PROMO

(Advertisement)

Do Betting Odds Know Best?

weighing possibility that betting odds predict election outcomes better than polls can

Soumen Datta

October 22, 2024

(Advertisement)

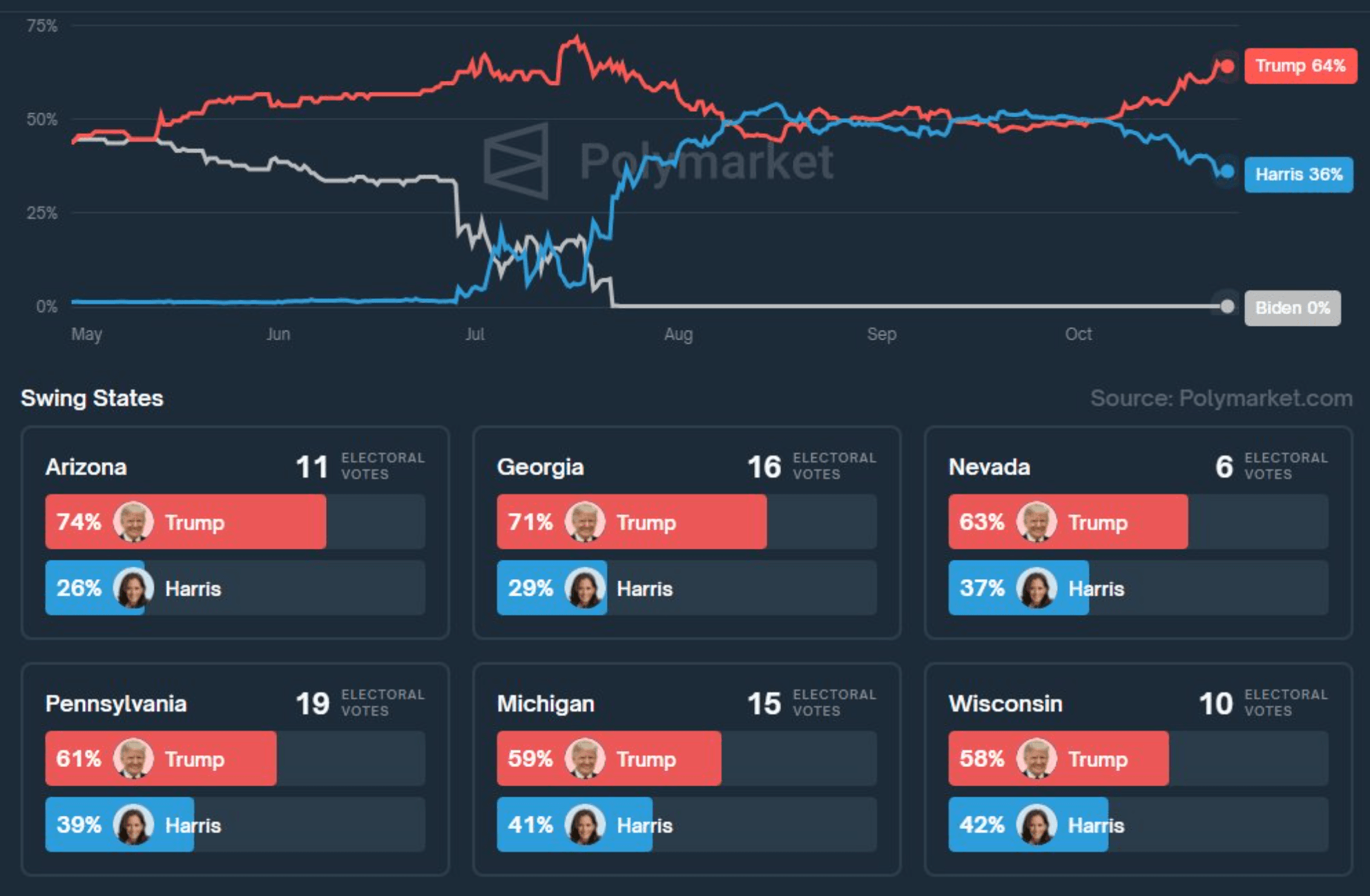

With just weeks until the U.S. presidential election, betting markets are buzzing with activity, particularly around former President Donald Trump’s unexpected surge in the odds. On major prediction platforms like Polymarket and Kalshi, Trump’s chances of victory have jumped to over 60%, signaling a shift that has captured the attention of political analysts, bettors, and even market skeptics like billionaire Mark Cuban. But the question arises: Do betting odds really know best, or are they just a reflection of noise in an increasingly speculative market?

Trump’s Surge in Swing States

As of now, Trump holds commanding odds of winning not only on Polymarket (63.3%) but also on Kalshi (60%), positioning him as the favorite in all six swing states. This rise in confidence from bettors comes despite Trump canceling several high-profile media appearances, including a debate and interviews with major news outlets. Yet his absence hasn’t deterred the betting public, who continue to show strong support in key battleground states like Pennsylvania, where his win probability is at 62% on Polymarket and 59% on Kalshi.

These rising odds are particularly intriguing because they come against a backdrop of uncertainty. Rumors about Trump’s health and speculation over his campaign strategy have swirled, and his critics argue that betting markets might not be the best indicator of election outcomes. However, bettors appear unfazed, with Polymarket volumes exceeding $700 million—far outpacing the betting activity on Vice President Kamala Harris, who trails Trump by a significant margin.

Betting Markets as Election Indicators: A Flawed Measure?

Despite this surge in Trump’s odds, not everyone is convinced that betting markets are reliable predictors of political outcomes. Mark Cuban, the outspoken billionaire and investor, has been vocal in his criticism of prediction markets like Polymarket. He argues that much of the betting activity is driven by foreign money, which skews the results and undermines the reliability of these odds. "From all indications, most of the money coming into Polymarket is foreign money, so I don't think it's an indication of anything," Cuban told CNBC, dismissing the significance of Trump’s rising odds.

Cuban’s critique raises important questions about the legitimacy of using betting odds as a barometer for real-world events. Since U.S. citizens are technically prohibited from betting on platforms like Polymarket, much of the capital could be coming from outside the country. If true, this influx of foreign money could distort the actual sentiment on the ground, making it harder to gauge the true chances of any candidate's victory.

Betting Odds and Market Sentiment

To understand whether betting odds "know best," it's important to recognize that prediction markets are driven by the collective wisdom—or speculation—of bettors. In theory, the aggregation of information from thousands of participants should create an efficient prediction. However, in practice, these markets can be swayed by factors that don’t necessarily reflect broader public opinion.

For example, Trump’s increased odds after a highly-publicized shift at McDonald’s in Pennsylvania may reflect short-term enthusiasm among his base, but it doesn’t necessarily translate into electoral success. Similarly, the surge in betting volumes may be fueled by individuals betting on what they hope will happen rather than a true analysis of the race.

Cuban’s point about the potential for foreign money distorting betting odds also casts doubt on their accuracy as predictors. If the majority of capital is coming from outside the U.S., it may reflect the political preferences of foreign bettors rather than the views of American voters.

What Betting Odds Really Tell Us

Betting odds, while informative, aren’t infallible. They are snapshots of market sentiment at a particular moment in time and can be influenced by a variety of external factors—from headlines to rumors, and even strategic market manipulation. While Trump’s rising odds on Polymarket and Kalshi may indicate a surge in confidence among some bettors, they do not guarantee electoral success.

Ultimately, betting markets are not designed to predict the future with certainty. They are a tool for gauging sentiment, but they must be interpreted with caution. As Cuban points out, the flow of money into these markets, particularly from foreign sources, can create a distorted picture of what’s really happening on the ground.

Conclusion: Do Betting Odds Know Best?

The rise of Trump’s election odds on betting platforms like Polymarket and Kalshi has sparked debate over whether these markets are true indicators of political outcomes or merely a reflection of speculative enthusiasm. Mark Cuban’s critique highlights the potential flaws in relying on betting odds as a crystal ball for the future, especially when foreign money could be driving much of the action.

While betting markets offer an intriguing lens through which to view the election, they are not immune to distortion and bias. As we approach election day, it’s worth considering whether these odds are capturing real-world trends or simply feeding into the noise of an unpredictable election cycle. In the end, only time will tell whether betting markets truly "know best" or if they are as volatile as the political landscape itself.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

(Advertisement)

Latest News

(Advertisement)

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens