Mitosis Unveils MITO Tokenomics: How Close is the Token Generation Event?

Explore Mitosis’ newly revealed MITO tokenomics, covering distribution, architecture, and ecosystem role, as community activity hints at a nearing token generation event.

Miracle Nwokwu

August 19, 2025

Table of Contents

On August 16, the Mitosis Foundation revealed comprehensive details about its native token, MITO, on X. The announcement outlined the token's distribution, architecture, and role in the ecosystem. It arrived amid ongoing community campaigns and testnet activities. While the post stopped short of naming a date for the Token Generation Event (TGE), the timing, following months of reward programs and ecosystem builds, hints that it may not be far off. No concrete timeline emerged, but the details provide clarity for participants tracking the project's progress.

This development builds on Mitosis's efforts to refine DeFi liquidity. Users who have engaged through vaults and incentives now have a clearer picture of how MITO fits in. Still, questions linger about the exact launch sequence.

What is Mitosis

Mitosis operates as a Layer 1 blockchain dedicated to programmable liquidity in DeFi. At its core, the project addresses common challenges like static positions and uneven access to yields. Vaults serve as the main tool here. They convert deposited assets into programmable elements, which users can then deploy in various strategies.

The system relies on two key frameworks: Ecosystem-Owned Liquidity (EOL) and Matrix. EOL lets communities vote on liquidity allocation, ensuring decisions reflect collective input. Matrix, meanwhile, runs time-bound campaigns that offer rewards for deposits. These include yields from protocols, project tokens, and points tied to MITO.

Mitosis emphasizes alignment among users, developers, and validators. Its chain is EVM-compatible, making it straightforward for builders to integrate. The network tokenizes liquidity positions into maAssets—receipt tokens that represent deposits. These maAssets can move across chains, enabling composability. For instance, a user might deposit ETH, receive miETH, and use it as collateral elsewhere while earning yields.

The project launched its testnet earlier in 2024, allowing participants to test vaults and earn points. Recent integrations, like with YO (a yield optimizer), let users access yields before mainnet. Mitosis positions itself as infrastructure for sustainable DeFi, where liquidity isn't locked but actively contributes to network growth.

MITO Token Structure Breakdown

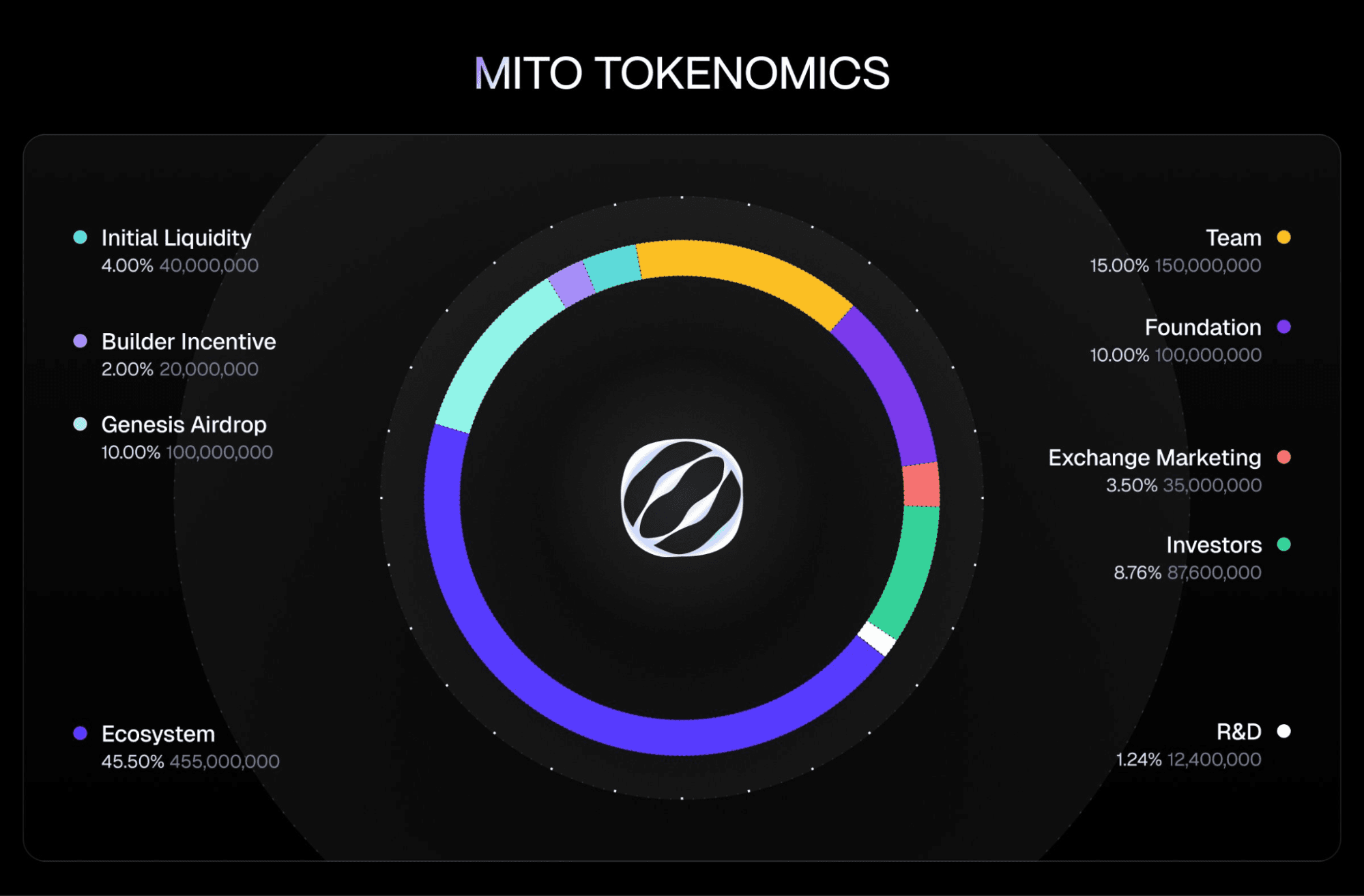

The MITO token serves as the core utility in the ecosystem, with total supply capped at 1 billion MITO. Distribution allocates 45.5% to the ecosystem, 15% to the team, 8.76% to investors, 10% to the foundation, 10% to a genesis airdrop, 2% to builder incentives, 3.5% to exchange marketing, 4% to initial liquidity, and 1.24% to research and development. Any unutilized portions from the genesis airdrop or exchange marketing shift back to the ecosystem pool.

Investor and team portions remain non-stakeable until vested. This design seeks to prevent early dumping and encourage long-term holding. The token release schedule, though finalized, awaits disclosure on the airdrop registration date for regulatory reasons.

Token Architecture and Mechanics

MITO operates in three forms to support different functions. The base MITO acts as a transferable, stakeable gas token for transactions on the Mitosis Chain. Staking it yields gMITO, a non-transferable governance token that grants voting rights. Then there's LMITO, a time-locked version distributed via rewards, with unlocks accelerated by holding gMITO and participating in governance.

This structure rewards sustained involvement. For instance, users stake MITO to get gMITO, influencing decisions on liquidity allocation. LMITO ties into the DNA program, which stands for Decentralized Network Alignment. It distributes rewards based on liquidity provision to vaults and interactions with dApps, bypassing traditional grant committees. Users earn LMITO by engaging actively, aligning incentives across participants.

The chain itself uses a validator collateral system. It avoids slashing risks for stakers by requiring validators to add commission earnings as collateral instead of selling them. This reduces sell pressure and bolsters network security.

How MITO Drives Ecosystem Utility

MITO integrates deeply into operations. It covers gas fees on the chain, secures the network through validator staking, and enables governance via gMITO. Holding gMITO speeds up LMITO unlocks, creating a loop that favors committed users. Interactions with dApps also require MITO, making it central as adoption grows.

Vaults play a key role. They convert static liquidity into programmable elements, offering access to yields typically reserved for institutions. Through Vault Liquidity Frameworks, positions become building blocks for strategies. Matrix vaults filter out short-term capital, while EOL allows collective governance over allocations.

Builders benefit too. Projects like Yarm AI for social liquidity, Chromo Exchange for AMMs with plugins, and Spindle AG for tradable yield positions build on this foundation. Others include Telo Money's money market, Zygo Finance's perpetuals, SpaceID Protocol's identity tools, among others. Each relies on MITO for deeper integration.

As more strategies emerge, MITO's value ties to ecosystem growth. It's not just a token; it underpins programmable liquidity, fostering alignment among users, protocols, and developers.

Opportunities to Earn Rewards

Mitosis has run several programs to reward engagement. These build points or assets convertible post-TGE, offering ways to position for MITO.

The Kaito rewards program, announced in June 2025, allocated 0.8% of MITO supply. It targeted top yappers (posters) on a leaderboard, sKAITO holders, and participants in a social-liquidity primitive. Snapshots occurred in late July, with partial distributions at TGE. Rewards followed the mainnet airdrop schedule for yappers.

Season 2 of Kaitosis, launched August 15, runs for 30 days. It shifts rewards on-chain, offering 50,000 miUSDC monthly to top 35 yappers. Content must be original and aligned—AI-generated posts disqualify. Top 300 at snapshot gain future allocations. miUSDC works across Mitosis dApps like DeFi, perps, and casinos.

The Binance Booster Campaign which went live on August 19 allows users to deposit BNB or USDT on BSC via Binance Wallet for a share of $1M in MITO, plus yields from Lista DAO strategies. APYs stood at 117.91% for BNB and 115.94% for USDT at launch, with the campaign running for only one week.

EOL Pre-deposit, active since August 13, lets users mint miUSDC or miETH on Base. Rewards: 2x YO points and MITO yields (details pending). Yields averaged 5.9% for ETH and 10.9% for USDC. Withdrawals take about seven days.

Zootosis Vaults, from May 2025 with Morph, allowed deposits of 10+ assets for MITO and Morph rewards. Two phases: deposit for maAssets, then use in protocols for extra yields. Multipliers boosted shares; early exits forfeited rewards.

Matrix Straddle Vault offered phases with no caps in the final one, earning MITO points and Theo tokens.

How Close is the Token Generation Event?

While the Mitosis team has not officially disclosed any exact date, recent activities indicate the token generation event might be near. The tokenomics reveal, mainnet progress at 95%, and campaigns like Booster tie rewards to TGE. Snapshots and phased distributions align with this timeline.

Community sentiment reflects the anticipation as users express optimism. Some predict the TGE to occur in late August or early September while others discuss positioning via deposits and yapping. Validators and builders prepare too. The chain's collateral system, eliminating slashing, appeals for security.

Delays have occurred before, but current momentum feels different. Mitosis, however, has reminded users that MITO hasn't launched, urging caution against scams.

Final Thoughts…

Mitosis positions itself as infrastructure for DeFi's future, with MITO as the alignment tool. By tokenizing liquidity and rewarding participation, it creates a self-sustaining loop. The token design—focusing on governance, yields, and composability—offers a solid base, as the project makes a critical step towards mainnet.

Readers interested in joining should review official channels for updates. Deposits in ongoing campaigns provide entry points. As events unfold, tracking progress on mitosis.org or X will clarify next steps. The project evolves methodically, balancing innovation with stability.

Sources:

- Mitosis Foundation X Announcement on MITO Tokenomics: https://x.com/MitosisFdn/status/1956836207046140389

- Kaito Rewards Program Announcement: https://x.com/MitosisOrg/status/1938709522782228776

- Kaitosis Season 2 Campaign Details: https://x.com/MitosisOrg/status/1956388966493749500

- Binance Booster Campaign Information: https://x.com/MitosisOrg/status/1957623663035052472

Read Next...

Frequently Asked Questions

What is the MITO token and its role in the Mitosis ecosystem?

The MITO token is the native utility token of the Mitosis Layer 1 blockchain, capped at 1 billion total supply. It functions as a transferable and stakeable gas token for transactions, enables governance through staked gMITO, and supports time-locked rewards via LMITO to encourage long-term participation and ecosystem alignment.

How is the MITO token supply distributed?

MITO's 1 billion total supply is allocated as follows: 45.5% to the ecosystem, 15% to the team, 8.76% to investors, 10% to the foundation, 10% to a genesis airdrop, 2% to builder incentives, 3.5% to exchange marketing, 4% to initial liquidity, and 1.24% to research and development. Unutilized portions from airdrop or marketing revert to the ecosystem.

When might the MITO Token Generation Event (TGE) occur?

Although no official date has been announced, recent activities like the tokenomics reveal on August 16, ongoing reward campaigns, 95% mainnet progress, and community sentiment suggest the TGE could happen in late August or early September 2025.

How can users earn rewards related to MITO before the TGE?

Users can participate in programs like the Kaito rewards (0.8% of MITO supply for social engagement), Kaitosis Season 2 (on-chain rewards for yappers), Binance Booster Campaign ($1M in MITO for BNB/USDT deposits), EOL Pre-deposit (for miUSDC/miETH minting with yields), Zootosis Vaults (for multi-asset deposits), and Matrix Straddle Vault (for uncapped phases earning points and tokens).

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Miracle Nwokwu

Miracle NwokwuMiracle holds undergraduate degrees in French and Marketing Analytics and has been researching cryptocurrency and blockchain technology since 2016. He specializes in technical analysis and on-chain analytics, and has taught formal technical analysis courses. His written work has been featured across multiple crypto publications including The Capital, CryptoTVPlus, and Bitville, in addition to BSCN.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens