Is India Becoming the Next Crypto Powerhouse?

Despite regulatory ambiguity and taxes, crypto is gaining popularity—especially among youth, women, and Tier-2 city dwellers.

Soumen Datta

April 11, 2025

Table of Contents

Once viewed as speculative or risky, digital assets is becoming part of everyday financial decisions for millions of Indians. From city centers to small towns, the crypto movement is gaining momentum.

Crypto Adoption in India Is Growing at a Breakneck Pace

India is now one of the fastest-growing crypto markets in the world. In 2024, the projected compound annual growth rate (CAGR) for cryptocurrency in India stands at an impressive 54.11%, expected to continue until 2032. This explosive growth isn't random.

Several factors are at play:

- Wider acceptance of crypto as a long-term investment.

- A booming digital economy backed by government support.

- An increasingly young, tech-savvy population.

- Dozens of startups and platforms making crypto easier to access.

The global backdrop also helps. Bitcoin reached a record high of $73,750 in March 2024, pushing the market cap to $2.5 trillion. Meanwhile, India’s own crypto market is expected to reach $6.6 billion in 2024.

But while these numbers paint a bullish picture, India’s story goes far beyond the charts.

Demographics Tell the Real Story

A deeper look into who’s investing in crypto reveals an interesting pattern. A large portion of India’s crypto users are between the ages of 20 to 35, making up nearly 75% of the investor base. They're educated, ambitious, and comfortable with technology.

A Mudrex survey found that between June 2023 and January 2024, there was a 300% increase in the number of women investing in crypto. One in five users is now a woman — a trend showing slow but steady progress in gender inclusivity.

These are not just city dwellers either. Tier-2 and Tier-3 cities like Jaipur, Lucknow, and Botad are witnessing strong growth in crypto adoption.

Local communities are organizing workshops. Traders like Ashish Nagose, a flower shop owner from Nagpur, are learning about crypto in offline classes. For many like him, digital assets are becoming an additional income source when small businesses face seasonal slowdowns.

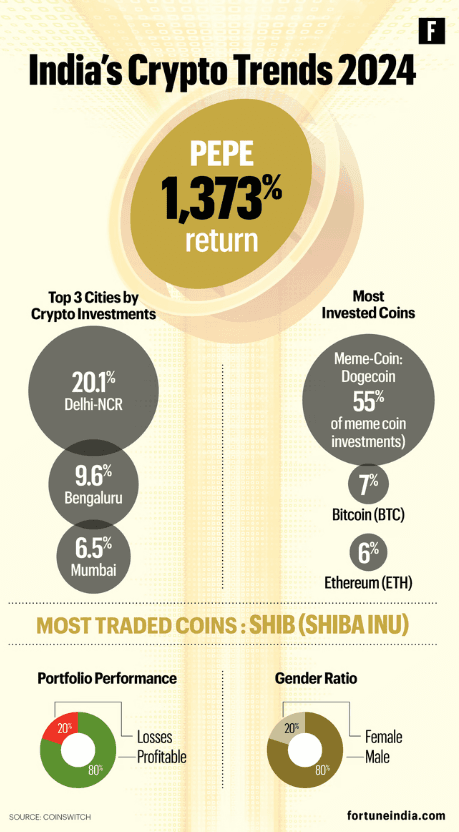

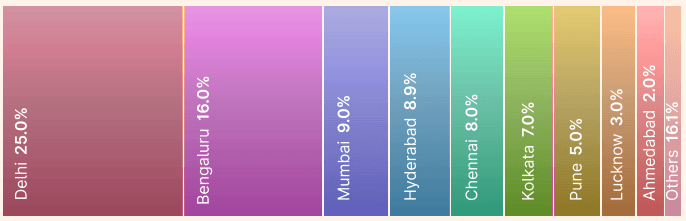

India’s Urban Crypto Capitals

Delhi-NCR leads India in total crypto investments, followed by Bengaluru and Mumbai. In fact, Delhi alone accounts for 20.1% of India’s crypto volume in 2024. Bengaluru and Mumbai contribute another 16% combined.

Interestingly, Pune stands out for a different reason. Over 86% of investors from Pune reported positive returns — the highest profitable user base in the country.

Smaller cities like Kolkata and Botad made their first appearances in India’s top 10 crypto investment cities in 2024. It signals a broader trend: crypto is no longer just a metro game.

Trading Volumes and Token Trends Are Surging

Indian exchanges saw a dramatic spike in activity in early 2024:

- A 200% rise in sign-ups over three months.

- A 100% increase in total transactions.

- An 80% jump in deposits from January to February.

Popular assets? Dogecoin leads the pack, making up 11% of investments, followed by Bitcoin (8.5%) and Ethereum (6.4%). Memecoins overall represent 13% of total investments, with PEPE delivering a jaw-dropping 1373% return in 2024.

But it’s not all hype. Investors are becoming more sophisticated. The most preferred tokens are blue-chip cryptos like Bitcoin and Ethereum, as well as Layer-1 tokens and DeFi assets, which offer both utility and reliability.

Regulatory Headwinds Continue

India’s crypto industry is not without its challenges. Regulation remains a wildcard. The RBI’s 2018 ban on banking services for crypto exchanges was lifted in 2020, but the threat of restrictions looms.

The current 1% TDS (Tax Deducted at Source) on crypto trades has been a major obstacle. Many exchanges are pushing for this to be reduced to 0.01%, citing loss of volume to offshore platforms. In fact, high taxation has driven an estimated five million Indian users to foreign exchanges, causing an estimated $420 million revenue loss for the government since July 2022.

Despite these hurdles, domestic exchanges are innovating. Many now offer crypto futures in INR, enabling easier trading without currency conversion. Platforms also provide P&L tracking, local language support, and lower brokerage fees to attract users.

India’s Crypto Future: What Lies Ahead?

India has over 1.4 billion people, with nearly two-thirds under the age of 35. This demographic advantage — coupled with increasing internet access and mobile-first financial platforms — positions India as a key driver in the global crypto economy.

By 2035, India's crypto market is expected to surpass $15 billion, growing at a CAGR of 18.5%. This will be fueled not just by speculation but by growing institutional interest, smarter retail investors, and evolving regulation.

Crypto is also becoming culturally relevant. Younger generations are seeing digital assets not just as a means of investment, but as a statement of independence. It's a new asset class for a new era.

As Vikram Subburaj, CEO of Giottus, points out, “Crypto is no longer a fringe idea. It’s a legitimate, strategic asset class. The last two years have shown us that it’s here to stay.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens