What is Pump.fun and How Does it Work?

Discover how Pump.fun is transforming memecoin token launches on Solana and beyond. Learn about its innovative features, ecosystem impact, and the controversies surrounding this controversial platform.

Crypto Rich

February 11, 2025

Table of Contents

In the world of decentralized finance (DeFi), Pump.fun has emerged as a controversial yet influential platform that's reshaping how token launches occur in the cryptocurrency space. While some memecoins on the Solana layer-1 haven’t launched on the platform, like TRUMP and MELANIA, the cast majority have done so. This comprehensive analysis explores the platform's journey, features, and impact on the broader DeFi ecosystem.

Origins and Historical Development

Pump.fun burst onto the DeFi scene in January 2024, quickly establishing itself as a pioneering force in the token launch space. The platform was developed as a response to the growing demand for more efficient and accessible token launch mechanisms on the Solana blockchain. Its emergence coincided with the rise of memecoins and the increasing need for streamlined token creation processes.

Core Functions and Features

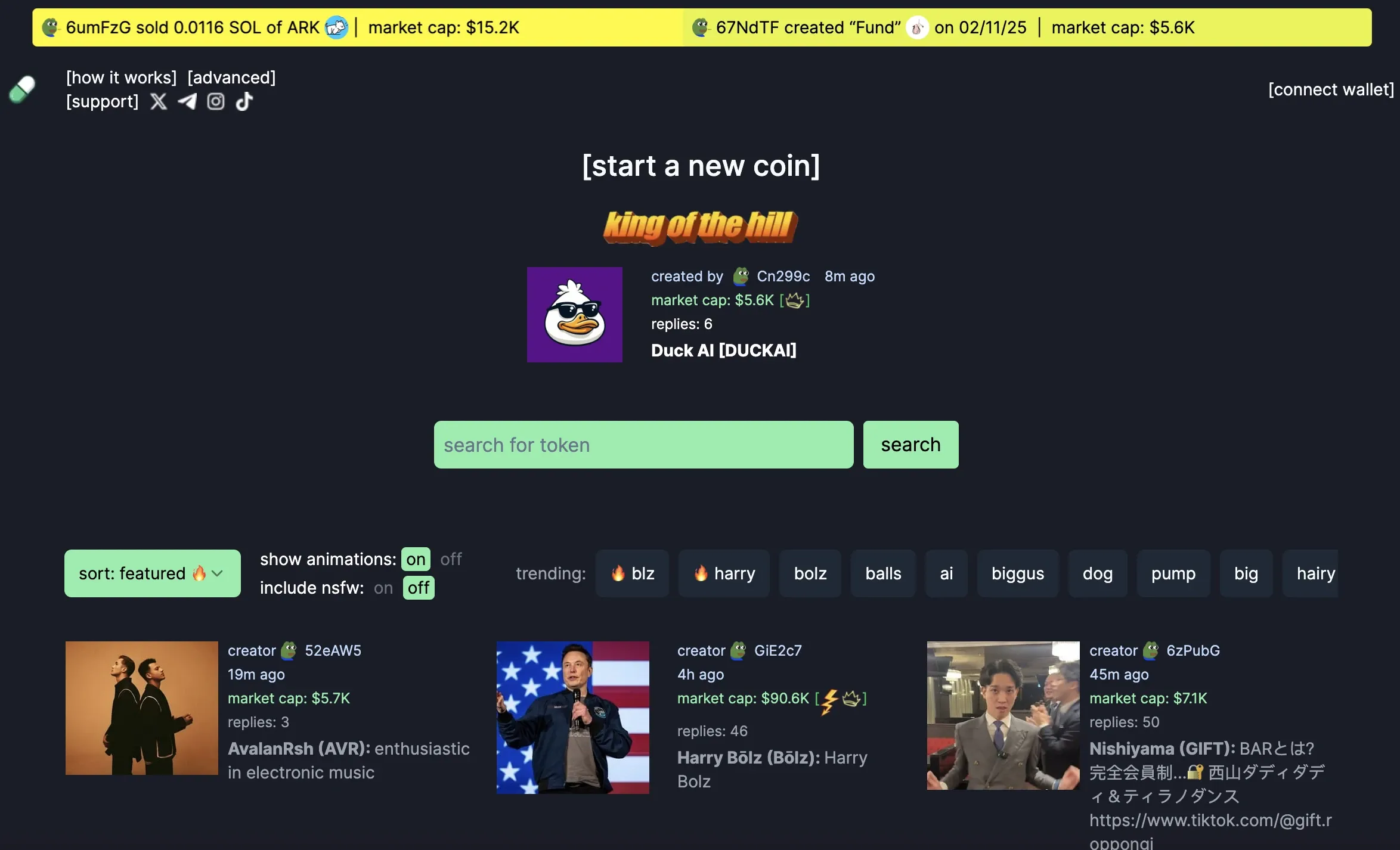

Pump.fun operates primarily on the Solana network, leveraging its fast transaction speeds and low fees. The platform recently expanded to include the Blast network, broadening opportunities for token creators and traders. Its key features include a sophisticated bonding curve model for trading, which dynamically adjusts token prices based on supply and demand. This mathematical model ensures efficient price discovery and liquidity management.

The platform offers instant token trading capabilities, eliminating traditional waiting periods for liquidity accumulation or review processes. Additionally, Pump.fun implements robust safety mechanisms against rug pulls, ensuring all created tokens undergo fair launches without presales or team allocations.

How Pump.fun Token Creation Works

The token creation process on Pump.fun is streamlined and user-friendly. "Devs" (token creators) can become memecoin architects by following these simple steps:

- Initial Setup: Creators select a name, ticker, and upload a JPG image for their token

- Trading Activation: The token immediately begins trading on the platform's bonding curve

- Liquidity Milestones: For Solana tokens, when market capitalization reaches $69,000, $12,000 of liquidity is deposited to Raydium and burned*

- Blast Integration: On the Blast network, the requirement is $420,000 market cap, triggering a $30,000 liquidity deposit to Thruster DEX**

Trading can be conducted through either Telegram trading bots (like Trojan or Banana Gun Bot) or the Pump.fun web application, with the former being the recommended option for enhanced usability and speed.

* The token-burning process on Solana is particularly noteworthy. When a token reaches the $69,000 market cap threshold, $12,000 worth of liquidity is automatically moved to Raydium and permanently locked. This process involves creating a new Raydium liquidity pool pair, transferring the designated amount of tokens and SOL to this pool, and then burning the LP tokens by sending them to a designated burn address. This irreversible process ensures that the initial liquidity can never be removed, providing a baseline level of trading stability for investors and reducing the risk of immediate liquidity-based manipulations.

** On the Blast network, Pump.fun implements a more demanding threshold system with higher requirements for token maturity. When tokens reach a $420,000 market cap, the platform automatically triggers a liquidity deposit of $30,000 to the Thruster DEX. This higher threshold and larger liquidity requirement reflects Blast's position as a newer, emerging Layer 2 solution. The integration with Thruster DEX, Blast's native decentralized exchange, creates a seamless trading experience while ensuring deeper liquidity pools. This strategic choice of higher thresholds on Blast aims to reduce the incidence of short-lived speculative tokens that often plague newer networks.

Impact on Solana's Ecosystem

Pump.fun has fundamentally transformed the Solana ecosystem by democratizing token creation and launch processes. The platform's user-friendly interface and automated features have made it possible for developers with minimal technical expertise to launch tokens, leading to increased token creation activity and enhanced liquidity across the ecosystem.

Legal and Regulatory Challenges

Currently, the platform faces significant legal scrutiny, particularly through class action lawsuits alleging violations of U.S. securities laws. These lawsuits, filed in the Southern District of New York, claim that tokens created through Pump.fun qualify as unregistered securities.

The platform has allegedly generated nearly $500 million in fees through what plaintiffs claim is the promotion and sale of unregistered securities. Further complications arise from the platform's apparent lack of basic investor protections, including the absence of Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols.

Content Moderation Crisis

A particularly controversial aspect of Pump.fun's operation was its livestream feature, which was suspended following widespread criticism. The platform faced backlash over unmoderated content that included inappropriate material being used to promote tokens, raising serious questions about platform liability and content moderation responsibilities.

Conclusion

Pump.fun represents a pivotal moment in DeFi's evolution, showcasing both the innovative potential and inherent risks of decentralized token launches. While it has democratized token creation and facilitated numerous successful launches, the platform's challenges have broader implications for the entire cryptocurrency industry. The regulatory scrutiny faced by Pump.fun has highlighted the urgent need for clear, comprehensive cryptocurrency regulations that can protect investors while fostering innovation.

The platform's experience demonstrates that the cryptocurrency industry can no longer operate in a regulatory grey area. As governments and regulatory bodies worldwide grapple with these challenges, the case of Pump.fun may serve as a crucial reference point for developing balanced regulatory frameworks. These frameworks will need to address key issues such as investor protection, platform liability, and the classification of digital assets, while maintaining the innovative spirit that drives the crypto industry forward.

Pump.fun has also caused a wave of other memecoin launch platforms, like Four.meme on BNB Chain, however for many, Pump.fun remains the OG.

The future of both Pump.fun and similar platforms will likely be shaped by how the industry adapts to these emerging regulations. Success will depend not only on technical innovation but also on the ability to operate within established regulatory boundaries while maintaining the decentralized ethos that makes cryptocurrency platforms unique.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events