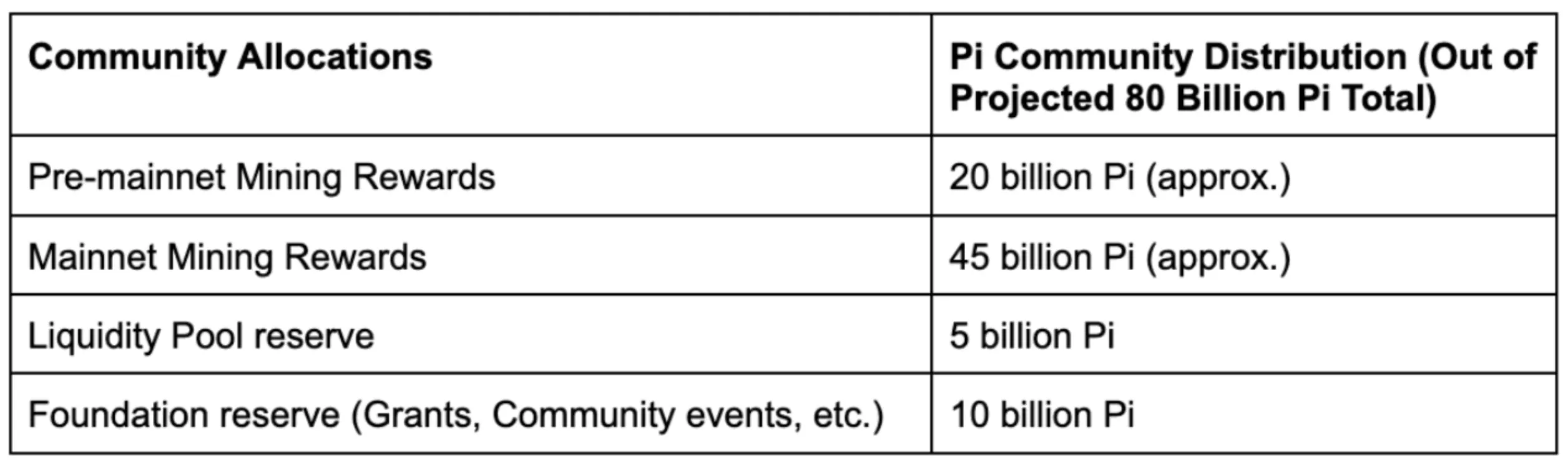

As outlined in its original 2019 whitepaper, Pi Network’s tokenomics begins with a total supply of 100 billion PI. Below is the breakdown of the allocation:

- Community (80 billion Pi): This includes mining rewards, referral bonuses, and ecosystem incentives aimed at Pioneers who mine via the mobile app, run nodes, or contribute to network growth.

- Core Team (20 billion Pi): This portion, reserved for the developers and operational backbone, funds ongoing development, infrastructure, and strategic initiatives like partnerships and ecosystem expansion.

This structure reflects Pi’s mission to democratize cryptocurrency. Unlike Bitcoin, where mining now favors those with significant computational power, Pi’s mobile-based approach lowers barriers, distributing tokens widely across millions of users.

Deflationary Mechanism

A cornerstone of Pi’s tokenomics is its deflationary mechanism, designed to balance supply and demand over time. The mining rate, the reward Pioneers earn daily tapping the app, decreases as the network scales. By January 2025, the base mining rate had halved several times, triggered by community growth milestones (e.g., 1 million, 5 million, 10 million users). This mimics Bitcoin’s halving events but ties reductions to adoption rather than a fixed schedule.

With the Open Network live and many users, there is growing speculation about the protocol finalizing the mining mechanism. While not explicitly detailed, this likely means the mining phase is winding down or shifting focus following the mainnet milestone. The reduced issuance aims to create scarcity, encouraging Pioneers to hold or use Pi.

PI Tokenomics and Utility

Tokenomics is about utility. With the Open Network launch, Pi has transitioned from a speculative currency within an application into a functional asset available on several exchanges. The platform is focused on creating an ecosystem where Pioneers embrace the habit of using $Pi currency. This aligns with events like Pifest, launched on March 14, which saw active sellers accepting Pi for goods and services. Another initiative promoting PI utility is the .pi domain auctions, which require Pi to bid.

These developments signal a push toward real-world adoption. Pi’s tokenomics incentivizes spending within the ecosystem. Furthermore, the end goal is to make Pi a peer-to-peer currency that rivals traditional payment systems, not just a store of value like most assets, including Bitcoin.

Closing Comments

Despite its promise, Pi’s tokenomics face scrutiny. Posts on X reflect mixed sentiment: some Pioneers celebrate utility milestones, while others question centralized control (the Core Team’s 20% share) or transparency around future supply adjustments, with just under 7 billion in circulation. Further, some were critical of returning unmigrated Pi coins to the app. Some even claimed their migrated assets were recorded as unmigrated, calling it a glitch on Pi Network’s system.

In any case, questions have still been asked: Will mining rewards cease entirely? Could lost Pi be replaced to maintain circulation, as hinted in the whitepaper?

Pi Network’s tokenomics are a living system poised for evolution. The deflationary model and utility focus lay a strong foundation, but success hinges on adoption and trust. If Pifest scales dApps provide efficient use-cases, and nodes decentralize control, Pi could become a top valuable asset soon.

Currently, the team focuses on refining infrastructure (nodes, mining) and driving usage (commerce, habits). Pioneers and observers watch closely as Pi’s tokenomics unfold in real-time on Open Network.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens