BNB Chain Q2 2025 in Numbers and Recent Updates

BNB Chain Q2 2025 report shows higher transactions and active addresses, protocol upgrades, DeFi growth, and stablecoin expansion despite fee revenue decline.

Soumen Datta

August 27, 2025

Table of Contents

BNB Chain recorded a notable Q2 2025, with higher onchain activity, faster block times, and ecosystem growth, despite a decline in fee revenue, according to a recent Messari report. The quarter highlighted the impact of lower gas prices, new incentive campaigns, and major protocol upgrades, as well as a reshaping of stablecoin and DeFi activity.

Market Performance

BNB’s market capitalization rose 7.5% quarter-over-quarter (QoQ) to $92.6 billion, rebounding from a Q1 dip. While still below its late 2024 peak, the increase reflected relative resilience compared to other assets in a period of liquidity tightening and macroeconomic uncertainty. The rebound was supported by upgrades and incentive campaigns that boosted onchain demand.

Network Revenue

BNB Smart Chain generated $44.1 million in fees in Q2, down 37.5% from $70.5 million in Q1. The decrease stemmed largely from the minimum gas price reduction from 1 gwei to 0.1 gwei, which cut per-transaction revenue but drove higher transaction counts. Despite the fall, Q2 still ranked as the third-highest revenue quarter for the chain in the past year.

Token Supply and Burns

BNB is deflationary through three mechanisms: Auto-Burn, Pioneer Burn, and gas fee burns under BEP-95.

The 31st quarterly burn on April 16, 2025, removed 1.6 million BNB, worth $916.1 million at the time. Circulating supply ended Q2 at 139.3 million, producing an annualized deflation rate of 4.5%.

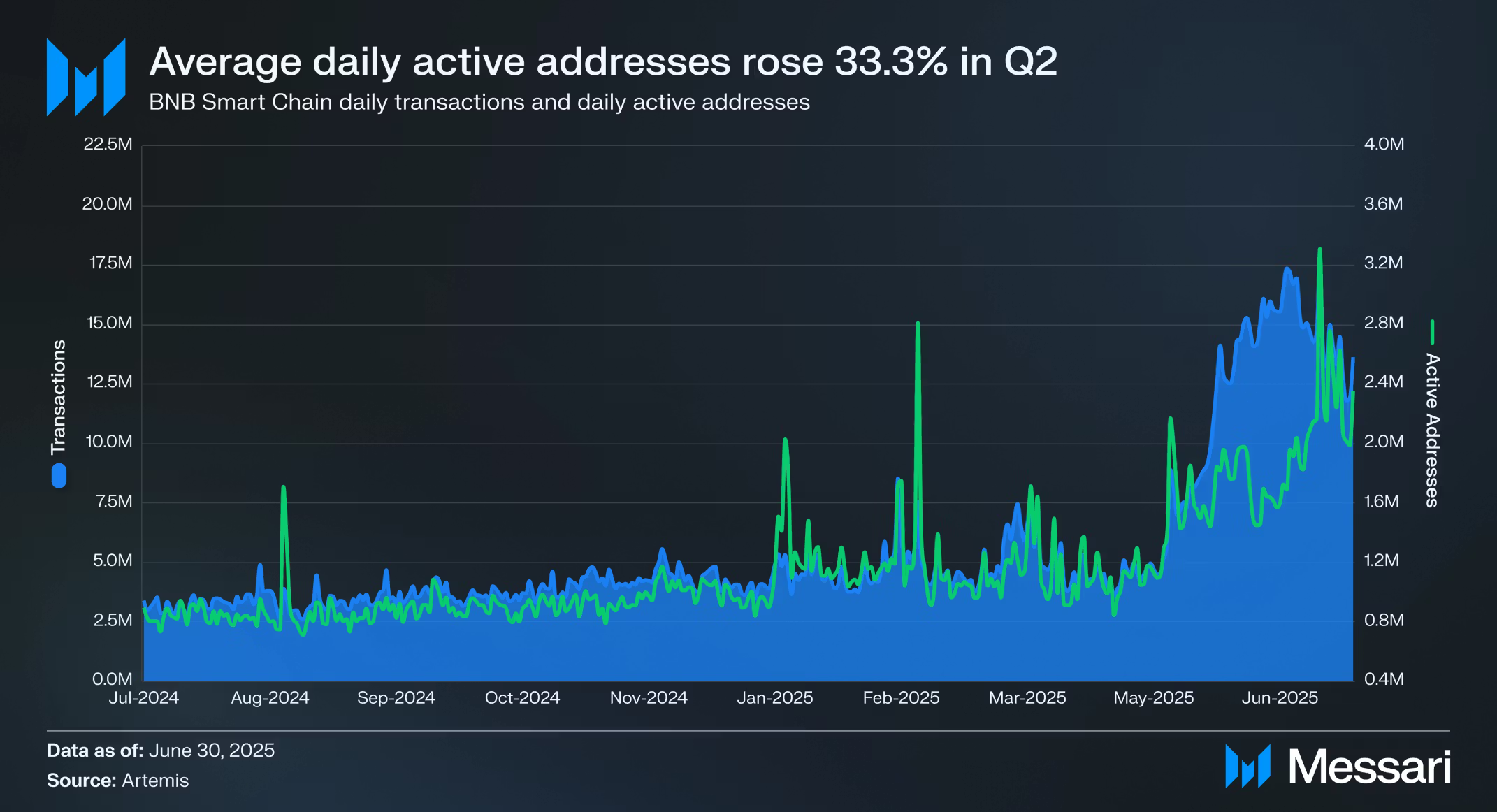

Onchain Activity

Average daily transactions more than doubled QoQ to 9.9 million in Q2 from 4.9 million in Q1. Daily active addresses increased 33.2% to 1.6 million.

Much of this activity was driven by Binance Alpha, the early-stage token launch platform, which ran airdrops, trading competitions, and campaigns requiring onchain actions.

Key highlights:

- Record 291 million total transactions in May, including a single-day peak of 15.2 million

- 17 million new addresses added in May alone

- Stablecoin transfers averaged 1.5 million daily transactions, up 22.9% QoQ

- DeFi transactions grew 81.6% QoQ to 594,100 daily

- MEV-related transactions increased 72.5% QoQ to 134,600 daily, while sandwich attacks dropped 95% due to ecosystem mitigation efforts

- Gaming activity surged 481.6% QoQ, averaging 14,800 daily transactions

- “Other” activity rose 173.7% QoQ, largely tied to Alpha campaigns

BNB Smart Chain finished the quarter as the fourth-largest chain in daily active addresses.

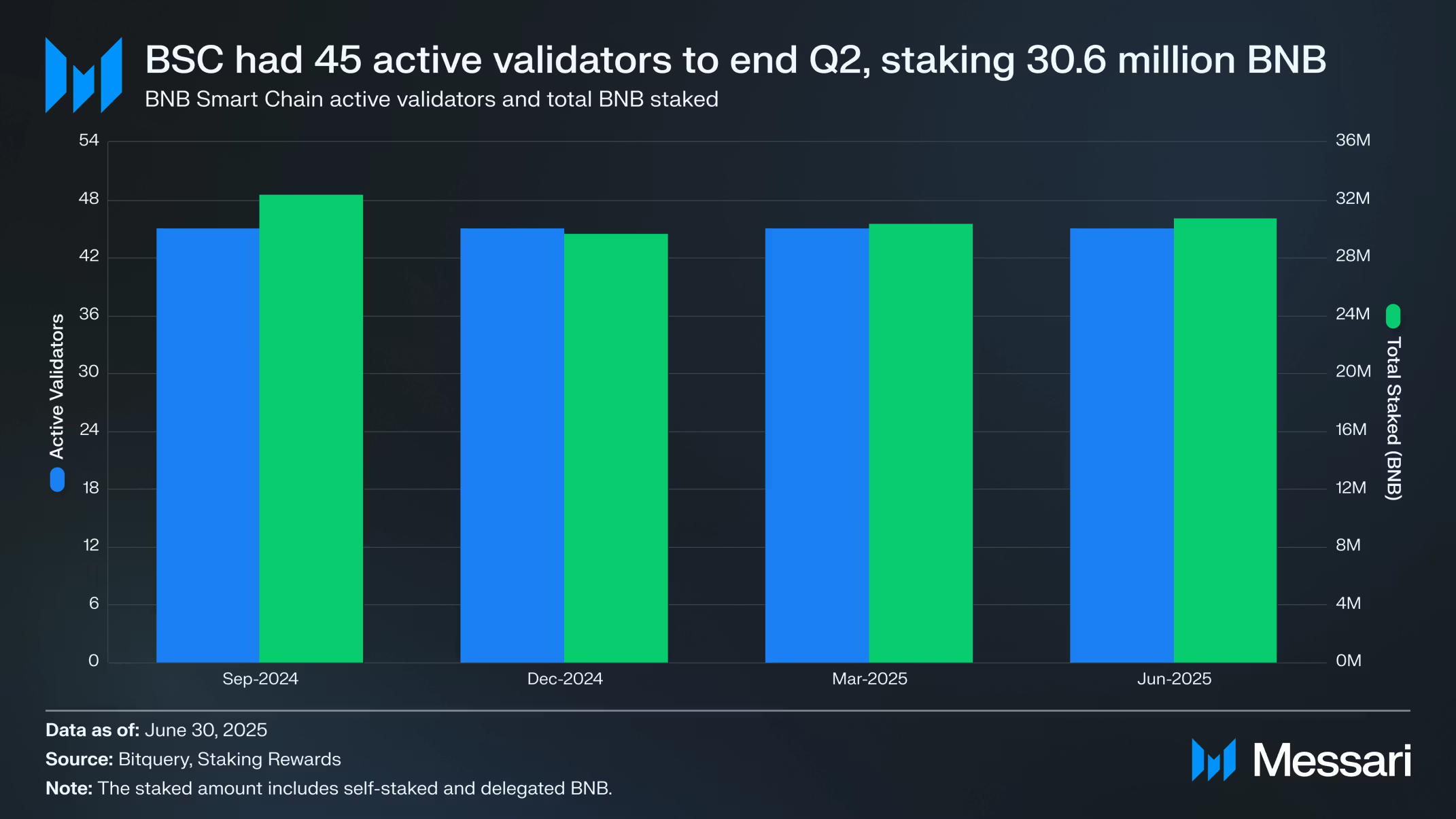

Security and Decentralization

BNB Smart Chain operates with a Proof-of-Staked Authority (PoSA) consensus, electing 45 validators daily, with 21 serving as Cabinets and 24 as Candidates. Block production rotates between Cabinets and Candidates.

The validator set remained at maximum capacity through Q2, sustaining network reliability. Total staked BNB increased 1.1% QoQ to 30.7 million, with a dollar value of $20.2 billion, placing BNB Smart Chain fourth among Proof-of-Stake networks by staked value.

Protocol Upgrades

Two major upgrades reshaped network performance in Q2.

Lorentz Hardfork (April 29, 2025):

- Reduced block times from 3 seconds to 1.5 seconds

- Introduced efficient block fetching and enhanced validator networking

- Improved responsiveness for latency-sensitive applications

Maxwell Hardfork (June 30, 2025):

- Reduced block times further to 0.75 seconds

- Adjusted consensus parameters and doubled epoch lengths

- Reduced time-to-finality to 1.875 seconds

These upgrades advanced BNB Chain into sub-second block production territory.

DeFi Growth

Total value locked (TVL) on BNB Smart Chain rose 14% QoQ to $6.0 billion. In BNB terms, TVL increased 4.9% to 9.2 million BNB.

By end of Q2, BNB ranked fourth among all blockchains in TVL, trailing Ethereum, Tron, and Solana.

Key protocols:

- Venus: $1.6 billion TVL, down 1.6% QoQ

- PancakeSwap: $1.3 billion TVL, up 10.6% QoQ

- ListaDAO: $1.1 billion TVL, up 188.7% QoQ, now third largest protocol on BNB

- Aave V3: $239.3 million, up 104.7% QoQ

- Kernel: $225.1 million, down 63.7% QoQ after incentive phase ended

DEX activity strengthened with average daily volumes of $3.3 billion, making BNB Smart Chain the leading chain by DEX trading volume. PancakeSwap led with $2.9 billion daily, while Uniswap’s volume rose 755.4% QoQ to $297 million.

Stablecoins and BTCB

The stablecoin market cap on BNB Chain grew 49.6% QoQ to $10.5 billion, its largest quarterly increase since 2022.

- USDT: $6.3 billion, up 21.3% QoQ

- USD1: new entrant, $2.2 billion market cap

- USDC: $989.7 million, up 33.8% QoQ

- USDX: $519.1 million, up 7.0% QoQ

- BUSD: $255.1 million, slightly down

- USDF: $63.8 million, down 51.7% QoQ

The “0-Fee Carnival,” which waived gas fees for stablecoin transfers, withdrawals, and bridges, played a major role in boosting adoption.

BTCB supply remained flat at 65,300, while holders increased 6% QoQ to 1.3 million, supported by BTCFi applications.

opBNB

opBNB, an EVM-compatible optimistic rollup, grew modestly with total value bridged reaching $64.9 million. The Volta Upgrade in April reduced block intervals to 500 milliseconds, improving latency and aligning rollup cadence with mainnet improvements.

Ecosystem Programs

BNB Chain advanced ecosystem growth through its Most Valuable Builder (MVB) program.

- MVB Season 9: April cohort, 16 projects selected from over 500 applicants, focus on AI, DeFi, DePIN, and gaming.

- MVB Season 10: Concluded with Demo Day at the NYSE, featuring 15 incubated projects.

- MVB Season 11: Expanded into a global 10-week residency with up to $500,000 per project, hubs in Dubai, San Francisco, Singapore, and New York, concluding at Binance Blockchain Week in Dubai.

Institutional Involvement

On Aug. 10, BNB Network Company (BNC), listed on Nasdaq, announced purchasing 200,000 BNB worth about $160 million, funded by a $500 million private placement. With warrant-backed access to $750 million more, BNC could acquire up to $1.25 billion in BNB, making it the largest corporate holder of the asset.

Moreover, on Aug. 27, Rex Osprey submitted an application to the U.S. Securities and Exchange Commission (SEC) seeking approval to launch a spot BNB staking exchange-traded fund (ETF). The move positions the firm alongside other asset managers pursuing similar products, including VanEck, which filed for a BNB-based ETF earlier this year.

The filing highlights growing institutional appetite for Binance Coin (BNB), as more investment companies attempt to secure regulatory approval to provide U.S. investors with direct exposure to the altcoin.

Conclusion

BNB Chain’s Q2 reflected strong network growth despite lower fee revenue. Key drivers included lower gas fees, incentive campaigns, faster block production, and ecosystem support for stablecoins, DeFi, and gaming. With activity up across addresses and transactions, and major upgrades delivering sub-second block times, BNB Chain reinforced its position as one of the most active blockchain ecosystems.

Conclusion:

Messari BNB Chain Q2 Report: https://messari.io/report/state-of-bnb-q2-2025

BNC Announcement: https://www.globenewswire.com/news-release/2025/08/11/3130588/0/en/BNC-Makes-160M-BNB-Bet-Becomes-Largest-BNB-Treasury-Globally.html

BNB Chain’s Maxwell Hardfork announcement: https://www.bnbchain.org/en/blog/bnb-chain-announces-maxwell-hardfork-bsc-moves-to-0-75-second-block-times

BNB Chain’s Season 11 MVB announcement: https://www.bnbchain.org/en/blog/mvb-11-where-founders-break-through

Rex Osprey’s application to launch a spot BNB staking exchange-traded fund (ETF): https://x.com/ericbalchunas/status/1960453869495779654?s=46&t=nznXkss3debX8JIhNzHmzw

Read Next...

Frequently Asked Questions

What was BNB Chain’s total fee revenue in Q2 2025?

BNB Smart Chain generated $44.1 million in fees, down 37.5% from Q1 due to a reduction in the minimum gas price.

How did BNB Chain’s stablecoin market perform in Q2 2025?

Stablecoin market cap grew 49.6% to $10.5 billion, led by USDT and the new entrant USD1.

What upgrades improved BNB Chain’s performance in Q2?

The Lorentz and Maxwell Hardforks reduced block times to 0.75 seconds and cut time-to-finality to 1.875 seconds, enhancing speed and responsiveness.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events