Algorand (ALGO): Speed, Security, and Sustainability

Algorand (ALGO) delivers 10,000 TPS with instant finality and carbon neutrality. Explore its Pure Proof-of-Stake consensus, ecosystem, and 2025 roadmap.

Crypto Rich

December 3, 2025

Table of Contents

Algorand handles over 10,000 transactions per second, confirms them in under three seconds, and has never gone offline since launching in 2019. No forks. No rollbacks. Just consistent uptime across more than 3 billion transactions.

The network was built by Silvio Micali, an MIT cryptographer who won the Turing Award for foundational work that shaped modern encryption. His goal was to solve what developers call the blockchain trilemma: the conventional wisdom that networks must sacrifice either decentralization, security, or scalability to achieve the other two. Algorand rejects that tradeoff.

Today, the network powers FIFA NFTs, Nubank integrations, and UN humanitarian aid tracking across over 40 million accounts. Quantum-resistant cryptography went live on mainnet in early November 2025. Carbon neutrality has been maintained since 2021. For institutions tired of network congestion and unpredictable fees, Algorand offers something increasingly rare in crypto: boring reliability.

What Is Algorand?

At its core, Algorand is a Layer-1 blockchain designed for real-world use. DeFi protocols, tokenized real estate, enterprise payment rails, NFT platforms: they all run here alongside each other.

The network uses Pure Proof-of-Stake consensus. Rather than mining or delegating votes to a small validator set, Algorand randomly selects block producers from anyone holding ALGO tokens. The selection happens through cryptographic sortition, a lottery system Micali helped invent. Thousands of participants secure each block, spreading power widely without burning electricity on mining rigs.

Blocks finalize in about 2.78 seconds. That finality is absolute. Once confirmed, a transaction stays confirmed. There is no waiting for additional blocks, no risk of reorganization. If you are building payment systems or trading platforms where certainty matters, this changes what is possible.

Performance stays consistent too. When other networks get congested, fees spike, and transactions slow. Algorand processes the same volume at the same speed regardless of demand. In Q2 2025, the network processed over 425 million transactions without missing a beat.

Who Created Algorand?

Silvio Micali is not your typical crypto founder. Before blockchain existed, he spent decades at MIT developing the cryptographic building blocks that secure modern computing: zero-knowledge proofs, probabilistic encryption, and secure multi-party computation. The Turing Award he received in 2012 is computer science's equivalent of the Nobel Prize.

He founded Algorand in 2017 with a specific frustration in mind. Existing blockchains forced compromises he found unnecessary. Bitcoin was slow. Ethereum congested. Delegated systems centralized power. Micali believed better cryptography could solve all three problems simultaneously.

The project incorporated in Singapore. Two entities divide responsibilities: the Algorand Foundation handles ecosystem development and governance, while Algorand Inc. builds the protocol itself. This separation keeps incentives clean.

How the Network Evolved

Key milestones tell the story:

- June 2019: Mainnet launches, introducing Pure Proof-of-Stake to production

- 2021: Carbon neutrality achieved through efficient consensus and offset partnerships

- 2022-2024: Transaction count crosses 2 billion, FIFA mints 1.3 million World Cup NFTs, adoption spreads into Latin America, Africa, and Asia

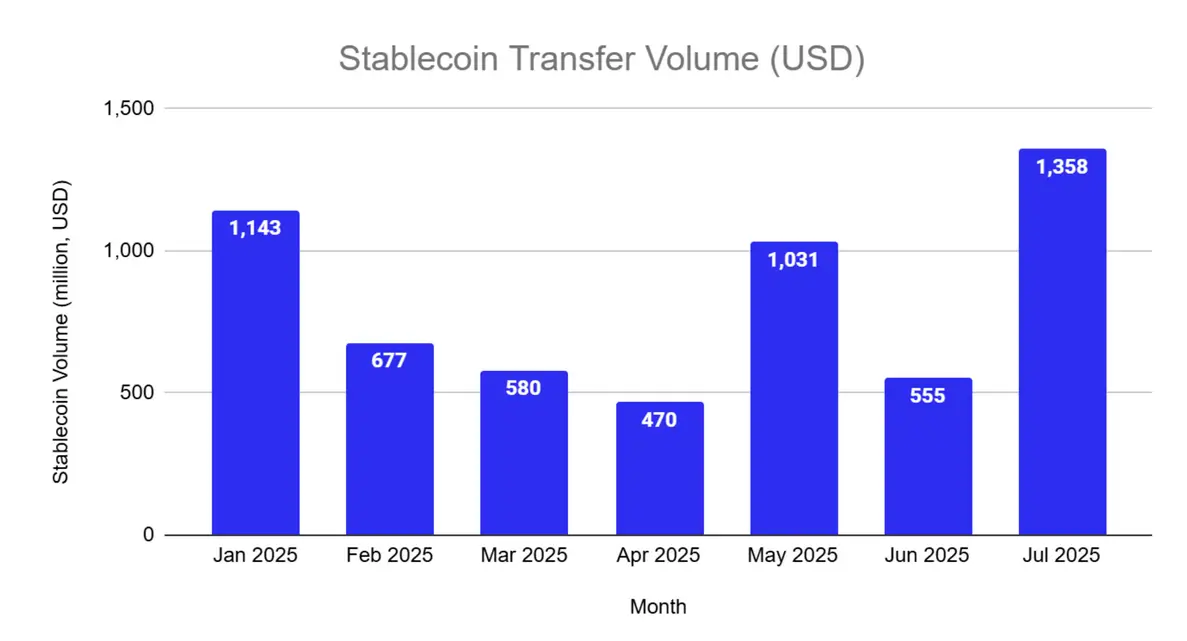

- Late 2025: 51 million blocks produced, stablecoin volumes hit all-time highs, US relocation progressing toward completion after July 2025 announcement

Developer tooling improved steadily throughout, with AlgoKit simplifying smart contract deployment and educational programs expanding the builder community.

Who Runs It Now

Leadership evolved in 2025. Nikolaos Bougalis joined as CTO after spending nearly a decade building Ripple's XRP Ledger. He brings enterprise blockchain experience and a focus on decentralization that aligns with Algorand's ethos.

Marc van Leeuwen leads strategy and marketing. Matt Keller runs sustainability and humanitarian initiatives. The xGov community council, a governance body of active participants, held retreats in 2025 that produced over 500,000 lines of ecosystem code. This is not a network run by a small insider group.

How Does the Technology Work?

Algorand uses layered architecture. The base layer handles consensus and native token issuance through the Algorand Standard Asset protocol. Smart contracts run on the Algorand Virtual Machine above that foundation.

Performance Specs

The numbers that matter:

- Over 10,000 transactions per second

- Blocks every 2.78 seconds

- Fees under a cent regardless of network load

- Native support for atomic swaps and multi-signature transactions

That last point needs unpacking. Atomic swaps mean complex multi-party transactions either complete entirely or fail entirely. No partial executions. No stuck funds. This happens at the protocol level, not through smart contract workarounds.

Fees deserve attention too. Ethereum users know the pain of gas auctions during congestion, watching costs spike from dollars to hundreds of dollars. Algorand sidesteps this entirely. Predictable costs make budgeting possible for enterprises building on the network.

Writing Smart Contracts

The Algorand Virtual Machine supports Python and TypeScript through TEALScript and PyTeal. Developers already comfortable with these languages can build without learning Solidity or Rust. The learning curve shrinks considerably.

AlgoKit 3.0, released in 2025, handles environment setup, testing, and deployment in a unified workflow. Open-source contributions hit all-time highs by late 2025. Educational programs from EasyA and RiseIn have engaged over a million developers globally, expanding the talent pool.

Quantum-Resistant Security

This is where Algorand gets ahead of the curve. In early November 2025, the network completed its first mainnet transaction using Falcon signatures, a NIST-approved standard designed to resist quantum computing attacks.

Practical quantum threats remain years away. But migrating cryptographic systems takes time, and waiting until the threat materializes means scrambling under pressure. Algorand is already there. Post-quantum accounts are available now for users who want future-proof security. Most competitors are still debating when to start.

What Is Pure Proof-of-Stake?

Most proof-of-stake systems concentrate power. Users delegate tokens to a handful of validators who produce blocks on their behalf. This is faster than mining but creates chokepoints. A few large validators can collude or get compromised.

Algorand works differently. Every ALGO holder can participate directly in consensus. The protocol selects block proposers and validation committees randomly, weighted by stake but open to all. Selection uses verifiable random functions: participants can prove they were chosen, but only after acting. Attackers cannot target validators in advance because nobody knows who will be selected until the moment arrives.

Thousands of accounts participate in each round. Compare that to delegated systems, where a dozen validators control everything. The distribution makes collusion impractical and censorship nearly impossible.

Why This Matters for Security

Pure Proof-of-Stake achieves Byzantine fault tolerance. The network reaches consensus correctly even if up to one-third of participants act maliciously. Blocks finalize immediately with no possibility of forks.

That last point has real consequences. On networks where forks happen, transactions can get reversed hours after confirmation. Exchanges require multiple confirmations before crediting deposits. Merchants wait before shipping goods. Algorand eliminates this uncertainty. One confirmation means done.

Governance participation requires just 1 ALGO. No expensive hardware. No minimum stake that prices out small holders. As of late 2025, roughly 23% of the circulating supply was actively staked, reflecting broad participation.

Machine-to-Machine Applications

The speed and finality open possibilities beyond human transactions. The x402 project builds payment infrastructure for robotics and autonomous systems. When machines transact with each other, they need instant settlement and predictable costs. Waiting for confirmations or managing fee volatility does not work at machine speed. Algorand handles this natively.

Why Is Algorand Considered Carbon Neutral?

Proof-of-work mining consumes staggering amounts of electricity. Bitcoin uses more power than some countries to process roughly seven transactions per second. Algorand handles over 10,000 TPS with energy usage comparable to running a few household appliances.

The difference comes from consensus design. PPoS validates transactions through stake-weighted voting rather than computational puzzles. No mining rigs. No GPU farms. No arms race for more powerful hardware. Participation nodes run on standard servers or even consumer computers.

An August 2025 IEEE study confirmed what the architecture suggests: Algorand consumes less energy per transaction than Ethereum and Solana. The network achieved carbon neutrality in 2021 and has maintained it through efficiency and offset partnerships.

Building Carbon Markets On-Chain

Several platforms leverage Algorand for sustainability applications. ClimateTrade enables transparent carbon credit trading, with enterprises like Telefónica and Santander using it for ESG compliance. Ureca tokenizes carbon credits for broader investor access, bringing retail participants into markets previously limited to institutions.

On the energy side, Enel Group tokenizes renewable energy investments, connecting traditional finance to blockchain infrastructure. Sow & Reap generates credits from agricultural data, linking farmers directly to carbon markets without intermediaries taking cuts.

The Aid Trust Portal, launched in September 2025 for UN partners, tracks humanitarian aid distribution transparently while aligning operational efficiency with environmental responsibility. When donations flow through blockchain rails, overhead drops and accountability rises.

How Do ALGO Tokenomics Work?

ALGO is the native token. It pays transaction fees, earns staking rewards, and enables governance participation.

Supply Dynamics

Circulating supply is approximately 8.81 billion ALGO. Early token distribution faced criticism for concentration, a common complaint across crypto projects. The foundation addressed this systematically, reducing its own stake from 63% to 21% over time. More tokens now sit with independent participants and ecosystem projects.

Transaction fees stay deliberately low, usually fractions of a cent. Users benefit, but this creates a sustainability question. Low fees mean low revenue for validators. The foundation plans to address long-term economics through Project King Safety and upcoming technical papers.

Earning Rewards

The Algorand 4.0 upgrade in early 2025 changed how staking works. Previously, rewards were distributed at the end of governance periods. Now they accrue continuously in real-time. Holdings grow as you watch.

This shift drove significant validator growth. The foundation reports 250% more nodes since implementing real-time rewards. More nodes means greater decentralization and stronger security.

Participating in Governance

The xGov system, live in 2025, lets community members submit proposals for protocol changes, ecosystem grants, and strategic initiatives. Voting power scales with holdings, but anyone with 1 ALGO can participate. First proposals have already been funded.

Algoland offers on-chain quests that gamify engagement, rewarding participation with tokens and building habits that strengthen governance over time.

What Can You Build on Algorand?

The ecosystem covers over 15 industries. Developer activity reached all-time highs in late 2025, driven by improved tooling and educational programs. Here is where the action concentrates.

DeFi and Payments

Folks Finance handles lending, borrowing, and liquid staking. Wormhole integration connects it to cross-chain liquidity, addressing one of the main criticisms of non-EVM ecosystems.

Tinyman runs automated market making. By late 2025, the protocol locked 100 million TINY tokens, its highest level ever. Liquidity depth keeps improving.

Pact.fi combines trading with liquidity mining, attracting yield-focused participants.

Stablecoin integration expanded dramatically in 2025. USDC now flows through Wirex (7 million users), Crypto.com, and Telegram Wallet, which serves over a billion users globally. Coinify was integrated on November 20. Noah HQ launched institutional payment rails on November 18. For European institutions navigating new regulations, Quantoz offers MiCA-compliant EURQ and USDQ stablecoins.

Real-World Asset Tokenization

Tokenizing physical assets requires legal clarity and reliable settlement. Algorand's absolute finality and regulatory focus make it a natural fit.

Lofty lets investors buy fractional real estate. Rental income distributes on-chain proportionally to holdings. Property ownership becomes liquid without traditional intermediaries.

Agrotoken tokenizes agricultural commodities across Latin America. Farmers use crop tokens as collateral to access credit in regions where traditional banking fails them.

MIDAS and Exodus enable broader tokenization from securities to collectibles.

NFTs and Digital Media

The NFT market cooled across the industry, but utility-focused applications continue to grow. FIFA minted over 1.3 million NFTs during the World Cup partnership, demonstrating the network's ability to handle enterprise scale. ANote Music tokenizes royalty rights, letting fans invest in catalog income streams. TravelX issues NFTickets for tradeable travel bookings with built-in fraud prevention. World Chess renewed its partnership in October 2025, using Algorand for on-chain loyalty programs and tournament verification.

Humanitarian and Social Impact

Blockchain finds genuine utility where traditional finance fails. SEWA Bharat provides digital identities for women workers in India, a project featured by The New York Times in November 2025. When marginalized populations lack official documentation, blockchain-based identity opens access to services that would otherwise remain closed.

The Aid Trust Portal helps UN partners track humanitarian distributions with full transparency. HesabPay handles payments in challenging environments where banking infrastructure has collapsed or never existed. These are not speculative use cases. They are operational systems serving real populations.

AI and Gaming

Autonomous systems require a payment infrastructure that keeps pace with their speed. GoPlausible deploys AI agents on-chain to execute automated trading strategies without human intervention. The x402 project extends this to robotics and IoT, building the rails for machines that transact with each other. Fracctal Labs tests the gaming angle with over 875 active beta players exploring on-chain mechanics.

Who Are Algorand's Major Partners?

Partnerships reveal where a network finds traction. Algorand's spread tells a story of institutional credibility meeting emerging market opportunity.

The financial sector anchors the ecosystem. Nubank, serving over 100 million Latin American users, represents the headline integration. One of the world's largest digital banks has chosen Algorand for its crypto services, underscoring the network's enterprise-readiness. Robinhood EU and SBI VC in Japan extend institutional access across continents. Uphold offers staking services.

Enterprise adoption spans energy, consumer goods, and entertainment. Enel Group tokenizes renewable energy certificates, connecting sustainability commitments to verifiable records. Lavazza explores coffee supply chain tracking. Google demonstrated agentic commerce capabilities using Algorand infrastructure, signaling interest from the tech giants.

Payment rails expanded significantly through 2025. Wirex Visa and Immersve Mastercard enable card-based spending of Algorand assets. Liquid Auth simplifies wallet authentication through passkeys. Allbridge rolled out cross-chain stablecoin bridging in Q4. These integrations make ALGO usable beyond crypto-native contexts.

Emerging markets differentiate Algorand from competitors chasing the same institutional clients. Koibanx builds financial infrastructure across Latin America, enabling banking access where traditional institutions underserve populations. Paycode delivers services across Africa. HesabPay handles humanitarian payments in crisis zones. This is not a peripheral activity. It represents Algorand's thesis that blockchain serves the underbanked, not just the already-wealthy.

Market infrastructure continues to develop. XBTO joined as market maker in August 2025, improving liquidity depth. Hackathons like AlgoBharat offer $125,000 in prizes, with over 200 projects submitted in recent programs.

What Challenges Does Algorand Face?

No honest analysis skips the hard parts. Algorand's challenges are real, and some cut deeper than others.

The EVM Problem

Algorand does not run on the Ethereum Virtual Machine. This is not just a technical footnote. It is the single biggest factor limiting the network's growth.

Most DeFi liquidity lives in EVM-compatible ecosystems. Most developer tooling targets Solidity. When builders choose where to deploy, network effects pull them toward Ethereum, Polygon, Arbitrum, and increasingly Solana's EVM layer. Algorand sits outside this gravity well.

Developers must learn platform-specific tools rather than porting existing code. Cross-chain bridges like Wormhole and Allbridge help move liquidity, but they also introduce friction and risk. The ecosystem remains smaller than EVM alternatives despite clear technical advantages. Superior architecture means little if developers and liquidity go elsewhere.

Economic Sustainability

Low fees benefit users but starve validators. This is not a minor concern. It is the central tension in Algorand's economic design.

Validators earn minimal revenue from transactions, relying on staking rewards and foundation support. Long-term, the network needs economics that sustain security without constant subsidy. Every low-fee chain faces this challenge, but Algorand's fees are among the lowest in the industry. The math gets harder.

Project King Safety and upcoming technical papers aim to address this. Whether they succeed will determine if the network can secure itself independently or remains foundation-dependent.

Regulatory Exposure

Like many crypto projects, Algorand faced SEC scrutiny over whether ALGO qualifies as a security. The foundation's US relocation signals proactive engagement rather than avoidance. Whether this provides protection or exposure depends on how regulation evolves.

The Adoption Gap

Enterprise traction has outpaced retail engagement by a wide margin. Technical observers appreciate the architecture but note limited mainstream awareness. One analyst described Algorand as "beautiful but underused." This is the Achilles' heel of technically superior blockchains: being right is not the same as winning.

Initiatives like Algoland's gamified quests and the upcoming Rocca Wallet with seedless passkey authentication aim to close this gap. Removing friction matters. Most people will not manage seed phrases, and pretending otherwise limits growth. If Algorand cannot make itself accessible to non-technical users, its technical excellence becomes a private achievement rather than public infrastructure.

What Is on Algorand's Roadmap?

The July 2025 roadmap organizes around four pillars: Web3 values, mainstream adoption, economic sustainability, and technical advancement. The foundation frames its mission simply: "kill complexity."

Near-Term Priorities

- Project King Safety: Economic model improvements tackling fee sustainability

- Rocca Wallet: Seedless passkey authentication eliminating seed phrase friction

- AlgoKit 4.0: Continued developer experience improvements

- Peer-to-peer networking upgrades: Further infrastructure decentralization

- Europe Unified Digital Ledger verification: Regulatory compliance positioning

Privacy and Security

Falcon quantum-resistant signatures will expand beyond initial implementation. Zero-knowledge proof designs are under development for privacy-preserving applications, though specific timelines have not been announced.

AI and Enterprise

The x402 project continues expanding for autonomous payment systems. Intermezzo simplifies enterprise blockchain integration with abstraction layers. Agentic commerce capabilities demonstrated with Google will continue to develop as AI adoption accelerates.

Final Thoughts

Algorand does what it claims. The network processes thousands of transactions per second, settles them in seconds, and has maintained perfect uptime since 2019. Quantum-resistant security is live, not theoretical. Carbon neutrality is verified, not marketing.

The ecosystem supports real applications: Folks Finance and Tinyman for DeFi, Lofty and Agrotoken for asset tokenization, Aid Trust Portal for humanitarian work, Nubank and Google for enterprise integration.

Challenges remain real. EVM dominance limits liquidity access. Fee economics need long-term solutions. Retail awareness lags technical merit. The roadmap addresses each through Rocca's frictionless onboarding, Project King Safety's economic improvements, and continued bridge development.

For builders and institutions prioritizing reliability over hype cycles, Algorand offers infrastructure that works.

For more information or updates, visit algorand.co and follow @AlgoFoundation on X.

Sources

- Algorand - Official announcements, roadmap, and partnership news

- Algorand Developer Portal - Protocol specifications and technical documentation

- IEEE Energy Study - Blockchain efficiency comparisons

- @AlgoFoundation on X - Real-time updates and metrics

- Genfinity - Ecosystem reports and staking data

- Algorand Foundation Telegram - Official community updates and announcements

Read Next...

Frequently Asked Questions

What makes Algorand different from Ethereum?

Algorand processes 10,000+ TPS with instant finality. Ethereum handles around 30 TPS and requires multiple confirmations. Algorand has been carbon neutral since 2021 with zero downtime or forks.

What is Algorand's transaction speed?

Over 10,000 transactions per second with 2.78-second blocks. Single confirmation means permanent settlement with no reversal risk.

Is Algorand environmentally friendly?

Yes. Carbon neutral since 2021 through efficient PPoS consensus requiring no mining hardware. An August 2025 IEEE study confirmed lower energy use per transaction than Ethereum and Solana.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens