Chainbase Explained: A Look at The Omnichain Data Network for AI and its $C Token

Chainbase is a Decentralized Layer 1 infrastructure that processes blockchain data for AI and Web3 apps, with $C token supporting utilities, governance, and ecosystem growth.

UC Hope

July 29, 2025

Table of Contents

Chainbase is a decentralized Layer 1 infrastructure that processes raw blockchain data into structured formats for use in AI and Web3 applications, with its native $C token supporting network operations and governance.

Launched in 2021 as a centralized platform for Web3 data APIs, it has since transitioned to a decentralized model, raising significant funds from investors including Tencent and Matrix Partners. Currently, the blockchain network handles over 550 billion data calls. Additionally, it supports more than 35,000 developers across 10,000 project integrations, positioning it as a key player in the intersection of blockchain and artificial intelligence.

The Origin: How Chainbase Started?

Chainbase began operations in 2021, initially offering centralized services that provided application programming interfaces (APIs) to help Web3 developers access both on-chain and off-chain data. The platform aimed to simplify data retrieval from blockchains, addressing common challenges like interoperability and data fragmentation.

By 2024, Chainbase had shifted toward decentralization, rebranding as a hyperdata network with a focus on omnichain capabilities. This evolution marked its fourth year in the sector, during which it achieved milestones, including full decentralization and significant community expansion.

The project's funding history includes a total of $18 million raised from backers like Tencent, Matrix Partners, and other venture firms. These resources supported the development of core technologies, including the Manuscript protocol for data transformation. Chainbase also adopted a dual-chain architecture, integrating EigenLayer for restaking security and Cosmos for cross-chain interoperability. In 2025, the platform introduced its $C token, conducted airdrops, and secured listings on exchanges such as Binance and, most recently, Bithumb. These steps have reinforced its role in what the team describes as the DataFi era, where data functions as a financial asset within blockchain ecosystems.

How Does Chainbase Work?

Chainbase functions as a Layer 1 infrastructure that tackles interoperability issues in blockchain data. It ingests raw activity from various chains, such as Ethereum, zkSync, and Polygon, and converts it into structured, composable data suitable for AI and applications. The process involves several components:

Core Components:

- Manuscript protocol: Uses programmable scripts to tag, categorize, and process on-chain data for usability in AI and applications.

- Co-processor layer: Supports collaborative data processing and sharing of AI expertise, allowing users to convert knowledge into structured data assets.

- Dual-chain architecture: Integrates EigenLayer for restaking and security with Cosmos for interoperability, enabling cross-chain data management and programmability.

- Data flow: Ingests raw data from chains such as Ethereum, zkSync, and Polygon; processes it via APIs including REST, Stream, and JSON-RPC; and makes it available for queries in SQL, GraphQL, or natural language.

Consensus Model:

- Restaking Mechanism: Leverages EigenLayer's restaking mechanism, built on Ethereum's proof-of-stake, for security and validation in the actively validated services (AVS) layer.

- Cross-chain Consensus: Combines with Cosmos' CometBFT Byzantine fault tolerance (BFT) for cross-chain consensus, incorporating delegated proof-of-stake (DPoS) elements.

- Hybrid approach: Ensures decentralized verification without a standalone native consensus, relying on underlying chains for finality.

The Chainbase Ecosystem and Core Applications

Chainbase's ecosystem centers on scalable data infrastructure for AI, Decentralized Finance (DeFi), and Web3. It has processed over 550 billion data calls, engaged more than 35,000 developers, and integrated with over 10,000 projects.

Core applications include AI integrations that provide structured data to copilots and agents for real-time decision-making, as well as DeFi tools for wallets and analytics with faster access than competitors like The Graph. The protocol also incorporates a DataFi marketplace where data owners can monetize their assets via agents or decentralized applications (dApps). Here is a detailed breakdown:

Ecosystem Focus Areas:

- AI and agent integration: Supplies structured data to AI copilots, blockchain for AI, and agents for real-time decision-making.

- DeFi and analytics: Supports wallets, security tools, and DeFi protocols with fast data access, noted for outperforming The Graph in speed.

- DataFi economy: Functions as a marketplace where data owners monetize assets, and developers access them via agents or dApps.

Supporting projects such as zkSync, Scroll, and Linea contributes to the network's foundation. Partnerships, including with Aethir for computing resources, help build a system for decentralized AI and data-driven tools.

This ecosystem draws similarities to modular blockchains, where specialized layers handle specific functions, such as data processing, thereby enhancing overall efficiency in Web3 environments.

Advanced Features and Roadmap Milestones

Chainbase features a hyperdata network that connects blockchains, AI agents, and applications for seamless data flow:

Key Features:

- Hyperdata network: Connects blockchains, AI agents, and apps for seamless data flow.

- AVS layer: Provides decentralized verification and processing for trustless data pipelines.

- AI plug-ins and agents: Support natural language queries for on-chain data, integrated with platforms like ElizaOS for agent decision-making.

- DataFi financialization: Employs smart contracts for data licensing, monetization, and audits, treating data as tradable capital.

- Scalability elements: Draws from Chainlink-inspired modular architectures for multi-chain composability.

- Additional tools include Dual-Staking for security and Theia AI assistant for natural language interactions.

Innovation Pipeline (Roadmap Milestones):

- ZIRCON genesis phase: Ongoing from early 2025, building a unified, secure data network.

- Aquamarine phase: Started in March 2025, advancing AI collaboration and Web3 data integration.

- Q3 2025: Integrate the majority of blockchain data into Walrus for next-generation data lakes.

- Long-term plans: Develop open agent marketplaces, enhance protocol efficiency, and support DataFi ecosystems with fully decentralized infrastructure and scalable AI workloads.

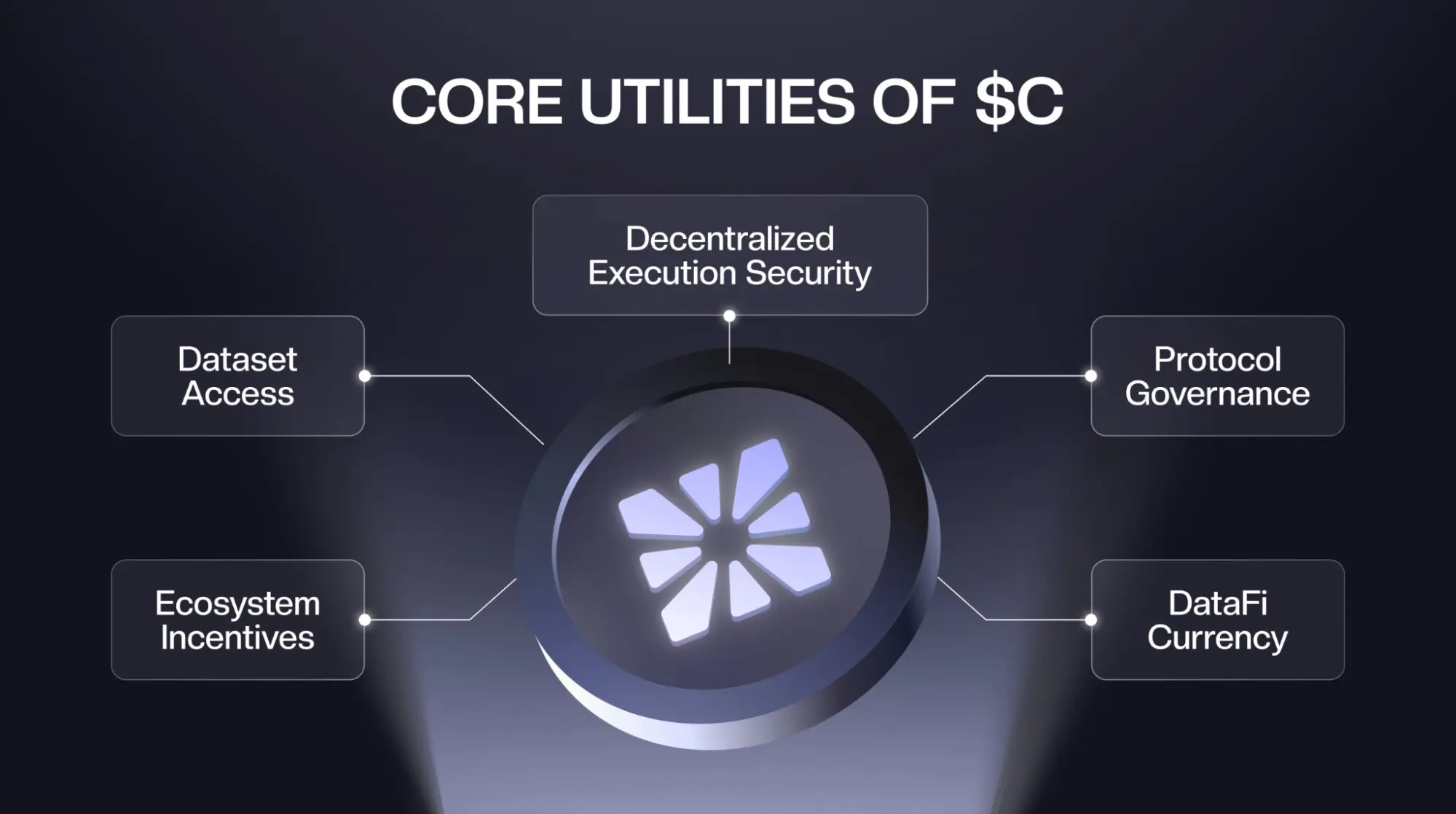

Exploring the $C Token

The $C token serves as Chainbase's native utility and governance asset, designed to facilitate operations in the DataFi economy. It enables payments for data queries, publishing, and consumption, with fees allocated to node operators, burned, or distributed as rewards.

Users can stake $C to operate nodes or delegate to data specialists for rewards tied to dataset creation and maintenance. Governance enables holders to propose and vote on decisions, including incentives and protocol upgrades. The token also supports airdrops and loyalty programs to capture value in the data economy.

Tokenomics and Vesting Schedules

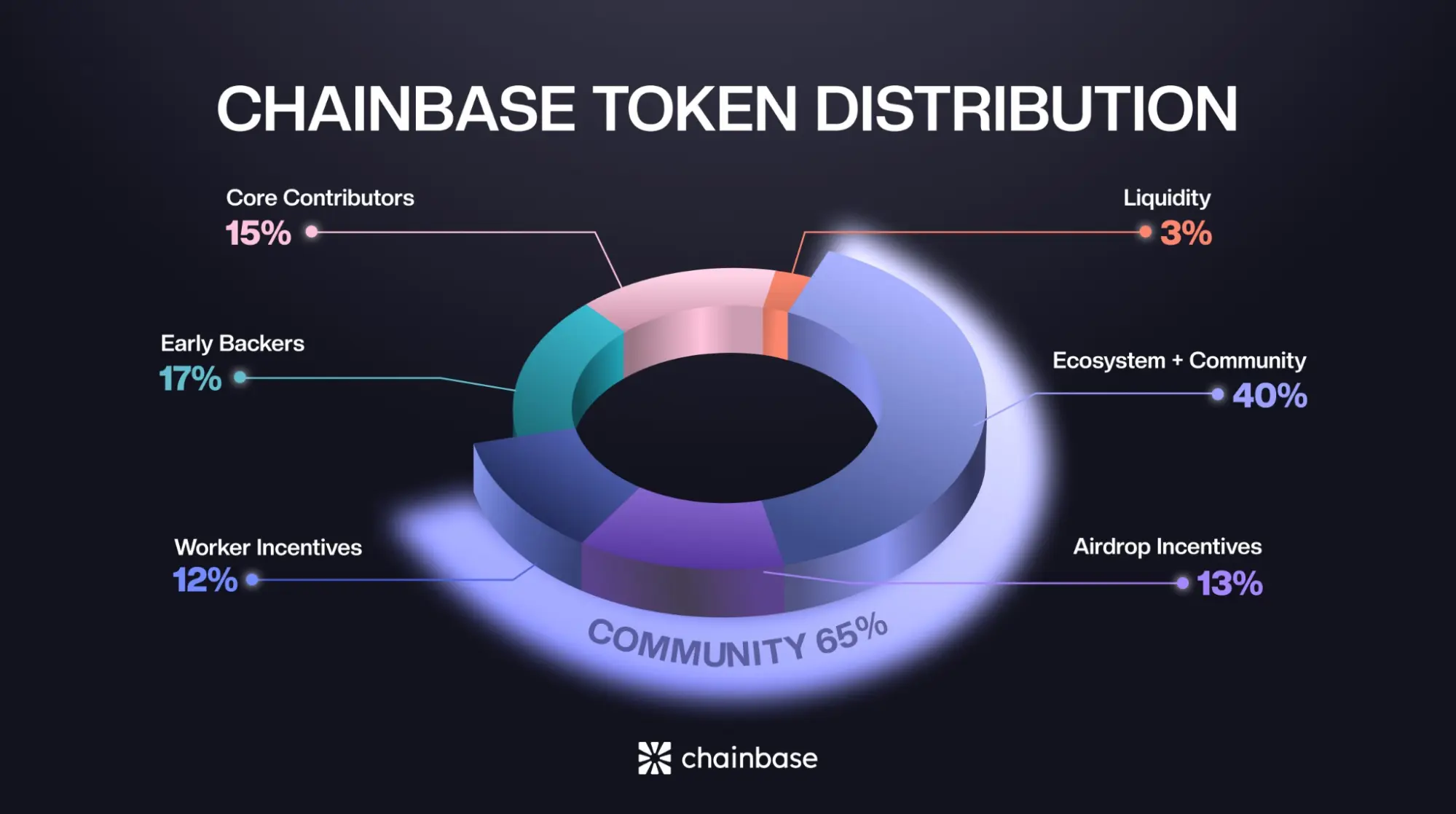

The $C token has a total supply of 1,000,000,000, with 16% of the supply unlocked at launch, designed to align incentives for data providers, node operators, developers, and users. It was launched primarily on Base, with liquidity on the BNB Smart Chain. Below is the breakdown:

Distribution Allocations:

- Ecosystem + community: 40% – For grants, integrations, developer incentives, campaign rewards, and long-term growth.

- Airdrop incentives: 13% – Over three seasons; Season 1 at 3.5% (2% for native community, 1.5% for Binance Alpha).

- Worker incentives: 12% – For data node operators.

- Early backers: 17% – For initial investors.

- Core contributors: 15% – For founding team and builders.

- Liquidity: 3% – For exchange support and market dynamics.

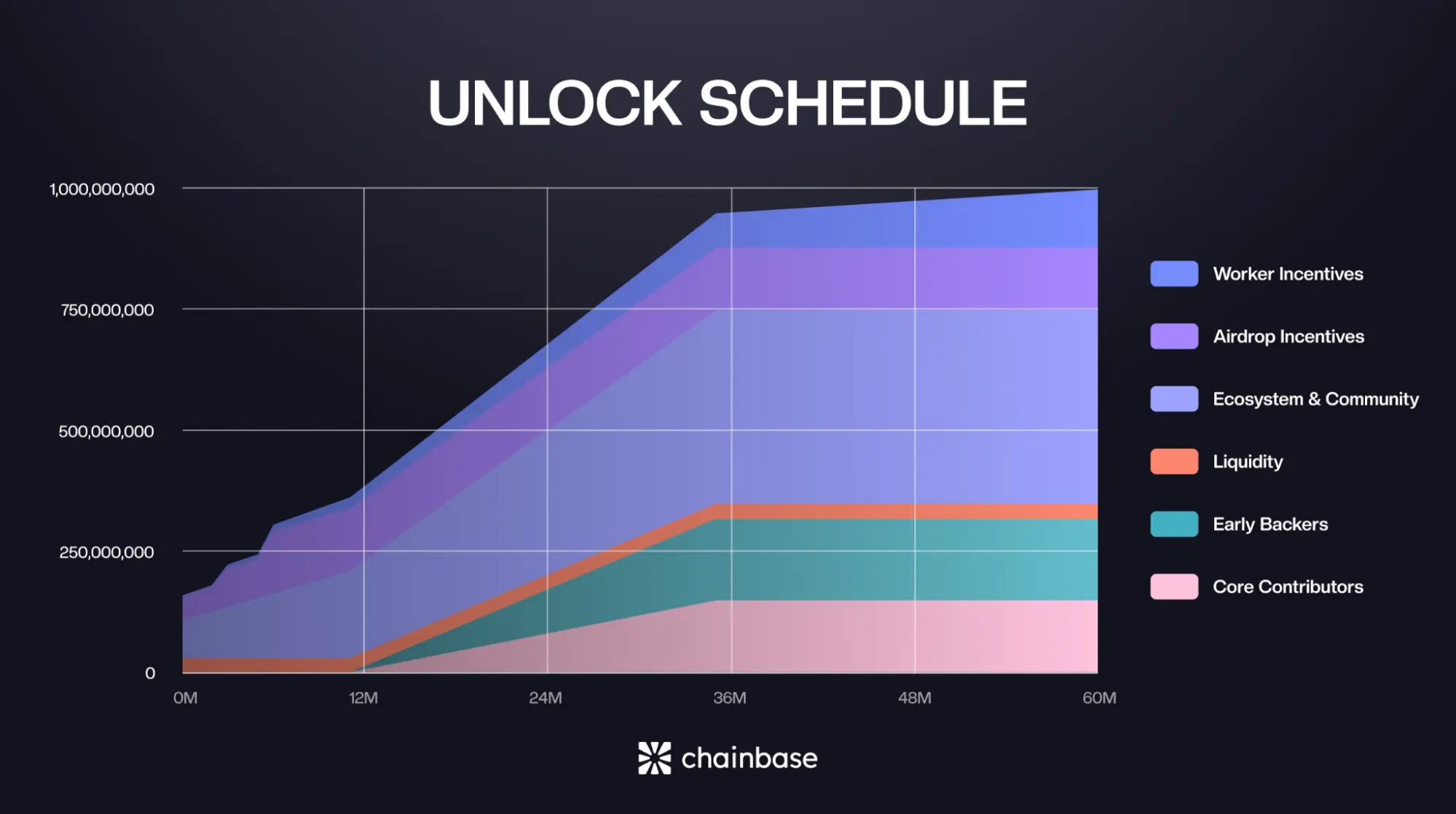

Vesting Schedules:

- Core team & early backers: Over 3 years, with a 12-month cliff followed by linear distribution over 24 months.

- Worker incentives: Linear vesting over 60 months.

- Ecosystem-aligned emissions: Linear unlock over 36 months, tied to developer growth, incentive programs, and adoption milestones.

Current Market Performance and Recent Updates

As of the time of writing, the $C token trades at approximately $0.3327, with a minimal price change over the last seven days. However, the trading volume over the past 24 hours has increased above 200%, at $282.5M, with a market capitalization of around $53M.

The recent listing on one of Korea’s top exchanges, Bithumb, may be a likely cause of the significant surge in trading volume. Not forgetting Binance's support, although post-airdrop sales have caused fluctuations. This performance reflects common patterns in token launches, where listings boost liquidity but airdrops introduce volatility.

Strategic Integrations Strengthening the Chainbase Ecosystem

Chainbase has formed partnerships to strengthen its data and AI capabilities. Collaborations include CARV for asset data in AI and gaming, Theoriq for Web3 AI models, Privasea for proof-of-humanity verification, Gaia for on-chain data in AI agents, Trusta Labs for identity and reputation systems, Masa for crypto data access, Walrus Protocol for decentralized storage in DeFi and AI, Binance for token listings and airdrops, Codatta for human insights on-chain, and OKX Wallet for distributions.

Additional ties involve Story Protocol for intellectual property management, focEliza for AI agents, and Aethir for computing. These integrations focus on AI, security, and cross-ecosystem functionality.

Risks Associated With Chainbase?

Chainbase encounters risks typical of blockchain projects. Market volatility arises from post-airdrop dumps and the influence of whales, resulting in price fluctuations. Operational challenges in the past have included a terminated loyalty program due to spam, which can affect trust.

Initial limited exchange presence and roadmap opacity could slow adoption, though recent listings help. Security concerns involve scams drawn to active communities, as highlighted in official alerts. These factors underscore the need for due diligence, similar to the risks in DeFi, where smart contract vulnerabilities or market manipulations can occur.

What's Next for Chainbase?

Chainbase's roadmap prioritizes decentralization and AI. The ZIRCON genesis phase, which began in early 2025, establishes a unified data network. The Aquamarine phase in March 2025 advances AI collaboration and Web3 integration. By Q3 2025, the platform plans to incorporate most blockchain data into Walrus for advanced data lakes.

Long-term goals include open agent marketplaces, protocol efficiency improvements, and support for the DataFi ecosystem, with the aim of achieving fully decentralized infrastructure and scalable AI.

Final Thoughts

Chainbase provides data processing capabilities through its Manuscript protocol, dual-chain architecture, and AVS layer, supporting AI integrations and a DataFi marketplace. The $C token facilitates utilities such as staking and fees, backed by tokenomics that allocate 65% of the tokens to ecosystem growth.

Partnerships with entities like Binance and Gaia enhance its network, while features such as natural language queries improve usability. While risks such as volatility and operational issues persist, the roadmap outlines expansions in decentralization and the use of AI.

Sources:

- Chainbase Official Website - https://chainbase.com

- CoinMarketCap Chainbase Page - https://coinmarketcap.com/currencies/chainbase/

- Binance HODLer Airdrop: Chainbase - https://research.binance.com/en/projects/chainbase

- Chainbase Series A Funding and $18M Total raise: https://www.theblock.co/post/306140/blockchain-data-network-chainbase-funding

Read Next...

Frequently Asked Questions

What is Chainbase?

Chainbase is a decentralized Layer 1 infrastructure that processes blockchain data for AI and Web3, with over 550 billion data calls and 35,000 developers.

What are the $C Token Use-cases?

$C enables payments, staking, governance, and incentives within the network, with a total supply of 1 billion and vesting for stability.

What are Chainbase's main risks?

Risks include token volatility from airdrops and potential scams in the community.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens