Mango Network: New L1 Blockchain Claims 297,450 TPS

Mango Network launches its Layer 1 blockchain with 297,450 TPS, Multi-VM support, and $10B MGO token supply. TGE scheduled for June 24, 2025 with major exchange listings.

Crypto Rich

June 23, 2025

Table of Contents

The blockchain industry continues to grapple with fundamental scalability and interoperability challenges that have persisted since Ethereum's early days. High transaction fees, slow confirmation times, and isolated ecosystems create barriers preventing mainstream adoption of decentralized applications. Mango Network, a new Layer 1 blockchain built by MangoNet Labs, claims to solve these problems through an ambitious technical architecture that combines multiple virtual machines, cross-chain functionality, and throughput capabilities that dwarf existing solutions.

With $13.5 million in funding, Mango Network promises to process 297,450 transactions per second with 380-millisecond finality while supporting both Ethereum Virtual Machine (EVM) and Move Virtual Machine (MoveVM) in a unified ecosystem. These bold claims arrive alongside the project's Token Generation Event on June 24, 2025, when $MGO tokens begin trading on Bitget, MEXC, and KuCoin at 09:00 AM UTC.

But technical specifications alone don't guarantee success in the competitive Layer 1 landscape. This analysis examines Mango Network's architecture, tokenomics, and real-world potential to determine whether it represents genuine innovation or another case of blockchain hype exceeding reality.

Technical Architecture: Multi-VM Innovation

The Move Programming Language Advantage

Mango Network implements "Mango Move," an enhanced version of the Move programming language originally developed by Facebook for the Diem project. Move was designed specifically for digital assets, treating tokens and NFTs as "first-class citizens" in the programming model.

This resource-oriented approach provides several critical advantages:

- Ownership Safety: Digital assets are represented as resources that cannot be copied or implicitly discarded, preventing double-spending attacks

- Static Typing: Every variable's type is known at compile time, eliminating entire categories of runtime bugs that have plagued other smart contract platforms

- Formal Verification: The Move Prover tool mathematically verifies smart contract behavior before deployment, allowing developers to specify contract logic in formal terms

- Modular Design: Smart contracts can be safely upgraded and composed without breaking existing functionality

Dual Virtual Machine Implementation

While Move provides superior security for financial applications, Mango Network recognizes that most existing DeFi protocols and tools are built for the Ethereum Virtual Machine. Rather than forcing developers to choose between security and compatibility, Mango implements both EVM and MoveVM within the same blockchain.

This dual-VM approach works through parallel execution, allowing EVM-based applications to operate alongside Move-based contracts without interference. Each VM maintains its own state space while sharing the underlying blockchain infrastructure. Mango's OP-Mango Layer 2 solution facilitates communication between EVM and MoveVM environments through standardized event capture and data serialization protocols.

The platform implements sophisticated resource allocation to prevent one VM from monopolizing network capacity. Transaction fees and execution limits are balanced across both environments to maintain fair access, while both virtual machines access a shared data availability layer to ensure state changes in one environment are visible to the other when needed.

Modular Architecture

Traditional blockchains bundle multiple functions into single systems that become difficult to optimize. Mango separates four core functions: execution handles smart contract computation, consensus manages validator coordination through DPoS, settlement provides final transaction confirmation, and data availability stores transaction information across the network.

This separation allows each component to optimize independently while maintaining system integrity. The claimed 297,450 TPS throughput depends on this modular design, though real-world performance often differs from theoretical maximums.

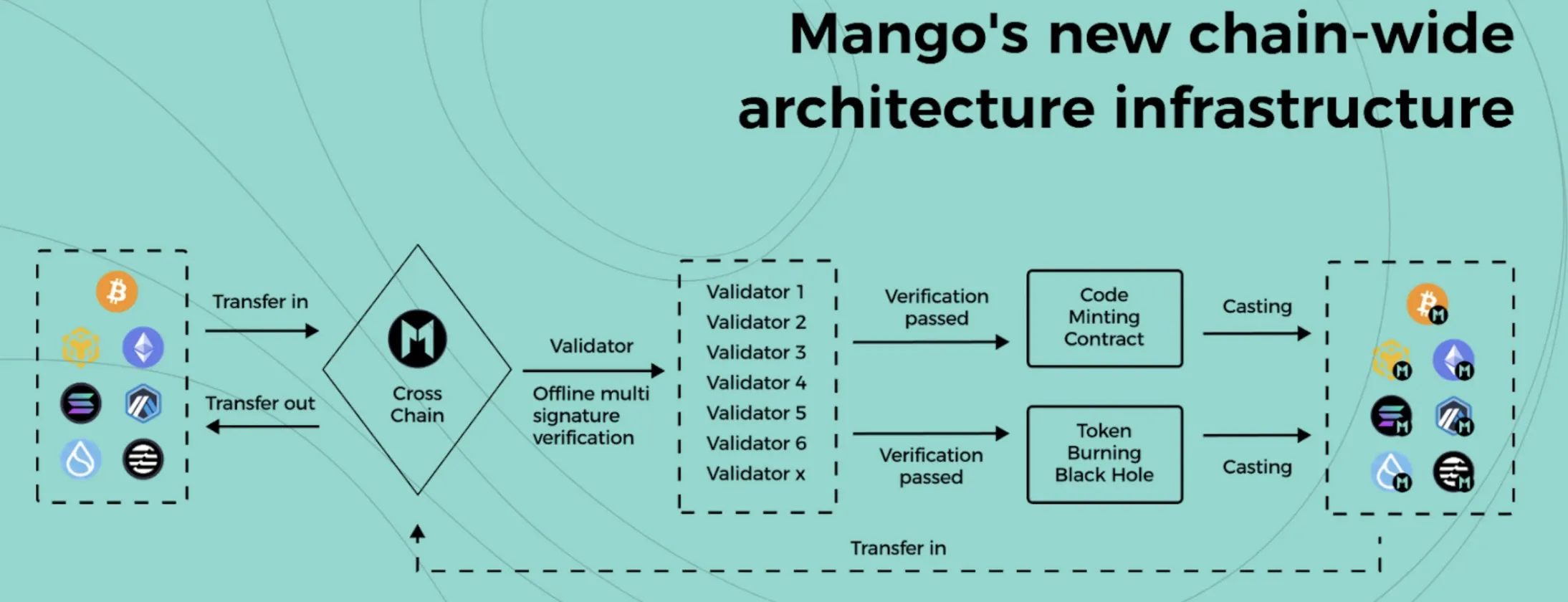

Cross-Chain Infrastructure and Zero-Knowledge Integration

Cross-Chain Infrastructure and Privacy Features

OP-Mango powers cross-chain functionality by processing transactions off-chain in batches before submitting results to networks like Ethereum. The system uses $MGO tokens as gas for cross-chain operations, includes fraud proof mechanisms, and enables asset transfers between different blockchains while maintaining security through cryptographic verification.

Privacy and Storage Features

The platform incorporates ZK-SNARK and ZK-STARK technologies for privacy-preserving transactions and cross-chain transfers. Users can trade anonymously or move assets between chains without revealing transaction details. The platform also uses decentralized storage with data backups and economic incentives for storage providers who earn $MGO tokens for maintaining data availability.

MgoDNS represents the platform's decentralized domain name system that bridges traditional internet and blockchain environments. The system can resolve standard internet domain names while adding blockchain-specific features. For example, a single domain name like "alice.mgo" could resolve to wallet addresses on multiple different blockchains. Smart contracts can also automatically update these domain resolutions based on programmed conditions.

Tokenomics Deep Dive

Distribution Strategy and Economic Model

The $MGO token's 10 billion total supply with immediate full unlock represents a significant departure from typical token release schedules. This strategy reflects specific theories about token velocity and network adoption but creates substantial economic risks.

The comprehensive distribution allocates tokens across eight categories. The Foundation receives 20% (2 billion tokens) for long-term development and operations, while the POS Stake Pool gets an equal 20% for network security and validator rewards. The Ecosystem Innovation Fund holds 17% (1.7 billion tokens) for dApp development and partnerships, indicating serious commitment to ecosystem growth.

Private investors receive 15% (1.5 billion tokens) from the $13.5 million funding round, which means these tokens face immediate unlock and potential selling pressure. The team and early contributors also get 15%, which raises questions about long-term alignment incentives given the lack of vesting schedules.

Community airdrops represent 10% of the total supply, split equally between testnet (500 million tokens) and mainnet (500 million tokens) participants. Claims open at 17:50 UTC on June 24, 2025, on a first-come, first-served basis.

Advisors receive the smallest allocation at 3% (300 million tokens), suggesting they provide primarily strategic rather than operational value.

Token Utility and Value Drivers

The $MGO token serves multiple functions that should create various sources of demand:

- Transaction Fees: All network operations require $MGO for gas, creating baseline demand that scales with network usage

- Cross-Chain Operations: OP-Mango uses $MGO as universal gas for cross-chain transactions, potentially driving significant demand as interoperability grows

- Network Security: Validators must stake $MGO to participate in consensus, removing tokens from circulation while earning staking rewards

- Governance Rights: Token holders vote on protocol changes and parameter updates, giving $MGO value beyond pure utility

- Ecosystem Integration: Various protocols within Mango may incorporate $MGO into their own tokenomics, creating additional demand sources

However, the immediate unlock strategy creates several economic risks. Ten billion tokens entering circulation simultaneously could overwhelm demand, particularly if early participants rush to realize profits. The large ecosystem fund allocation assumes rapid adoption and development activity, but if ecosystem growth lags expectations, these tokens could become a prolonged source of selling pressure.

Competitive Analysis and Market Positioning

Layer 1 Competition Landscape

Mango Network enters a crowded Layer 1 market where established players maintain significant advantages through developer adoption, total value locked, and ecosystem maturity. Ethereum retains the largest developer ecosystem despite high fees and scaling challenges, while Solana offers high throughput with a proven track record, though it has faced network stability issues.

Move-based competitors Aptos and Sui both use variations of the Move programming language with different approaches. Mango's dual-VM approach differentiates it from these competitors but also adds complexity.

The platform's claimed 297,450 TPS represents a significant improvement over most existing networks, but these theoretical maximums require validation under real-world conditions. Mango's omni-chain vision competes with established interoperability solutions like Cosmos and Polkadot, which offer cross-chain functionality through different technical approaches. Success will depend on whether Mango's integrated approach provides meaningful advantages over existing solutions and whether developers find the multi-VM architecture compelling enough to overcome the momentum of established platforms.

Security Audit and Development Team

Professional Security Review

Mango Network underwent comprehensive security audits by MoveBit, a recognized blockchain security firm. The project completed two separate audits: a core network audit (April 7-19, 2024) and a dedicated bridge audit (December 9, 2024 - January 6, 2025), demonstrating thorough security coverage across all critical components.

The core network audit employed multiple testing methodologies including dependency checks, static code analysis, fuzz testing, and manual code review. Results were notably positive, with only two issues identified - zero critical vulnerabilities, one major issue, and one informational finding. Both issues were resolved before mainnet launch.

The bridge audit was more comprehensive, identifying seven issues across different severity levels, including one critical vulnerability related to signature replay attacks. However, all seven issues were successfully fixed before deployment. The bridge audit covered cross-chain functionality between Sui, Ethereum, and Mango chains, ensuring secure asset transfers across the platform's multi-chain architecture.

MoveBit's reviews covered execution layers, consensus mechanisms, cross-chain infrastructure, and external dependencies, providing confidence in the platform's security foundation across both core functionality and critical bridge operations.

Development Team and Leadership

The project maintains transparency through visible leadership, including CEO Benjamin Kittle and CTO David Brouwer. Brouwer brings relevant technical expertise in Move programming and high-performance systems development. The team's commitment to open-source development is evident through their active GitHub repository with multiple branches and version tags, indicating ongoing development activity.

The development process emphasizes academic research and formal verification tools, with Move Prover being actively maintained as an open-source component. This approach aligns with the technical rigor required for the platform's ambitious multi-VM architecture.

Ecosystem Applications and Adoption Strategy

DeFi and Cross-Chain Use Cases

Traditional DeFi operates in a multi-chain environment where protocols deploy separate instances on different blockchains, creating liquidity silos and forcing users to manage assets across multiple environments. Mango Network's omni-chain approach promises unified liquidity pools that can access assets from multiple blockchains simultaneously.

For example, a lending protocol on Mango could theoretically accept Bitcoin collateral, Ethereum-based tokens, and Solana assets within the same pool, dramatically expanding available liquidity. However, this vision requires solving challenges around asset price synchronization, bridge security, and regulatory complexity across multiple jurisdictions.

The platform's high throughput and low fees also make it suitable for gaming applications that require frequent microtransactions. Dynamic NFTs that change properties based on player actions or cross-game interactions become feasible, potentially creating shared gaming economies where assets move between different games.

Enterprise Integration Potential

MgoDNS represents the platform's decentralized domain name system that bridges traditional internet and blockchain environments. The system can resolve standard internet domain names while adding blockchain-specific features. For example, a single domain name like "alice.mgo" could resolve to wallet addresses on multiple different blockchains. Smart contracts can also automatically update these domain resolutions based on programmed conditions.

Companies could potentially manage tokenized assets through familiar web interfaces backed by blockchain security, or integrate blockchain tracking into existing supply chain systems without complete infrastructure overhauls. However, enterprise adoption typically requires proven security track records and regulatory clarity that new platforms lack.

The success of these applications depends on more than technical capability. User experience factors, regulatory compliance, and integration with existing business processes often determine adoption rates more than underlying technical performance.

Investment Analysis and Risk Assessment

Bull Case for Mango Network

The platform addresses real problems in current blockchain infrastructure through technical innovation that, if executed successfully, could provide sustainable competitive advantages. Growing demand for cross-chain functionality creates market opportunities for platforms that deliver seamless omni-chain experiences.

Positive Development Indicators

The platform demonstrates several encouraging signals for potential success. The MoveBit security audits, with minimal findings, suggest solid code quality and development practices. The $13.5 million funding provides adequate resources for ecosystem development, while the substantial ecosystem fund allocation indicates a serious commitment to attracting developers and applications.

Active GitHub development with multiple branches and regular commits shows ongoing technical progress. The team's emphasis on formal verification through Move Prover and academic research references suggests a rigorous approach to blockchain development that could appeal to institutional users and serious DeFi protocols.

The blockchain infrastructure market continues to grow rapidly, with room for multiple successful Layer 1 platforms serving different use cases and user segments. If Mango can prove its technical claims and attract quality developers, it could capture significant market share in the cross-chain and high-performance blockchain segments.

Risk Factors and Concerns

The technical complexity of supporting multiple VMs and seamless cross-chain functionality creates significant execution risk. Many blockchain projects fail to deliver on ambitious technical promises, and Mango's scope increases both potential impact and failure risk.

Established Layer 1 platforms have network effects, developer mindshare, and institutional relationships that will be difficult to overcome regardless of technical superiority. The immediate unlock of all tokens creates significant downside risk and suggests either overconfidence in immediate adoption or inexperience with token economic best practices.

Cross-chain functionality and privacy features may face regulatory challenges that could limit adoption or require costly compliance modifications. The Layer 1 blockchain market may also be approaching saturation, with limited room for new entrants to achieve meaningful market share and developer adoption.

Conclusion

Mango Network presents a technically sophisticated approach to Layer 1 blockchain infrastructure through its multi-VM architecture, comprehensive cross-chain functionality, and strong security foundation. The platform's clean audit results from MoveBit, transparent development practices, and substantial funding provide a solid foundation for ecosystem growth.

While the immediate token unlock strategy and competitive market dynamics present challenges, the project's technical innovations address real problems in current blockchain infrastructure. The combination of Move programming language security, EVM compatibility, and omni-chain capabilities could provide meaningful advantages if properly executed and adopted.

The June 24, 2025 token launch will provide important market feedback on investor and user interest. Early performance metrics, developer adoption rates, and the platform's ability to deliver on its high-throughput promises will be key indicators of long-term viability and success in the competitive Layer 1 landscape.

For more information about Mango Network and airdrop eligibility, visit mangonet.io, or for updates, follow @MangoOS_Network on X.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events