Deepdive

(Advertisement)

Everything You Need to Know About Injective $INJ in 2025

Injective ($INJ) 2025 guide: Layer-1 blockchain for finance, tokenized RWAs, MEV-resistant trading, AI integration, and institutional partnerships.

Crypto Rich

July 14, 2025

(Advertisement)

While traditional financial markets operate within banking hours and geographic restrictions, imagine trading Apple stock at 3 AM on a Sunday or buying tokenized oil futures without a broker. This reality exists today on Injective Protocol, where over $1 billion in traditional assets—stocks, commodities, and foreign exchange—now trade around the clock in a permissionless environment.

Injective Protocol stands as a specialized layer-1 blockchain built exclusively for finance. It enables users to create and trade tokenized real-world assets (RWAs), stocks, commodities, and financial instruments without traditional barriers. Having processed over 2 billion transactions and $57 billion in on-chain volume, Injective has positioned itself as a leader in asset tokenization during a pivotal moment for the industry.

The protocol's mission centers on democratizing global finance through a unified platform for Web3 financial applications. Built using the Cosmos SDK, Injective delivers high-performance transactions with near-instant finality, MEV resistance, and cross-chain interoperability. Its bridges connect to ecosystems like Ethereum and Solana, while supporting a massive throughput of up to 20,000 transactions per second. Advanced account abstraction and parallelization make it AI-optimized for real-time onchain inference in DeFi agents and intelligent dApps.

In the current market landscape, blockchain faces increased institutional interest amid regulatory progress in the United States. This environment has driven substantial capital flows to specialized L1s like Injective, which ranks in the top 5 for net inflows year-to-date. The protocol surpasses networks like Bitcoin and Arbitrum as the RWA sector grows toward potentially exceeding DeFi's $121 billion market cap. Tokenization gains traction as a major innovation, with regulators and platforms like Kraken emphasizing stocks as a "Trojan Horse" for onchain adoption. This aligns perfectly with Injective's $1B+ traded volume across equities, commodities, and FX.

History and Background

Injective Labs founded the protocol in 2018 with a U.S.-based team focused on addressing DeFi limitations through an optimized financial blockchain. The mainnet launched in 2021, introducing early innovations including an MEV-resistant on-chain orderbook and Tendermint consensus for enhanced speed. The leadership team includes CEO Eric Chen and General Counsel Noah Axler, both actively engaged in U.S. regulatory discussions through Capitol Hill visits and SEC outreach initiatives.

Major Platform Upgrades

Several major upgrades have shaped Injective's development. The Nivara Mainnet upgrade in February 2025 enhanced RWA performance capabilities, while the MultiVM Initiative the same month created unified liquidity across virtual machines. The iAgent 2.0 launch in January 2025 introduced AI-DeFi integration for autonomous agents. The ecosystem has experienced explosive growth, with daily active addresses increasing over 1,000% year-to-date (some metrics showing up to 1,700% from ~4,500 to over 81,000) and more than 100 projects deployed across the network. In 2025, Injective underwent a rebrand, updating its logo, website, and tools like Injective Hub and INJScan to reflect its expanded mission.

Technology and Architecture

Injective's architecture leverages a customized Tendermint consensus mechanism that achieves sub-second finality and high throughput. Performance tests demonstrate that the network outperforms leading EVM networks by over 400% in testing scenarios, with theoretical performance up to 8 times faster than prominent networks. The protocol supports module-based development, enabling custom smart contracts and applications that are not possible on other blockchain networks.

Core Technical Innovations

The protocol introduces several core innovations that differentiate it from traditional blockchain networks:

- MEV-Resistant Orderbook: Ensures fair trading without front-running, protecting users from maximum extractable value exploitation through native orderbook implementation

- IBC and Cross-Chain Bridges: Native interoperability connects Injective to over 123 blockchain networks, enabling seamless asset transfers and communication across ecosystems

- MultiVM Token Standard (MTS): Launched in July 2025, enables tokens to operate seamlessly across Cosmos and EVM environments without requiring bridges for cross-chain functionality

- Native EVM Implementation: Currently live on testnet as of July 2025, includes precompiles, developer tools, and full Ethereum compatibility with gasless and signless interactions via account abstraction

- RWA Module: Provides end-to-end tokenization capabilities with embedded on-chain compliance and KYC/AML features built directly into assets for regulatory compliance

Developer Infrastructure

The protocol offers comprehensive developer support through updated EVM documentation, software development kits (SDKs), and certification programs via partnerships like HackQuest. Tools include Solidity, Foundry, MetaMask integration, and the upcoming iBuild no-code interface for smart contract creation. AI integration through iAgent 2.0 and ElizaOS enables the creation of autonomous DeFi agents.

Key Features and Products

Injective supports unlimited tokenization of stocks, commodities, and foreign exchange instruments. Notable examples include $WTI oil tokenization, generating over $200 million in year-to-date volume with a potential market cap exceeding $35 billion. Other tokenized assets include Oil, Nvidia, and Euros. The protocol's decentralized exchange, Helix DEX, operates around the clock, supporting various trading pairs, including Circle's $CRCL tokenized asset. The exchange provides institutional-grade trading features while maintaining the security benefits of decentralized infrastructure.

Native Financial Infrastructure

Agora issues the native AUSD stablecoin, which has recorded over $10 million in mints. AUSD maintains deep liquidity across 13 networks and offers zero-fee minting through USDC and USDT pairs. The ecosystem includes several specialized dApps: Mach for cross-chain swap functionality, Degen Arena as a social trading platform, and KaitoAI for analytics and data insights. All applications are currently available on the EVM testnet for public testing. Additional native dApps include Meowtrade for Discord-native social trading.

EVM dApp Ecosystem

The first wave of EVM dApps further expands capabilities across multiple DeFi verticals:

- Pumex: AMM with yield optimization, achieving $120M+ volume through capital-efficient trading mechanisms and advanced liquidity management

- Yei Finance: Leveraged yield farming and undercollateralized lending solutions for enhanced capital efficiency in DeFi protocols

- Borderless: Pre-TGE and cross-chain asset trading capabilities, enabling early access to token launches and seamless cross-ecosystem transactions

- Lair Finance: Liquid restaking via LRTs (Liquid Restaking Tokens) for dual rewards, maximizing staking yield opportunities across multiple networks

- Stryke: Decentralized options trading with low collateral requirements, providing advanced derivatives trading without traditional barriers

- Bondi Finance: Tokenized corporate bonds and sovereign debt as part of RWA expansion, bringing traditional fixed-income instruments onchain

- Timeswap: Fixed-term lending AMM without oracles or liquidations, offering innovative lending solutions with reduced risk vectors and enhanced capital efficiency

- Accumulated Finance: Algorithmic yield optimizer for compounding returns, automatically maximizing yield across multiple DeFi protocols

- Orbiter Finance: Fast bridging between Ethereum L2s and Injective, facilitating quick and efficient cross-layer asset transfers

Deflationary Tokenomics

The protocol implements a community-driven burn mechanism, with 6.6 million $INJ tokens burned as of July 2025. The INJ 3.0 upgrade, launched in January 2025 with 99.99% community approval, reduces total token supply through dynamic adjustments and weekly burn auctions, enhancing deflationary aspects.

Injective Hub

Injective Hub serves as the protocol's primary user interface, providing a comprehensive platform for users to interact with all aspects of the Injective ecosystem. The Hub consolidates essential functions including governance participation, staking rewards, wallet management, and tokenomics features into a seamless user experience.

Governance and Voting

Injective maintains active community governance via INJ tokens, which serve as a decentralized utility for proposals, voting, and protocol incentives. Token holders can participate in key decisions affecting the protocol's development, parameter changes, and ecosystem upgrades through the Hub's governance interface. The democratic approach ensures community-driven evolution while maintaining technical excellence.

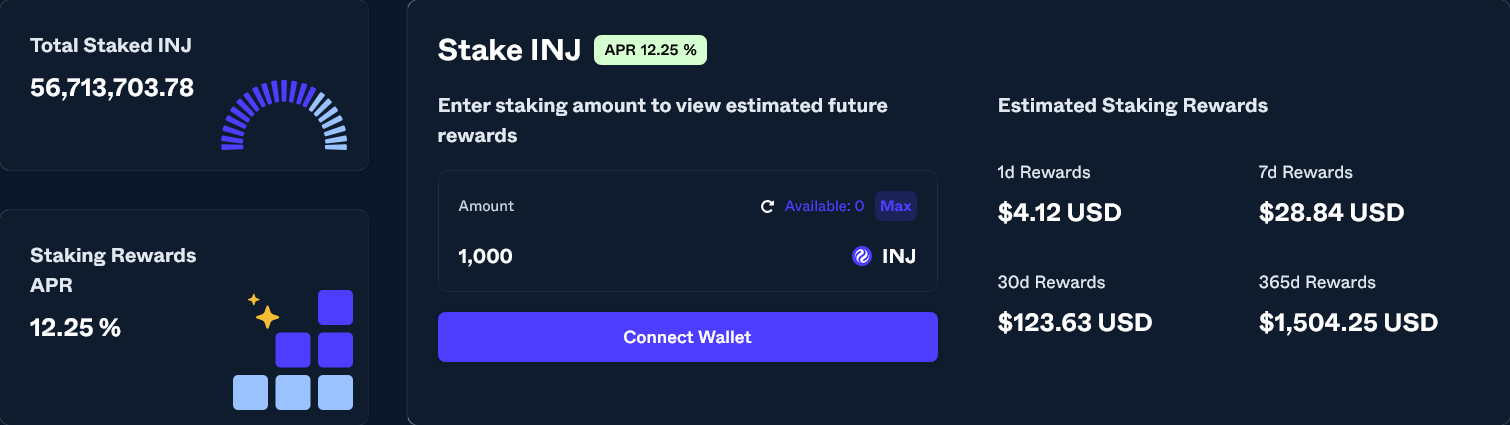

Native Staking

INJ holders can stake tokens natively through Injective Hub, earning competitive yields currently at 12.25% APR while participating in network security and governance. The staking mechanism supports the protocol's proof-of-stake consensus while providing sustainable rewards to participants. Staking rewards are distributed regularly, contributing to the overall tokenomics and network stability.

Wallet Integration

The Hub provides seamless wallet integration supporting multiple connection methods and cross-chain functionality. Users can manage their assets, track portfolio performance, and execute transactions across the Injective ecosystem and connected networks. The interface supports both novice and advanced users with intuitive design and powerful features for sophisticated trading and DeFi operations.

Token Burns and Auctions

Community-driven burn mechanisms operate through the Hub, where users can participate in weekly burn auctions as part of the INJ 3.0 deflationary model. The transparent burn process removes tokens from circulation permanently, creating deflationary pressure while allowing community participation in tokenomics decisions. Real-time burn statistics and auction schedules keep users informed of upcoming events.

Ecosystem and Partnerships

Injective maintains an active ecosystem with over 100 projects deployed and trending dApps focused on RWAs and DeFi. The Injective Council, launched in July, includes prominent institutional members focused on adoption and tokenization. Google Cloud provides validator operations and cloud infrastructure tools, while Deutsche Telekom handles telecommunications integration. BitGo offers custody services and staking infrastructure. Galaxy provides investment and advisory services, and Republic manages tokenization platform integration. NTT Digital focuses on enterprise blockchain solutions, and KDAC handles Asian market expansion. The Council offers members early insights and influence on priorities, fostering governance-driven innovation.

Strategic Collaborations

Strategic partnerships span institutional and technology collaborations. Hex Trust launched staking services in March 2024, while Tenderly integrated developer tools this past July. Ripple and Peersyst provide $XRP integration and cross-chain functionality, and SonicSVM develops cross-chain AI agents. Financial partnerships include Agora's $50 million Series A funding for AUSD expansion, BlackRock's BUIDL index integration, and Nomura's tokenized fund offerings. Additionally, 21Shares offers the AINJ Staking ETP—a 100% backed product that tracks INJ performance while reinvesting staking yields.

The team participates actively in industry events, including the Injective Summit 2025 in New York City with speakers from NYDFS, Gemini, and VanEck, plus presentations at Korea BUIDL Week. Key partnership developments in Q1 2025 involved Google Cloud and Nomura focusing on validators and tokenized funds, while April 2025 saw Hex Trust and INF CryptoLab collaborations on staking and RWA presentations. June 2025 brought BitGo and CoinDesk partnerships for custody and summit media coverage, and July 2025 featured Council member integration, Agora funding, and Tenderly development tools.

Recent Developments

July 2025 brought significant updates across multiple areas of the Injective ecosystem. Key developments include:

- EVM Testnet Enhancements: Integration of the MTS standard, new dApps like ChoiceXchange for unified liquidity, comprehensive developer guides, and a public campaign with rewards

- XRP Integration Success: Injective became the largest chain for $XRP holdings following successful integration with the Ripple ecosystem

- Regulatory Engagement: Formal SEC outreach for decentralized protocol clarity and safe harbor provisions, complemented by Capitol Hill visits supporting pro-crypto policy initiatives

- Council Launch: Inaugural meeting with enterprise leaders focused on tokenization standards and institutional adoption frameworks

- Platform Integrations: Mach platform for instant swaps, Tenderly development tools, and Ambassador Program upgrades

- Network Growth Metrics: 6.6 million tokens burned, daily active addresses up 1,000% year-to-date, and $50 million raised for AUSD expansion

- RWA Expansion: Addition of $WTI oil tokenization, $10 billion custodian total value locked, and BUIDL index integration

- Content Initiatives: "Wall Street Onchain," a new weekly analysis series by Injective's @0xBrans, covers onchain stock developments

- Documentation Updates: New EVM docs released on July 13, enhancing guides, precompiles, and code examples

The first week of July focused on EVM documentation and the Mach platform launch, improving developer accessibility and cross-chain access. The second week emphasized regulatory progress through SEC correspondence and Council launch, enhancing institutional depth. Recent developments have highlighted deflationary mechanics through token burns, AUSD fundraising, and XRP integration, driving liquidity growth.

Challenges and Market Conditions

Injective addresses regulatory uncertainties through proactive engagement, including a formal SEC letter advocating for decentralized protocol clarity to prevent innovation from moving offshore. This approach demonstrates the team's commitment to working within regulatory frameworks while maintaining decentralized principles. Industry-wide challenges include IBC vulnerabilities and stablecoin fragmentation, requiring unified standards and enhanced security protocols. Injective's embedded compliance tools and native stablecoin offerings position the protocol to address these concerns effectively.

The 2025 market environment shows optimism for RWAs and DeFi, with tokenization accelerating toward a $35 billion market cap and a projected $30 trillion opportunity. With over 52 million U.S. crypto users and increasing institutional inflows, market conditions favor platforms like Injective that bridge traditional finance and Web3. Technical adoption gaps and compliance requirements remain hurdles, though Injective's integrated tools and regulatory engagement provide competitive advantages in addressing these challenges. Platforms like Kraken, Gemini, and Robinhood launching tokenized equities validate the sector's direction.

Future Outlook

Injective's roadmap prioritizes several key initiatives for continued growth and market leadership:

Core Development Priorities:

- EVM Mainnet Launch: Full production deployment of EVM compatibility with enhanced performance and developer tools

- Expanded RWA Tokenization: Private credit instruments and white-labeled stablecoins to capture traditional finance markets

- AI Agent Hubs: Cross-chain integration through SonicSVM for autonomous trading and intelligent DeFi operations

- Institutional DeFi: Enhanced Council-driven enterprise adoption with tailored solutions for institutional participants

Upcoming Market Initiatives:

- INJ Staked ETF Filing: Regulatory submission for exchange-traded fund products to provide traditional investment vehicle access

- On-Chain Summer Campaigns: Community engagement and adoption programs designed to drive user growth and ecosystem expansion

- Summit 2025 Conference: Comprehensive agenda featuring regulatory panels with NYDFS participation, tokenized asset discussions, and speakers from Gemini and VanEck

INJ 3.0's deflationary mechanics and Injective's position among high-performance L1 networks create significant advantages in a market increasingly focused on tokenization and U.S. cryptocurrency leadership. With regulatory clarity advancing and institutional adoption accelerating, Injective's comprehensive approach to bridging traditional finance and Web3 creates substantial competitive advantages in the evolving financial landscape.

Conclusion

Injective Protocol has established itself as the leading blockchain for on-chain finance through advanced technology, strategic partnerships, and proactive regulatory engagement. The protocol successfully bridges traditional finance and Web3 through specialized infrastructure designed specifically for financial applications.

The 2025 developments in RWAs, EVM compatibility, and institutional partnerships demonstrate Injective's resilience and growth potential amid the expanding tokenization trends. With over 2 billion transactions processed and $57 billion in on-chain volume, Injective has proven its technical capabilities and market demand.

Through continued innovation in AI integration, cross-chain functionality, and regulatory collaboration, Injective addresses key challenges facing the broader cryptocurrency ecosystem while delivering practical solutions for real-world financial applications. The depth of its ecosystem, from diverse dApps to deflationary tokenomics, underscores its scale—far from "little," it's a robust platform poised for success in onchain finance.

For the latest updates and developments, visit the Injective Protocol website and follow @Injective on X for real-time news and announcements.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

(Advertisement)

Latest News

(Advertisement)

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events