Research

(Advertisement)

Is Crypto Security Crumbling? How the Industry Can Fight Back

Crypto security is under fire as hacks and money laundering cases rise. Expert warns slow responses and weak safeguards put users at risk.

Miracle Nwokwu

March 19, 2025

(Advertisement)

Table of Contents

Cryptocurrency has been hailed as the future of finance, offering benefits like decentralization, fast transactions, and borderless trading. However, its dark side is becoming harder to ignore as a wave of hacks, scams, and money laundering scandals questions the industry's commitment to security. Experts like on-chain investigator ZachXBT have sounded the alarm, warning that the crypto space might be failing to protect itself and its users.

High-Profile Hacks Expose Security Gaps

Over the past six months, the industry has seen a troubling rise in cyberattacks that have drained billions from decentralized finance (DeFi) projects and centralized exchanges alike. Notably, the Lazarus Group—a hacking organization linked to North Korea—has allegedly laundered several billions in stolen assets, exploiting flaws across multiple platforms.

For instance, a recent $1.4 billion hack on crypto exchange Bybit left the platform scrambling to freeze stolen funds, with ZachXBT directly involved in attempts to mitigate damages. Despite efforts, the time it took for exchanges to react allowed hackers to launder substantial amounts through sophisticated tactics. The situation revealed the industry's sluggish response to emergencies, giving criminals a head start.

Meanwhile, decentralized projects also face scrutiny, with some refusing to address illicit activities happening on their platforms. This lack of accountability not only undermines user trust but also invites regulatory intervention that could drastically alter the crypto landscape.

Then there’s the DMM Bitcoin hack from May 30. Hackers made off with $305 million in Bitcoin, with ZachXBT later tying the laundering to Lazarus Group tactics. The funds flowed through privacy mixers and cross-chain bridges before landing at Huione Guarantee, a Cambodian exchange linked to illicit activity. Japan’s DMM Bitcoin scrambled to raise $320 million to cover losses, but the incident highlighted how easily hackers exploit gaps in exchange infrastructure.

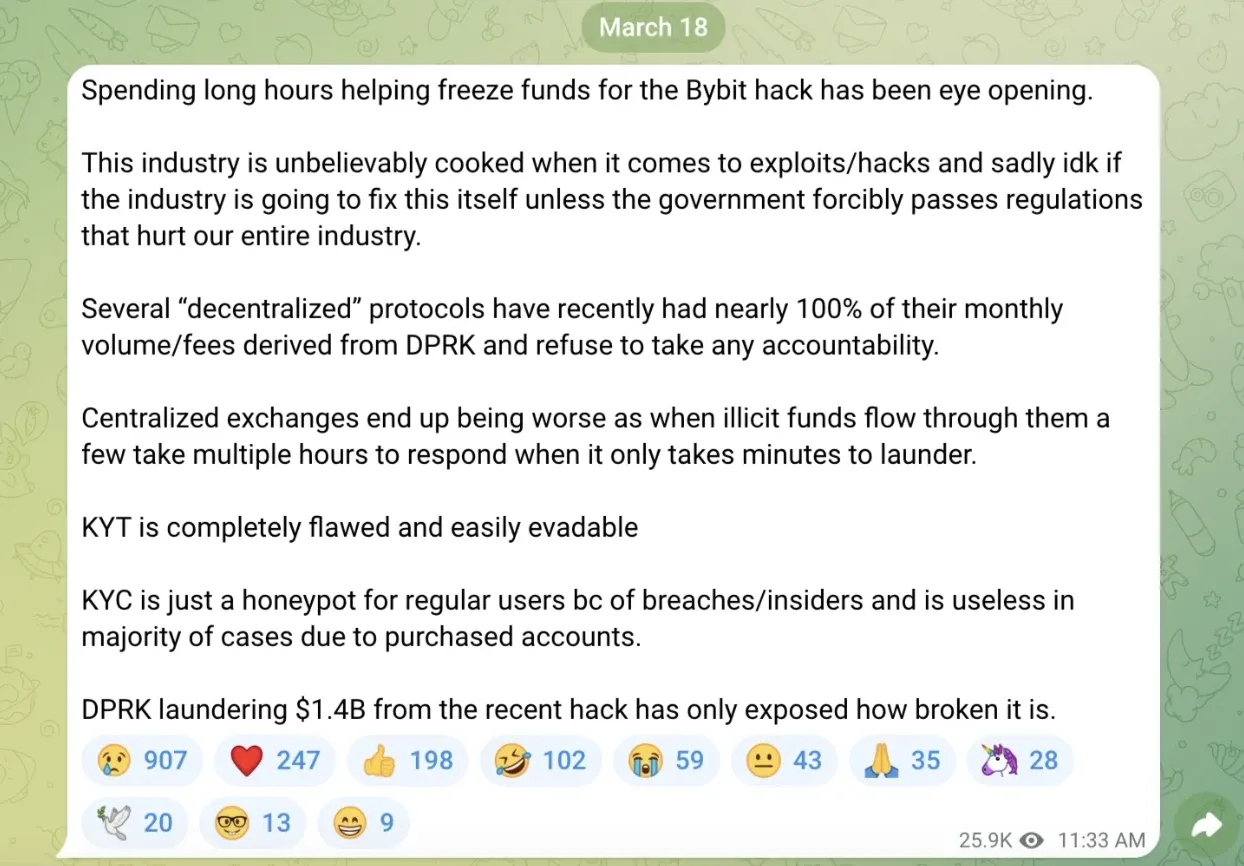

“This industry is unbelievably cooked when it comes to exploits/hacks,” ZachXBT stated on his Telegram channel.

The detective didn’t mince words: decentralized protocols are ignoring illicit activity, while centralized exchanges take hours to freeze funds—far too late when laundering can happen in minutes. With the stakes this high, is the crypto industry teetering on the edge of a security crisis?

A Flawed System: KYC and KYT Under Fire

Industry-standard measures like Know Your Customer (KYC) and Know Your Transaction (KYT) protocols have come under severe criticism. ZachXBT points out that even these mechanisms are failing to deter criminals effectively.

Hackers have reportedly sidestepped these safeguards by using purchased or fake accounts, rendering KYC protocols nearly useless. At the same time, KYT analysis tools—meant to trace illicit transactions—are frequently evaded by advanced laundering techniques.

For example, recent reports revealed how North Korean hackers intentionally made “mistakes” while trading stablecoins like USDC and USDT to avoid detection while profiting through bots. Such vulnerabilities have created a breeding ground for bad actors, putting regular users at risk and exposing them to theft, scams, and data breaches.

Centralized Exchanges: Too Slow to Respond?

While decentralized platforms face valid criticism, centralized exchanges haven’t fared much better. When illicit funds flow through these platforms, many take hours—sometimes longer—to respond. That gap is all criminals need to move assets into untraceable wallets or other laundering mechanisms.

The Bybit hack is a clear example. Despite multiple alerts, freezing the stolen funds took far too long. This slow reaction has led experts to speculate whether such platforms prioritize user protection or if bureaucracy slows progress. Either way, the result is the same: criminals escape, leaving users and exchanges to pick up the pieces.

North Korea's Role Escalates

North Korea’s involvement has highlighted just how broken crypto security is. ZachXBT called out DeFi networks that appear to turn a blind eye to the origin of their transaction volume, some of which are derived almost entirely from illicit activities. This negligence not only fuels global security risks but also paints the crypto industry as unwilling—or unable—to self-regulate its bad actors.

Reports from investigative sites and blockchain analytics firms confirm that groups like Lazarus are growing more sophisticated. From manipulating trades to exploiting multi-chain transactions, their strategies evolve faster than the protocols built to stop them.

Governments worldwide are now paying closer attention. Some speculate that unless the industry shores up security, governments will introduce sweeping regulations that could stifle innovation or force platforms to shut down.

Can Crypto Fix Itself—Or Will Regulation Take Over?

The crypto world continues to promote itself as a revolutionary force in the finance sector. But with massive security breaches and rampant money laundering dominating headlines, questions arise about whether it can manage its risks without external intervention.

ZachXBT warns that government regulation could soon become inevitable if platforms don’t tackle these flaws seriously. While regulation might reduce the frequency of attacks, it could also hurt the freedom and innovation that crypto enthusiasts value. Striking the right balance is the challenge ahead.

Solutions the Industry Needs

So, what’s the way forward? Improving the security of crypto platforms is not just a technical issue; it’s a moral obligation to protect users and uphold trust. The following measures could help:

- Regular Audits: Ensuring that smart contracts and protocols are routinely checked by third-party experts to catch vulnerabilities before hackers do.

- Faster Response Times: Improving the agility of exchanges and DeFi projects in freezing stolen funds and blocking fraudulent activities.

- Enhanced Private Key Security: Encouraging users to adopt multi-signature wallets and hardware security measures.

- Better Collaboration: Platforms must work more closely with blockchain analysis firms and law enforcement to trace and recover stolen assets.

- Education and Awareness: Users need better tools and education about how to recognize scams and secure their assets.

With threats evolving rapidly, these steps are critical to safeguarding the future of the industry.

Final Thoughts

The crypto industry is at a crossroads. On one hand, its promise of decentralized finance continues to attract millions. On the other, its inability to address fundamental security flaws risks leaving its users vulnerable and regulators no choice but to intervene.

ZachXBT's warnings should be a wake-up call for everyone in the sector. If platforms want to maintain their independence while encouraging public trust, they must prioritize security, act faster in emergencies, and close the gaps being exploited daily. The question isn’t whether crypto can grow—it’s whether it can do so without falling apart under the weight of its own vulnerabilities.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Miracle Nwokwu

Miracle NwokwuMiracle holds undergraduate degrees in French and Marketing Analytics and has been researching cryptocurrency and blockchain technology since 2016. He specializes in technical analysis and on-chain analytics, and has taught formal technical analysis courses. His written work has been featured across multiple crypto publications including The Capital, CryptoTVPlus, and Bitville, in addition to BSCN.

(Advertisement)

Latest News

(Advertisement)

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens