A Look at ASTER’s Dramatic Rise: Possible Reasons and Future Potential

Aster DEX’s trading activity has positively impacted the $ASTER price, resulting in an over 2000% increase in the past 7 days.

UC Hope

September 24, 2025

Table of Contents

The $ASTER token, the native cryptocurrency of Aster DEX, has surged by over 2,700% since its launch on September 17, 2025, climbing from a low of $0.08439 to a peak of $2.42 by September 24, 2025. This rapid price increase, driven by a combination of high trading volumes, strategic tokenomics, and endorsements from notable figures, has positioned Aster DEX as a significant player in the Decentralized Finance (DeFi) space.

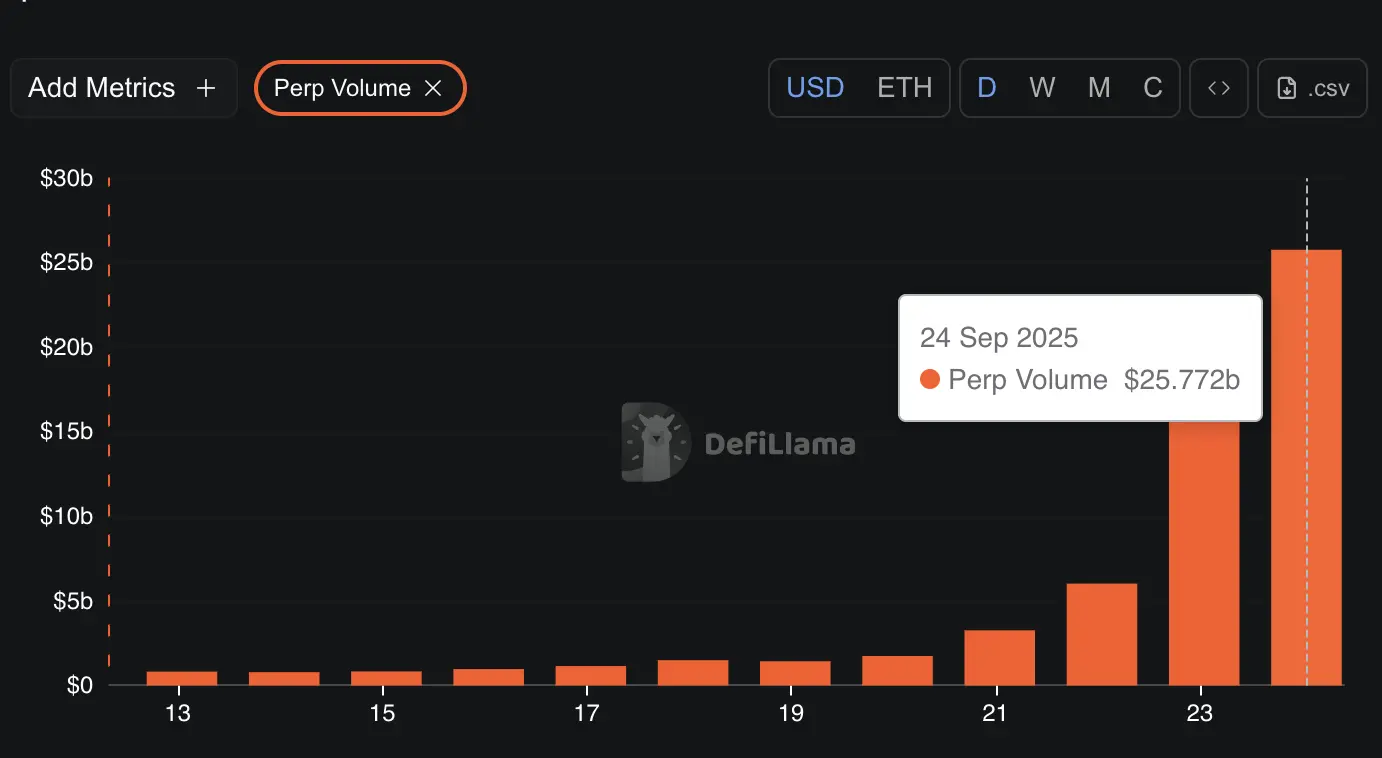

The platform recorded $20.88 billion in 24-hour perpetual futures trading volume, ranking it second globally among Decentralized Exchanges (DEXs) in perpetual futures trading. This article examines the factors behind $ASTER’s swift ascent. It considers what may lie ahead for the token and its platform, based on data from CoinMarketCap, DeFiLlama, and the Aster DEX X account.

What is ASTER and Aster DEX?

The $ASTER token serves as the governance and utility token for Aster DEX, a decentralized exchange designed for perpetual futures and spot trading. Launched on September 17, 2025, on the BNB Chain, Aster DEX operates across multiple blockchains, including Ethereum, Arbitrum, and Solana.

Backed by YZi Labs, the platform offers trading fees of 0.01% for makers and 0.035% for takers, supports up to 1,001x leverage in its Simple Mode, and includes features like miner extractable value (MEV)-free trading, hidden orders for institutional traders, grid trading, and yield-bearing collateral such as asBNB and USDF, a stablecoin with built-in yield.

Aster DEX was formed through the merger of Astherus, a yield-focused protocol, and APX Finance, a perpetual futures platform. The $ASTER token has a total supply of 8 billion, with 1.65 billion (20.7%) in circulation as of September 24, 2025. It supports governance, offers a 5% discount on trading fees, and incentivizes user participation through airdrops and rewards programs. The platform has experienced significant adoption, with a Total Value Locked (TVL) of $1.93 billion, primarily on BNB Chain ($1.51 billion). Aster DEX ranks as the largest perpetual futures DEX globally in terms of 24-hour volume, ahead of Hyperliquid, with $25.772 billion in perp volume.

The platform’s user base has grown to over 1.2 million wallets, with 330,000 new wallets added in the first 24 hours after the Token Generation Event (TGE). The Genesis Stage 2 rewards program, running until October 5, 2025, allocates 4% of the total token supply for Rh points earned through trading, with team-based multipliers up to 1.2x. These incentives, combined with features like tokenized stock perpetuals and privacy-focused tools, have driven Aster DEX’s rapid growth.

ASTER’s Meteoric Rise: Possible Reasons

The $ASTER token's significant price increase over seven days is attributed to several factors, including endorsements, platform performance, and market dynamics. Below are the primary drivers of this surge.

Comments from Binance’s Former CEO

Changpeng Zhao (CZ), former CEO of Binance, has been vocal on X, sharing numerous posts about Aster DEX and its native $ASTER token. Although his comments are not a direct endorsement, they significantly boosted market interest. This first started when he highlighted the DEX’s game-changing feature, “Hidden Orders.”

👏 This Hidden Order feature went live on @Aster_DEX 18 days after my post.

— CZ 🔶 BNB (@cz_binance) June 20, 2025

I didn't discuss with any project beforehand, but since then I have gotten 30+ in-bound project pitches.

Time-to-market is key. Keep building!https://t.co/tkPgmDAagg https://t.co/U6YwqE5CvL

The development, coupled with Aster’s connection to YZi Labs and its listings on Binance Alpha for spot trading and Binance Futures for perpetuals, attracted both retail and institutional traders.

Strong Performance Against Competitors

Aster DEX has outperformed Hyperliquid, the leading perpetual futures DEX, in daily futures volume and revenue on several days. Features like tokenized stock perpetuals (e.g., Apple, Tesla) and hidden orders for whale traders have drawn significant volume, with $35.99 billion traded over seven days.

No. 1 in perp DEX trading volume during the past 24 hours with over $11+ billion on Aster. 👀

— Aster (@Aster_DEX) September 23, 2025

ASTER MODE. pic.twitter.com/gjPAtE7AJF

The platform’s low fees and multi-chain support across BNB Chain, Ethereum, and others have made it a preferred choice for traders, contributing to $ASTER’s price momentum.

Airdrops and Token Swap Program

The TGE on September 17 included a 704 million token airdrop for early users and a 1:1 swap for APX token holders. This swap reduced available supply and drove demand, pushing the price from $0.08 to $0.79 within 24 hours.

The Genesis Stage 2 rewards program, distributing 4% of the total supply via Rh points for trading, has further encouraged participation. Team-based multipliers and weekly epoch resets have sustained engagement, with X posts describing the program as accessible for new users.

Exchange Listings and Liquidity Growth

Rapid listings on centralized exchanges like Binance Futures, MEXC, and BingX, alongside DEX liquidity on Aster Pro with up to 10x leverage, expanded $ASTER’s accessibility. By September 24, daily trading volume reached $3.13 billion, with $1.09 billion on centralized exchanges and $1.84 billion on DEXs. The 5% fee discount for using $ASTER and integrations like Trust Wallet, as well as support for perpetual trading, has increased adoption and liquidity.

Tokenomics and Market Activity

With only 1.65 billion tokens in circulation out of a total 8 billion, $ASTER benefits from supply scarcity, reinforced by scheduled token unlocks to manage sell pressure. Whale activity, including reported accumulations and a $9 million swap from $HYPE to $ASTER, has driven short squeezes and price spikes.

On-chain data shows 330,000 new wallets and $2.5 billion in daily volume, though some analysts have raised concerns about potential wash trading. The protocol’s fee buyback mechanism, using trading revenue to repurchase $ASTER, supports long-term value.

What Next for Aster?

The rapid rise of the $ASTER token raises questions about its sustainability. Upcoming token unlocks from October 17, 2025, could introduce sell pressure, and concerns about wash trading may impact credibility. However, the Genesis Stage 3 rewards program, which will include spot trading scoring and planned integrations, could sustain user growth. Aster DEX’s $195 million in annualized fees and expanding features, such as yield-bearing collateral and tokenized assets, provide a foundation for continued adoption.

In the meantime, the platform’s ability to maintain high trading volumes, grow its 1.2 million wallet user base, and deliver on technical developments will be critical. Traders should monitor updates on Aster DEX’s X account and metrics on DeFiLlama for real-time insights.

Sources

- ASTER Price and Market Data from Coinmarketcap: https://coinmarketcap.com/currencies/aster/

- Aster Protocol Metrics and TVL: https://defillama.com/protocol/aster

- AsterDEX X: https://x.com/Aster_DEX

Read Next...

Frequently Asked Questions

What is the $ASTER token used for?

The $ASTER token is the governance and utility token for Aster DEX, enabling voting, a 5% trading fee discount, and participation in rewards programs like Genesis Stage 2, which distributes Rh points convertible to $ASTER.

Why did $ASTER’s price increase so rapidly in September 2025?

$ASTER surged 2,753% from $0.08439 to $2.42 due to several reasons, including a recent comment from Binance’s former CEO, rapid exchange listings, a 704 million token airdrop, and more…

What are the risks of trading $ASTER?

Risks include potential sell pressure from token unlocks starting October 17, 2025, market volatility, and concerns about wash trading. Traders should review tokenomics and platform updates before engaging.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens