Dogecoin: From Meme to Mainstream Crypto Payment

Dogecoin evolves from a 2013 meme into a utility-focused cryptocurrency - 730M+ DOGE institutional holdings, 3.5+ PH/s hashrate, and expanding payment adoption

Crypto Rich

November 7, 2023

Table of Contents

Last revision: October 27, 2025

Dogecoin is a peer-to-peer digital currency that emphasizes low-cost transactions, community engagement, and accessibility for everyday users. Originally launched in 2013 as a lighthearted alternative to Bitcoin, it has developed into a recognized cryptocurrency with growing institutional interest and expanding real-world utility.

The journey from internet joke to legitimate payment infrastructure shows how community-driven projects can achieve substance beyond their origins. While the Shiba Inu mascot and meme culture remain central to its identity, Dogecoin's technical capabilities and increasing adoption mark tangible progress toward becoming practical digital money.

How Did Dogecoin Start and Why?

Dogecoin emerged on December 6, 2013, during the early cryptocurrency boom when Bitcoin dominated headlines. Software engineers Billy Markus from IBM and Jackson Palmer from Adobe created it as a satirical commentary on the proliferation of questionable cryptocurrency projects flooding the market.

Palmer's joke tweet about combining two internet phenomena—cryptocurrency hype and the viral "Doge" meme featuring a Shiba Inu—sparked Markus to actually build the project. The collaboration took place almost entirely online, with Markus handling the technical implementation and Palmer focusing on concept development and promotion.

The Philosophy Behind the Launch

The project intentionally embraced absurdity from the start. Where Bitcoin presented itself as serious financial technology and other cryptocurrencies made grandiose promises, Dogecoin leaned into humor and accessibility. This approach resonated immediately with Reddit and social media communities looking for a cryptocurrency that didn't take itself too seriously.

The launch strategy differed fundamentally from typical cryptocurrency projects. No initial coin offering, no venture capital backing, and no promises of revolutionary technology. Instead, Dogecoin offered something simpler: a fun, approachable entry point into cryptocurrency that anyone could understand and use without technical expertise.

Both founders stepped back from active development by 2014 as the project grew beyond their initial expectations. Palmer cited the increasingly commercialized nature of cryptocurrency as conflicting with Dogecoin's community-first ethos. Markus moved on to other projects but maintained positive sentiment toward the community that formed around his creation.

Community-Led Development Takes Over

Since 2014, development has been entirely community-led through open-source contributions. Volunteers like Michi Lumin maintain the codebase and create educational resources such as the book "Dogecoin Tricks," ensuring the network operates without centralized leadership.

This decentralized development model proved surprisingly resilient. Without corporate oversight or venture capital pressure, the community focused on incremental improvements that served users rather than investors. Updates addressed security vulnerabilities, improved wallet software, and enhanced network efficiency without fanfare or marketing campaigns.

What Makes Dogecoin Different from Bitcoin?

Dogecoin differs from Bitcoin primarily through faster transaction speeds, lower fees, and a fundamentally different economic model. Built as a fork of Litecoin, which itself forked from Bitcoin, Dogecoin inherited technical characteristics that make it better suited to frequent, small-value transactions.

Block times average around 1 minute, compared to Bitcoin's 10 minutes. This enables faster transaction confirmations, making Dogecoin more practical for everyday purchases where users expect quick settlement. The Scrypt hashing algorithm provides ASIC-resistant mining, though specialized hardware has since been developed for Scrypt mining.

Transaction fees typically cost fractions of a cent, removing economic barriers that make Bitcoin impractical for micropayments. Sending $5 worth of DOGE costs essentially the same as sending $5,000, creating utility for small transfers that would be prohibitively expensive on other networks.

Understanding Dogecoin's Tokenomics

The tokenomics represent Dogecoin's most distinctive characteristic. Where Bitcoin caps at 21 million coins, Dogecoin has no maximum supply. Each block produces 10,000 DOGE, adding approximately 5.256 billion coins annually, creating a gradually declining inflation rate currently around 3-4% per year.

Comparing blockchain fundamentals reveals how Dogecoin positions itself differently. Bitcoin uses SHA-256 hashing with 10-minute blocks and halvings every 4 years, while Litecoin uses Scrypt with 2.5-minute blocks and an 84-million-coin cap. Dogecoin shares Scrypt consensus with Litecoin but operates with one-minute blocks and no supply limit, creating its unique profile as an inflationary digital currency.

The economic design serves practical purposes beyond technical specifications:

- A constant new supply encourages spending rather than hoarding behavior

- Miners receive consistent rewards without relying solely on transaction fees

- Lost or inaccessible wallets have minimal long-term impact on circulation

- Inflation rate decreases annually as the total supply grows larger

- Predictable issuance creates stable economic expectations for users and businesses

Technical specifications include:

- Proof-of-work consensus using the Scrypt algorithm

- Approximately one-minute block generation time

- Uncapped supply with fixed issuance per block

- 256-bit private keys for wallet security

- Merge-mining capability with Litecoin

- Public blockchain serving as a decentralized ledger

How Merge-Mining Strengthens Security

The merge-mining arrangement with Litecoin allows miners to secure both networks simultaneously without additional computational costs. Miners submit proof-of-work that validates blocks on both chains, earning rewards from both networks with the same computational effort. This innovation solved a critical problem for smaller proof-of-work chains: maintaining sufficient hashrate to resist attacks while benefiting from Litecoin's established mining infrastructure.

How Secure is Dogecoin's Network?

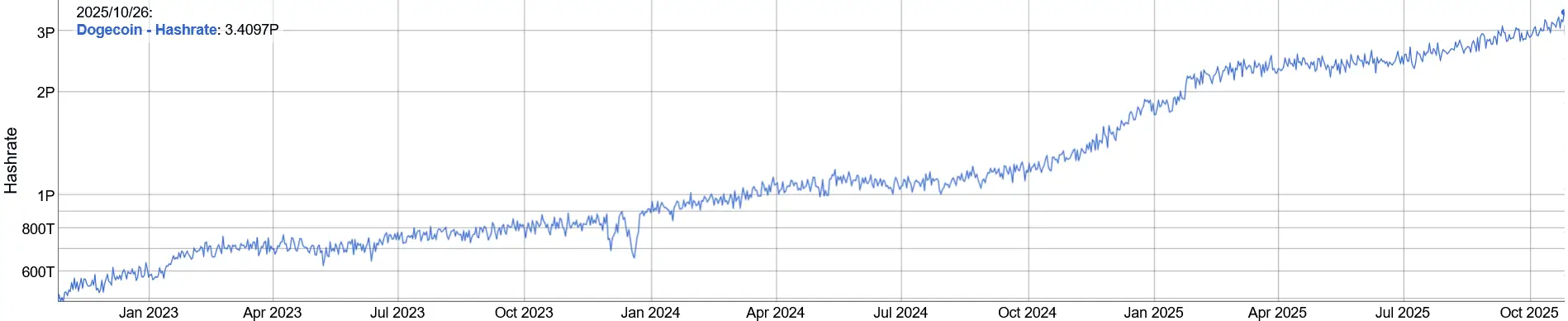

Network security reached unprecedented levels in 2025 as hashrate climbed to record highs. By late October, the network's computational power exceeded 3.5 petahashes per second, with an all-time high of 8.37 petahashes reported on October 22. These metrics significantly enhance protection against potential attacks.

The hashrate surge reflects growing miner confidence and demonstrates Dogecoin's evolution beyond its meme origins. Higher hashrate makes 51% attacks prohibitively expensive, as malicious actors would need to control more than half of the network's total computational power to compromise transaction integrity.

Merge-mining with Litecoin significantly enhances this security profile, giving Dogecoin security levels typically associated with much larger blockchain networks.

Proven Track Record of Reliability

The network has operated continuously since 2013 without successful attacks or critical failures. This twelve-year track record matters increasingly to institutions evaluating cryptocurrency infrastructure for business applications. Unlike newer networks that are still proving their resilience, Dogecoin demonstrates consistent reliability over time.

Major stress tests have validated network resilience. During periods of extreme market volatility, transaction volumes spike dramatically as users move funds between exchanges and wallets. Dogecoin has handled these surges without congestion or failure, processing millions of transactions during peak activity periods.

Node distribution across global regions provides additional security through decentralization. The public blockchain structure allows anyone to verify transactions independently, creating transparency that reduces reliance on centralized intermediaries.

Why Does Dogecoin Have Unlimited Supply?

The uncapped supply model stems from a deliberate design choice prioritizing circulation over scarcity. Where Bitcoin's fixed supply creates store-of-value characteristics similar to gold, Dogecoin's inflationary model resembles that of traditional fiat currencies, designed for spending rather than hoarding.

Each block generates exactly 10,000 DOGE regardless of network conditions or market price. This fixed issuance translates to roughly 5.256 billion new coins annually. While this sounds enormous in absolute terms, the percentage inflation rate declines continuously as the existing supply base grows larger.

The Economics of Controlled Inflation

Current inflation sits around 3-4% annually and decreases each year. A 3% inflation rate falls below historical averages for major fiat currencies, offering relatively predictable supply expansion. This generates sufficient new coins to replace lost wallets and reward miners while avoiding the hyperinflation that destroys currency value.

No token burning mechanisms exist within the protocol. Lost coins become permanently inaccessible but remain counted in total supply figures. This differs from cryptocurrencies that are implementing burn mechanisms to artificially constrain supply and potentially increase prices.

Critics argue that unlimited supply undermines long-term value appreciation, while supporters counter that modest inflation better serves currency utility. The debate reflects fundamental disagreements over whether cryptocurrency should primarily serve as money or as an asset.

What Major Developments Happened in 2024-2025?

Institutional adoption accelerated significantly throughout 2024 and into 2025, marking a shift from purely community-driven growth to serious business integration. The Dogecoin Foundation's commercial arm, House of Doge, spearheaded several major initiatives that expanded Dogecoin's presence in traditional business sectors.

Corporate Treasury Adoption

The most significant development involved CleanCore Solutions, a New York Stock Exchange-listed company that announced a $175 million Dogecoin treasury strategy in September 2024. By mid-October, the company's holdings surpassed 730 million DOGE with unrealized gains exceeding $20 million, pursuing long-term targets of 5% of the circulating supply. Alex Spiro, who serves as Elon Musk's attorney, chairs CleanCore's board.

House of Doge merged with Brag House Holdings, a NASDAQ-listed company, in October 2024. The merger, expected to close in early 2026, builds enhanced infrastructure for institutional adoption of Dogecoin and positions the combined entity to pursue larger strategic opportunities.

This treasury strategy mirrors Bitcoin corporate adoption, but with significant differences. Companies choosing Dogecoin cite its dual utility as both treasury asset and an operational payment method. The lower price per coin allows larger position sizes in absolute terms, while the established payment infrastructure enables immediate business use rather than pure speculation.

Strategic Partnerships Expand Utility

Strategic partnerships expanded Dogecoin's utility across multiple sectors. The collaboration with 21Shares focuses on developing yield strategies for DOGE holders, addressing criticism that Dogecoin lacks income-generating mechanisms. Partnership with inKind brought DOGE payments to over 4,750 venues across the United States, reaching more than 3.5 million users and dramatically expanding real-world spending opportunities.

Sports sponsorships marked another validation path. House of Doge acquired ownership stakes in U.S. Triestina Calcio, an Italian soccer club, and HC Sierre, a Swiss hockey team. These investments extend Dogecoin's brand presence into traditional sports markets while creating additional use cases for the currency.

Key partnership achievements include:

- 4,750+ venues accepting DOGE through inKind integration serving 3.5M+ users

- 21Shares yield product development for passive income generation

- Sports team ownership creating brand visibility in traditional markets

- Cross-chain bridges enabling DeFi participation without native smart contracts

- Merchant payment tools simplifying DOGE acceptance for small businesses

Infrastructure Investment Grows

Mining infrastructure received substantial investment. Thumzup Media committed $2.5 million to DogeHash mining operations targeting the deployment of 4,000 mining rigs. Bit Origin expanded its Dogecoin treasury holdings while developing merchant payment tools designed to simplify DOGE acceptance for businesses.

Technical integration progressed on multiple fronts. Internet Computer Protocol completed its Dogecoin integration milestone in March 2025, enabling DOGE to interact with smart contract platforms despite lacking native smart contract functionality. These cross-chain bridges expand Dogecoin's reach into DeFi ecosystems while maintaining its core characteristics.

How Do People Actually Use Dogecoin?

Practical applications center primarily on peer-to-peer payments, social media tipping, and charitable donations. The low-fee structure, combined with fast confirmations, makes Dogecoin particularly effective for small-value transactions where Bitcoin's fees would be prohibitive.

Tipping and Micropayments

Social media tipping emerged as an early killer application. Platforms like Reddit and X historically supported Dogecoin tipping bots, allowing users to send small amounts as appreciation for content. While some of these services have sunset, the tipping culture remains embedded in Dogecoin's community identity through various implementations.

The tipping use case demonstrates Dogecoin's practical advantages. Sending a few dollars worth of Bitcoin might cost more in fees than the transfer amount itself, making such transactions economically irrational. Dogecoin's sub-penny fees make tipping viable, enabling users to show appreciation without worrying about fees consuming the gift.

Merchant Adoption and Retail Payments

Merchants across retail, gaming, and online services increasingly accept DOGE directly. Companies like SPAR Switzerland integrated Dogecoin payments for grocery purchases. The inKind partnership enables DOGE spending at thousands of U.S. restaurants and hospitality venues, opening practical outlets for cryptocurrency holdings.

Cross-border remittances represent another growing use case. Traditional international money transfers often involve high fees and multi-day settlement times. Dogecoin enables near-instant transfers at minimal cost, providing particular value for workers sending money to families in different countries.

Real-world adoption patterns reveal interesting trends:

- Restaurant payments through inKind are showing steady monthly growth

- Cross-border remittances are particularly strong in Asian and Latin American markets

- Gaming platforms using DOGE for microtransactions and player rewards

- E-commerce sites accepting DOGE alongside traditional payment methods

- Charitable organizations receiving regular DOGE donations from community members

Philanthropy and Community Giving

Charitable giving remains central to community culture. The Dogecoin community funded clean water projects in Kenya in 2014, environmental initiatives like #TeamSeas in 2021, and supports various ongoing causes. Many charitable organizations now accept DOGE directly, recognizing the community's philanthropic tendencies.

Gaming integration keeps expanding. Some online games accept DOGE for in-game purchases or reward players with DOGE for achievements. These implementations introduce cryptocurrency to users who might not otherwise engage with digital assets.

Corporate treasury holdings represent a newer application category. Companies like CleanCore Solutions and Bit Origin hold DOGE as balance-sheet assets, treating it as both a potential store of value and operational currency. This dual-purpose utility distinguishes Dogecoin from cryptocurrencies that primarily serve as investments.

What Challenges Does Dogecoin Face?

Limited smart contract functionality represents Dogecoin's most significant technical limitation. While Ethereum and newer platforms enable complex decentralized applications, Dogecoin remains primarily a payment-focused blockchain. This constrains its ability to participate directly in DeFi protocols, NFT marketplaces, and other programmable money applications without relying on cross-chain bridges.

Technical Limitations and Perception Issues

Perception remains a persistent challenge. Many observers still view Dogecoin primarily as a meme rather than a serious cryptocurrency infrastructure. This perception persists despite growing institutional adoption and expanding utility, potentially limiting appeal to conservative institutions evaluating cryptocurrency options.

The uncapped supply model generates debate about long-term value propositions. While supporters argue that modest inflation supports currency functionality, critics contend that unlimited supply undermines investment rationale. This fundamental disagreement over Dogecoin's economic model shapes how different audiences assess its potential.

Market Volatility and External Dependencies

Social media dependency cuts both ways. Elon Musk's tweets have historically moved DOGE prices significantly, introducing volatility that undermines currency stability. While attention from high-profile figures increases awareness, reliance on external personalities for relevance raises sustainability concerns.

Regulatory uncertainty affects memecoins more broadly as authorities worldwide develop cryptocurrency frameworks. While Dogecoin's longevity and community focus may provide some protection, classification questions and potential restrictions on cryptocurrency marketing could impact its ecosystem.

Current challenges facing the network include:

- Lack of native smart contract capability is limiting DeFi participation

- Perception as a meme asset rather than a serious payment infrastructure

- Price volatility driven by social media and celebrity influence

- Regulatory uncertainty around memecoin classification

- Competition from newer payment-focused blockchains

- Limited development resources compared to venture-backed projects

- Debate about the long-term sustainability of the inflationary model

Competition intensifies constantly as new payment-focused cryptocurrencies launch with superior technical specifications. Networks offering faster transactions, more sophisticated features, or better marketing challenge Dogecoin's market position. Maintaining relevance requires ongoing development and adoption growth.

Development resources remain limited compared to venture-backed cryptocurrency projects. The all-volunteer developer community achieves impressive results but cannot match funding levels that support thousands of engineers working on competing platforms. This resource disparity affects development velocity and feature advancement.

Who Maintains the Dogecoin Community Today?

The Dogecoin community operates without centralized leadership through distributed social media presence and informal coordination. Active participants on platforms like X and Reddit maintain engagement through memes, updates, and mutual support that reinforces community bonds.

Official social media accounts managed by community volunteers share news, celebrate milestones, and maintain the playful tone that differentiates Dogecoin from more serious cryptocurrency projects. The @dogecoin account on X serves as a primary communication channel with over a million followers receiving updates and participating in community discussions.

Organizational Structure and Development

The Dogecoin Foundation, re-established in 2021 after years of inactivity, provides organizational structure for development coordination and strategic initiatives. It operates as a nonprofit that supports the Dogecoin ecosystem rather than controlling it, reflecting the project's decentralized ethos.

Developer contributions happen through open-source repositories where anyone can propose improvements or fix issues. Core developers review and merge changes in accordance with community consensus, maintaining the network without requiring permission from centralized authorities. This model has sustained Dogecoin's technical development for over a decade.

Content creators, artists, and meme-makers are essential to community vitality. The constant stream of Dogecoin-related humor and creative content maintains visibility and attracts new participants. This cultural production may appear frivolous, but it serves crucial marketing and community-building functions.

Community Values and Culture

Large holders, often called whales, include both exchanges holding customer funds and long-term community members. Unlike some cryptocurrencies where whale concentration raises concerns about manipulation, many large Dogecoin addresses belong to exchanges or community treasuries rather than individual speculators.

Charitable initiatives draw steady community participation. The "Do Only Good Everyday" motto encourages members to use Dogecoin for positive actions, creating a shared identity beyond financial speculation. This philanthropic tradition distinguishes Dogecoin from cryptocurrencies focused exclusively on price appreciation.

Can Dogecoin Compete with Modern Cryptocurrencies?

Dogecoin competes effectively in payment-focused niches despite lacking features present in newer blockchain platforms. While it cannot match Solana's transaction speeds or Ethereum's smart contract capabilities, Dogecoin offers advantages in simplicity, established infrastructure, and proven reliability.

The twelve-year operational history provides credibility that newer projects lack. Networks claiming superior technology must still prove resilience across multiple market cycles, regulatory changes, and technical challenges. Dogecoin's survival through numerous "Dogecoin killer" projects demonstrates durable community and technical foundations.

Competitive Advantages

Brand recognition significantly exceeds most competitors. Dogecoin's name recognition among mainstream audiences rivals that of Bitcoin and Ethereum, providing marketing advantages that are hard to replicate. This visibility matters more as cryptocurrency adoption moves beyond early adopters into the general population.

The absence of venture capital backing eliminates conflicts of interest that affect many newer projects. No token allocations to insider investors create selling pressure, and no roadmap promises generate unrealistic expectations. This organic development model builds more sustainable growth patterns.

Payment integration advantages stem from widespread existing support. Exchanges, wallets, and payment processors already support DOGE, reducing friction for new merchants and users. Newer cryptocurrencies must convince service providers to add support, creating adoption barriers.

Ongoing Limitations

However, technical limitations remain real. Cross-chain bridges enable DeFi participation but add complexity and potential security risks. NFT markets exist but remain smaller than on native smart contract platforms. These functional gaps limit Dogecoin's appeal for users seeking programmable money capabilities.

Conservative development philosophy prioritizes stability over innovation. While this produces fewer headline-grabbing announcements than competitors, it reduces risks from untested features. For users and institutions valuing predictability, this approach offers advantages over bleeding-edge experimentation.

Potential Pathways for Dogecoin's Evolution

The trajectory established by early corporate treasury adopters like CleanCore Solutions and Bit Origin creates frameworks that other companies may evaluate when considering cryptocurrency strategies. As digital assets gain acceptance in corporate finance, Dogecoin's dual nature as both a payment medium and a potential treasury asset positions it distinctively in the market.

Payment infrastructure continues to develop through partnerships and merchant integrations. The inKind collaboration demonstrates one pathway for expanding cryptocurrency utility in everyday commerce. Similar integrations with payment processors and point-of-sale systems could further extend Dogecoin's practical utility.

Community-Driven Development Continues

Technical development follows a measured pace, prioritizing reliability over revolutionary changes. Improvements to wallet software, mining efficiency, and network infrastructure are driven by community contributions rather than centralized development teams. This gradual evolution reflects Dogecoin's conservative approach that has sustained the network through multiple market cycles.

Regulatory developments will significantly influence cryptocurrency markets broadly. Clear classification frameworks and regulatory guidance can either facilitate or constrain adoption, depending on the specific requirements and restrictions authorities implement.

Cross-chain integration offers potential access to DeFi and other advanced applications without requiring fundamental protocol changes. As bridge technology matures and security improves, these connections could expand Dogecoin's ecosystem participation while preserving its core payment-focused design.

Cultural Position and Community Identity

Dogecoin's cultural relevance stems partly from unpredictable social media dynamics and community engagement patterns. The network's resilience through multiple hype cycles suggests foundational appeal beyond temporary attention spikes.

The community's emphasis on charitable giving and everyday transactions reinforces Dogecoin's identity as an accessible cryptocurrency. This positioning distinguishes it from investment-focused cryptocurrencies and aligns with its "Do Only Good Everyday" philosophy, which has characterized the project since its early days.

Conclusion

Dogecoin's evolution from a 2013 satirical cryptocurrency to a legitimate payment infrastructure shows how community-driven projects can achieve substance beyond their origins. The combination of technical reliability, low transaction costs, and expanding institutional adoption validates its role as an accessible entry point to cryptocurrency.

Current developments, including treasury accumulation by public companies, payment integration at thousands of venues, and record network security metrics, show tangible progress toward mainstream utility. The twelve-year operational history provides credibility that newer projects cannot match, regardless of superior technical specifications.

While challenges remain around smart contract functionality, supply model debates, and perception issues, Dogecoin's core strengths in payments, community engagement, and brand recognition support its market position. The network's conservative development approach and community-first ethos set it apart in increasingly crowded cryptocurrency markets.

For more information, visit the official Dogecoin website and follow @dogecoin on X for updates.

Sources

- Dogecoin Official Website - History, Technical Documentation, and Community Updates.

- Changelly - Dogecoin Background and Development History.

- Fortune - CleanCore Solutions Leadership and Strategic Direction.

- Investing.com - House of Doge Merger and Partnership Details.

- CoinGecko - Real-time Price Data and Market Statistics.

- Bitinfocharts - Blockchain Explorer and Network Hashrate Data.

Read Next...

Frequently Asked Questions

What makes Dogecoin different from Bitcoin?

Dogecoin offers faster block times (one minute vs. ten minutes), lower transaction fees (fractions of a cent), and an uncapped supply model designed for spending rather than hoarding. It uses Scrypt hashing and merge-mines with Litecoin for enhanced security.

Why does Dogecoin have an unlimited supply?

The uncapped supply supports Dogecoin's role as a transactional currency rather than an investment asset. Fixed issuance of 10,000 DOGE per block creates gradually declining inflation (currently 3-4% annually) that encourages circulation while maintaining value stability.

Where can I actually spend Dogecoin?

Dogecoin works for peer-to-peer payments, social media tipping, and purchases at thousands of merchants, including 4,750+ restaurants through inKind partnership serving over 3.5 million users. SPAR Switzerland and various online retailers accept DOGE directly, with adoption continuing to expand.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events

Buterin's 10,000 $ETH Selling Spree: Why Now?

February 24, 2026

February 24, 2026